Bluetooth in Automotive Market Trends

Bluetooth in Automotive Market Research Report Information By Application (Communication, Infotainment, and Telematics), By Vehicle Type (Passenger Car, Light Commercial Vehicle, and Heavy Commercial Vehicle), and By Region (North America, Europe, Asia-Pacific, and Rest of The World) – Market Forecast Till 2035

Market Summary

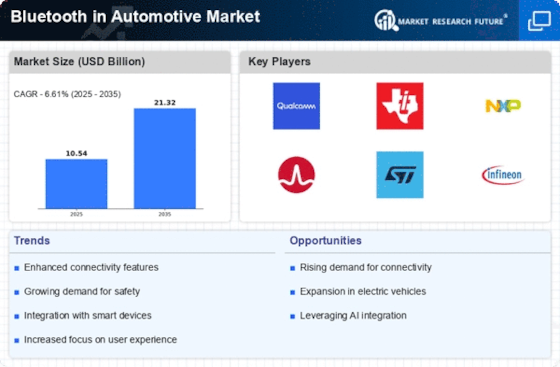

As per Market Research Future Analysis, the Bluetooth in Automotive market was valued at USD 10.54 Billion in 2024 and is projected to grow to USD 21.32 Billion by 2035, with a CAGR of 6.61% from 2025 to 2035. Key drivers include rising investments in smart vehicles and the integration of smartphone connectivity, enhancing vehicle safety and user experience. The market is significantly influenced by the demand for infotainment systems and automation in vehicles, with Asia-Pacific leading in market share due to increased vehicle production and technology adoption.

Key Market Trends & Highlights

The Bluetooth in Automotive market is experiencing robust growth driven by technological advancements and consumer demand.

- Market Size in 2024: USD 10.54 Billion.

- Projected Market Size by 2035: USD 21.32 Billion.

- CAGR from 2025 to 2035: 6.61%.

- Asia-Pacific held 45.80% market share in 2022.

Market Size & Forecast

| 2024 Market Size | USD 10.54 Billion |

| 2035 Market Size | USD 21.32 Billion |

| CAGR (2024-2035) | 6.61% |

| Largest Regional Market Share in 2022 | Asia-Pacific. |

Major Players

Key players include Texas Instruments Incorporated, QUALCOMM Incorporated, Cypress Semiconductor Corporation, Marvell Technology Group Ltd, Toshiba Corporation, Samsung Corporation, Broadcom Corporation, Pioneer Corporation, and Silicon Laboratories.

Market Trends

Integration of smartphone connectivity in cars is driving the market growth

The worldwide automobile market is expected to see a major expansion in the Bluetooth business, which is already highly active. This market's growth is significantly influenced by the surge in demand for smartphone features from cars and other vehicles. Adopting this technology also makes it possible to analyze car diagnostic data, improving vehicle safety. automobile Bluetooth links the telecommunications and automobile industries. Because of smartphone and infotainment system synchronizing technologies like Apple CarPlay, Spotify, and Android Auto, the need for Bluetooth in cars is expected to increase.

More and more automakers are integrating this technology into their vehicles to keep up with the demand and maintain their market share.

The surge in automakers' investments in intelligent transportation systems and smart automobiles is one of the main factors driving the market's robust expansion on a global scale. The increased use of automation in automotive systems is another factor driving the growth of the global market. The manufacturing companies also invest a lot of money in research to develop cutting-edge technology. Automotive electronics use a variety of technological solutions to improve and automate vehicles for a safer and better driving experience. Additionally, technologies for autonomous driving are fundamentally replacing traditional automotive technologies, such as telematics, V2X communication, and infotainment.

In the automotive sector, automation and electrification of vehicles are becoming commonplace. As a result, increased automation and the use of digital technology in cars are facilitating the growth of the automotive market.

The introduction of connectivity, electrification, and autonomous driving has caused a major revolution in the automotive industry. Automobiles are evolving from only being a means of transportation to offering an interior environment. The most recent improvements in the vehicle system provide its occupants with warm and personalized settings despite the availability of a wide range of comfort and convenience options. People want more access to their vehicles from their smartphones and the flexibility to customize their whole in-car experience, which is driving up demand for Bluetooth in cars.

One of the primary advancements propelling this shift is the creation of the power-saving Bluetooth Smart or Bluetooth Low Energy (BLE) technology. Due to BLE's low power needs, the device may run for months or even years on a single rechargeable battery. Bluetooth low energy technology was added when the automobile access system was modified. This made it possible for passive entry and activation systems to employ phones as keys, resulting in a new user interface that is focused on digital keys and digital profiles.

The development of protected auto access applications, which will ensure the accuracy and security of the phone-as-key solution, has also been sparked by the formulation of matching requirements. Thus, driving the Bluetooth in Automotive market revenue.

The integration of Bluetooth technology in automotive systems is poised to enhance connectivity and user experience, reflecting a broader trend towards smart vehicle solutions.

U.S. Department of Transportation

Bluetooth in Automotive Market Market Drivers

Market Growth Projections

The Global Bluetooth in Automotive Market Industry is characterized by robust growth projections, with expectations of reaching 21.3 USD Billion by 2035. This growth trajectory is underpinned by a compound annual growth rate of 6.62% from 2025 to 2035. The increasing integration of Bluetooth technology in vehicles, coupled with rising consumer demand for connectivity and smart features, indicates a favorable market environment. Automotive manufacturers are likely to invest in research and development to enhance Bluetooth capabilities, further driving market expansion. The convergence of technological advancements and consumer preferences suggests a promising outlook for the Global Bluetooth in Automotive Market.

Rising Demand for Connectivity

The Global Bluetooth in Automotive Market Industry experiences a notable surge in demand for seamless connectivity features. As consumers increasingly prioritize integrated technology in vehicles, Bluetooth technology serves as a pivotal solution for hands-free communication and audio streaming. This trend is evidenced by the projected market value of 10.5 USD Billion in 2024, reflecting a growing consumer preference for connected vehicles. Major automotive manufacturers are incorporating Bluetooth systems to enhance user experience, thereby driving the market forward. The integration of Bluetooth with advanced driver-assistance systems further amplifies its significance in modern vehicles, suggesting a robust growth trajectory for the industry.

Emerging Markets and Global Expansion

The Global Bluetooth in Automotive Market Industry is poised for growth in emerging markets, where rising disposable incomes and urbanization are driving vehicle ownership. As more consumers in these regions seek modern vehicles equipped with advanced technologies, the demand for Bluetooth-enabled systems is expected to increase. Countries in Asia-Pacific and Latin America are particularly noteworthy, as they exhibit rapid growth in automotive sales. This trend suggests a significant opportunity for manufacturers to expand their presence in these markets. The anticipated increase in market value from 10.5 USD Billion in 2024 to 21.3 USD Billion by 2035 underscores the potential for growth in the Global Bluetooth in Automotive Market.

Consumer Preference for Smart Features

The Global Bluetooth in Automotive Market Industry is increasingly driven by consumer preference for smart features in vehicles. As the automotive landscape evolves, consumers are seeking vehicles equipped with advanced technologies that enhance convenience and connectivity. Bluetooth technology plays a crucial role in enabling features such as smartphone integration, voice commands, and real-time navigation. This shift in consumer expectations is reflected in the projected compound annual growth rate of 6.62% from 2025 to 2035, indicating a robust market expansion. Automotive manufacturers are responding by incorporating Bluetooth systems into their offerings, thereby aligning with consumer demands for smarter, more connected vehicles.

Government Regulations and Safety Standards

The Global Bluetooth in Automotive Market Industry is shaped by stringent government regulations aimed at enhancing vehicle safety and reducing distractions. Regulatory bodies worldwide are advocating for hands-free communication systems to minimize driver distraction, thereby promoting the adoption of Bluetooth technology in vehicles. For example, many jurisdictions have implemented laws mandating the use of hands-free devices while driving. This regulatory push not only encourages manufacturers to integrate Bluetooth systems but also fosters consumer acceptance of such technologies. As a result, the market is likely to witness sustained growth, driven by compliance with safety standards and consumer demand for safer driving experiences.

Technological Advancements in Automotive Systems

The Global Bluetooth in Automotive Market Industry is significantly influenced by rapid technological advancements. Innovations in Bluetooth technology, such as improved range and data transfer rates, enhance the functionality of automotive systems. For instance, the introduction of Bluetooth 5.0 allows for greater connectivity options and supports multiple devices simultaneously. This evolution in technology not only improves user experience but also aligns with the increasing complexity of in-car systems. As vehicles become more sophisticated, the demand for advanced Bluetooth solutions is likely to rise, contributing to the market's expansion. The anticipated growth from 10.5 USD Billion in 2024 to 21.3 USD Billion by 2035 illustrates this trend.

Market Segment Insights

Bluetooth in Automotive Application Insights

The Bluetooth in Automotive market segmentation, based on application, includes communication, infotainment, and telematics. In the global market, the infotainment category commands the biggest market share. The term "infotainment system" refers to a group of automotive systems that work together to deliver information and entertainment to passengers via a video or audio interface control element, such as a bluetooth system, button panel, touch screen displays, or voice commands, among others.

Bluetooth in Automotive Vehicle Type Insights

The Bluetooth in Automotive market segmentation, based on vehicle type, includes passenger car, light commercial vehicle, and heavy commercial vehicle. Due to increased global production of passenger cars and quick consumer uptake, the passenger car category holds the greatest share of the global market. the expanding need for in-car entertainment systems that allow for calling, hands-free audio streaming, and application management.

Bluetooth is utilized in commercial cars for fleet management tasks to supervise, coordinate, and promote various transportation-related activities. By making the most efficient use of resources like vehicles, fuel, and replacement parts, this effectively helps lower and minimize overall expenses. As a result, the application of this technology in commercial vehicles is expanding quickly, which fuels market expansion.

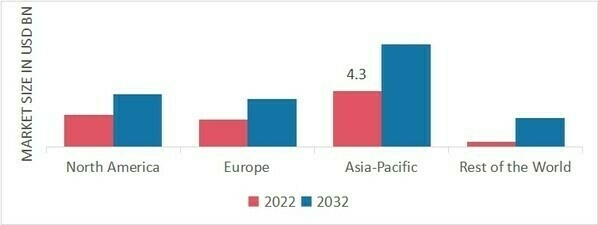

Figure 1: Bluetooth in Automotive Market, by Vehicle Type, 2022 & 2032 (USD Billion)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Get more detailed insights about Bluetooth in Automotive Market Research Report - Global Forecast till 2032

Regional Insights

By region, the study provides the market insights into North America, Europe, Asia-Pacific and Rest of the World. The Asia Pacific Bluetooth in Automotive market, dominated this market in 2022 (45.80%), due to increased vehicle production and sales, as well as the quick uptake of cutting-edge automotive technology, particularly in China, Japan, and India. Automobile manufacturers are concentrating on increasing production by implementing various entertainment and communication technologies in local manufacturing facilities.

The Chinese Ministry of Transport's 2017 New Energy Vehicle (NEV) directive is also encouraging the nation's production and demand for electric and autonomous vehicles, which will give automakers more opportunities to incorporate cutting-edge technology into the vehicles' equipment and components. Moreover, China’s Bluetooth in Automotive market held the largest market share, and the Indian Bluetooth in Automotive market was the fastest growing market in the Asia-Pacific region.

Further, the major countries studied in the market report are The US, Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: Bluetooth In Automotive Market Share By Region 2022 (USD Billion)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

The North America Bluetooth in Automotive Market is expected to register significant growth from 2024 to 2032. In terms of revenue, the automotive Bluetooth market in North America is likewise well-developed, driving up the use of smart infotainment and telematics application systems in vehicles. Further, the U.S. Bluetooth in Automotive market held the largest market share, and the Canada Bluetooth in Automotive market was the fastest growing market in the North America region.

Europe Bluetooth in Automotive market accounts for the second-largest market share. In the automotive sector in Europe, automation and electrification of vehicles are becoming more prevalent. Bluetooth is playing a bigger role in the region's automotive industry as a result of increased automation and the use of digital solutions in cars. Further, the German Bluetooth in Automotive market held the largest market share, and the U.K Bluetooth in Automotive market was the fastest growing market in the European region.

Key Players and Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Bluetooth in Automotive market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, Bluetooth in Automotive industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the Bluetooth in Automotive industry to benefit clients and increase the market sector. In recent years, the Bluetooth in Automotive industry has offered some of the most significant advantages to medicine. Major players in the Bluetooth in Automotive market, including Texas Instruments Incorporated, QUALCOMM Incorporated, Cypress Semiconductor Corporation, Marvell Technology Group Ltd, Toshiba Corporation, Samsung Corporation, Semiconductor Corporation, Broadcom Corporation, Pioneer Corporation, and Silicon Laboratories, are attempting to increase market demand by investing in research and development operations.

Panasonic Holdings Corp. (Panasonic), formerly known as Panasonic Corp., is a global manufacturer, retailer, and service provider of a wide range of electric and electronic products. Individual room air conditioners, TVs, landlines, digital cameras, home audio and video equipment, rice cookers, lamps, wiring devices, air conditioners, air purifiers, and bicycles are just a few of the things Panasonic offers. In addition, it sells PCs, tablets, batteries, electric motors, mounting machines, semiconductors, LCD panels, electronic materials, electronic components, and electronic materials. The company manages and operates facilities and R&D locations in Europe, Asia, the Americas, and Japan.

Panasonic's corporate headquarters are in Kadoma-shi in the Japanese city of Osaka. In May 2019, Panasonic Corporation revealed the new frictionless connectivity solution, which is a safer way to wirelessly link mobile devices with automobiles.

Qualcomm Inc. creates and creates digital wireless telecommunications products and services. System software and integrated circuits for wireless mobile devices are sold by the company. Among its product lines are radio frequency transceivers, modems, processors, consumer wireless goods, integrated chipsets for wireless communication, and power management. The company's products are used in a variety of products, including mobile phones, laptops, handheld wireless computers, data modules, routers, access points, gateway equipment, desktop computers, gaming devices, infrastructure equipment, and Internet of Things (IoT) devices.

The corporation has operations in a number of nations, including Brazil, China, France, Germany, India, Mexico, South Korea, Indonesia, Japan, the UK, and the United States. Qualcomm's global headquarters are in San Diego, California. In May 2019, Qualcomm revealed a new infotainment control platform.

Key Companies in the Bluetooth in Automotive Market market include

Industry Developments

January 2021: Alps Alpine Co., Ltd. worked with Broadcom Inc. to introduce a Bluetooth Low Energy (BLE)-based, secure, and extremely accurate distance measurement system for the automotive market.

Future Outlook

Bluetooth in Automotive Market Future Outlook

The Global Bluetooth in Automotive Market is projected to grow at a 6.61% CAGR from 2025 to 2035, driven by advancements in connectivity, consumer demand for smart features, and regulatory support for vehicle safety.

New opportunities lie in:

- Develop integrated Bluetooth solutions for electric vehicles to enhance user experience.

- Invest in R&D for advanced audio streaming technologies to capture premium market segments.

- Forge partnerships with automotive manufacturers to embed Bluetooth technology in next-gen vehicles.

By 2035, the market is expected to be robust, reflecting substantial growth and innovation in automotive connectivity.

Market Segmentation

Bluetooth in Automotive Regional Outlook

- US

- Canada

Bluetooth in Automotive Application Outlook

- Communication

- Infotainment

- Telematics

Bluetooth in Automotive Vehicle Type Outlook

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

Report Scope

| Attribute/Metric | Details |

| Market Size 2024 | USD 10.54 Billion |

| Market Size 2035 | 21.32 (Value (USD Billion)) |

| Compound Annual Growth Rate (CAGR) | 6.61% (2025 - 2035) |

| Base Year | 2024 |

| Market Forecast Period | 2025 - 2035 |

| Historical Data | 2018- 2023 |

| Market Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Application, Vehicle Type, and Region |

| Geographies Covered | North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered | The US, Canada, German, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled | Texas Instruments Incorporated, QUALCOMM Incorporated, Cypress Semiconductor Corporation, Marvell Technology Group Ltd, Toshiba Corporation, Samsung Corporation, Semiconductor Corporation, Broadcom Corporation, Pioneer Corporation, and Silicon Laboratories |

| Key Market Opportunities | Rising sales of EV |

| Key Market Dynamics | Integration of smartphone connectivity in cars and increased investment in smart vehicles |

| Market Size 2025 | 11.24 (Value (USD Billion)) |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

How much is the Bluetooth in Automotive market?

The Bluetooth in Automotivemarket size was valued at USD 9.1 Billion in 2022.

What is the growth rate of the Bluetooth in Automotive market?

The global market is projected to grow at a CAGR of 6.61% during the forecast period, 2024-2032.

Which region held the largest market share in the Bluetooth in Automotive market?

Asia Pacific had the largest share in the global market

Who are the key players in the Bluetooth in Automotive market?

The key players in the market are Texas Instruments Incorporated, QUALCOMM Incorporated, Cypress Semiconductor Corporation, Marvell Technology Group Ltd, Toshiba Corporation, Samsung Corporation, Semiconductor Corporation, Broadcom Corporation, Pioneer Corporation, and Silicon Laboratories.

Which Application led the Bluetooth in Automotive market?

The Infotainment Application dominated the market in 2022.

Which Vehicle Type had the largest market share in the Bluetooth in Automotive market?

The Passenger Car Vehicle Type had the largest share in the global market.

-

Executive Summary

- Suggestions 9

-

Research Methodology

- Definition 10

- Scope of the Study 10

- Assumptions 10

-

Research Methodology

- Research Process 11

- Primary Research 12

- Secondary Research 12

- Market Size Estimation 12

- Forecast Model 14

-

Global Bluetooth In Automotive Market, By Application

- Introduction 19

- Communication 20

- Infotainment 21

- Telematics 21

-

Global Bluetooth In Automotive Market, By Vehicle Type

- Introduction 22

- Passenger Car 23

- Light Commercial Vehicles 24

- Heavy Commercial Vehicle 24

-

Global Bluetooth In Automotive Market, By OEM Makers

- Introduction 26

-

Global Bluetooth In Automotive Market, By Region

- Introduction 29

-

North America 30

- By Application 31

- By Vehicle Type 32

- By OEM Maker 33

-

Europe 35

- By Application 36

- By Vehicle Type 37

- By OEM Maker 38

-

Asia-Pacific 39

- By Application 40

- By Vehicle Type 41

- By OEM Maker 42

-

Rest Of The World 43

- By Application 44

- By Vehicle Type 45

- By OEM Maker 46

-

List of Tables and Figures

- 8 List Of Tables

- TABLE 1 GLOBAL BLUETOOTH IN AUTOMOTIVE MARKET, BY APPLICATION, 2023-2032 (MILLION UNITS) 20

- TABLE 2 GLOBAL BLUETOOTH IN AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2023-2032 (MILLION UNITS) 22

- TABLE 3 GLOBAL BLUETOOTH IN AUTOMOTIVE MARKET, BY OEM MAKERS, 2023-2032 (MILLION UNITS) 27

- TABLE 4 GLOBAL BLUETOOTH IN AUTOMOTIVE MARKET, BY REGION, 2023-2032 (MILLION UNITS) 30

- TABLE 5 NORTH AMERICA BLUETOOTH IN AUTOMOTIVE MARKET, BY APPLICATION, 2023-2032 (MILLION UNITS) 32

- TABLE 6 NORTH AMERICA BLUETOOTH IN AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2023-2032 (MILLION UNITS) 33

- TABLE 7 NORTH AMERICA BLUETOOTH IN AUTOMOTIVE MARKET, BY OEM MAKER, 2023-2032 (MILLION UNITS) 34

- TABLE 8 EUROPE BLUETOOTH IN AUTOMOTIVE MARKET, BY APPLICATION, 2023-2032 (MILLION UNITS) 36

- TABLE 9 EUROPE BLUETOOTH IN AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2023-2032 (MILLION UNITS) 37

- TABLE 10 EUROPE BLUETOOTH IN AUTOMOTIVE MARKET, BY OEM MAKER, 2023-2032 (MILLION UNITS) 38

- TABLE 11 ASIA-PACIFIC BLUETOOTH IN AUTOMOTIVE MARKET, BY APPLICATION, 2023-2032 (MILLION UNITS) 40

- TABLE 12 ASIA-PACIFIC BLUETOOTH IN AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2023-2032 (MILLION UNITS) 41

- TABLE 13 ASIA-PACIFIC BLUETOOTH IN AUTOMOTIVE MARKET, BY OEM MAKER, 2023-2032 (MILLION UNITS) 42

- TABLE 14 REST OF THE WORLD BLUETOOTH IN AUTOMOTIVE MARKET, BY APPICATION, 2023-2032 (MILLION UNITS) 46

- TABLE 15 REST OF THE WORLD BLUETOOTH IN AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2023-2032 (MILLION UNITS) 47

- TABLE 16 REST OF THE WORLD BLUETOOTH IN AUTOMOTIVE MARKET, BY OEM MAKER, 2023-2032 (MILLION UNITS) 48 9 List Of Figures

- FIGURE 1 GLOBAL TOTAL VEHICLE PRODUCTION 2014-2023 10

- FIGURE 2 RESEARCH PROCESS OF MRFR 11

- FIGURE 3 TOP DOWN & BOTTOM UP APPROACH 13

- FIGURE 4 GLOBAL BLUETOOTH IN AUTOMOTIVE MARKET SHARE (%), BY APPLICATION, 2023 (%) 19

- FIGURE 5 GLOBAL BLUETOOTH IN AUTOMOTIVE MARKET, BY APPLICATION, 2023-2032 (MILLION UNITS) 19

- FIGURE 6 GLOBAL BLUETOOTH IN AUTOMOTIVE MARKET FOR COMMUNICATION, 2023-2032 (MILLION UNITS) 20

- FIGURE 7 GLOBAL BLUETOOTH IN AUTOMOTIVE MARKET FOR INFOTAINMENT, 2023-2032 (MILLION UNITS) 21

- FIGURE 8 GLOBAL BLUETOOTH IN AUTOMOTIVE MARKET FOR TELEMATICS, 2023-2032 (MILLION UNITS) 21

- FIGURE 9 GLOBAL BLUETOOTH IN AUTOMOTIVE MARKET SHARE (%), BY VEHICLE TYPE, 2023 (%) 22

- FIGURE 10 GLOBAL BLUETOOTH IN AUTOMOTIVE MARKET FOR PASSENGER CAR, 2023-2032 (MILLION UNITS) 23

- FIGURE 11 GLOBAL BLUETOOTH IN AUTOMOTIVE MARKET FOR LIGHT COMMERCIAL VEHICLES, 2023-2032 (MILLION UNITS) 24

- FIGURE 12 GLOBAL BLUETOOTH IN AUTOMOTIVE MARKET FOR HEAVY COMMERCIAL VEHICLE, 2023-2032 (MILLION UNITS) 24

- FIGURE 13 GLOBAL BLUETOOTH IN AUTOMOTIVE MARKET SHARE (%), BY OEM MAKERS, 2023 (%) 26

- FIGURE 14 GLOBAL BLUETOOTH IN AUTOMOTIVE MARKET, BY OEM MAKERS, 2023-2032 (MILLION UNITS) 27

- FIGURE 15 GLOBAL BLUETOOTH IN AUTOMOTIVE MARKET SHARE (%), BY REGION, 2023 29

- FIGURE 16 GLOBAL BLUETOOTH IN AUTOMOTIVE MARKET, BY REGION, 2023-2032 (MILLION UNITS) 29

- FIGURE 17 NORTH AMERICA BLUETOOTH IN AUTOMOTIVE MARKET, BY APPLICATION, 2023-2032 (MILLION UNITS) 31

- FIGURE 18 NORTH AMERICA BLUETOOTH IN AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2023-2032 (MILLION UNITS) 32

- FIGURE 19 NORTH AMERICA BLUETOOTH IN AUTOMOTIVE MARKET, BY OEM MAKER, 2023-2032 (MILLION UNITS) 33

- FIGURE 20 EUROPE BLUETOOTH IN AUTOMOTIVE MARKET, BY APPLICATION, 2023-2032 (MILLION UNITS) 36

- FIGURE 21 EUROPE BLUETOOTH IN AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2023-2032 (MILLION UNITS) 37

- FIGURE 22 EUROPE BLUETOOTH IN AUTOMOTIVE MARKET, BY OEM MAKER, 2023-2032 (MILLION UNITS) 38

- FIGURE 23 ASIA-PACIFIC BLUETOOTH IN AUTOMOTIVE MARKET, BY APPLICATION, 2023-2032 (MILLION UNITS) 40

- FIGURE 24 ASIA-PACIFIC BLUETOOTH IN AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2023-2032 (MILLION UNITS) 41

- FIGURE 25 ASIA-PACIFIC BLUETOOTH IN AUTOMOTIVE MARKET, BY OEM MAKER, 2023-2032 (MILLION UNITS) 42

- FIGURE 26 REST OF THE WORLD BLUETOOTH IN AUTOMOTIVE MARKET, BY APPLICATION, 2023-2032 (MILLION UNITS) 44

- FIGURE 27 REST OF THE WORLD BLUETOOTH IN AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2023-2032 (MILLION UNITS) 45

- FIGURE 28 REST OF THE WORLD BLUETOOTH IN AUTOMOTIVE MARKET, BY OEM MAKER, 2023-2032 (MILLION UNITS) 46

Bluetooth in Automotive Market Segmentation

Bluetooth in Automotive Application Outlook (USD Billion, 2018-2032)

- Communication

- Infotainment

- Telematics

Bluetooth in Automotive Vehicle Type Outlook (USD Billion, 2018-2032)

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

Bluetooth in Automotive Regional Outlook (USD Billion, 2018-2032)

North America Outlook (USD Billion, 2018-2032)

- Bluetooth in Automotive by Application

- Communication

- Infotainment

- Telematics

- Bluetooth in Automotive by Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

US Outlook (USD Billion, 2018-2032)

- Bluetooth in Automotive by Application

- Communication

- Infotainment

- Telematics

- Bluetooth in Automotive by Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

Canada Outlook (USD Billion, 2018-2032)

- Bluetooth in Automotive by Application

- Communication

- Infotainment

- Telematics

- Bluetooth in Automotive by Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Bluetooth in Automotive by Application

Europe Outlook (USD Billion, 2018-2032)

- Bluetooth in Automotive by Application

- Communication

- Infotainment

- Telematics

- Bluetooth in Automotive by Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

Germany Outlook (USD Billion, 2018-2032)

- Bluetooth in Automotive by Application

- Communication

- Infotainment

- Telematics

- Bluetooth in Automotive by Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

France Outlook (USD Billion, 2018-2032)

- Bluetooth in Automotive by Application

- Communication

- Infotainment

- Telematics

- Bluetooth in Automotive by Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

UK Outlook (USD Billion, 2018-2032)

- Bluetooth in Automotive by Application

- Communication

- Infotainment

- Telematics

- Bluetooth in Automotive by Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

Italy Outlook (USD Billion, 2018-2032)

- Bluetooth in Automotive by Application

- Communication

- Infotainment

- Telematics

- Bluetooth in Automotive by Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

Spain Outlook (USD Billion, 2018-2032)

- Bluetooth in Automotive by Application

- Communication

- Infotainment

- Telematics

- Bluetooth in Automotive by Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

Rest Of Europe Outlook (USD Billion, 2018-2032)

- Bluetooth in Automotive by Application

- Communication

- Infotainment

- Telematics

- Bluetooth in Automotive by Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Bluetooth in Automotive by Application

Asia-Pacific Outlook (USD Billion, 2018-2032)

- Bluetooth in Automotive by Application

- Communication

- Infotainment

- Telematics

- Bluetooth in Automotive by Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

China Outlook (USD Billion, 2018-2032)

- Bluetooth in Automotive by Application

- Communication

- Infotainment

- Telematics

- Bluetooth in Automotive by Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

Japan Outlook (USD Billion, 2018-2032)

- Bluetooth in Automotive by Application

- Communication

- Infotainment

- Telematics

- Bluetooth in Automotive by Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

India Outlook (USD Billion, 2018-2032)

- Bluetooth in Automotive by Application

- Communication

- Infotainment

- Telematics

- Bluetooth in Automotive by Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

Australia Outlook (USD Billion, 2018-2032)

- Bluetooth in Automotive by Application

- Communication

- Infotainment

- Telematics

- Bluetooth in Automotive by Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

Rest of Asia-Pacific Outlook (USD Billion, 2018-2032)

- Bluetooth in Automotive by Application

- Communication

- Infotainment

- Telematics

- Bluetooth in Automotive by Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Bluetooth in Automotive by Application

Rest of the World Outlook (USD Billion, 2018-2032)

- Bluetooth in Automotive by Application

- Communication

- Infotainment

- Telematics

- Bluetooth in Automotive by Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

Middle East Outlook (USD Billion, 2018-2032)

- Bluetooth in Automotive by Application

- Communication

- Infotainment

- Telematics

- Bluetooth in Automotive by Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

Africa Outlook (USD Billion, 2018-2032)

- Bluetooth in Automotive by Application

- Communication

- Infotainment

- Telematics

- Bluetooth in Automotive by Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

Latin America Outlook (USD Billion, 2018-2032)

- Bluetooth in Automotive by Application

- Communication

- Infotainment

- Telematics

- Bluetooth in Automotive by Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Bluetooth in Automotive by Application

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment