Aquafeed Size

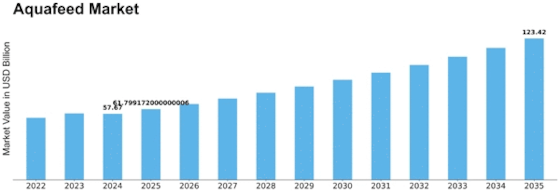

Aquafeed Market Growth Projections and Opportunities

The rising interest for fish and seafood, combined with the growth of the hydroponics area, has moved the Aquafeed market into a domain of steady development. One of the essential main impetuses behind this dynamism is the rising worldwide population and the resulting demand sought after for protein-rich food. As usual sources of fish face supportability challenges, hydroponics arises as a feasible answer for meet the developing protein needs. Thus, the Aquafeed market is seeing a popularity rise, driven by the need to give ideal nourishment to cultivated fish and improve their growth. This change in buyer inclinations and administrative systems has prompted the turn of events and reception of creative feed plans that focus on both wholesome productivity and ecological obligation. Thus, market players are taken part in constant innovative work to make Aquafeed arrangements that advance the growth of sea species as well as line up with the standards of manageable and dependable hydroponics. Besides, the Aquafeed market is set apart by a cutthroat scene where makers are competing for market share through essential unions, consolidations, and acquisitions. These exercises add to the union of the business as vital participants expect to fortify their presence and broaden their item portfolios. The spotlight is not just on the definition of nutritious feeds yet in addition on utilizing mechanical progressions to upgrade creation processes and work on generally effectiveness. Development in feed fixings, for example, elective protein sources and utilitarian added substances, stays a vital procedure to remain ahead in the competitive Aquafeed market. Besides, globalization assumes an urgent part in molding the elements of the Aquafeed market. The interconnectedness of markets across the globe has prompted the trading of innovations, best practices, and market patterns. This globalization has worked with the exchange of information and mastery, adding to the general improvement of Aquafeed plans and creation strategies. It similarly opens new open doors for market extension as Aquafeed makers investigate undiscovered districts with the potential for critical growth in hydroponics applications.

Leave a Comment