Market Analysis

In-depth Analysis of Automotive Flex Fuel Engine Market Industry Landscape

The Automotive Flex Fuel Engine market is shaped by various factors that collectively influence its growth and dynamics. One of the primary drivers for this market is the increasing focus on alternative fuels and the growing awareness of environmental sustainability in the automotive industry. Flex Fuel Engines, capable of running on a blend of gasoline and ethanol, offer a versatile solution to address both energy security concerns and reduce greenhouse gas emissions. Governments and consumers alike are showing interest in flexible fuel options, contributing to the rising adoption of Flex Fuel Engines.

Technological advancements play a crucial role in shaping the Automotive Flex Fuel Engine market. Ongoing research and development efforts focus on optimizing engine performance, fuel efficiency, and emission characteristics of Flex Fuel Engines. Innovations such as advanced engine control systems, improved fuel injection technologies, and materials compatible with ethanol blends contribute to the market's evolution. Manufacturers aim to develop Flex Fuel Engines that not only meet regulatory standards but also offer a compelling balance between performance, fuel flexibility, and environmental impact.

Market factors are closely tied to the broader automotive industry trends and regulatory landscape. As the industry navigates towards cleaner and more sustainable mobility solutions, Flex Fuel Engines provide a transitional alternative, allowing drivers to use renewable biofuels without significant changes to existing infrastructure. Government incentives, emission regulations, and consumer preferences for eco-friendly options are driving the integration of Flex Fuel Engines into vehicle lineups.

Economic conditions significantly impact the Automotive Flex Fuel Engine market. Economic growth, consumer purchasing power, and fuel prices influence the adoption of alternative fuel technologies. Flex Fuel Engines offer a cost-effective solution, especially in regions where ethanol is produced locally or subsidized. Economic downturns may impact consumer willingness to invest in new technologies, but overall, the market aligns with the economic benefits of using biofuels.

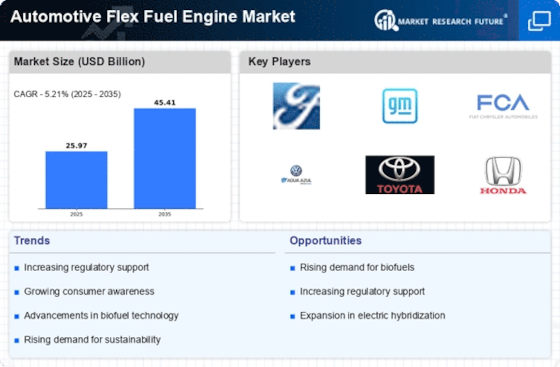

Competitive dynamics and the presence of key market players are essential factors influencing the Automotive Flex Fuel Engine market. The industry is characterized by competition among automakers to offer vehicles with flexible fuel capabilities. Manufacturers differentiate themselves through technology innovation, marketing strategies, and collaboration with biofuel producers. Strategic partnerships contribute to market expansion and the development of advanced Flex Fuel Engine solutions.

Environmental considerations and the global push towards sustainability are significant influencers on the market. Flex Fuel Engines play a role in reducing the carbon footprint of the transportation sector by utilizing renewable and lower-emission biofuels. As environmental awareness grows, the demand for vehicles equipped with Flex Fuel Engines is expected to rise, aligning with the broader trend of adopting cleaner and greener transportation solutions.

The evolution of government policies and regulations related to biofuels and alternative fuels also shapes the Automotive Flex Fuel Engine market. Policies promoting the use of renewable fuels, subsidies for biofuel production, and carbon reduction initiatives contribute to the market's growth. Regulatory support provides an impetus for automakers to invest in and expand their Flex Fuel Engine offerings.

Consumer preferences and awareness of biofuels and Flex Fuel Engines are additional factors influencing the market. As consumers become more conscious of the environmental impact of their vehicles, the availability of Flex Fuel Engines provides an attractive option for those seeking a greener alternative without compromising on vehicle performance or convenience. Education and awareness campaigns contribute to increasing consumer acceptance and adoption of Flex Fuel Engine technology.

Supply chain dynamics and the availability of biofuels impact the Automotive Flex Fuel Engine market. Manufacturers need to ensure a stable supply chain for biofuel-compatible components and collaborate with fuel providers to establish infrastructure for the distribution of ethanol blends. Any disruptions in the supply chain can affect production schedules and the availability of vehicles equipped with Flex Fuel Engines.

In conclusion, the Automotive Flex Fuel Engine market is influenced by a combination of technological, regulatory, economic, competitive, environmental, and consumer-related factors. As the automotive industry continues to embrace sustainable and alternative fuel solutions, Flex Fuel Engines provide a flexible and viable option for reducing the environmental impact of transportation. The market is expected to witness further growth and innovation as automakers respond to changing regulations, consumer preferences, and global initiatives towards a more sustainable mobility future.

Leave a Comment