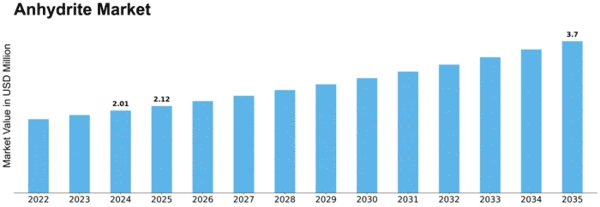

Anhydrite Size

Anhydrite Market Growth Projections and Opportunities

The Anhydrite Market is shaped by many factors. Anhydrite's role as a calcium sulfate source drives the market. Anhydrite, a glasslike calcium sulfate mineral, has uses in development, horticulture, and current cycles. The global demand for anhydrite, driven by its adaptability and large development area, drives market growth and highlights its importance in current applications.

Development significantly affects the Anhydrite Market. A popular deck layout in private and commercial development is self-evening out floor tirades, which use anhydrite as a foundation. Its minimal shrinkage and excellent flow characteristics make it ideal for smooth, level surfaces. Interest in anhydrite for floor tirades and other development applications is high as the development area grows worldwide, influencing the market.

Another Anhydrite Market driver is horticulture. Calcium and sulfur make anhydrite a significant soil correction. Anhydrite improves soil structure, supplement accessibility, and causticity levels. As controllable agricultural practices gain prominence, anhydrite's use as a dirt conditioner grows, boosting the market.

Geography and natural resource availability shape the Anhydrite Market. Evaporite reserves often include anhydrite. Changes in soil conditions, extraction methods, or additional storage might affect anhydrite production and estimates. Anhydrite production hotspots are investigated as the market responds to regional changes.

Mechanical advances in current cycles shape the Anhydrite Market. Continuous innovation improves anhydrite production efficiency, quality, and cost. Modern applications make anhydrite more serious, enabling its adaptation to changing market patterns and new commercial uses.

Environmental guidelines and maintainability considerations shape the Anhydrite Market. The market emphasizes sustainable and eco-friendly anhydrite mining and handling as enterprises face more scrutiny of natural effects. Maintaining strict environmental standards and researching reliable mining practices boosts the market. Market responds to company's responsibility to reduce natural impact and ensure reliable mineral extraction.

Buyer tastes and market trends also shape the Anhydrite Market. As buyers and businesses grow more mindful of sustainable development practices, soil health, and natural duty, anhydrite-consolidated products for development and horticulture are gaining popularity. The market adapts to end-client business patterns that require anhydrite for manageability and effectiveness.

Competitive estimates and elective material availability affect the Anhydrite Market. Ventures employing anhydrite must consider its cost viability compared to other folios or soil repairs. In response to supply-demand variations, the market adjusts to advances in elective material or cycles that might alter anhydrite's cost.

Leave a Comment