Automotive Adaptive Front Light Market Summary

As per Market Research Future analysis, the Automotive Adaptive Front Light Market Size was estimated at 0.82 USD Billion in 2024. The Automotive Adaptive Front Light industry is projected to grow from USD 1.024 Billion in 2025 to USD 9.456 Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 24.89% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Automotive Adaptive Front Light Market is poised for substantial growth driven by technological advancements and increasing safety concerns.

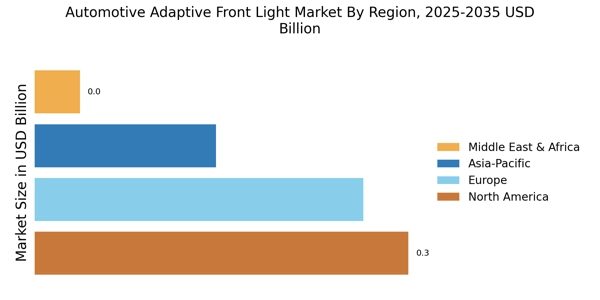

- Technological advancements in lighting systems are reshaping the Automotive Adaptive Front Light Market, particularly in North America.

- The LED segment remains the largest, while the halogen segment is experiencing rapid growth, especially in Asia-Pacific.

- Passenger vehicles dominate the market, yet commercial vehicles are emerging as the fastest-growing segment.

- Key market drivers include regulatory compliance and consumer demand for enhanced driving experiences.

Market Size & Forecast

| 2024 Market Size | 0.82 (USD Billion) |

| 2035 Market Size | 9.456 (USD Billion) |

| CAGR (2025 - 2035) | 24.89% |

Major Players

Valeo (FR), Hella (DE), Osram (DE), Magneti Marelli (IT), Koito Manufacturing (JP), Stanley Electric (JP), Aisin Seiki (JP), Continental (DE), Denso (JP)