Automotive Adaptive Front Light Market Analysis

Automotive Adaptive Front Light Market Research Report Information By Type (Halogen and LED), By Vehicle Type (Passenger Vehicle and Commercial Vehicle) And By Region (North America, Europe, Asia-Pacific, And Rest Of The World) –Global Industry Size, Share, Growth, Trends and Forecast To 2035

Market Summary

As per Market Research Future Analysis, the Automotive Adaptive Front Light market was valued at USD 0.82 Billion in 2024 and is projected to reach USD 9.46 Billion by 2035, growing at a CAGR of 24.89% from 2025 to 2035. The market is driven by increasing demand for vehicle safety features, advanced driver-assistance systems (ADAS), and energy-efficient lighting systems. The halogen segment currently dominates the market, accounting for 35% of revenue, while the LED segment is the fastest-growing due to its energy efficiency. Passenger vehicles represent 70.4% of market revenue, with commercial vehicles showing rapid growth. North America leads the market, followed by Europe and Asia-Pacific, with significant contributions from the US and China.

Key Market Trends & Highlights

Key trends driving the Automotive Adaptive Front Light market include advancements in safety features and technology.

- Market Size in 2024: USD 0.82 Billion; projected to reach USD 9.46 Billion by 2035.

- CAGR of 24.89% from 2024 to 2032.

- Halogen segment accounts for 35% of market revenue; LED is the fastest-growing segment.

- Passenger vehicles generate 70.4% of market income.

Market Size & Forecast

| 2024 Market Size | USD 0.82 Billion |

| 2035 Market Size | USD 9.46 Billion |

| CAGR | 24.89% |

| Largest Regional Market Share in 2024 | North America. |

Major Players

Key players include Hella GmbH & Co. KGaA, Magneti Marelli S.p.A, Koito Manufacturing, Valeo SA, and Stanley Electric Co. Ltd.

Market Trends

Growing concern toward road safety is driving the market growth

Market CAGR for automotive adaptive front lights is being driven by the rise in concern toward road safety. The demand for safety features and adaptive front lighting has increased due to a surge in road accidents worldwide. Vehicles with adaptive and intelligent lighting can detect threats on the path, allowing the vehicle driver to take appropriate actions. The rise in global concern regarding road accidents fuels the demand for better vehicle safety features, eventually leading to intelligent lighting systems and supporting the market's growth.

Intelligent lights are primarily installed to enhance visibility in curve roads and improve the vehicle's conspicuity in critical conditions.

For instance, as per World Health Organization's published data in June 2021, nearly 1.3 million people die in road traffic accidents each year, which comprises a significant portion of improper vehicle lighting systems. These factors boost the demand for adaptive and intelligent lighting systems in vehicles. Therefore, increasing concern toward road safety drives the automotive adaptive front light market revenue growth.

An expansion in disposable income, improved lifestyle, and changing preferences of customers have positively impacted the sales of premium cars across the globe. Various driver assistance features, such as Lane Departure Warning (LDW), Blind Spot Detection (BSD), Forward Collision Warning System (FCWS), and Adaptive Cruise Control (ACC), are not mandated by laws or regulations. However, some premium car manufacturers offer these features to keep their position in the market, leading to healthy competition between automobile manufacturers. Car segments such as SUV-D and SUV-E are now provided with numerous premium features.

Premium segment vehicle manufacturers are moving their product and R&D focus towards electrification. Major OEMs like Ford, Stellantis, and Volkswagen have declared their complete electrification targets by the end of the next decade. As a result, major luxury cars will be launching various EV models. Due to this, advanced lighting technologies, including LEDs, adaptive lights and ambient lights, will be more rapidly incorporated into cars due to their better efficiencies and temperature control than halogen and xenon HID technologies.

The increased demand for adaptive lighting systems and advanced lighting technology has been used to limit road accidents worldwide. Advanced lighting technology, such as the automatic adjusts of the headlamp beam to lighten the road at a wide-range adaptive front light system, makes it more comfortable for the driver to concentrate on the road. The advanced lighting technology will hence result in the expansion of the automotive lighting market.

As per The Royal Society for the Prevention of Accidents, driving at night hours, especially between 7 pm and 8 am, contributes to only a quarter of all travel by car, yet it contributes to 40% of fatal accidents. Pedestrians and roads with limited visibility result in a growing number of accidents. Hence, the limited number of roadway lights will enhance the demand for the automotive lighting market to decrease fatal accidents.

The increasing emphasis on vehicle safety and the integration of advanced lighting technologies are driving the evolution of automotive adaptive front lighting systems, which are poised to enhance nighttime visibility and overall driving experience.

U.S. Department of Transportation

Automotive Adaptive Front Light Market Market Drivers

Regulatory Support

Government regulations aimed at improving vehicle safety are driving the Global Automotive Adaptive Front Light Market Industry. Various countries are implementing stringent standards for vehicle lighting systems, which necessitates the adoption of adaptive front lighting technologies. For example, the European Union has introduced regulations mandating the use of advanced lighting systems to enhance road safety. This regulatory push not only encourages manufacturers to innovate but also increases consumer awareness regarding the benefits of adaptive lighting. Consequently, the market is expected to witness substantial growth, aligning with the projected increase in market value from 0.82 USD Billion in 2024 to 9.51 USD Billion by 2035.

Technological Advancements

The Global Automotive Adaptive Front Light Market Industry is experiencing rapid technological advancements, particularly in LED and laser lighting technologies. These innovations enhance visibility and safety during nighttime driving, which is crucial as road traffic accidents remain a significant concern worldwide. For instance, adaptive lighting systems can adjust beam patterns based on vehicle speed and steering angle, improving illumination in curves and turns. As a result, the market is projected to grow from 0.82 USD Billion in 2024 to an estimated 9.51 USD Billion by 2035, reflecting a robust CAGR of 24.95% from 2025 to 2035.

Market Growth Visualization

The Global Automotive Adaptive Front Light Market Industry is characterized by a remarkable growth trajectory, as illustrated in the following charts. The market is expected to expand from 0.82 USD Billion in 2024 to 9.51 USD Billion by 2035, indicating a substantial increase in demand for adaptive lighting technologies. The projected CAGR of 24.95% from 2025 to 2035 further underscores the potential for innovation and investment in this sector. These visual representations highlight the significant opportunities available for stakeholders within the automotive lighting market.

Consumer Demand for Safety Features

There is a growing consumer demand for enhanced safety features in vehicles, which significantly influences the Global Automotive Adaptive Front Light Market Industry. As consumers become more aware of the benefits of adaptive lighting systems, such as improved visibility and reduced glare for oncoming drivers, manufacturers are compelled to integrate these technologies into their vehicles. This trend is particularly evident in premium vehicle segments, where adaptive front lighting is increasingly viewed as a standard feature rather than an optional upgrade. The market's expansion is further supported by the anticipated growth from 0.82 USD Billion in 2024 to 9.51 USD Billion by 2035, driven by this heightened consumer expectation.

Integration with Autonomous Driving Technologies

The integration of adaptive front lighting systems with autonomous driving technologies is poised to reshape the Global Automotive Adaptive Front Light Market Industry. As the automotive sector moves towards greater automation, the need for advanced lighting solutions that can communicate with other vehicle systems becomes paramount. Adaptive lighting can enhance the functionality of autonomous vehicles by providing optimal illumination based on real-time environmental conditions. This synergy not only improves safety but also enhances the overall driving experience. The market is likely to benefit from this trend, contributing to the projected growth from 0.82 USD Billion in 2024 to 9.51 USD Billion by 2035.

Market Segment Insights

Automotive Adaptive Front Light Type Insights

The Automotive Adaptive Front Light market segmentation, based on type, includes halogen and LED. The halogen segment dominated the market, accounting for 35% of market revenue (0.22 Billion). In developing economies, category growth is driven by the availability of advanced halogen or high-intensity discharge (HID) adaptive lighting systems from original equipment manufacturers (OEMs) at a reasonable price. However, LED is the fastest-growing category due to the growing need for more energy-efficient lighting and high-performance lighting technologies, which has increased the demand for LED in the automotive adaptive front light market.

Automotive Adaptive Front Light Vehicle Type Insights

The Automotive Adaptive Front Light market segmentation, based on vehicle type, includes passenger vehicles and commercial vehicles. The passenger vehicle category generated the most income (70.4%) due to an increase in the production of passenger vehicles provided with advanced safety features. However, commercial vehicles are the fastest-growing category due to the growing demand for adaptive lighting systems in heavy commercial vehicles, such as buses and trucks.

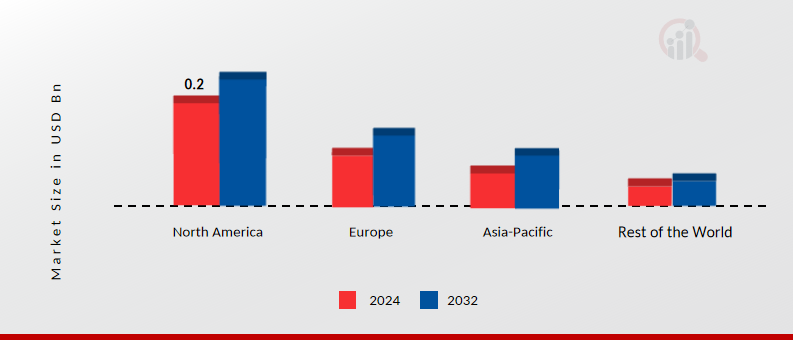

Figure 1: Automotive Adaptive Front Light Market by Vehicle Type, 2024 & 2032 (USD Billion)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Get more detailed insights about Automotive Adaptive Front Light Market Research Report- Forecast till 2032

Regional Insights

By region, the study provides market insights into North America, Europe, Asia-Pacific and the Rest of the World. The North American automotive adaptive front light market will dominate this market, owing to the growing adoption of autonomous and semi-autonomous vehicles, high demand for safety features, and increased requirement for comfort, driving the growth of the automotive adaptive front lighting market growth in this region. Further, the US automotive adaptive front light market held the largest market share, and the Canadian automotive adaptive front light market was the fastest-growing market in the North American region.

Further, the major countries studied in the market report are The US, Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: Automotive Adaptive Front Light Market Share By Region 2024 (USD Billion)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Europe's automotive adaptive front light market accounts for the second-largest market share due to the increasing prevalence of vehicle electrification, governmental initiatives, and reduction in overall vehicle production costs in this region. Further, the German automotive adaptive front light market held the largest market share, and the UK automotive adaptive front light market was the fastest-growing market in the European region.

The Asia-Pacific automotive adaptive front light market is expected to grow at the fastest CAGR from 2023 to 2032. This is due to the existence of major OEMs in the region, such as Honda Motor Co. Ltd., Toyota Motor Corporation, and Hyundai Motor Company, which are deploying adaptive front lighting systems in their offerings. Moreover, China’s automotive adaptive front light market held the largest market share, and the Indian automotive adaptive front light market was the fastest-growing market in the Asia-Pacific region.

Key Players and Competitive Insights

Leading market players are investing heavily in research and development to expand their product lines, which will help the automotive adaptive front light market grow even more. Market participants are also undertaking various strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the automotive adaptive front light industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics manufacturers use in the Automotive Adaptive Front Light industry to benefit clients and increase the market sector. Major players in the automotive adaptive front light market, including Hella GmbH & Co. KGaA, Magneti Marelli S.p.A, Koito Manufacturing, Valeo SA, Stanley Electric Co. Ltd., and others, are attempting to increase market demand by investing in research and development operations.

BMW is an automotive company. It develops, manufactures, and sells automobiles, motorcycles, spare parts, accessories, and engines. The company also offers deposit business, retail customer and dealer financing, insurance, fleet business, and car leasing services. It markets products under the BMW, MINI, Rolls-Royce, Alphabet, John Cooper Works, YOUR NOW, and Motorrad brands. It has production and assembly facilities and a sales network across the world.

In February 2020, BMW launched its Made in India 530i Sport which comes with various safety features such as ABS with brake assist, dynamic stability control, hill descent control, run-flat tires, electronic vehicle immobilizer and cornering brake control. Along with that, it also has adaptive LED headlights and six airbags.

Force Motors Limited is a vertically integrated automobile company that designs, develops and manufactures automotive components, aggregates and vehicles. The company's product offering includes small commercial vehicles, multi-utility vehicles (MUV), and light commercial vehicles (LCV). It also offers sports utility vehicles (SUV), agricultural tractors and other automobile industry products, including diesel engines. Force Motors provides Trax Cruiser, Trax Kargo King, Trax Toofan, Trax Ambulance and Trax Delivery Van, Balwan 550 and Orchard Mini, among other vehicles. The company also provides transport solutions.

In December 2019, Force Motors announced to invest USD 85.85 million to develop two new models over the next two years. Similarly, Morris Garages (MG), which has already invested a huge amount in entering the Indian market, has announced further investing USD 429.25 million in India.

Key Companies in the Automotive Adaptive Front Light Market market include

Industry Developments

January 2024: The new European-adapted Adaptive Headlights by Tesla are now only available for the new Model 3.

When Tesla began producing and delivering the new Model 3 called “Highland,” one of the most obvious changes that can be seen is the headlights, together with other cosmetic updates.

Tesla is currently rolling out the newest Adaptive Headlights for the Model 3 Highland through software update version 2024.2, but at least for now, they're only applicable to European vehicles.

According to the release notes, these novel Adaptive Headlights will “adjust to reduce glare for other drivers and cyclists,” and they also still provide dimmed pixels on headlights that help improve visibility while driving in low light conditions at night:

Now, instead, the high beam adjusts down and away from oncoming drivers or those ahead whom you want to see. It detects other road users and selectively dims individual pixels of its headlights, thereby allowing it to remain on high beam longer and hence improving night vision.

February 2024 : QAF Auto Sdn Bhd has increased its offering in Malaysia based on the BMW3 series. The all-new BMW3 series Touring was presented at the QAF Auto Chinese New Year open house.

Standard adaptive LED headlights include slim contours and daytime driving lights shaped like an L turned upside-down. Additionally, outer elements of daytime running lights act as turn indicators. Adaptive headlight functionality also covers the stop/start operation of dynamic cornering lights and non-dazzling matrix main-beam functionality coupled with dynamic light range control with variable light distribution functions.

BMW has introduced the M Sport Pro package globally into its lineup for the first time, making it standard in the Sultanate.

Some exterior design highlights consist of extended M high-gloss Shadowline trim and signature BMW kidney grille with double bars finished in black. With full-color heads-up displays offered as standard equipment, drivers can additionally have relevant information within their field of view.

March 2023: HELLA, the automotive supplier operating under the FORVIA umbrella brand, is expanding its Black Magic product range with 32 new lightbars. The company is thus continuing a success story in Europe as well, as the headlamp series has already been a top seller in the USA for many years. It was also launched in Europe for off-road applications in early 2022.

Future Outlook

Automotive Adaptive Front Light Market Future Outlook

The Automotive Adaptive Front Light Market is poised for growth at 24.89% CAGR from 2025 to 2035, driven by technological advancements, regulatory support, and increasing consumer demand for safety features.

New opportunities lie in:

- Develop advanced sensor integration for enhanced adaptive lighting systems.

- Invest in R&D for energy-efficient lighting technologies.

- Expand partnerships with automotive manufacturers for customized lighting solutions.

By 2035, the market is expected to achieve substantial growth, reflecting evolving consumer preferences and technological innovations.

Market Segmentation

Automotive Adaptive Front Light Type Outlook

- Halogen

- LED

Automotive Adaptive Front Light Regional Outlook

- US

- Canada

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia-Pacific

- Middle East

- Africa

- Latin America

Automotive Adaptive Front Light Vehicle Type Outlook

- Passenger Vehicle

- Commercial Vehicle

Report Scope

| Attribute/Metric | Details |

| Market Size 2024 | USD 0.82 Billion |

| Market Size 2035 | 9.46 (Value (USD Billion)) |

| Compound Annual Growth Rate (CAGR) | 24.89% (2025 - 2035) |

| Base Year | 2024 |

| Market Forecast Period | 2025 - 2035 |

| Historical Data | 2018- 2022 |

| Market Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Type, Vehicle Type, and Region |

| Geographies Covered | North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered | The US, Canada, German, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled | Saicheng Autoparts (China), Hella (Germany), Koito Manufacturing (Japan), Magneti Marelli (Italy), Stanley Electric (Japan), North American Lighting (US), Varroc (US), OSRAM (Germany), Valeo (France), and Neolite (China). |

| Key Market Opportunities | Growing demand for advanced driver-assistance systems |

| Key Market Dynamics | Integration of machine learning for automatic adjustment of lighting. |

| Market Size 2025 | 1.02 (Value (USD Billion)) |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

How much is the automotive adaptive front light market?

The Automotive Adaptive Front Light market size was valued at USD 0.64 Billion in 2023.

What is the growth rate of the automotive adaptive front light market?

The global market is projected to grow at a CAGR of 24.89% during the forecast period, 2024-2032.

Which region held the largest market share in the automotive adaptive front light market?

North America had the largest share of the global market

Who are the key players in the automotive adaptive front light market?

The key players in the market are Saicheng Autoparts (China), Hella (Germany), Koito Manufacturing (Japan), Magneti Marelli (Italy), Stanley Electric (Japan), North American Lighting (US), and Varroc (US).

Which type led the automotive adaptive front light market?

The halogen category dominated the market in 2023.

Which vehicle type had the largest market share in the automotive adaptive front light market?

The passenger vehicle had the largest share in the global market.

-

Table of Contents

-

INTRODUCTION

- DEFINITION

- SCOPE OF STUDY

- RESEARCH OBJECTIVE

- ASSUMPTIONS & LIMITATIONS

- MARKET STRUCTURE:

-

RESEARCH VEHICLE TYPEOLOGY

- RESEARCH PROCESS

- PRIMARY RESEARCH

- SECONDARY RESEARCH

-

MARKET DYNAMICS

- DRIVERS

- RESTRAINTS

- OPPORTUNITIES

- CHALLENGES

- MACROECONOMIC INDICATORS

-

MARKET FACTOR ANALYSIS

-

PORTER’S FIVE FORCES MODEL

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF CUSTOMER

- INTENSITY OF COMPETITOR’S

- THREAT OF NEW ENTRANTS

-

PORTER’S FIVE FORCES MODEL

-

AUTOMOTIVE ADAPTIVE FRONT LIGHT, BY TYPE

-

INTRODUCTION

- HALOGEN

- LED

-

INTRODUCTION

-

AUTOMOTIVE ADAPTIVE FRONT LIGHT, BY VEHICLE TYPE

-

INTRODUCTION

- PASSENGER VEHICLE

- COMMERCIAL VEHICLE

-

INTRODUCTION

-

AUTOMOTIVE ADAPTIVE FRONT LIGHT, BY REGION

-

INTRODUCTION

- NORTH AMERICA

- EUROPE

- ASIA PACIFIC

- MIDDLE EAST & AFRICA

-

INTRODUCTION

-

COMPANY LANDSCAPE

-

INTRODUCTION

- MERGERS ACQUISITIONS

- COLLABORATIONS

- RELEASE/NEW PRODUCT LAUNCHES

- OTHER (EXPANSION, UPDATES, PARTNERSHIP)

-

INTRODUCTION

-

COMPANY PROFILE

-

SAICHENG AUTOPARTS

- COMPANY OVERVIEW

- PRODUCT/BUSINESS SEGMENT OVERVIEW

- FINANCIALS

- KEY DEVELOPMENTS

-

HELLA

- OVERVIEW

- PRODUCT/BUSINESS SEGMENT OVERVIEW

- FINANCIALS

- KEY DEVELOPMENTS

-

KOITO MANUFACTURING

- OVERVIEW

- PRODUCT/BUSINESS SEGMENT OVERVIEW

- FINANCIALS

- KEY DEVELOPMENTS

-

MAGNETI MARELLI

- OVERVIEW

- PRODUCT/BUSINESS SEGMENT OVERVIEW

- FINANCIALS

- KEY DEVELOPMENTS

-

STANLEY ELECTRIC

- OVERVIEW

- PRODUCT/BUSINESS SEGMENT OVERVIEW

- FINANCIALS

- KEY DEVELOPMENTS

-

NORTH AMERICAN LIGHTING

- OVERVIEW

- PRODUCT/BUSINESS SEGMENT OVERVIEW

- FINANCIALS

- KEY DEVELOPMENTS

-

VARROC

- OVERVIEW

- PRODUCT/BUSINESS SEGMENT OVERVIEW

- FINANCIALS

- KEY DEVELOPMENTS

-

SAICHENG AUTOPARTS

-

APPENDIX

-

List of Tables and Figures

- LIST OF TABLES

- TABLE 1 EUROPE AUTOMOTIVE ADAPTIVE FRONT LIGHT, BY REGION 2024-2032, (USD MILLION) 19

- TABLE 2 EUROPE AUTOMOTIVE ADAPTIVE FRONT LIGHT FOR PASSENGER VEHICLE, BY REGION 2024-2032, (MILLION) 19

- TABLE 3 EUROPE AUTOMOTIVE ADAPTIVE FRONT LIGHT FOR COMMERCIAL VEHICLE, BY REGION 2024-2032, (MILLION) 20

- TABLE 4 EUROPE AUTOMOTIVE ADAPTIVE FRONT LIGHT FOR PASSENGER VEHICLE, BY REGION 2024-2032, (MILLION) 20

- TABLE 5 EUROPE AUTOMOTIVE ADAPTIVE FRONT LIGHT FOR COMMERCIAL VEHICLE, BY REGION 2024-2032, (MILLION) 20

- TABLE 6 EUROPE AUTOMOTIVE ADAPTIVE FRONT LIGHT FOR LED, BY REGION 2024-2032, (MILLION) 2

- TABLE 7 EUROPE AUTOMOTIVE ADAPTIVE FRONT LIGHT FOR HALOGEN, BY REGION 2024-2032, (MILLION) 21

- TABLE 8 EUROPE AUTOMOTIVE ADAPTIVE FRONT LIGHT FOR LED, BY REGION 2024-2032, (MILLION) 21

- TABLE 9 EUROPE AUTOMOTIVE ADAPTIVE FRONT LIGHT, BY TYPE 2024-2032, (MILLION) 22

- TABLE 10 EUROPE AUTOMOTIVE ADAPTIVE FRONT LIGHT, BY TYPE 2024-2032, (MILLION) 22

- TABLE 11 MIDDLE EAST AUTOMOTIVE ADAPTIVE FRONT LIGHT, BY TYPE 2024-2032, (MILLION) 23

- TABLE 12 AFRICA AUTOMOTIVE ADAPTIVE FRONT LIGHT, BY TYPE, 2024-2032, (MILLION) 23

- TABLE 13 EUROPE AUTOMOTIVE ADAPTIVE FRONT LIGHT 2024-2032, (USDMILLION) 24

- TABLE 14 EUROPE AUTOMOTIVE ADAPTIVE FRONT LIGHT, BY COUNTRY 2024-2032, (USDMILLION) 25

- TABLE 15 GERMANY AUTOMOTIVE ADAPTIVE FRONT LIGHT, BY VEHICLE TYPE 2024-2032, (USDMILLION) 25

- TABLE 16 GERMANY AUTOMOTIVE ADAPTIVE FRONT LIGHT, BY TYPE 2024-2032, (USDMILLION) 26

- TABLE 17 FRANCE AUTOMOTIVE ADAPTIVE FRONT LIGHT, BY VEHICLE TYPE 2024-2032, (USDMILLION) 26

- TABLE 18 FRANCE AUTOMOTIVE ADAPTIVE FRONT LIGHT, BY TYPE 2024-2032, (USDMILLION) 26

- TABLE 19 ITALY AUTOMOTIVE ADAPTIVE FRONT LIGHT, BY VEHICLE TYPE 2024-2032, (USDMILLION) 27

- TABLE 20 ITALY AUTOMOTIVE ADAPTIVE FRONT LIGHT, BY TYPE 2024-2032, (USDMILLION) 27

- TABLE 21 SPAIN AUTOMOTIVE ADAPTIVE FRONT LIGHT, BY VEHICLE TYPE 2024-2032, (USDMILLION) 28

- TABLE 22 SPAIN AUTOMOTIVE ADAPTIVE FRONT LIGHT, BY TYPE 2024-2032, (USDMILLION) 28

- TABLE 23 U.K. AUTOMOTIVE ADAPTIVE FRONT LIGHT, BY VEHICLE TYPE 22024-2032, (USDMILLION) 29

- TABLE 24 U.K. AUTOMOTIVE ADAPTIVE FRONT LIGHT, BY TYPE 2024-2032, (USDMILLION) 29

- TABLE 25 SCANDINAVIA AUTOMOTIVE ADAPTIVE FRONT LIGHT, BY VEHICLE TYPE 2024-2032, (USDMILLION) 30

- TABLE 26 SCANDINAVIA AUTOMOTIVE ADAPTIVE FRONT LIGHT, BY TYPE 2024-2032, (USDMILLION) 30

- TABLE 27 BENELUX AUTOMOTIVE ADAPTIVE FRONT LIGHT, BY VEHICLE TYPE 2024-2032, (USDMILLION) 31

- TABLE 28 BENELUX AUTOMOTIVE ADAPTIVE FRONT LIGHT, BY TYPE 2024-2032, (USDMILLION) 31

- TABLE 29 REST OF EUROPE AUTOMOTIVE ADAPTIVE FRONT LIGHT, BY VEHICLE TYPE 2024-2032, (USDMILLION) 32

- TABLE 30 REST OF EUROPE AUTOMOTIVE ADAPTIVE FRONT LIGHT, BY TYPE 2024-2032, (USDMILLION) 32

- TABLE 31 MIDDLE EAST AUTOMOTIVE ADAPTIVE FRONT LIGHT, BY COUNTRY 2024-2032, (USDMILLION) 33

- TABLE 32 SAUDI ARABIA AUTOMOTIVE ADAPTIVE FRONT LIGHT, BY VEHICLE TYPE 2024-2032, (USDMILLION) 34

- TABLE 33 SAUDI ARABIA AUTOMOTIVE ADAPTIVE FRONT LIGHT, BY TYPE 2024-2032, (USDMILLION) 34

- TABLE 34 UAE AUTOMOTIVE ADAPTIVE FRONT LIGHT, BY VEHICLE TYPE 2024-2032, (USDMILLION) 35

- TABLE 35 UAE AUTOMOTIVE ADAPTIVE FRONT LIGHT, BY TYPE 2024-2032, (USDMILLION) 35

- TABLE 36 KUWAIT AUTOMOTIVE ADAPTIVE FRONT LIGHT, BY VEHICLE TYPE 2024-2032, (USDMILLION) 36

- TABLE 37 KUWAIT AUTOMOTIVE ADAPTIVE FRONT LIGHT, BY VEHICLE TYPE 2024-2032, (USDMILLION) 36

- TABLE 38 QATAR AUTOMOTIVE ADAPTIVE FRONT LIGHT, BY VEHICLE TYPE 2024-2032, (USDMILLION) 37

- TABLE 39 QATAR AUTOMOTIVE ADAPTIVE FRONT LIGHT, BY VEHICLE TYPE 2024-2032, (USDMILLION) 37

- TABLE 40 REST OF MIDDLE EAST AUTOMOTIVE ADAPTIVE FRONT LIGHT, BY VEHICLE TYPE 2024-2032, (USDMILLION) 38

- TABLE 41 REST OF MIDDLE EAST AUTOMOTIVE ADAPTIVE FRONT LIGHT, BY VEHICLE TYPE 2024-2032, (USDMILLION) 38

- TABLE 42 AFRICA AUTOMOTIVE ADAPTIVE FRONT LIGHT, BY COUNTRY 2024-2032, (USDMILLION) 39

- TABLE 43 SOUTH AFRICA AUTOMOTIVE ADAPTIVE FRONT LIGHT, BY VEHICLE TYPE 2024-2032, (USDMILLION) 40

- TABLE 44 SOUTH AFRICA AUTOMOTIVE ADAPTIVE FRONT LIGHT, BY VEHICLE TYPE 2024-2032, (USDMILLION) 40

- TABLE 45 NIGERIA AUTOMOTIVE ADAPTIVE FRONT LIGHT, BY VEHICLE TYPE 2024-2032, (USDMILLION) 41

- TABLE 46 NIGERIA AUTOMOTIVE ADAPTIVE FRONT LIGHT, BY VEHICLE TYPE 2024-2032, (USDMILLION) 41

- TABLE 47 ALGERIA AUTOMOTIVE ADAPTIVE FRONT LIGHT, BY VEHICLE TYPE 2024-2032, (USDMILLION) 42

- TABLE 48 ALGERIA AUTOMOTIVE ADAPTIVE FRONT LIGHT, BY VEHICLE TYPE 2024-2032, (USDMILLION) 42

- TABLE 49 REST OF AFRICA AUTOMOTIVE ADAPTIVE FRONT LIGHT, BY VEHICLE TYPE 2024-2032, (USDMILLION) 43

- TABLE 50 REST OF AFRICA AUTOMOTIVE ADAPTIVE FRONT LIGHT, BY VEHICLE TYPE 2024-2032, (USDMILLION) 43 LIST OF FIGURES

- FIGURE 1 SUPPLY CHAIN: AUTOMOTIVE ADAPTIVE FRONT LIGHT 16

- FIGURE 2 PORTER’S FIVE FORCES ANALYSIS 17

Automotive Adaptive Front Light Market Segmentation

Automotive Adaptive Front Light Type Outlook (USD Billion, 2018-2032)

- Halogen

- LED

Automotive Adaptive Front Light Vehicle Type Outlook (USD Billion, 2018-2032)

- Passenger Vehicle

- Commercial Vehicle

Automotive Adaptive Front Light Regional Outlook (USD Billion, 2018-2032)

North America Outlook (USD Billion, 2018-2032)

- North America Automotive Adaptive Front Light by Type

- Halogen

- LED

- North America Automotive Adaptive Front Light by Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

US Outlook (USD Billion, 2018-2032)

- US Automotive Adaptive Front Light by Type

- Halogen

- LED

- US Automotive Adaptive Front Light by Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

CANADA Outlook (USD Billion, 2018-2032)

- CANADA Automotive Adaptive Front Light by Type

- Halogen

- LED

- CANADA Automotive Adaptive Front Light by Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

- North America Automotive Adaptive Front Light by Type

Europe Outlook (USD Billion, 2018-2032)

- Europe Automotive Adaptive Front Light by Type

- Halogen

- LED

- Europe Automotive Adaptive Front Light by Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

Germany Outlook (USD Billion, 2018-2032)

- Germany Automotive Adaptive Front Light by Type

- Halogen

- LED

- Germany Automotive Adaptive Front Light by Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

France Outlook (USD Billion, 2018-2032)

- France Automotive Adaptive Front Light by Type

- Halogen

- LED

- France Automotive Adaptive Front Light by Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

UK Outlook (USD Billion, 2018-2032)

- UK Automotive Adaptive Front Light by Type

- Halogen

- LED

- UK Automotive Adaptive Front Light by Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

ITALY Outlook (USD Billion, 2018-2032)

- ITALY Automotive Adaptive Front Light by Type

- Halogen

- LED

- ITALY Automotive Adaptive Front Light by Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

SPAIN Outlook (USD Billion, 2018-2032)

- Spain Automotive Adaptive Front Light by Type

- Halogen

- LED

- Spain Automotive Adaptive Front Light by Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

Rest Of Europe Outlook (USD Billion, 2018-2032)

- Rest Of Europe Automotive Adaptive Front Light by Type

- Halogen

- LED

- REST OF EUROPE Automotive Adaptive Front Light by Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

- Europe Automotive Adaptive Front Light by Type

Asia-Pacific Outlook (USD Billion, 2018-2032)

- Asia-Pacific Automotive Adaptive Front Light by Type

- Halogen

- LED

- Asia-Pacific Automotive Adaptive Front Light by Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

China Outlook (USD Billion, 2018-2032)

- China Automotive Adaptive Front Light by Type

- Halogen

- LED

- China Automotive Adaptive Front Light by Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

Japan Outlook (USD Billion, 2018-2032)

- Japan Automotive Adaptive Front Light by Type

- Halogen

- LED

- Japan Automotive Adaptive Front Light by Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

India Outlook (USD Billion, 2018-2032)

- India Automotive Adaptive Front Light by Type

- Halogen

- LED

- India Automotive Adaptive Front Light by Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

Australia Outlook (USD Billion, 2018-2032)

- Australia Automotive Adaptive Front Light by Type

- Halogen

- LED

- Australia Automotive Adaptive Front Light by Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

Rest of Asia-Pacific Outlook (USD Billion, 2018-2032)

- Rest of Asia-Pacific Automotive Adaptive Front Light by Type

- Halogen

- LED

- Rest of Asia-Pacific Automotive Adaptive Front Light by Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

- Asia-Pacific Automotive Adaptive Front Light by Type

Rest of the World Outlook (USD Billion, 2018-2032)

- Rest of the World Automotive Adaptive Front Light by Type

- Halogen

- LED

- Rest of the World Automotive Adaptive Front Light by Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

Middle East Outlook (USD Billion, 2018-2032)

- Middle East Automotive Adaptive Front Light by Type

- Halogen

- LED

- Middle East Automotive Adaptive Front Light by Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

Africa Outlook (USD Billion, 2018-2032)

- Africa Automotive Adaptive Front Light by Type

- Halogen

- LED

- Africa Automotive Adaptive Front Light by Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

Latin America Outlook (USD Billion, 2018-2032)

- Latin America Automotive Adaptive Front Light by Type

- Halogen

- LED

- Latin America Automotive Adaptive Front Light by Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

- Rest of the World Automotive Adaptive Front Light by Type

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment