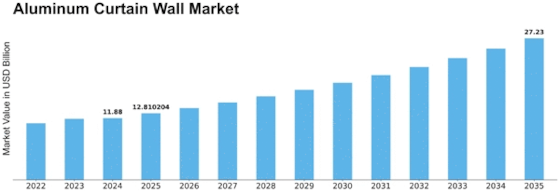

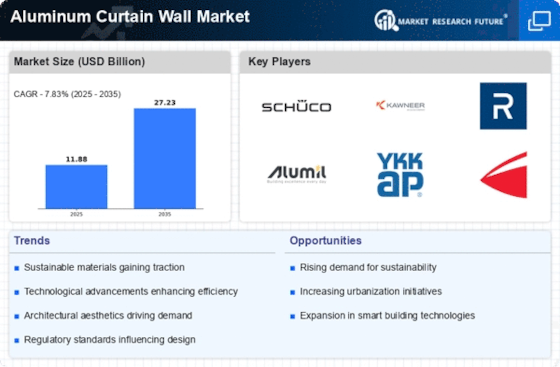

Aluminum Curtain Wall Size

Aluminum Curtain Wall Market Growth Projections and Opportunities

The aluminum curtain wall market is influenced by several key factors that shape its dynamics and growth trajectory. One significant market factor is the increasing demand for energy-efficient and aesthetically pleasing building facades. Aluminum curtain walls, consisting of lightweight aluminum frames and glass panels, offer architects and developers a versatile solution for creating modern and sustainable building exteriors. With a focus on energy efficiency and green building practices, the demand for aluminum curtain walls equipped with thermal insulation and solar control features is on the rise, particularly in commercial and high-rise residential construction projects.

This leads to the rise in urbanization which promotes the growth of the market. High penetration of the aluminum curtain wall in the commercial construction activities especially in the region of India, China, Australia, and some of the Indonesian region has spurred up the aluminum curtain wall market size. Moreover, curtains have been widely used in offices, hospitals, restaurants, and hotels. There are several other advantages associated with the usage of the aluminum wall like enhancing the thermal efficiency of the houses or buildings for preventing the spread of fire.

Moreover, technological advancements and innovations in aluminum curtain wall systems contribute to market growth. Manufacturers are continuously developing new materials, designs, and fabrication techniques to enhance the performance, durability, and aesthetics of aluminum curtain walls. For example, the introduction of high-performance coatings and finishes improves the weather resistance and maintenance requirements of aluminum frames, while advancements in glass technology enable the integration of energy-efficient glazing options such as low-emissivity coatings and insulated glass units.

Market factors also include regulatory standards and building codes governing building envelope performance and safety. Government regulations and industry standards prescribe specific requirements for curtain wall systems to ensure compliance with structural integrity, fire safety, and energy efficiency standards. Compliance with these regulations is essential for architects, developers, and builders to obtain permits and certifications for construction projects, driving market demand for aluminum curtain walls that meet regulatory requirements.

Furthermore, macroeconomic factors such as urbanization and construction activity influence the demand for aluminum curtain walls. With rapid urbanization and population growth, there is a growing need for commercial and residential buildings with modern and aesthetically pleasing facades. Additionally, infrastructure development projects, such as airports, hospitals, and educational institutions, contribute to market growth for aluminum curtain walls as these projects require durable and visually appealing building exteriors.

Additionally, market factors encompass environmental considerations and sustainability concerns. As governments and businesses increasingly prioritize environmental sustainability and energy efficiency, there is a growing demand for eco-friendly building materials and systems, including aluminum curtain walls. Manufacturers are responding to this demand by incorporating recycled materials, energy-efficient components, and sustainable fabrication processes into their aluminum curtain wall offerings to meet the growing demand for environmentally responsible building solutions.

Global market trends and trade dynamics also influence the aluminum curtain wall market. International trade agreements, tariffs, and trade barriers impact the import and export of aluminum curtain wall components, affecting pricing dynamics and market competitiveness. Moreover, regional differences in architectural styles and design preferences influence the demand for specific types of aluminum curtain wall systems in different geographic markets.

Leave a Comment