Automotive Airbag Fabric Size

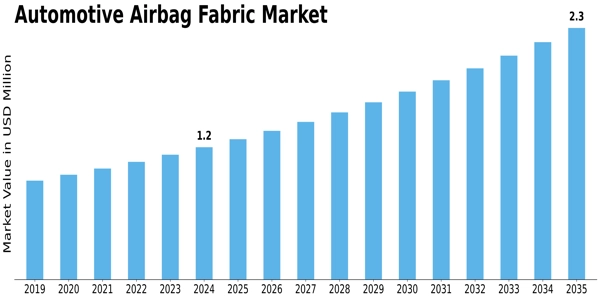

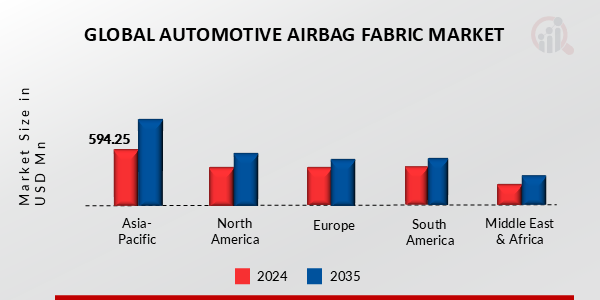

Automotive Airbag Fabric Market Growth Projections and Opportunities

The market factors influencing automotive airbag fabric are diverse and are intricately tied to advancements in vehicle safety, regulatory standards, technological innovations, and market demand. One crucial factor is the continued emphasis on vehicle safety. As safety awareness increases among consumers and governments worldwide, the demand for advanced safety features, including airbags, continues to grow. Automotive airbag fabric is a critical component in the design and effectiveness of airbag systems, contributing to occupant protection in the event of a collision. The pursuit of enhanced safety and a reduction in road fatalities are key drivers influencing the market dynamics of automotive airbag fabric.Stringent regulatory standards and mandates significantly shape the market factors of automotive airbag fabric. Governments and regulatory bodies impose strict safety requirements, necessitating the integration of airbags into vehicles. Compliance with these standards is paramount for automakers, driving the demand for high-quality airbag fabrics that meet or exceed regulatory specifications. As safety regulations evolve and become more sophisticated, the automotive industry must adapt, influencing the design and manufacturing standards of airbag fabrics to ensure optimal performance and occupant protection.

Technological advancements in both airbag systems and fabric manufacturing processes play a crucial role in the market dynamics of automotive airbag fabric. Innovations in sensor technologies, inflator mechanisms, and deployment algorithms contribute to the effectiveness and efficiency of airbag systems. Simultaneously, advancements in fabric materials, weaving techniques, and coating technologies enhance the performance and durability of airbag fabrics. The integration of smart textiles and advanced materials in airbag fabrics represents a notable trend, offering additional benefits such as weight reduction and improved occupant protection.

Market factors are also influenced by the evolving landscape of vehicle design and manufacturing. The trend towards lighter and more fuel-efficient vehicles has prompted automakers to explore materials that maintain safety standards while contributing to overall weight reduction. Automotive airbag fabric manufacturers respond to this trend by developing lightweight yet strong and durable fabrics that align with the automotive industry's emphasis on fuel efficiency and environmental sustainability.

Global economic factors, including raw material prices and manufacturing costs, impact the market dynamics of automotive airbag fabric. Fluctuations in the prices of materials such as nylon, polyester, and coatings can affect the overall production costs for airbag fabric manufacturers. Economic conditions also influence the pricing strategies adopted by suppliers and the purchasing decisions of automakers. Moreover, the economic landscape plays a role in determining investments in research and development, affecting the pace of technological innovation within the automotive airbag fabric sector.

Consumer awareness and demand for advanced safety features contribute significantly to the market factors of automotive airbag fabric. As consumers become more informed about vehicle safety ratings and the effectiveness of airbag systems, they increasingly prioritize vehicles equipped with comprehensive safety features, including advanced airbag technologies. Automakers respond to this demand by incorporating airbags into various vehicle models, driving the need for reliable and high-performance airbag fabrics that contribute to the overall safety profile of the vehicle.

The market factors of automotive airbag fabric are shaped by a combination of safety considerations, regulatory standards, technological advancements, vehicle design trends, global economic conditions, and consumer demand. As the automotive industry continues to prioritize safety and technological innovation, the demand for advanced airbag fabrics is expected to persist and evolve. Manufacturers in this sector must navigate these multifaceted factors, adapting their products and processes to meet the evolving requirements of the automotive market and contribute to the ongoing efforts to enhance vehicle safety.

Leave a Comment