Automotive Smart Display Market Trends

Automotive Smart Display Market Research Report By Technology (Liquid Crystal Display, Organic Light Emitting Diode, MicroLED, Digital Light Processing), By Display Type (Instrument Cluster, Center Stack Display, Head-Up Display, Rear Seat Entertainment), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Electric Vehicles), By Functionality (Infotainment, Na...

Market Summary

As per Market Research Future Analysis, the Automotive Smart Display Market was valued at 16.48 USD Billion in 2022 and is projected to grow to 18.73 USD Billion by 2035, reflecting a CAGR of 7.13% from 2025 to 2035. The market is driven by technological advancements, consumer demand for enhanced in-vehicle experiences, and the integration of advanced driver assistance systems (ADAS).

Key Market Trends & Highlights

The Automotive Smart Display Market is witnessing significant growth due to several key trends.

- Market Size in 2024: 8.78 USD Billion; Expected to reach 18.73 USD Billion by 2035.

- LCD technology held a market value of 6.5 USD Billion in 2023, projected to grow to 12.5 USD Billion by 2032.

- OLED technology valued at 4.5 USD Billion in 2023, expected to reach 18.73 USD Billion by 2035.

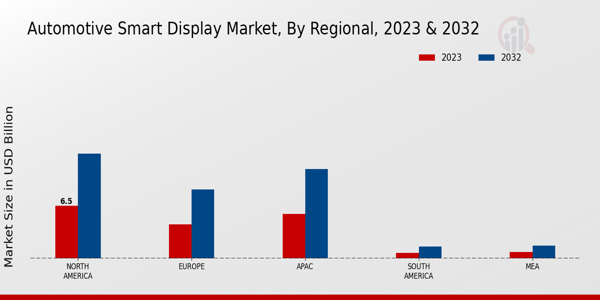

- North America held a market share of 6.5 USD Billion in 2023, forecasted to grow to 12.9 USD Billion by 2032.

Market Size & Forecast

| 2024 Market Size | USD 8.78 Billion |

| 2035 Market Size | USD 18.73 Billion |

| CAGR (2024-2035) | 7.13% |

| Largest Regional Market Share in 2023 | North America. |

Major Players

Key players include MRAM, Denso Corporation, Toshiba, Qualcomm, Faurecia, Continental AG, Robert Bosch, Gentex Corporation, Panasonic, Samsung Display, Visteon Corporation, Aisin Seiki, Aptiv, LG Display, NVIDIA.

Market Trends

The global market for automotive smart displays is expanding significantly due to a number of important factors. The market is being supported by the rise of linked cars and the growing need for sophisticated entertainment systems.

More attention is being paid to integrating smartphone connectivity, navigation, and entertainment capabilities as a result of consumers' desire for better in-car experiences.

Furthermore, the trend toward electric cars and self-driving technology is fostering the creation of increasingly complex display interfaces that intuitively convey crucial information. Opportunities abound in this changing environment.

Manufacturers are looking into ways to improve functionality and interface design in order to improve the user experience. The emergence of augmented reality displays offers a singular opportunity to improve safety and navigation by superimposing real-time information on drivers' field of vision.

Furthermore, the growing interest in personalized in-car experiences opens doors for tailored content and services, presenting an avenue for tech companies to collaborate with automotive manufacturers.

Recently, trends have shifted toward incorporating larger and higher-resolution displays that support multi-functionality. Touchscreen interfaces, along with gesture and voice recognition technologies, are increasingly becoming standard in vehicles.

There is also a noticeable movement towards energy-efficient displays that cater to the environmental concerns associated with automotive production. Integration of artificial intelligence in smart displays is on the rise, enabling predictive analytics and smarter automotive systems.

As the industry progresses, the focus on durability and user-friendly designs continues to be a priority, ensuring that displays can withstand the rigors of automotive usage while remaining accessible and easy to operate.

The ongoing evolution of automotive smart displays is poised to redefine user interaction within vehicles, enhancing safety and connectivity while aligning with the broader trends of digital transformation in the automotive industry.

U.S. Department of Transportation

Automotive Smart Display Market Market Drivers

Market Growth Projections

The Global Automotive Smart Display Market Industry is projected to experience substantial growth over the coming years. The market is expected to reach a valuation of 18.9 USD Billion in 2024, with a remarkable increase to 43.1 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 7.75% from 2025 to 2035, indicating a robust demand for smart display technologies in vehicles. The increasing integration of advanced features and functionalities in automotive displays is likely to drive this expansion, reflecting the evolving needs of consumers and the automotive industry.

Technological Advancements

The Global Automotive Smart Display Market Industry is experiencing rapid technological advancements, particularly in display technologies such as OLED and LCD. These innovations enhance visual clarity and responsiveness, making driving experiences more intuitive and enjoyable. For instance, the integration of augmented reality in heads-up displays allows drivers to receive real-time navigation information without diverting their attention from the road. Such advancements are likely to contribute to the market's growth, as consumers increasingly demand high-quality displays that improve safety and convenience.

Growing Electric Vehicle Adoption

The Global Automotive Smart Display Market Industry is poised for growth due to the rising adoption of electric vehicles (EVs). As EV manufacturers seek to differentiate their products, they are increasingly incorporating advanced smart displays that provide essential information about battery status, charging locations, and energy consumption. This trend is particularly evident in premium EV models, where sophisticated displays enhance the overall user experience. The shift towards electric mobility is likely to create new opportunities for smart display technologies, contributing to a compound annual growth rate of 7.75% from 2025 to 2035.

Rising Consumer Demand for Connectivity

In the Global Automotive Smart Display Market Industry, there is a noticeable increase in consumer demand for connectivity features in vehicles. Modern drivers expect seamless integration of their smartphones with in-car systems, enabling access to navigation, music, and communication applications. This trend is reflected in the growing adoption of infotainment systems that utilize smart displays to provide a user-friendly interface. As a result, manufacturers are investing in advanced connectivity solutions, which is anticipated to drive market growth significantly, with projections indicating a market value of 18.9 USD Billion in 2024.

Regulatory Support for Advanced Safety Features

The Global Automotive Smart Display Market Industry benefits from regulatory support aimed at enhancing vehicle safety. Governments worldwide are increasingly mandating the inclusion of advanced driver assistance systems (ADAS) that utilize smart displays for functions such as lane departure warnings and collision avoidance. This regulatory push not only promotes the adoption of smart displays but also encourages manufacturers to innovate and improve their offerings. As safety becomes a priority for consumers and regulators alike, the market is expected to expand, potentially reaching a value of 43.1 USD Billion by 2035.

Consumer Preference for Enhanced User Experience

In the Global Automotive Smart Display Market Industry, consumer preference for enhanced user experiences is driving innovation in display technologies. Modern drivers seek intuitive interfaces that facilitate easy access to information and entertainment while on the road. This demand has led to the development of touch-sensitive displays, voice recognition systems, and customizable interfaces that cater to individual preferences. As manufacturers strive to meet these expectations, the market is likely to witness significant advancements, further solidifying the role of smart displays in modern vehicles.

Market Segment Insights

Automotive Smart Display Market Technology Insights

The Automotive Smart Display Market, particularly within the technology segment, showed notable activity and growth potential.

Among the various technologies, Liquid Crystal Display (LCD) held a majority share, with a market value of 6.5 USD Billion in 2023 and projected growth to 12.5 USD Billion by 2032. This dominance can be attributed to its widespread use and established presence in the automotive sector, providing efficient and reliable displays for dashboards and infotainment systems.

Organic Light Emitting Diode (OLED) technology also played a significant role in this market, with a valuation of 4.5 USD Billion in 2023 and expected growth to 9.0 USD Billion in 2032. OLED displays were highly favored for their superior color reproduction, thinner profile, and flexibility, thereby enhancing the aesthetic appeal and user experience in modern vehicles.

The emerging MicroLED technology carved out its niche, valued at 3.0 USD Billion in 2023 and anticipated to reach 6.0 USD Billion by 2032. MicroLED offered advantages like high brightness and energy efficiency, making it a promising choice as automotive makers look to integrate next-generation displays.

In comparison, Digital Light Processing (DLP) technology stood at a valuation of 3.74 USD Billion in 2023, projected to grow to 7.0 USD Billion by 2032. DLP's significance lies in its capability to create high-resolution images and vivid colors, making it suitable for applications such as heads-up displays (HUDs) and advanced driver-assistance systems (ADAS).

Automotive Smart Display Market Display Type Insights

Display Type segmentation plays a crucial role in this market, encompassing Instrument Cluster, Center Stack Display, Head-Up Display, and Rear Seat Entertainment. The Instrument Cluster is essential for driver information, enhancing safety and user experience, while the Center Stack Display serves as a primary interface for infotainment and vehicle controls, significantly increasing demand.

The Head-Up Display (HUD) is gaining traction due to its ability to project critical information directly onto the windshield, minimizing driver distraction.

Rear-seat entertainment systems are also becoming increasingly popular as consumers seek enhanced in-car experiences for passengers. Together, these segments form a vital part of the Automotive Smart Display Market revenue.

This market growth is fueled by trends such as increasing connectivity, consumer demand for advanced features, and technological advancements in display solutions, alongside challenges like high costs and integration complexities. Overall, these factors present substantial opportunities for innovation and market expansion.

Automotive Smart Display Market Vehicle Type Insights

The market is witnessing a diverse segmentation into categories such as Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, and Electric Vehicles. Passenger Cars are a driving force in the market, primarily due to consumer demand for enhanced in-car connectivity and infotainment systems.

Light Commercial Vehicles are also gaining traction, reflecting the growing need for smart solutions in logistics and transportation, aiming to improve operational efficiency.

Heavy Commercial Vehicles are spotlighted as they increasingly adopt smart display technologies to enhance safety and navigational features, addressing demands in freight and logistics industries. Electric Vehicles play a crucial role, representing a significant portion of the market, as these vehicles require advanced display systems to manage various metrics crucial to their performance and user experience.

This continued evolution across these vehicle categories showcases the dynamic nature of the Automotive Smart Display Market and its adaptability to emerging automotive technologies and consumer preferences.

The anticipated growth trajectories highlight the potential for lucrative opportunities driven by advancing technology and increasing consumer expectations.

Automotive Smart Display Market Functionality Insights

The Automotive Smart Display Market is expected to experience notable growth, driven largely by advancements in functionality. Within this segment, areas such as infotainment, navigation, vehicle monitoring, and communication play critical roles.

Infotainment, integrating entertainment with information services, has become essential for enhancing user experience, while navigation systems significantly improve driver safety and efficiency by providing real-time geographic data. Vehicle monitoring facilitates ongoing vehicle diagnostics, ensuring optimal performance and maintenance, and communication systems foster better interactions between vehicles, drivers, and the surrounding environment.

These aspects of functionality not only contribute to market growth but also shape consumer expectations, highlighting the increasing need for smarter, safer, and more connected vehicles.

Overall, the Automotive Smart Display Market data points to a trend towards sophisticated interfaces that improve overall driving experiences, suggesting further developments in these functional areas will continue to drive significant advancements in the industry.

Get more detailed insights about Automotive Smart Display Market Research Report - Global Forecast till 2032

Regional Insights

The Automotive Smart Display Market encompassed various regions that contribute significantly to its overall growth. In 2023, North America held a majority share with a valuation of 6.5 USD Billion and is forecasted to grow to 12.9 USD Billion by 2032, highlighting its dominant position driven by technological advancements and consumer demand for enhanced vehicle connectivity.

Europe followed closely with a value of 4.2 USD Billion in 2023, projected to reach 8.5 USD Billion by 2032, benefiting from strict regulations on vehicle safety and infotainment systems.

The APAC region, valued at 5.5 USD Billion in 2023 and expected to double to 11.0 USD Billion by 2032, emerged as a significant player owing to the rapid adoption of smart technologies and a burgeoning automotive industry. South America and MEA, while valued at 0.7 USD Billion and 0.8 USD Billion, respectively, showed potential for growth, ultimately reaching 1.5 USD Billion and 1.6 USD Billion by 2032, driven by increasing vehicle production and improvements in infrastructure.

This distribution emphasizes the varying growth dynamics and opportunities across different regions within the Automotive Smart Display Market, ultimately making it a diverse and evolving landscape.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Key Players and Competitive Insights

The Automotive Smart Display Market has been experiencing significant growth due to the increasing integration of advanced technologies in vehicles. Smart displays are becoming a fundamental component in modern automobiles, facilitating enhanced connectivity, functionality, and user experience.

As consumers demand more intuitive interfaces and seamless infotainment options, companies in this space are intensifying their focus on innovative display solutions. The competitive landscape is characterized by rapid technological advancements, strategic partnerships, and collaborative ventures aimed at meeting the evolving needs of the automotive industry.

Additionally, the rise of electric and autonomous vehicles is further driving investments in smart display systems, leading to a dynamically competitive environment where key players are pushing the boundaries of innovation while striving for market share.

In this market, MRAM stands out as a prominent player with a robust foothold in automotive smart display technology. The company specializes in memory technology that supports high-performance graphics and rapid data access, which is vital for the increasing demands of automotive applications.

MRAM's strengths lie in its state-of-the-art manufacturing processes, which allow for high-quality and reliable products capable of withstanding the rigors of automotive environments. Its focus on research and development enables the creation of innovative solutions that enhance user interaction and enable the integration of various functionalities into smart displays.

By consistently pushing technology forward, MRAM maintains a strong presence in the competitive landscape, keeping pace with the rapid evolution of customer expectations and regulatory requirements in the automotive sector.

On the other hand, Denso Corporation has established itself as a key player in the Automotive Smart Display Market through its dedication to delivering cutting-edge automotive technology. The company leverages its extensive experience in electronic and automotive systems to create high-performance smart displays that enhance vehicle safety and user connectivity.

Denso Corporation's commitment to innovation is evident in its investment in advanced display technologies, including touch and gesture recognition, which significantly improve the driver and passenger experience. The company's partnerships with leading automakers amplify its reach and strengthen its market presence, allowing Denso Corporation to integrate its display solutions into a variety of vehicle models globally.

These initiatives highlight Denso Corporation's significant role in shaping the future of automotive smart display technology as it continuously strives to meet the ever-evolving demands of the automotive market.

Key Companies in the Automotive Smart Display Market market include

Industry Developments

- Q2 2024: Hyundai Motor Group and LG Display Sign Strategic Partnership to Develop Next-Generation Automotive OLED Displays Hyundai Motor Group announced a strategic partnership with LG Display to co-develop advanced OLED smart displays for upcoming vehicle models, aiming to enhance in-car infotainment and instrument cluster experiences.

- Q2 2024: Continental AG opens new automotive display manufacturing facility in China Continental AG inaugurated a new manufacturing plant in Changzhou, China, dedicated to producing automotive smart displays, expanding its capacity to meet growing demand from Asian automakers.

- Q2 2024: Bosch Launches Curved Smart Display for Mercedes-Benz S-Class Bosch introduced a new curved smart display, which debuted in the 2024 Mercedes-Benz S-Class, featuring advanced touch and haptic feedback technology.

- Q3 2024: Panasonic to supply next-gen automotive smart displays to Toyota Panasonic announced it has secured a contract to supply its latest generation of automotive smart displays for Toyota’s 2025 vehicle lineup.

- Q3 2024: Valeo and Faurecia Announce Joint Venture for Automotive Smart Display Modules Valeo and Faurecia revealed a new joint venture focused on the design and production of integrated smart display modules for global automotive OEMs.

- Q3 2024: Apple Car project hires former Samsung Display executive to lead automotive display development Apple has appointed a former Samsung Display executive to head its automotive display division, signaling a renewed focus on in-car display technology for its upcoming vehicle project.

- Q4 2024: Denso Unveils New Head-Up Display Technology for Electric Vehicles Denso launched a new head-up display (HUD) system designed specifically for electric vehicles, offering enhanced AR navigation and driver assistance features.

- Q4 2024: Magna International acquires minority stake in automotive display startup Envisics Magna International announced the acquisition of a minority stake in Envisics, a UK-based startup specializing in holographic automotive smart displays.

- Q1 2025: Samsung Display secures $1 billion contract to supply OLED panels for Volkswagen Samsung Display signed a $1 billion contract to provide OLED smart display panels for Volkswagen’s next-generation electric vehicles, starting with 2025 models.

- Q1 2025: General Motors partners with Sharp for next-gen in-car infotainment displays General Motors announced a partnership with Sharp to co-develop and supply advanced infotainment smart displays for its upcoming electric and autonomous vehicles.

- Q2 2025: Automotive display startup VividScreen raises $75M Series B to expand production VividScreen, a startup specializing in high-resolution automotive smart displays, raised $75 million in Series B funding to scale up manufacturing and accelerate R&D.

- Q2 2025: Tesla unveils new panoramic smart display for Model S and Model X Tesla introduced a new panoramic smart display system for its 2025 Model S and Model X vehicles, featuring seamless integration of navigation, entertainment, and vehicle controls.

Future Outlook

Automotive Smart Display Market Future Outlook

The Automotive Smart Display Market is projected to grow at a 7.75% CAGR from 2024 to 2035, driven by advancements in connectivity, consumer demand for enhanced user experiences, and regulatory support for smart technologies.

New opportunities lie in:

- Develop integrated display solutions for electric vehicles to enhance user interaction.

- Leverage AI for personalized driver information displays to improve safety and convenience.

- Expand partnerships with tech firms to innovate in augmented reality applications for navigation.

By 2035, the Automotive Smart Display Market is expected to achieve substantial growth, reflecting evolving consumer preferences and technological advancements.

Market Segmentation

Automotive Smart Display Market Regional Outlook

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

Automotive Smart Display Market Technology Outlook

- Instrument Cluster

- Center Stack Display

- Head-Up Display

- Rear Seat Entertainment

Automotive Smart Display Market Display Type Outlook

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Electric Vehicles

Automotive Smart Display Market Vehicle Type Outlook

- Infotainment

- Navigation

- Vehicle Monitoring

- Communication

Automotive Smart Display Market Functionality Outlook

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

Report Scope

| Attribute/Metric | Details |

| Market Size 2022 | 16.48 (USD Billion) |

| Market Size 2023 | 17.74 (USD Billion) |

| Market Size 2032 | 34.5 (USD Billion) |

| Compound Annual Growth Rate (CAGR) | 7.67% (2024 - 2032) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Base Year | 2023 |

| Market Forecast Period | 2024 - 2032 |

| Historical Data | 2019 - 2023 |

| Market Forecast Units | USD Billion |

| Key Companies Profiled | MRAM, Denso Corporation, Toshiba, Qualcomm, Faurecia, Continental AG, Robert Bosch, Gentex Corporation, Panasonic, Samsung Display, Visteon Corporation, Aisin Seiki, Aptiv, LG Display, NVIDIA |

| Segments Covered | Technology, Display Type, Vehicle Type, Functionality, Regional |

| Key Market Opportunities | Rising demand for connected vehicles, Growth in electric vehicle adoption, Advancements in display technology, Increasing consumer preference for infotainment, Integration of augmented reality features |

| Key Market Dynamics | Technological advancements in displays, Growing demand for connected vehicles, Rising consumer preference for infotainment, Increasing electric vehicle adoption, Enhanced safety and navigation features |

| Countries Covered | North America, Europe, APAC, South America, MEA |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

What is the projected market size of the Automotive Smart Display Market by 2032?

The Automotive Smart Display Market is expected to be valued at 34.5 USD Billion by 2032.

What is the expected compound annual growth rate (CAGR) for the Automotive Smart Display Market from 2024 to 2032?

The market is expected to grow at a CAGR of 7.67% from 2024 to 2032.

Which region is projected to dominate the Automotive Smart Display Market by 2032?

North America is projected to have the largest market share, valued at 12.9 USD Billion by 2032.

How much is the Liquid Crystal Display segment expected to be valued by 2032?

The Liquid Crystal Display segment is anticipated to be valued at 12.5 USD Billion by 2032.

What is the estimated market size for Organic Light light-emitting diode technology in 2032?

By 2032, the Organic Light Emitting Diode segment is expected to reach a value of 9.0 USD Billion.

What is the projected market growth rate for the APAC region from 2024 to 2032?

The APAC region is forecasted to show significant growth, with expectations to reach 11.0 USD Billion by 2032.

Who are the key players in the Automotive Smart Display Market?

Major players include Denso Corporation, Qualcomm, and Samsung Display, contributing significantly to the market.

What is the expected value for the MicroLED segment by 2032?

The MicroLED segment is forecasted to be valued at 6.0 USD Billion by 2032.

What will be the market size of the Digital Light Processing segment in 2032?

The Digital Light Processing segment is projected to reach 7.0 USD Billion by 2032.

How is the South American market for Automotive Smart Displays expected to grow by 2032?

The South American market is expected to grow to 1.5 USD Billion by 2032.

-

Table of Contents

-

Executive Summary

- Market Overview

- Key Findings

- Market Segmentation

- Competitive Landscape

- Challenges and Opportunities

- Future Outlook

-

Market Introduction

- Definition

-

Scope of the Study

- Research Objective

- Assumption

- Limitations

-

Research Methodology

- Overview

- Data Mining

- Secondary Research

-

Primary Research

- Primary Interviews and Information Gathering Process

- Breakdown of Primary Respondents

- Forecasting Model

-

Market Size Estimation

- Bottom-up Approach

- Top-Down Approach

- Data Triangulation

- Validation

-

MARKET DYNAMICS

- Overview

- Drivers

- Restraints

- Opportunities

-

MARKET FACTOR ANALYSIS

- Value chain Analysis

-

Porter''s Five Forces Analysis

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of New Entrants

- Threat of Substitutes

- Intensity of Rivalry

-

COVID-19 Impact Analysis

- Market Impact Analysis

- Regional Impact

- Opportunity and Threat Analysis

-

AUTOMOTIVE SMART DISPLAY MARKET, BY TECHNOLOGY (USD BILLION)

- Liquid Crystal Display

- Organic Light Emitting Diode

- MicroLED

- Digital Light Processing

-

AUTOMOTIVE SMART DISPLAY MARKET, BY DISPLAY TYPE (USD BILLION)

- Instrument Cluster

- Center Stack Display

- Head-Up Display

- Rear Seat Entertainment

-

AUTOMOTIVE SMART DISPLAY MARKET, BY VEHICLE TYPE (USD BILLION)

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Electric Vehicles

-

AUTOMOTIVE SMART DISPLAY MARKET, BY FUNCTIONALITY (USD BILLION)

- Infotainment

- Navigation

- Vehicle Monitoring

- Communication

-

AUTOMOTIVE SMART DISPLAY MARKET, BY REGIONAL (USD BILLION)

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Russia

- Italy

- Spain

- Rest of Europe

-

APAC

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Indonesia

- Rest of APAC

-

South America

- Brazil

- Mexico

- Argentina

- Rest of South America

-

MEA

- GCC Countries

- South Africa

- Rest of MEA

-

North America

-

Competitive Landscape

- Overview

- Competitive Analysis

- Market share Analysis

- Major Growth Strategy in the Automotive Smart Display Market

- Competitive Benchmarking

- Leading Players in Terms of Number of Developments in the Automotive Smart Display Market

-

Key developments and growth strategies

- New Product Launch/Service Deployment

- Merger & Acquisitions

- Joint Ventures

-

Major Players Financial Matrix

- Sales and Operating Income

- Major Players R&D Expenditure. 2023

-

COMPANY PROFILES

-

MRAM

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Denso Corporation

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Toshiba

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Qualcomm

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Faurecia

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Continental AG

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Robert Bosch

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Gentex Corporation

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Panasonic

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Samsung Display

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Visteon Corporation

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Aisin Seiki

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Aptiv

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

LG Display

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

NVIDIA

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

MRAM

-

APPENDIX

- References

- Related Reports

-

List of Tables and Figures

- LIST OF TABLES

- TABLE 1. LIST OF ASSUMPTIONS

- TABLE 2. NORTH AMERICA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2032 (USD BILLIONS)

- TABLE 3. NORTH AMERICA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY DISPLAY TYPE, 2019-2032 (USD BILLIONS)

- TABLE 4. NORTH AMERICA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2032 (USD BILLIONS)

- TABLE 5. NORTH AMERICA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY FUNCTIONALITY, 2019-2032 (USD BILLIONS)

- TABLE 6. NORTH AMERICA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 7. US AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2032 (USD BILLIONS)

- TABLE 8. US AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY DISPLAY TYPE, 2019-2032 (USD BILLIONS)

- TABLE 9. US AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2032 (USD BILLIONS)

- TABLE 10. US AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY FUNCTIONALITY, 2019-2032 (USD BILLIONS)

- TABLE 11. US AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 12. CANADA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2032 (USD BILLIONS)

- TABLE 13. CANADA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY DISPLAY TYPE, 2019-2032 (USD BILLIONS)

- TABLE 14. CANADA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2032 (USD BILLIONS)

- TABLE 15. CANADA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY FUNCTIONALITY, 2019-2032 (USD BILLIONS)

- TABLE 16. CANADA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 17. EUROPE AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2032 (USD BILLIONS)

- TABLE 18. EUROPE AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY DISPLAY TYPE, 2019-2032 (USD BILLIONS)

- TABLE 19. EUROPE AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2032 (USD BILLIONS)

- TABLE 20. EUROPE AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY FUNCTIONALITY, 2019-2032 (USD BILLIONS)

- TABLE 21. EUROPE AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 22. GERMANY AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2032 (USD BILLIONS)

- TABLE 23. GERMANY AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY DISPLAY TYPE, 2019-2032 (USD BILLIONS)

- TABLE 24. GERMANY AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2032 (USD BILLIONS)

- TABLE 25. GERMANY AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY FUNCTIONALITY, 2019-2032 (USD BILLIONS)

- TABLE 26. GERMANY AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 27. UK AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2032 (USD BILLIONS)

- TABLE 28. UK AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY DISPLAY TYPE, 2019-2032 (USD BILLIONS)

- TABLE 29. UK AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2032 (USD BILLIONS)

- TABLE 30. UK AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY FUNCTIONALITY, 2019-2032 (USD BILLIONS)

- TABLE 31. UK AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 32. FRANCE AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2032 (USD BILLIONS)

- TABLE 33. FRANCE AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY DISPLAY TYPE, 2019-2032 (USD BILLIONS)

- TABLE 34. FRANCE AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2032 (USD BILLIONS)

- TABLE 35. FRANCE AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY FUNCTIONALITY, 2019-2032 (USD BILLIONS)

- TABLE 36. FRANCE AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 37. RUSSIA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2032 (USD BILLIONS)

- TABLE 38. RUSSIA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY DISPLAY TYPE, 2019-2032 (USD BILLIONS)

- TABLE 39. RUSSIA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2032 (USD BILLIONS)

- TABLE 40. RUSSIA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY FUNCTIONALITY, 2019-2032 (USD BILLIONS)

- TABLE 41. RUSSIA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 42. ITALY AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2032 (USD BILLIONS)

- TABLE 43. ITALY AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY DISPLAY TYPE, 2019-2032 (USD BILLIONS)

- TABLE 44. ITALY AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2032 (USD BILLIONS)

- TABLE 45. ITALY AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY FUNCTIONALITY, 2019-2032 (USD BILLIONS)

- TABLE 46. ITALY AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 47. SPAIN AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2032 (USD BILLIONS)

- TABLE 48. SPAIN AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY DISPLAY TYPE, 2019-2032 (USD BILLIONS)

- TABLE 49. SPAIN AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2032 (USD BILLIONS)

- TABLE 50. SPAIN AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY FUNCTIONALITY, 2019-2032 (USD BILLIONS)

- TABLE 51. SPAIN AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 52. REST OF EUROPE AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2032 (USD BILLIONS)

- TABLE 53. REST OF EUROPE AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY DISPLAY TYPE, 2019-2032 (USD BILLIONS)

- TABLE 54. REST OF EUROPE AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2032 (USD BILLIONS)

- TABLE 55. REST OF EUROPE AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY FUNCTIONALITY, 2019-2032 (USD BILLIONS)

- TABLE 56. REST OF EUROPE AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 57. APAC AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2032 (USD BILLIONS)

- TABLE 58. APAC AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY DISPLAY TYPE, 2019-2032 (USD BILLIONS)

- TABLE 59. APAC AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2032 (USD BILLIONS)

- TABLE 60. APAC AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY FUNCTIONALITY, 2019-2032 (USD BILLIONS)

- TABLE 61. APAC AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 62. CHINA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2032 (USD BILLIONS)

- TABLE 63. CHINA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY DISPLAY TYPE, 2019-2032 (USD BILLIONS)

- TABLE 64. CHINA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2032 (USD BILLIONS)

- TABLE 65. CHINA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY FUNCTIONALITY, 2019-2032 (USD BILLIONS)

- TABLE 66. CHINA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 67. INDIA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2032 (USD BILLIONS)

- TABLE 68. INDIA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY DISPLAY TYPE, 2019-2032 (USD BILLIONS)

- TABLE 69. INDIA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2032 (USD BILLIONS)

- TABLE 70. INDIA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY FUNCTIONALITY, 2019-2032 (USD BILLIONS)

- TABLE 71. INDIA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 72. JAPAN AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2032 (USD BILLIONS)

- TABLE 73. JAPAN AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY DISPLAY TYPE, 2019-2032 (USD BILLIONS)

- TABLE 74. JAPAN AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2032 (USD BILLIONS)

- TABLE 75. JAPAN AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY FUNCTIONALITY, 2019-2032 (USD BILLIONS)

- TABLE 76. JAPAN AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 77. SOUTH KOREA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2032 (USD BILLIONS)

- TABLE 78. SOUTH KOREA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY DISPLAY TYPE, 2019-2032 (USD BILLIONS)

- TABLE 79. SOUTH KOREA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2032 (USD BILLIONS)

- TABLE 80. SOUTH KOREA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY FUNCTIONALITY, 2019-2032 (USD BILLIONS)

- TABLE 81. SOUTH KOREA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 82. MALAYSIA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2032 (USD BILLIONS)

- TABLE 83. MALAYSIA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY DISPLAY TYPE, 2019-2032 (USD BILLIONS)

- TABLE 84. MALAYSIA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2032 (USD BILLIONS)

- TABLE 85. MALAYSIA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY FUNCTIONALITY, 2019-2032 (USD BILLIONS)

- TABLE 86. MALAYSIA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 87. THAILAND AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2032 (USD BILLIONS)

- TABLE 88. THAILAND AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY DISPLAY TYPE, 2019-2032 (USD BILLIONS)

- TABLE 89. THAILAND AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2032 (USD BILLIONS)

- TABLE 90. THAILAND AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY FUNCTIONALITY, 2019-2032 (USD BILLIONS)

- TABLE 91. THAILAND AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 92. INDONESIA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2032 (USD BILLIONS)

- TABLE 93. INDONESIA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY DISPLAY TYPE, 2019-2032 (USD BILLIONS)

- TABLE 94. INDONESIA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2032 (USD BILLIONS)

- TABLE 95. INDONESIA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY FUNCTIONALITY, 2019-2032 (USD BILLIONS)

- TABLE 96. INDONESIA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 97. REST OF APAC AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2032 (USD BILLIONS)

- TABLE 98. REST OF APAC AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY DISPLAY TYPE, 2019-2032 (USD BILLIONS)

- TABLE 99. REST OF APAC AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2032 (USD BILLIONS)

- TABLE 100. REST OF APAC AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY FUNCTIONALITY, 2019-2032 (USD BILLIONS)

- TABLE 101. REST OF APAC AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 102. SOUTH AMERICA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2032 (USD BILLIONS)

- TABLE 103. SOUTH AMERICA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY DISPLAY TYPE, 2019-2032 (USD BILLIONS)

- TABLE 104. SOUTH AMERICA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2032 (USD BILLIONS)

- TABLE 105. SOUTH AMERICA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY FUNCTIONALITY, 2019-2032 (USD BILLIONS)

- TABLE 106. SOUTH AMERICA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 107. BRAZIL AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2032 (USD BILLIONS)

- TABLE 108. BRAZIL AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY DISPLAY TYPE, 2019-2032 (USD BILLIONS)

- TABLE 109. BRAZIL AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2032 (USD BILLIONS)

- TABLE 110. BRAZIL AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY FUNCTIONALITY, 2019-2032 (USD BILLIONS)

- TABLE 111. BRAZIL AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 112. MEXICO AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2032 (USD BILLIONS)

- TABLE 113. MEXICO AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY DISPLAY TYPE, 2019-2032 (USD BILLIONS)

- TABLE 114. MEXICO AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2032 (USD BILLIONS)

- TABLE 115. MEXICO AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY FUNCTIONALITY, 2019-2032 (USD BILLIONS)

- TABLE 116. MEXICO AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 117. ARGENTINA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2032 (USD BILLIONS)

- TABLE 118. ARGENTINA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY DISPLAY TYPE, 2019-2032 (USD BILLIONS)

- TABLE 119. ARGENTINA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2032 (USD BILLIONS)

- TABLE 120. ARGENTINA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY FUNCTIONALITY, 2019-2032 (USD BILLIONS)

- TABLE 121. ARGENTINA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 122. REST OF SOUTH AMERICA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2032 (USD BILLIONS)

- TABLE 123. REST OF SOUTH AMERICA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY DISPLAY TYPE, 2019-2032 (USD BILLIONS)

- TABLE 124. REST OF SOUTH AMERICA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2032 (USD BILLIONS)

- TABLE 125. REST OF SOUTH AMERICA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY FUNCTIONALITY, 2019-2032 (USD BILLIONS)

- TABLE 126. REST OF SOUTH AMERICA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 127. MEA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2032 (USD BILLIONS)

- TABLE 128. MEA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY DISPLAY TYPE, 2019-2032 (USD BILLIONS)

- TABLE 129. MEA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2032 (USD BILLIONS)

- TABLE 130. MEA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY FUNCTIONALITY, 2019-2032 (USD BILLIONS)

- TABLE 131. MEA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 132. GCC COUNTRIES AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2032 (USD BILLIONS)

- TABLE 133. GCC COUNTRIES AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY DISPLAY TYPE, 2019-2032 (USD BILLIONS)

- TABLE 134. GCC COUNTRIES AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2032 (USD BILLIONS)

- TABLE 135. GCC COUNTRIES AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY FUNCTIONALITY, 2019-2032 (USD BILLIONS)

- TABLE 136. GCC COUNTRIES AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 137. SOUTH AFRICA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2032 (USD BILLIONS)

- TABLE 138. SOUTH AFRICA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY DISPLAY TYPE, 2019-2032 (USD BILLIONS)

- TABLE 139. SOUTH AFRICA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2032 (USD BILLIONS)

- TABLE 140. SOUTH AFRICA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY FUNCTIONALITY, 2019-2032 (USD BILLIONS)

- TABLE 141. SOUTH AFRICA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 142. REST OF MEA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2032 (USD BILLIONS)

- TABLE 143. REST OF MEA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY DISPLAY TYPE, 2019-2032 (USD BILLIONS)

- TABLE 144. REST OF MEA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY VEHICLE TYPE, 2019-2032 (USD BILLIONS)

- TABLE 145. REST OF MEA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY FUNCTIONALITY, 2019-2032 (USD BILLIONS)

- TABLE 146. REST OF MEA AUTOMOTIVE SMART DISPLAY MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 147. PRODUCT LAUNCH/PRODUCT DEVELOPMENT/APPROVAL

- TABLE 148. ACQUISITION/PARTNERSHIP LIST OF FIGURES

- FIGURE 1. MARKET SYNOPSIS

- FIGURE 2. NORTH AMERICA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS

- FIGURE 3. US AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 4. US AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY DISPLAY TYPE

- FIGURE 5. US AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY VEHICLE TYPE

- FIGURE 6. US AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY FUNCTIONALITY

- FIGURE 7. US AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY REGIONAL

- FIGURE 8. CANADA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 9. CANADA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY DISPLAY TYPE

- FIGURE 10. CANADA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY VEHICLE TYPE

- FIGURE 11. CANADA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY FUNCTIONALITY

- FIGURE 12. CANADA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY REGIONAL

- FIGURE 13. EUROPE AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS

- FIGURE 14. GERMANY AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 15. GERMANY AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY DISPLAY TYPE

- FIGURE 16. GERMANY AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY VEHICLE TYPE

- FIGURE 17. GERMANY AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY FUNCTIONALITY

- FIGURE 18. GERMANY AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY REGIONAL

- FIGURE 19. UK AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 20. UK AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY DISPLAY TYPE

- FIGURE 21. UK AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY VEHICLE TYPE

- FIGURE 22. UK AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY FUNCTIONALITY

- FIGURE 23. UK AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY REGIONAL

- FIGURE 24. FRANCE AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 25. FRANCE AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY DISPLAY TYPE

- FIGURE 26. FRANCE AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY VEHICLE TYPE

- FIGURE 27. FRANCE AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY FUNCTIONALITY

- FIGURE 28. FRANCE AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY REGIONAL

- FIGURE 29. RUSSIA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 30. RUSSIA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY DISPLAY TYPE

- FIGURE 31. RUSSIA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY VEHICLE TYPE

- FIGURE 32. RUSSIA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY FUNCTIONALITY

- FIGURE 33. RUSSIA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY REGIONAL

- FIGURE 34. ITALY AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 35. ITALY AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY DISPLAY TYPE

- FIGURE 36. ITALY AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY VEHICLE TYPE

- FIGURE 37. ITALY AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY FUNCTIONALITY

- FIGURE 38. ITALY AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY REGIONAL

- FIGURE 39. SPAIN AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 40. SPAIN AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY DISPLAY TYPE

- FIGURE 41. SPAIN AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY VEHICLE TYPE

- FIGURE 42. SPAIN AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY FUNCTIONALITY

- FIGURE 43. SPAIN AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY REGIONAL

- FIGURE 44. REST OF EUROPE AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 45. REST OF EUROPE AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY DISPLAY TYPE

- FIGURE 46. REST OF EUROPE AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY VEHICLE TYPE

- FIGURE 47. REST OF EUROPE AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY FUNCTIONALITY

- FIGURE 48. REST OF EUROPE AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY REGIONAL

- FIGURE 49. APAC AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS

- FIGURE 50. CHINA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 51. CHINA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY DISPLAY TYPE

- FIGURE 52. CHINA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY VEHICLE TYPE

- FIGURE 53. CHINA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY FUNCTIONALITY

- FIGURE 54. CHINA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY REGIONAL

- FIGURE 55. INDIA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 56. INDIA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY DISPLAY TYPE

- FIGURE 57. INDIA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY VEHICLE TYPE

- FIGURE 58. INDIA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY FUNCTIONALITY

- FIGURE 59. INDIA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY REGIONAL

- FIGURE 60. JAPAN AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 61. JAPAN AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY DISPLAY TYPE

- FIGURE 62. JAPAN AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY VEHICLE TYPE

- FIGURE 63. JAPAN AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY FUNCTIONALITY

- FIGURE 64. JAPAN AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY REGIONAL

- FIGURE 65. SOUTH KOREA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 66. SOUTH KOREA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY DISPLAY TYPE

- FIGURE 67. SOUTH KOREA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY VEHICLE TYPE

- FIGURE 68. SOUTH KOREA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY FUNCTIONALITY

- FIGURE 69. SOUTH KOREA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY REGIONAL

- FIGURE 70. MALAYSIA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 71. MALAYSIA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY DISPLAY TYPE

- FIGURE 72. MALAYSIA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY VEHICLE TYPE

- FIGURE 73. MALAYSIA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY FUNCTIONALITY

- FIGURE 74. MALAYSIA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY REGIONAL

- FIGURE 75. THAILAND AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 76. THAILAND AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY DISPLAY TYPE

- FIGURE 77. THAILAND AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY VEHICLE TYPE

- FIGURE 78. THAILAND AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY FUNCTIONALITY

- FIGURE 79. THAILAND AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY REGIONAL

- FIGURE 80. INDONESIA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 81. INDONESIA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY DISPLAY TYPE

- FIGURE 82. INDONESIA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY VEHICLE TYPE

- FIGURE 83. INDONESIA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY FUNCTIONALITY

- FIGURE 84. INDONESIA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY REGIONAL

- FIGURE 85. REST OF APAC AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 86. REST OF APAC AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY DISPLAY TYPE

- FIGURE 87. REST OF APAC AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY VEHICLE TYPE

- FIGURE 88. REST OF APAC AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY FUNCTIONALITY

- FIGURE 89. REST OF APAC AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY REGIONAL

- FIGURE 90. SOUTH AMERICA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS

- FIGURE 91. BRAZIL AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 92. BRAZIL AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY DISPLAY TYPE

- FIGURE 93. BRAZIL AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY VEHICLE TYPE

- FIGURE 94. BRAZIL AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY FUNCTIONALITY

- FIGURE 95. BRAZIL AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY REGIONAL

- FIGURE 96. MEXICO AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 97. MEXICO AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY DISPLAY TYPE

- FIGURE 98. MEXICO AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY VEHICLE TYPE

- FIGURE 99. MEXICO AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY FUNCTIONALITY

- FIGURE 100. MEXICO AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY REGIONAL

- FIGURE 101. ARGENTINA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 102. ARGENTINA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY DISPLAY TYPE

- FIGURE 103. ARGENTINA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY VEHICLE TYPE

- FIGURE 104. ARGENTINA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY FUNCTIONALITY

- FIGURE 105. ARGENTINA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY REGIONAL

- FIGURE 106. REST OF SOUTH AMERICA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 107. REST OF SOUTH AMERICA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY DISPLAY TYPE

- FIGURE 108. REST OF SOUTH AMERICA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY VEHICLE TYPE

- FIGURE 109. REST OF SOUTH AMERICA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY FUNCTIONALITY

- FIGURE 110. REST OF SOUTH AMERICA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY REGIONAL

- FIGURE 111. MEA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS

- FIGURE 112. GCC COUNTRIES AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 113. GCC COUNTRIES AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY DISPLAY TYPE

- FIGURE 114. GCC COUNTRIES AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY VEHICLE TYPE

- FIGURE 115. GCC COUNTRIES AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY FUNCTIONALITY

- FIGURE 116. GCC COUNTRIES AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY REGIONAL

- FIGURE 117. SOUTH AFRICA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 118. SOUTH AFRICA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY DISPLAY TYPE

- FIGURE 119. SOUTH AFRICA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY VEHICLE TYPE

- FIGURE 120. SOUTH AFRICA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY FUNCTIONALITY

- FIGURE 121. SOUTH AFRICA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY REGIONAL

- FIGURE 122. REST OF MEA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 123. REST OF MEA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY DISPLAY TYPE

- FIGURE 124. REST OF MEA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY VEHICLE TYPE

- FIGURE 125. REST OF MEA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY FUNCTIONALITY

- FIGURE 126. REST OF MEA AUTOMOTIVE SMART DISPLAY MARKET ANALYSIS BY REGIONAL

- FIGURE 127. KEY BUYING CRITERIA OF AUTOMOTIVE SMART DISPLAY MARKET

- FIGURE 128. RESEARCH PROCESS OF MRFR

- FIGURE 129. DRO ANALYSIS OF AUTOMOTIVE SMART DISPLAY MARKET

- FIGURE 130. DRIVERS IMPACT ANALYSIS: AUTOMOTIVE SMART DISPLAY MARKET

- FIGURE 131. RESTRAINTS IMPACT ANALYSIS: AUTOMOTIVE SMART DISPLAY MARKET

- FIGURE 132. SUPPLY / VALUE CHAIN: AUTOMOTIVE SMART DISPLAY MARKET

- FIGURE 133. AUTOMOTIVE SMART DISPLAY MARKET, BY TECHNOLOGY, 2024 (% SHARE)

- FIGURE 134. AUTOMOTIVE SMART DISPLAY MARKET, BY TECHNOLOGY, 2019 TO 2032 (USD Billions)

- FIGURE 135. AUTOMOTIVE SMART DISPLAY MARKET, BY DISPLAY TYPE, 2024 (% SHARE)

- FIGURE 136. AUTOMOTIVE SMART DISPLAY MARKET, BY DISPLAY TYPE, 2019 TO 2032 (USD Billions)

- FIGURE 137. AUTOMOTIVE SMART DISPLAY MARKET, BY VEHICLE TYPE, 2024 (% SHARE)

- FIGURE 138. AUTOMOTIVE SMART DISPLAY MARKET, BY VEHICLE TYPE, 2019 TO 2032 (USD Billions)

- FIGURE 139. AUTOMOTIVE SMART DISPLAY MARKET, BY FUNCTIONALITY, 2024 (% SHARE)

- FIGURE 140. AUTOMOTIVE SMART DISPLAY MARKET, BY FUNCTIONALITY, 2019 TO 2032 (USD Billions)

- FIGURE 141. AUTOMOTIVE SMART DISPLAY MARKET, BY REGIONAL, 2024 (% SHARE)

- FIGURE 142. AUTOMOTIVE SMART DISPLAY MARKET, BY REGIONAL, 2019 TO 2032 (USD Billions)

- FIGURE 143. BENCHMARKING OF MAJOR COMPETITORS

Automotive Smart Display Market Segmentation

- Automotive Smart Display Market By Technology (USD Billion, 2019-2032)

- Liquid Crystal Display

- Organic Light Emitting Diode

- MicroLED

- Digital Light Processing

- Automotive Smart Display Market By Display Type (USD Billion, 2019-2032)

- Instrument Cluster

- Center Stack Display

- Head-Up Display

- Rear Seat Entertainment

- Automotive Smart Display Market By Vehicle Type (USD Billion, 2019-2032)

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Electric Vehicles

- Automotive Smart Display Market By Functionality (USD Billion, 2019-2032)

- Infotainment

- Navigation

- Vehicle Monitoring

- Communication

- Automotive Smart Display Market By Regional (USD Billion, 2019-2032)

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

Automotive Smart Display Market Regional Outlook (USD Billion, 2019-2032)

- North America Outlook (USD Billion, 2019-2032)

- North America Automotive Smart Display Market by Technology Type

- Liquid Crystal Display

- Organic Light Emitting Diode

- MicroLED

- Digital Light Processing

- North America Automotive Smart Display Market by Display Type

- Instrument Cluster

- Center Stack Display

- Head-Up Display

- Rear Seat Entertainment

- North America Automotive Smart Display Market by Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Electric Vehicles

- North America Automotive Smart Display Market by Functionality Type

- Infotainment

- Navigation

- Vehicle Monitoring

- Communication

- North America Automotive Smart Display Market by Regional Type

- US

- Canada

- US Outlook (USD Billion, 2019-2032)

- US Automotive Smart Display Market by Technology Type

- Liquid Crystal Display

- Organic Light Emitting Diode

- MicroLED

- Digital Light Processing

- US Automotive Smart Display Market by Display Type

- Instrument Cluster

- Center Stack Display

- Head-Up Display

- Rear Seat Entertainment

- US Automotive Smart Display Market by Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Electric Vehicles

- US Automotive Smart Display Market by Functionality Type

- Infotainment

- Navigation

- Vehicle Monitoring

- Communication

- CANADA Outlook (USD Billion, 2019-2032)

- CANADA Automotive Smart Display Market by Technology Type

- Liquid Crystal Display

- Organic Light Emitting Diode

- MicroLED

- Digital Light Processing

- CANADA Automotive Smart Display Market by Display Type

- Instrument Cluster

- Center Stack Display

- Head-Up Display

- Rear Seat Entertainment

- CANADA Automotive Smart Display Market by Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Electric Vehicles

- CANADA Automotive Smart Display Market by Functionality Type

- Infotainment

- Navigation

- Vehicle Monitoring

- Communication

- Europe Outlook (USD Billion, 2019-2032)

- Europe Automotive Smart Display Market by Technology Type

- Liquid Crystal Display

- Organic Light Emitting Diode

- MicroLED

- Digital Light Processing

- Europe Automotive Smart Display Market by Display Type

- Instrument Cluster

- Center Stack Display

- Head-Up Display

- Rear Seat Entertainment

- Europe Automotive Smart Display Market by Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Electric Vehicles

- Europe Automotive Smart Display Market by Functionality Type

- Infotainment

- Navigation

- Vehicle Monitoring

- Communication

- Europe Automotive Smart Display Market by Regional Type

- Germany

- UK

- France

- Russia

- Italy

- Spain

- Rest of Europe

- GERMANY Outlook (USD Billion, 2019-2032)

- GERMANY Automotive Smart Display Market by Technology Type

- Liquid Crystal Display

- Organic Light Emitting Diode

- MicroLED

- Digital Light Processing

- GERMANY Automotive Smart Display Market by Display Type

- Instrument Cluster

- Center Stack Display

- Head-Up Display

- Rear Seat Entertainment

- GERMANY Automotive Smart Display Market by Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Electric Vehicles

- GERMANY Automotive Smart Display Market by Functionality Type

- Infotainment

- Navigation

- Vehicle Monitoring

- Communication

- UK Outlook (USD Billion, 2019-2032)

- UK Automotive Smart Display Market by Technology Type

- Liquid Crystal Display

- Organic Light Emitting Diode

- MicroLED

- Digital Light Processing

- UK Automotive Smart Display Market by Display Type

- Instrument Cluster

- Center Stack Display

- Head-Up Display

- Rear Seat Entertainment

- UK Automotive Smart Display Market by Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Electric Vehicles

- UK Automotive Smart Display Market by Functionality Type

- Infotainment

- Navigation

- Vehicle Monitoring

- Communication

- FRANCE Outlook (USD Billion, 2019-2032)

- FRANCE Automotive Smart Display Market by Technology Type

- Liquid Crystal Display

- Organic Light Emitting Diode

- MicroLED

- Digital Light Processing

- FRANCE Automotive Smart Display Market by Display Type

- Instrument Cluster

- Center Stack Display

- Head-Up Display

- Rear Seat Entertainment

- FRANCE Automotive Smart Display Market by Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Electric Vehicles

- FRANCE Automotive Smart Display Market by Functionality Type

- Infotainment

- Navigation

- Vehicle Monitoring

- Communication

- RUSSIA Outlook (USD Billion, 2019-2032)

- RUSSIA Automotive Smart Display Market by Technology Type

- Liquid Crystal Display

- Organic Light Emitting Diode

- MicroLED

- Digital Light Processing

- RUSSIA Automotive Smart Display Market by Display Type

- Instrument Cluster

- Center Stack Display

- Head-Up Display

- Rear Seat Entertainment

- RUSSIA Automotive Smart Display Market by Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Electric Vehicles

- RUSSIA Automotive Smart Display Market by Functionality Type

- Infotainment

- Navigation

- Vehicle Monitoring

- Communication

- ITALY Outlook (USD Billion, 2019-2032)

- ITALY Automotive Smart Display Market by Technology Type

- Liquid Crystal Display

- Organic Light Emitting Diode

- MicroLED

- Digital Light Processing

- ITALY Automotive Smart Display Market by Display Type

- Instrument Cluster

- Center Stack Display

- Head-Up Display

- Rear Seat Entertainment

- ITALY Automotive Smart Display Market by Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Electric Vehicles

- ITALY Automotive Smart Display Market by Functionality Type

- Infotainment

- Navigation

- Vehicle Monitoring

- Communication

- SPAIN Outlook (USD Billion, 2019-2032)

- SPAIN Automotive Smart Display Market by Technology Type

- Liquid Crystal Display

- Organic Light Emitting Diode

- MicroLED

- Digital Light Processing

- SPAIN Automotive Smart Display Market by Display Type

- Instrument Cluster

- Center Stack Display

- Head-Up Display

- Rear Seat Entertainment

- SPAIN Automotive Smart Display Market by Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Electric Vehicles

- SPAIN Automotive Smart Display Market by Functionality Type

- Infotainment

- Navigation

- Vehicle Monitoring

- Communication

- REST OF EUROPE Outlook (USD Billion, 2019-2032)

- REST OF EUROPE Automotive Smart Display Market by Technology Type

- Liquid Crystal Display

- Organic Light Emitting Diode

- MicroLED

- Digital Light Processing

- REST OF EUROPE Automotive Smart Display Market by Display Type

- Instrument Cluster

- Center Stack Display

- Head-Up Display

- Rear Seat Entertainment

- REST OF EUROPE Automotive Smart Display Market by Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Electric Vehicles

- REST OF EUROPE Automotive Smart Display Market by Functionality Type

- Infotainment

- Navigation

- Vehicle Monitoring

- Communication

- APAC Outlook (USD Billion, 2019-2032)

- APAC Automotive Smart Display Market by Technology Type

- Liquid Crystal Display

- Organic Light Emitting Diode

- MicroLED

- Digital Light Processing

- APAC Automotive Smart Display Market by Display Type

- Instrument Cluster

- Center Stack Display

- Head-Up Display

- Rear Seat Entertainment

- APAC Automotive Smart Display Market by Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Electric Vehicles

- APAC Automotive Smart Display Market by Functionality Type

- Infotainment

- Navigation

- Vehicle Monitoring

- Communication

- APAC Automotive Smart Display Market by Regional Type

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Indonesia

- Rest of APAC

- CHINA Outlook (USD Billion, 2019-2032)

- CHINA Automotive Smart Display Market by Technology Type

- Liquid Crystal Display

- Organic Light Emitting Diode

- MicroLED

- Digital Light Processing

- CHINA Automotive Smart Display Market by Display Type

- Instrument Cluster

- Center Stack Display

- Head-Up Display

- Rear Seat Entertainment

- CHINA Automotive Smart Display Market by Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Electric Vehicles

- CHINA Automotive Smart Display Market by Functionality Type

- Infotainment

- Navigation

- Vehicle Monitoring

- Communication

- INDIA Outlook (USD Billion, 2019-2032)

- INDIA Automotive Smart Display Market by Technology Type

- Liquid Crystal Display

- Organic Light Emitting Diode

- MicroLED

- Digital Light Processing

- INDIA Automotive Smart Display Market by Display Type

- Instrument Cluster

- Center Stack Display

- Head-Up Display

- Rear Seat Entertainment

- INDIA Automotive Smart Display Market by Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Electric Vehicles

- INDIA Automotive Smart Display Market by Functionality Type

- Infotainment

- Navigation

- Vehicle Monitoring

- Communication

- JAPAN Outlook (USD Billion, 2019-2032)

- JAPAN Automotive Smart Display Market by Technology Type

- Liquid Crystal Display

- Organic Light Emitting Diode

- MicroLED

- Digital Light Processing

- JAPAN Automotive Smart Display Market by Display Type

- Instrument Cluster

- Center Stack Display

- Head-Up Display

- Rear Seat Entertainment

- JAPAN Automotive Smart Display Market by Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Electric Vehicles

- JAPAN Automotive Smart Display Market by Functionality Type

- Infotainment

- Navigation

- Vehicle Monitoring

- Communication

- SOUTH KOREA Outlook (USD Billion, 2019-2032)

- SOUTH KOREA Automotive Smart Display Market by Technology Type

- Liquid Crystal Display

- Organic Light Emitting Diode

- MicroLED

- Digital Light Processing

- SOUTH KOREA Automotive Smart Display Market by Display Type

- Instrument Cluster

- Center Stack Display

- Head-Up Display

- Rear Seat Entertainment

- SOUTH KOREA Automotive Smart Display Market by Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Electric Vehicles

- SOUTH KOREA Automotive Smart Display Market by Functionality Type

- Infotainment

- Navigation

- Vehicle Monitoring

- Communication

- MALAYSIA Outlook (USD Billion, 2019-2032)

- MALAYSIA Automotive Smart Display Market by Technology Type

- Liquid Crystal Display

- Organic Light Emitting Diode

- MicroLED

- Digital Light Processing

- MALAYSIA Automotive Smart Display Market by Display Type

- Instrument Cluster

- Center Stack Display

- Head-Up Display

- Rear Seat Entertainment

- MALAYSIA Automotive Smart Display Market by Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Electric Vehicles

- MALAYSIA Automotive Smart Display Market by Functionality Type

- Infotainment

- Navigation

- Vehicle Monitoring

- Communication

- THAILAND Outlook (USD Billion, 2019-2032)

- THAILAND Automotive Smart Display Market by Technology Type

- Liquid Crystal Display

- Organic Light Emitting Diode

- MicroLED

- Digital Light Processing

- THAILAND Automotive Smart Display Market by Display Type

- Instrument Cluster

- Center Stack Display

- Head-Up Display

- Rear Seat Entertainment

- THAILAND Automotive Smart Display Market by Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Electric Vehicles

- THAILAND Automotive Smart Display Market by Functionality Type

- Infotainment

- Navigation

- Vehicle Monitoring

- Communication

- INDONESIA Outlook (USD Billion, 2019-2032)

- INDONESIA Automotive Smart Display Market by Technology Type

- Liquid Crystal Display

- Organic Light Emitting Diode

- MicroLED

- Digital Light Processing

- INDONESIA Automotive Smart Display Market by Display Type

- Instrument Cluster

- Center Stack Display

- Head-Up Display

- Rear Seat Entertainment

- INDONESIA Automotive Smart Display Market by Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Electric Vehicles

- INDONESIA Automotive Smart Display Market by Functionality Type

- Infotainment

- Navigation

- Vehicle Monitoring

- Communication

- REST OF APAC Outlook (USD Billion, 2019-2032)

- REST OF APAC Automotive Smart Display Market by Technology Type

- Liquid Crystal Display

- Organic Light Emitting Diode

- MicroLED

- Digital Light Processing

- REST OF APAC Automotive Smart Display Market by Display Type

- Instrument Cluster

- Center Stack Display

- Head-Up Display

- Rear Seat Entertainment

- REST OF APAC Automotive Smart Display Market by Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Electric Vehicles

- REST OF APAC Automotive Smart Display Market by Functionality Type

- Infotainment

- Navigation

- Vehicle Monitoring

- Communication

- South America Outlook (USD Billion, 2019-2032)

- South America Automotive Smart Display Market by Technology Type

- Liquid Crystal Display

- Organic Light Emitting Diode

- MicroLED

- Digital Light Processing

- South America Automotive Smart Display Market by Display Type

- Instrument Cluster

- Center Stack Display

- Head-Up Display

- Rear Seat Entertainment

- South America Automotive Smart Display Market by Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Electric Vehicles

- South America Automotive Smart Display Market by Functionality Type

- Infotainment

- Navigation