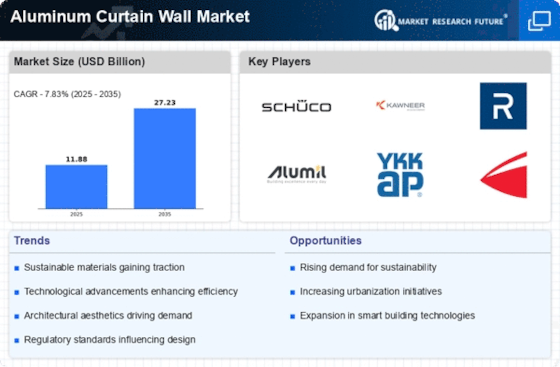

Urbanization Trends

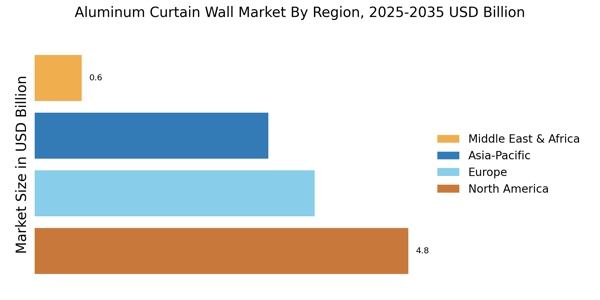

Urbanization trends are significantly impacting the Aluminum Curtain Wall Market. As populations migrate towards urban centers, the demand for high-rise buildings and commercial spaces is escalating. Aluminum curtain walls are favored in urban architecture due to their lightweight nature and ability to provide expansive glass facades, which enhance natural light and aesthetic appeal. Recent statistics suggest that urban areas are projected to account for over 70% of the global population by 2050, driving the need for innovative building solutions. This urban expansion is likely to propel the demand for aluminum curtain walls, as they offer both functional and aesthetic benefits in densely populated environments. Consequently, the market is poised for growth as urbanization continues to reshape the architectural landscape.

Aesthetic Versatility

Aesthetic versatility is a defining characteristic driving the Aluminum Curtain Wall Market. The ability of aluminum curtain walls to accommodate various architectural styles makes them a preferred choice among architects and designers. With a wide range of finishes, colors, and design options, aluminum curtain walls can seamlessly integrate into diverse building designs, from modern skyscrapers to traditional structures. This adaptability not only enhances the visual appeal of buildings but also allows for creative expression in architectural design. Market trends indicate that the demand for customized aluminum curtain walls is on the rise, as clients seek unique solutions that reflect their brand identity. This trend is likely to contribute to the sustained growth of the aluminum curtain wall market, as aesthetic considerations become increasingly important in construction.

Regulatory Compliance

Regulatory compliance is a crucial driver for the Aluminum Curtain Wall Market. Governments worldwide are implementing stringent building codes and standards aimed at enhancing energy efficiency and safety in construction. These regulations often mandate the use of materials that meet specific performance criteria, which aluminum curtain walls can fulfill. For instance, many regions require buildings to achieve certain energy performance ratings, and aluminum curtain walls are well-suited to meet these requirements. Market analysis indicates that compliance with these regulations could lead to a 20% increase in the adoption of aluminum curtain walls in new constructions. As builders and developers strive to adhere to these evolving standards, the demand for aluminum curtain walls is expected to rise.

Technological Innovations

Technological advancements play a pivotal role in shaping the Aluminum Curtain Wall Market. Innovations in manufacturing processes, such as improved extrusion techniques and surface treatments, enhance the performance and aesthetic appeal of aluminum curtain walls. These advancements not only increase durability but also allow for greater design flexibility. The integration of smart technologies, such as automated shading systems and energy-efficient glazing, further elevates the functionality of aluminum curtain walls. Market data indicates that the adoption of these technologies could lead to a 15% increase in market growth over the next five years. As architects and builders seek to incorporate cutting-edge solutions into their designs, the demand for technologically advanced aluminum curtain walls is expected to surge.

Sustainability Initiatives

The Aluminum Curtain Wall Market is increasingly influenced by sustainability initiatives. As environmental concerns gain prominence, architects and builders are prioritizing eco-friendly materials. Aluminum, being recyclable, aligns with these sustainability goals. The demand for energy-efficient buildings is also rising, as structures with aluminum curtain walls can significantly reduce energy consumption. According to recent data, buildings utilizing aluminum curtain walls can achieve up to 30% energy savings compared to traditional materials. This trend is likely to drive the market forward, as more stakeholders seek to comply with stringent environmental regulations and certifications. Furthermore, the emphasis on sustainable construction practices is expected to enhance the appeal of aluminum curtain walls, making them a preferred choice in the construction sector.