Focus on Teacher Training

The government education market in China is placing a strong emphasis on teacher training and professional development. Recognizing that educators are central to student success, the government has initiated various programs aimed at enhancing teaching skills and methodologies. In 2025, it is anticipated that approximately 30% of the education budget will be allocated to teacher training initiatives. These programs are designed to equip teachers with the necessary tools to effectively implement new curricula and utilize technology in the classroom. This focus on professional development is likely to lead to improved educational outcomes and a more competent teaching workforce, ultimately benefiting the government education market.

Technological Advancements

Technological advancements are playing a pivotal role in shaping the government education market in China. The integration of artificial intelligence, big data, and cloud computing into educational practices is becoming increasingly prevalent. For example, the use of AI-driven personalized learning platforms is gaining traction, allowing educators to tailor instruction to individual student needs. This trend is supported by the government's push for digital transformation in education, which aims to improve learning outcomes and operational efficiency. As of 2025, it is estimated that over 60% of schools in urban areas are utilizing some form of digital technology in their curricula, indicating a significant shift towards modernized educational practices.

Increased Government Funding

The government education market in China is experiencing a notable increase in funding allocations. In recent years, the Chinese government has committed substantial financial resources to enhance educational infrastructure and improve teaching quality. For instance, the budget for education in 2025 is projected to reach approximately 4 trillion CNY, reflecting a growth of around 10% from the previous year. This influx of capital is likely to facilitate the development of new educational programs and technologies, thereby enhancing the overall quality of education. Furthermore, the government education market is expected to benefit from targeted investments aimed at rural and underprivileged areas, ensuring equitable access to quality education across diverse demographics.

Policy Reforms for Educational Equity

Policy reforms aimed at promoting educational equity are significantly influencing the government education market in China. The government is implementing various initiatives to bridge the educational gap between urban and rural areas. For instance, policies that incentivize teachers to work in rural schools are being introduced, alongside funding for infrastructure improvements in less developed regions. By 2025, it is expected that these reforms will lead to a 20% increase in student enrollment in rural schools, thereby fostering a more inclusive educational environment. Such efforts are likely to enhance the overall quality of education and ensure that all students have access to the resources they need to succeed.

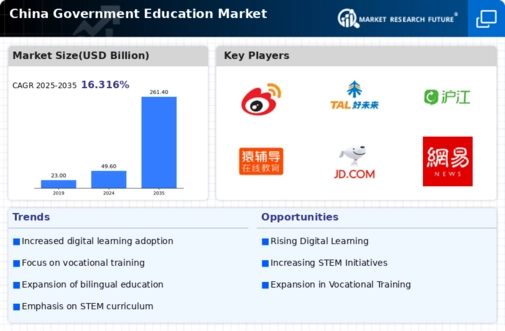

Rising Demand for Vocational Education

There is a growing demand for vocational education within the government education market in China. As the economy evolves, the need for skilled labor in various sectors is becoming increasingly apparent. The government has recognized this trend and is actively promoting vocational training programs to align education with market needs. In 2025, it is projected that enrollment in vocational schools will increase by approximately 15%, reflecting a shift in student preferences towards practical skills and job readiness. This emphasis on vocational education is likely to enhance employability among graduates and address skill shortages in key industries, thereby strengthening the overall government education market.