Automotive Battery Thermal Management System Market Trends

Automotive Battery Thermal Management Market Research Report Information By Technology (Air, Liquid, Phase Change Material, Thermo Electrics) Propulsion (Hybrid Electric Vehicles, Battery Electric Vehicles, Plug-in Hybrid Electric Vehicles, Fuel Cell Vehicle) Vehicle Type (Passenger Cars, Commercial Vehicle) And By Region (North America, Europe, Asia-Pacific, And Middle East & Africa, and S...

Market Summary

As per Market Research Future Analysis, the Global Automotive Battery Thermal Management Market was valued at USD 3.12 billion in 2022 and is projected to reach USD 6.27 billion by 2030, growing at a CAGR of 13.02% from 2023 to 2030. The market is driven by the increasing demand for electric vehicles (EVs) and supportive government initiatives promoting EV adoption. The Liquid segment is expected to dominate the market due to its superior thermal management capabilities. Asia-Pacific is anticipated to hold the largest market share, supported by government incentives for EVs and a focus on reducing carbon emissions. Key players are investing in R&D and strategic initiatives to enhance their market presence.

Key Market Trends & Highlights

The automotive battery thermal management market is witnessing significant growth driven by technological advancements and government policies.

- Market Size in 2022: USD 3.12 billion; projected to grow to USD 6.27 billion by 2030.

- CAGR of 13.02% during the forecast period (2023 - 2030).

- Liquid segment expected to dominate market share due to higher heat capacity and conductivity.

- Asia-Pacific projected to hold the largest revenue market share during the forecast period.

Market Size & Forecast

| 2022 Market Size | USD 3.12 billion |

| 2023 Market Size | USD 3.59 billion |

| 2030 Market Size | USD 6.27 billion |

| CAGR | 13.02% (2023 - 2030) |

| Largest Regional Market Share | Asia-Pacific. |

Major Players

Key companies include LG Chem, Continental, GenTherm, Robert Bosch, Valeo, Calsonic Kansei, DANA, Hanon Systems, Samsung SDI, Mahle, and VOSS Automotive.

Market Trends

Increase in demand for electric vehicles to boost market growth

Various government authorities around the world have undertaken numerous initiatives to encourage the sales of electric vehicles. For instance, the US federal government is offering incentives such as tax breaks, fleet acquisition, manufacturing support, and R&D funding. Similarly, the Indian government is actively promoting the adoption of electric vehicles by providing incentives for building charging infrastructure, manufacturing EV batteries domestically, and producing electric components. Moreover, several governing bodies in emerging economies are implementing strategic policies to transition from internal combustion engines (ICE) to electric vehicles, in order to improve the air quality in densely populated areas.

Therefore, the favorable government initiatives are anticipated to boost the growth of the automotive battery thermal management market in the forecast period.

The increasing preference for advanced technology-based vehicles, particularly those that are lightweight, is expected to fuel the growth of the automotive battery thermal management market. Industry leaders and customers alike tend to favor the use of lithium-ion battery technology in vehicles for various applications, given its higher energy density, longer battery life cycle, and superior resilience. Similarly, companies rely on these batteries in thermal battery management systems to ensure proper functioning and safety. Automakers have started to incorporate these batteries in various applications such as electronic devices, EVs, and industrial machinery.

Furthermore, these batteries can detect various types of malfunctions, such as excessive temperature rise and electric leaks, as well as monitor the state of charge at different temperatures in the charging/discharging environment. The COVID-19 pandemic has prompted many developing countries, including India, to encourage local production of li-ion batteries and automotive battery thermal management systems. As a result, countries are now moving towards local production of all components and raw materials, rather than relying on China for Li-ion batteries, electronic components, and other requirements.

These steps, along with supportive government policies and infrastructure development, are expected to drive the demand for the Battery Thermal Management market in the coming years.

The evolution of automotive battery thermal management systems is poised to enhance vehicle efficiency and safety, reflecting a growing commitment to sustainable transportation solutions.

U.S. Department of Energy

Automotive Battery Thermal Management System Market Market Drivers

Market Growth Projections

The Global Automotive Battery Thermal Management Market Industry is poised for substantial growth, with projections indicating a market size of 4.07 USD Billion in 2024 and an anticipated increase to 11.6 USD Billion by 2035. This growth trajectory suggests a robust demand for advanced thermal management solutions as the automotive industry evolves. The projected CAGR of 9.97% from 2025 to 2035 highlights the increasing importance of thermal management in enhancing battery performance and safety. As manufacturers continue to innovate and adapt to changing market dynamics, the thermal management sector is likely to play a pivotal role in the future of automotive technology.

Growing Focus on Sustainability

The increasing emphasis on sustainability and environmental responsibility is reshaping the Global Automotive Battery Thermal Management Market Industry. Consumers are becoming more aware of the environmental impact of their choices, prompting manufacturers to adopt greener technologies. This shift is leading to the development of thermal management systems that not only enhance battery efficiency but also reduce overall carbon footprints. Companies are exploring eco-friendly materials and processes in their thermal management solutions. As sustainability becomes a core value for automotive brands, the market is likely to see substantial growth, aligning with global efforts to combat climate change.

Rising Demand for Electric Vehicles

The increasing adoption of electric vehicles (EVs) is a primary driver for the Global Automotive Battery Thermal Management Market Industry. As consumers and manufacturers shift towards sustainable transportation solutions, the need for efficient thermal management systems becomes critical. In 2024, the market is projected to reach 4.07 USD Billion, reflecting the growing emphasis on battery performance and longevity. Effective thermal management ensures optimal battery operation, enhancing vehicle range and safety. This trend is expected to accelerate as global regulations tighten around emissions, further propelling the demand for advanced thermal management solutions in EVs.

Regulatory Compliance and Safety Standards

Stringent regulations regarding vehicle emissions and safety standards are driving the Global Automotive Battery Thermal Management Market Industry. Governments worldwide are implementing policies that mandate the use of efficient thermal management systems to ensure battery safety and performance. Compliance with these regulations is essential for manufacturers aiming to enter or remain competitive in the market. As a result, companies are investing in advanced thermal management technologies to meet these standards. This trend is expected to contribute to a compound annual growth rate (CAGR) of 9.97% from 2025 to 2035, indicating a robust market response to regulatory pressures.

Technological Advancements in Battery Systems

Innovations in battery technology are significantly influencing the Global Automotive Battery Thermal Management Market Industry. The development of high-capacity batteries necessitates sophisticated thermal management systems to maintain optimal operating temperatures. As manufacturers introduce new battery chemistries and configurations, the complexity of thermal management solutions increases. For instance, advancements in phase change materials and liquid cooling systems are becoming more prevalent. These technologies not only improve battery efficiency but also extend lifespan, which is crucial as the market is anticipated to grow to 11.6 USD Billion by 2035. Such innovations are likely to shape the future landscape of automotive thermal management.

Market Segment Insights

Automotive Battery Thermal Management Technology Insights

The Automotive Battery Thermal Management Market is segmented based on its application into Air, Liquid, Phase Change Material, and Thermo Electrics. The Liquid segment is projected to have the highest CAGR and dominate the Automotive Battery Thermal Management market share during the forecast period. The liquid battery cooling system relies on a flat heat pipe and offers an excellent thermal management effect on a single battery pack, making it the most efficient way to dissipate heat from the battery pack. Liquid coolants have higher heat capacity and conductivity than air, making them the optimal choice for maintaining battery temperature.

Thermal management systems mainly use two types of liquids: direct-contact and indirect-contact liquid. Direct-contact liquids, such as mineral oil, come into direct contact with battery cells, while indirect-contact liquids, like a mixture of water and ethylene glycol, contact battery cells indirectly

January 2021: Robert Bosch GmbH utilized intelligent thermal management to increase the range of electric vehicles by up to 25%. To accomplish this, the company combined a heat pump with innovative coolant pumps and valves, enabling precise distribution of heat and cold within the vehicle

Automotive Battery Thermal Management Propulsion Insights

The Automotive Battery Thermal Management Market is segmented based on applications into Hybrid Electric Vehicles, Battery Electric Vehicles, Plug-in Hybrid Electric Vehicles, and Fuel Cell Vehicles. The Hybrid Electric Vehicles segment is projected to have the highest CAGR and dominate the Automotive Battery Thermal Management market share during the forecast period. Hybrid Electric Vehicles use a combination of fuel injection and electricity to operate, with the battery helping to use fuel more efficiently while being recharged by the fuel. These vehicles cannot be charged via a plug but rely on regenerative braking and internal combustion engines for recharging.

Modern hybrid vehicles come equipped with technologies such as regenerative brakes and start-stop systems to improve their efficiency. The increasing focus on reducing emission levels and improving vehicle fuel economy is driving the demand for hybrid electric vehicles. For example, the Road and Transport Authority of Dubai has announced plans to convert 50% of the emirate's taxis to hybrid vehicles by 2021.

Figure 2: Automotive Battery Thermal Management Market, by Propulsion, 2022 & 2030 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Get more detailed insights about Automotive Battery Thermal Management System Market Research Report—Global Forecast till 2030

Regional Insights

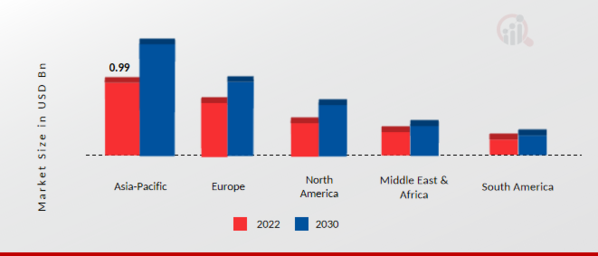

The Automotive Battery Thermal Management Market is segmented into North America, Europe, Asia-Pacific, Middle East & Africa, and South America regions. Asia-Pacific is projected to hold the largest revenue market share during the forecast period. This region is the largest Automotive Battery Thermal Management market for automobiles and comprises both emerging and developed economies. With a high focus on reducing carbon emissions and electrifying transportation, the use of electric vehicles in Asia-Pacific is prevalent.

Governments have incentivized the adoption of electric vehicles through subsidies and tax exemptions, further driving the growth of the automotive battery thermal management market in the region.

Figure 3: Automotive Battery Thermal Management Market Share By Region 2022 (%)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

In Europe, the European Union (EU) is leading the development of a sustainable circular economy and carbon-free transport system. The manufacturers in Europe have adopted two different approaches for developing electric vehicle models: conversion and purpose. The "conversion" approach involves incorporating new technology such as electric motors and batteries into existing models, while the "purpose" approach involves developing new vehicles that incorporate the latest technologies. These approaches allow manufacturers to install electric drives in cars, driving the growth of the European automotive battery thermal management market.

Additionally, the EU has regulated two policies to regulate average CO2 emissions for new passenger vehicles and vans.

Key Players and Competitive Insights

Major market players are spending a lot of money on R&D to increase their product lines, which will help the Automotive Battery Thermal Management market grow even more. The Automotive Battery Thermal Management Market participants are also taking a range of strategic initiatives to grow their worldwide footprint, including new product launches, contractual agreements, mergers and acquisitions, increased investments, and collaboration with other organizations. Competitors in the automotive battery thermal management industry must offer cost-effective items to expand and survive in an increasingly competitive and rising market environment.

The automotive battery thermal management market is characterized by intense competition, with players vying for greater market share. The market is challenged by factors such as rapid technological advancements, changes in government policies, and strict environmental regulations, which could impede its growth. In this competitive landscape, vendors are competing based on product quality, reliability, cost, and aftermarket services. To remain viable and thrive in this environment, vendors must deliver products that are both cost-effective and efficient.

Hanon system is the world’s leading automotive supplier and expertise in automotive battery thermal management solution supplier company. The company has pioneered in providing a wide product portfolio specializing in thermal and energy management. The company started offering its wide range of products, including thermal battery management, to support vehicle manufacturers supplying electric, fuel cell, hybrid, and autonomous vehicles to the Automotive Battery Thermal Management market.

Key Companies in the Automotive Battery Thermal Management System Market market include

Industry Developments

- Q2 2024: LG Energy Solution to build new battery thermal management R&D center in South Korea LG Energy Solution announced the opening of a dedicated research and development center focused on advanced battery thermal management technologies for electric vehicles, aiming to accelerate innovation and commercialization of next-generation cooling systems.

- Q2 2024: Tesla partners with Panasonic to co-develop advanced battery cooling systems for EVs Tesla and Panasonic revealed a strategic partnership to jointly develop and manufacture new battery cooling modules designed to improve thermal efficiency and safety in high-performance electric vehicles.

- Q2 2024: Valeo launches new high-efficiency battery thermal management system for commercial EV fleets Valeo introduced its latest battery thermal management solution, specifically engineered for commercial electric vehicle fleets, promising improved energy efficiency and extended battery life.

- Q3 2024: BorgWarner acquires battery thermal management startup ThermalX for $120 million BorgWarner completed the acquisition of ThermalX, a startup specializing in advanced battery cooling technologies, to strengthen its position in the automotive battery thermal management market.

- Q3 2024: Denso opens new manufacturing facility for battery thermal management components in Hungary Denso inaugurated a new plant in Hungary dedicated to producing battery thermal management modules for European electric vehicle manufacturers, expanding its global manufacturing footprint.

- Q3 2024: BYD secures major contract to supply battery thermal management systems to Volkswagen BYD signed a multi-year agreement to supply Volkswagen with advanced battery thermal management systems for its upcoming electric vehicle models in Europe.

- Q4 2024: Gentherm unveils new liquid-cooled battery thermal management platform for EVs Gentherm launched a new liquid-cooled battery thermal management platform designed to enhance temperature control and safety in next-generation electric vehicles.

- Q4 2024: Samsung SDI announces $200 million investment in battery thermal management technology Samsung SDI committed $200 million to expand its research and development efforts in battery thermal management, targeting improved performance and safety for future EV batteries.

- Q1 2025: Mahle wins contract to supply battery cooling systems for Stellantis electric vehicles Mahle secured a significant contract to provide battery cooling systems for Stellantis' new line of electric vehicles, marking a major expansion of its automotive thermal management business.

- Q1 2025: Hitachi Energy launches modular battery thermal management solution for grid storage Hitachi Energy introduced a modular battery thermal management system designed for large-scale grid energy storage applications, aiming to improve reliability and operational efficiency.

- Q2 2025: Modine Manufacturing opens new battery thermal management R&D center in Germany Modine Manufacturing announced the opening of a new research and development center in Germany focused on battery thermal management technologies for European automotive clients.

- Q2 2025: Faurecia and CATL form joint venture for battery thermal management systems Faurecia and CATL established a joint venture to develop and manufacture advanced battery thermal management systems for electric vehicles, targeting both European and Asian markets.

Future Outlook

Automotive Battery Thermal Management System Market Future Outlook

The Automotive Battery Thermal Management Market is projected to grow at a 9.97% CAGR from 2024 to 2035, driven by advancements in electric vehicle technology and regulatory support for sustainable transport.

New opportunities lie in:

- Develop advanced phase change materials for enhanced thermal regulation in batteries.

- Invest in AI-driven predictive maintenance solutions for battery thermal systems.

- Explore partnerships with EV manufacturers to integrate innovative thermal management solutions.

By 2035, the market is expected to achieve substantial growth, reflecting a robust demand for efficient battery thermal management solutions.

Market Segmentation

Regional Outlook

- US

- Canada

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia-Pacific

- Brazil

- Argentina

- Rest Of South America

Propulsion Outlook

- Hybrid Electric Vehicles

- Battery Electric Vehicles

- Plug-in Hybrid Electric Vehicles

- Fuel Cell Vehicle

Vehicle Type Outlook

- Passenger Cars

- Commercial Vehicle

By Technology Outlook

- Air

- Liquid

- Phase Change Material

- Thermo Electrics

Report Scope

| Report Attribute/Metric | Details |

| Market Size 2022 | USD 3.12 billion |

| Market Size 2023 | USD 3.59 billion |

| Market Size 2030 | USD 6.27 billion |

| Compound Annual Growth Rate (CAGR) | 13.02% (2023-2030) |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2018 & 2020 |

| Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | By Technology, Propulsion, Vehicle Type and Region |

| Geographies Covered | North America, Europe, Asia Pacific, and Middle East & Africa, and South America |

| Countries Covered | The U.S, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled | LG Chem (South Korea), Continental (Germany), GenTherm (U.S.), Robert Bosch (Germany), Valeo (France), Calsonic Kansei (Japan), DANA (U.S.), Hanon Systems (Korea), Samsung SDI (Korea), Mahle (Germany), VOSS Automotive (Germany), CapTherm Systems (Canada) among others |

| Key Market Opportunities | Increase In Demand For Electric Vehicles |

| Key Market Dynamics | Increasing Fuel Prices Government Initiatives |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

How big is the battery thermal management market?

The Automotive Battery Thermal Management Market size is projected to be worth USD 6.27 billion by 2030, registering a CAGR of 13.02% during the forecast period (2022–2030)

What is the growth rate of the Automotive Battery Thermal Management market?

The Automotive Battery Thermal Management Market would register a growth of ~13.02% during the forecast period.

Which region held the largest market share in the Automotive Battery Thermal Management market?

Asia Pacific was the largest region in the Automotive Battery Thermal Management Market

Who are the key players in the Automotive Battery Thermal Management market?

LG Chem (South Korea), Continental (Germany), GenTherm (U.S.), Robert Bosch (Germany), Valeo (France) are the key players in the market

What are the key drivers of growth in the automotive battery thermal management market?

The growing popularity of electric vehicles, strict laws governing vehicle safety and emissions, improvements in battery technology, and the requirement to increase battery lifespan and range are some of the factors propelling the market's expansion.

-

Table of Contents

-

Executive Summary

-

MARKET ATTRACTIVENESS ANALYSIS

- GLOBAL AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY

- GLOBAL AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION

- GLOBAL AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE

- GLOBAL AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY REGION

-

MARKET ATTRACTIVENESS ANALYSIS

-

Market Introduction

- DEFINITION

- Scope of the Study

- MARKET STRUCTURE

-

Research Methodology

- RESEARCH PROCESS

- PRIMARY RESEARCH

- SECONDARY RESEARCH

- MARKET SIZE ESTIMATION

- TOP-DOWN AND Bottom-up Approach

- FORECAST MODEL

- LIST OF ASSUMPTIONS

-

MARKET DYNAMICS

- INTRODUCTION

-

DRIVERS

- INCREASE IN DEMAND FOR ELECTRIC VEHICLES

- INCREASING FUEL PRICES

- GOVERNMENT INITIATIVES

- DRIVERS IMPACT ANALYSIS

-

RESTRAINTS

- DEMAND FOR CNG AND LPG VEHICLES

- HIGH PRICE AND LIMITED CAPACITY OF BATTERIES

- RESTRAINTS IMPACT ANALYSIS

-

OPPORTUNITIES

- INCREASING ADOPTION IN EMERGING ECONOMIES

-

COVID-19 IMPACT ANALYSIS

- ECONOMIC IMPACT ON AUTOMOTIVE INDUSTRY

- IMPACT ON AUTOMOTIVE PRODUCTION

- IMPACT ON AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET

- IMPACT ON WORLD TRADE

-

MARKET FACTOR ANALYSIS

-

PORTER’S FIVE FORCES MODEL

- THREAT OF NEW ENTRANTS

- BARGAINING POWER OF SUPPLIERS

- THREAT OF SUBSTITUTES

- BARGAINING POWER OF BUYERS

- INTENSITY OF RIVALRY

-

SUPPLY CHAIN ANALYSIS

- DESIGN & DEVELOPMENT

- RAW MATERIAL/COMPONENT SUPPLY

- MANUFACTURE

- DISTRIBUTION/SUPPLY

- END USE

-

PORTER’S FIVE FORCES MODEL

-

GLOBAL AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY

- OVERVIEW

- AIR

- LIQUID

- PHASE CHANGE MATERIAL

- THERMO ELECTRICS

-

GLOBAL AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION

- OVERVIEW

- BATTERY ELECTRIC VEHICLES

- HYBRID ELECTRIC VEHICLES

- PLUG-IN HYBRID ELECTRIC VEHICLES

- FUEL CELL VEHICLE

-

GLOBAL AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE

- OVERVIEW

- PASSENGER CAR

- COMMERCIAL VEHICLE

-

GLOBAL AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY REGION

- OVERVIEW

-

NORTH AMERICA

- US

- CANADA

- MEXICO

-

EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- REST OF EUROPE

-

ASIA-PACIFIC

- CHINA

- JAPAN

- INDIA

- REST OF ASIA-PACIFIC

-

SOUTH AMERICA

- BRAZIL

- ARGENTINA

- REST OF SOUTH AMERICA

- MIDDLE EAST & AFRICA

-

Competitive Landscape

- COMPETITIVE OVERVIEW

- MAJOR GROWTH STRATEGY IN THE GLOBAL AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET

- COMPETITIVE BENCHMARKING

-

KEY DEVELOPMENTS IN THE GLOBAL AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET

- KEY DEVELOPMENTS: MERGERS & ACQUISITIONS

- KEY DEVELOPMENTS: PARTNERSHIPS & COLLABORATIONS

- KEY DEVELOPMENTS: EXPANSIONS

- KEY DEVELOPMENTS: PRODUCT DEVELOPMENTS/LAUNCHES

-

COMPANY PROFILES

-

CONTINENTAL AG

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGY

-

ROBERT BOSCH GMBH

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS/SOLUTIONS/SERVICES OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

HANON SYSTEMS

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

LG CHEM

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

-

GENTHERM

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

-

VALEO

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

-

MARELLI CORPORATION

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

-

DANA LIMITED

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

-

SAMSUNG SDI CO., LTD.

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS/SOLUTIONS/SERVICES OFFERED

- KEY DEVELOPMENTS

-

MAHLE GMBH

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS/SOLUTIONS/SERVICES OFFERED

- KEY DEVELOPMENTS

-

VOSS AUTOMOTIVE GMBH

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

-

CONTINENTAL AG

-

APPENDIX

- DATA SOURCES

-

-

List of Tables and Figures

- LIST OF TABLES

- TABLE 1 LIST OF ASSUMPTIONS 27

- TABLE 2 GLOBAL AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY TECHNOLOGY, 2022–2030 (USD MILLION) 41

- TABLE 3 GLOBAL AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY PROPULSION, 2022–2030 (USD MILLION) 44

- TABLE 4 GLOBAL AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY VEHICLE TYPE, 2022–2030 (USD MILLION) 46

- TABLE 5 GLOBAL AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2022–2030 (USD MILLION) 49

- TABLE 6 NORTH AMERICA: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2022–2030 (USD MILLION) 50

- TABLE 7 NORTH AMERICA: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY TECHNOLOGY, 2022–2030 (USD MILLION) 50

- TABLE 8 NORTH AMERICA: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY PROPULSION, 2022–2030 (USD MILLION) 51

- TABLE 9 NORTH AMERICA: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY VEHICLE TYPE, 2022–2030 (USD MILLION) 51

- TABLE 10 US: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY TECHNOLOGY, 2022–2030 (USD MILLION) 52

- TABLE 11 US: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY PROPULSION, 2022–2030 (USD MILLION) 52

- TABLE 12 US: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY VEHICLE TYPE, 2022–2030 (USD MILLION) 53

- TABLE 13 CANADA: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY TECHNOLOGY, 2022–2030 (USD MILLION) 53

- TABLE 14 CANADA: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY PROPULSION, 2022–2030 (USD MILLION) 54

- TABLE 15 CANADA: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY VEHICLE TYPE, 2022–2030 (USD MILLION) 54

- TABLE 16 MEXICO: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY TECHNOLOGY, 2022–2030 (USD MILLION) 55

- TABLE 17 MEXICO: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY PROPULSION, 2022–2030 (USD MILLION) 55

- TABLE 18 MEXICO: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY VEHICLE TYPE, 2022–2030 (USD MILLION) 56

- TABLE 19 EUROPE: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2022–2030 (USD MILLION) 57

- TABLE 20 EUROPE: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY TECHNOLOGY, 2022–2030 (USD MILLION) 58

- TABLE 21 EUROPE: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY PROPULSION, 2022–2030 (USD MILLION) 58

- TABLE 22 EUROPE: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY VEHICLE TYPE, 2022–2030 (USD MILLION) 59

- TABLE 23 GERMANY: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY TECHNOLOGY, 2022–2030 (USD MILLION) 59

- TABLE 24 GERMANY: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY PROPULSION, 2022–2030 (USD MILLION) 60

- TABLE 25 GERMANY: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY VEHICLE TYPE, 2022–2030 (USD MILLION) 60

- TABLE 26 UK: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY TECHNOLOGY, 2022–2030 (USD MILLION) 61

- TABLE 27 UK: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY PROPULSION, 2022–2030 (USD MILLION) 61

- TABLE 28 UK: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY VEHICLE TYPE, 2022–2030 (USD MILLION) 62

- TABLE 29 FRANCE: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY TECHNOLOGY, 2022–2030 (USD MILLION) 62

- TABLE 30 FRANCE: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY PROPULSION, 2022–2030 (USD MILLION) 63

- TABLE 31 FRANCE: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY VEHICLE TYPE, 2022–2030 (USD MILLION) 63

- TABLE 32 ITALY: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY TECHNOLOGY, 2022–2030 (USD MILLION) 64

- TABLE 33 ITALY: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY PROPULSION, 2022–2030 (USD MILLION) 64

- TABLE 34 ITALY: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY VEHICLE TYPE, 2022–2030 (USD MILLION) 65

- TABLE 35 REST OF EUROPE: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY TECHNOLOGY, 2022–2030 (USD MILLION) 65

- TABLE 36 REST OF EUROPE: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY PROPULSION, 2022–2030 (USD MILLION) 66

- TABLE 37 REST OF EUROPE: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY VEHICLE TYPE, 2022–2030 (USD MILLION) 66

- TABLE 38 ASIA-PACIFIC: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2022–2030 (USD MILLION) 67

- TABLE 39 ASIA-PACIFIC: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY TECHNOLOGY, 2022–2030 (USD MILLION) 68

- TABLE 40 ASIA-PACIFIC: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY PROPULSION, 2022–2030 (USD MILLION) 68

- TABLE 41 ASIA-PACIFIC: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY VEHICLE TYPE, 2022–2030 (USD MILLION) 69

- TABLE 42 CHINA: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY TECHNOLOGY, 2022–2030 (USD MILLION) 69

- TABLE 43 CHINA: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY PROPULSION, 2022–2030 (USD MILLION) 70

- TABLE 44 CHINA: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY VEHICLE TYPE, 2022–2030 (USD MILLION) 70

- TABLE 45 JAPAN: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY TECHNOLOGY, 2022–2030 (USD MILLION) 71

- TABLE 46 JAPAN: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY PROPULSION, 2022–2030 (USD MILLION) 71

- TABLE 47 JAPAN: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY VEHICLE TYPE, 2022–2030 (USD MILLION) 72

- TABLE 48 INDIA: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY TECHNOLOGY, 2022–2030 (USD MILLION) 72

- TABLE 49 INDIA: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY PROPULSION, 2022–2030 (USD MILLION) 73

- TABLE 50 INDIA: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY VEHICLE TYPE, 2022–2030 (USD MILLION) 73

- TABLE 51 REST OF ASIA-PACIFC: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY TECHNOLOGY, 2022–2030 (USD MILLION) 74

- TABLE 52 REST OF ASIA-PACIFC: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY PROPULSION, 2022–2030 (USD MILLION) 74

- TABLE 53 REST OF ASIA-PACIFC: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY VEHICLE TYPE, 2022–2030 (USD MILLION) 75

- TABLE 54 SOUTH AMERICA: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2022–2030 (USD MILLION) 76

- TABLE 55 SOUTH AMERICA: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY TECHNOLOGY, 2022–2030 (USD MILLION) 76

- TABLE 56 SOUTH AMERICA: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY PROPULSION, 2022–2030 (USD MILLION) 77

- TABLE 57 SOUTH AMERICA: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY VEHICLE TYPE, 2022–2030 (USD MILLION) 77

- TABLE 58 BRAZIL: AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET ESTIMATES & FORECAST, BY TECHNOLOGY, 202

Automotive Battery Thermal Management System Market Segmentation

Market Segmentation Overview

- Detailed segmentation data will be available in the full report

- Comprehensive analysis by multiple parameters

- Regional and country-level breakdowns

- Market size forecasts by segment

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment