Market Trends

Key Emerging Trends in the Analytics of Things Market

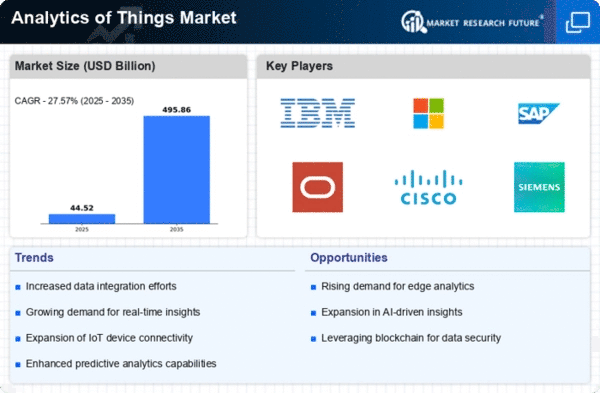

The Analytics of Things (AoT) market has witnessed significant growth and evolution in recent years, driven by the increasing adoption of IoT (Internet of Things) devices across various industries. The integration of analytics with IoT has given rise to Analytics of Things, enabling organizations to derive valuable insights from the vast amounts of data generated by connected devices. One prominent market trend is the growing emphasis on real-time analytics capabilities. Businesses are increasingly recognizing the importance of extracting actionable insights from IoT data in real-time to make informed decisions and respond promptly to changing conditions.

Moreover, the Analytics of Things market is experiencing a surge in demand for advanced analytics solutions, such as machine learning and artificial intelligence (AI). These technologies enhance the ability to analyze complex data sets, identify patterns, and predict future trends. As organizations seek more sophisticated and accurate insights, the integration of machine learning and AI into Analytics of Things platforms is becoming a standard practice

Another notable trend is the rising adoption of edge analytics in the Analytics of Things ecosystem. Edge analytics involves processing data closer to the source, reducing latency and bandwidth requirements. This approach is particularly crucial in scenarios where real-time insights are paramount, such as in industrial settings or smart cities. By analyzing data at the edge, organizations can optimize operational efficiency and respond swiftly to events as they unfold.

The Analytics of Things market is also witnessing a shift towards cloud-based solutions. Cloud platforms offer scalability, flexibility, and cost-effectiveness, making them an attractive option for businesses looking to deploy analytics solutions seamlessly. Cloud-based AoT solutions enable organizations to manage and analyze data efficiently, regardless of the scale of their IoT deployments. This trend aligns with the broader industry movement towards cloud adoption across various technology domains.

Interoperability and standardization are emerging as critical considerations in the Analytics of Things market. As the number of IoT devices continues to grow, ensuring compatibility and seamless communication between different devices and platforms becomes imperative. Standardization efforts are underway to establish common protocols and frameworks, fostering a more cohesive and interconnected AoT ecosystem. This trend is essential for promoting collaboration among diverse IoT devices and ensuring the interoperability of analytics solutions.

Security remains a top concern in the Analytics of Things market. With the proliferation of connected devices, the attack surface for potential cyber threats expands. Organizations are increasingly prioritizing robust security measures to safeguard sensitive IoT data and prevent unauthorized access. As the AoT market evolves, the integration of advanced security features and encryption technologies is becoming standard practice to address these concerns.

Leave a Comment