Alloys for Automotive Market Analysis

Alloys for Automotive Market Research Report Information By Type (Iron, Titanium, Steel, Copper, and Other), By Application (Chassis, Powertrain, Interior, Exterior), By Vehicles (Passenger Vehicle and Commercial Vehicles), And By Region (North America, Europe, Asia-Pacific, And Rest Of The World) –Market Forecast Till 2035

Market Summary

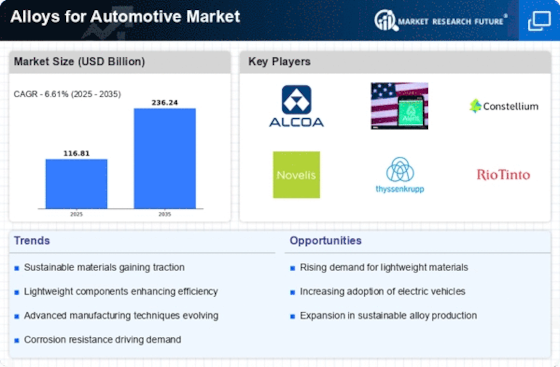

The Global Alloys for Automotive Market is projected to grow significantly from 116.81 USD Billion in 2024 to 236.24 USD Billion by 2035.

Key Market Trends & Highlights

Alloys for Automotive Key Trends and Highlights

- The market is expected to experience a compound annual growth rate (CAGR) of 6.62% from 2025 to 2035.

- By 2035, the market valuation is anticipated to reach 236.4 USD Billion, indicating robust growth potential.

- in 2024, the market is valued at 116.81 USD Billion, reflecting a strong foundation for future expansion.

- Growing adoption of lightweight materials due to increasing fuel efficiency regulations is a major market driver.

Market Size & Forecast

| 2024 Market Size | 116.81 (USD Billion) |

| 2035 Market Size | 236.24 (USD Billion) |

| CAGR (2025-2035) | 6.61% |

| Largest Regional Market Share in 2024 | latin_america) |

Major Players

ArcelorMittal SA (Luxembourg), Aditya Birla Group (India), Alcoa Inc. (U.S.), UACJ Corporation (Japan), ThyssenKrupp AG (Germany), Kobe Steel, Ltd. (Japan), Norsk Hydro ASA (Norway), AMG Advanced Metallurgical Group NV (Netherlands), Constellium (Netherlands), AGCO Corporation (U.S.)

Market Trends

The growing lightweight automobile industry is driving the market growth

The rising lightweight automobile industry drives the Market CAGR for alloys for automotive. The demand for lightweight wheels with similar strength and durability as steel wheels and high thermal stability, outstanding performance, and flexibility is driving growth in the automotive alloy wheel market. Aluminum or magnesium alloys, or a combination of the two, are used to make alloy wheels for automobiles. Car combination wheels are lightweight wheels that work on the direction and speed of a vehicle.

Additionally, during harsh driving circumstances, automotive alloy wheels limit thermal absorption from braking and result in the likelihood of brake collapse. Automotive alloy wheels have complicated geometries and must meet various design requirements, including size, design, efficiency, and manufacturability. Factors like strength-to-weight ratio and improved fuel economy are emphasized in the alloy wheel production process. To meet the automobile industry's needs and standard framework, the alloy wheels' manufacturing process has been evaluated and verified using sophisticated devices.

Because of unpredictable weather patterns, there is an increased need for lightweight and resistant to corrosion alloy wheels, which is a critical driver fueling the development of this market. Automotive alloy wheels enable tubeless tires and improve braking performance. The adoption of electric automobiles is expanding all over the world. To maximize battery range, an electric car needs to be lightweight. Alloy tires are used on electric vehicles to assist in lowering the total load of the vehicle. As a result, a growth in sales of electric vehicles is predicted to raise consumer demand throughout the projected timeframe.

The breakout of COVID-19 in various nations has caused an international economic downturn and has harmed all businesses, particularly the car industry. Because the Alloys for Automotive Market are reliant on automobiles, interruptions in the automobile sector have directly impacted the business. Society of Indian Automobile Manufacturers reported that passenger vehicle turnover fell by 2.24% in a month. China, another key supplier, also felt the effects of COVID-19 as it sold a mean of 1.3 million new passenger cars, a 23% in a month decrease from the first half of 2019.

These patterns impact the regional business outlook, which is directly related to automobile sales in the region. On the other hand, market leaders concentrate on responding to the order inventory to maintain a constant stream of income. As a result, post-pandemic relaxation of restrictions and resumption of all manufacturing operations will improve market demand shortly.

For instance, the US Department of Energy stated that a 10% decrease in car weight might result in a 6%-8% increase in energy efficiency. By substituting steel and cast-iron elements using lightweight alloys that include magnesium-based aluminum-based alloys, strong steel, and carbon fiber, an automobile bodywork's overall weight, and size can be reduced by 50%. This immediately decreases the fuel consumption of the car. For example, the use of lightweight parts and high-efficiency motors in a quarter of the US fleet could conserve over five billion gallons of gasoline yearly by 2030, according to the US Department of Energy.

Thus, the need for Alloys for Automotive is expected to increase throughout the projection period due to the rising lightweight automobile industry. Thus, driving the Alloys for Automotive market revenue.

The ongoing evolution in automotive design and manufacturing suggests a growing reliance on advanced alloys to enhance vehicle performance and sustainability.

U.S. Department of Energy

Alloys for Automotive Market Market Drivers

Market Growth Projections

The Global Alloys for Automotive Market Industry is projected to experience substantial growth, with estimates indicating a value of 116.8 USD Billion in 2024 and a remarkable increase to 236.4 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 6.62% from 2025 to 2035, reflecting the industry's response to evolving automotive trends and consumer demands. Factors such as the increasing adoption of lightweight materials, advancements in alloy production technologies, and the rising popularity of electric vehicles are likely to contribute to this positive outlook.

Rising Electric Vehicle Adoption

The surge in electric vehicle (EV) adoption is significantly impacting the Global Alloys for Automotive Market Industry. EVs require specific alloys that can withstand higher temperatures and provide better conductivity, leading to increased demand for specialized materials. As governments worldwide implement policies to promote electric mobility, the automotive sector is responding by investing in research and development of new alloys tailored for EV applications. This trend is likely to drive the market's compound annual growth rate (CAGR) of 6.62% from 2025 to 2035, reflecting the industry's adaptation to evolving consumer preferences and regulatory frameworks.

Global Infrastructure Development

Infrastructure development across various regions is a critical driver for the Global Alloys for Automotive Market Industry. As countries invest in transportation networks and urban development, the demand for vehicles, particularly commercial ones, is expected to rise. This increase in vehicle production necessitates the use of high-quality alloys that can withstand the rigors of daily use. Consequently, the market is poised for growth as manufacturers seek to enhance vehicle performance and safety through the use of advanced alloys. The anticipated growth in infrastructure projects globally suggests a robust future for the automotive alloys sector.

Environmental Regulations and Standards

The Global Alloys for Automotive Market Industry is increasingly influenced by stringent environmental regulations aimed at reducing carbon emissions and promoting sustainability. Governments are implementing standards that require automotive manufacturers to utilize materials that contribute to lower emissions throughout a vehicle's lifecycle. This regulatory landscape is pushing manufacturers to explore and adopt innovative alloys that not only comply with these standards but also enhance vehicle performance. As a result, the market is likely to see a shift towards more sustainable alloy options, further driving growth in the coming years.

Increasing Demand for Lightweight Materials

The Global Alloys for Automotive Market Industry is experiencing a notable shift towards lightweight materials, driven by the automotive sector's need for enhanced fuel efficiency and reduced emissions. As regulations become stricter, manufacturers are increasingly adopting aluminum and magnesium alloys, which provide strength without significantly increasing weight. This trend is projected to contribute to the market's growth, with the industry valued at 116.8 USD Billion in 2024. The push for lighter vehicles aligns with global sustainability goals, suggesting that the demand for lightweight alloys will continue to rise in the coming years.

Technological Advancements in Alloy Production

Innovations in alloy production techniques are shaping the Global Alloys for Automotive Market Industry. Advanced manufacturing processes, such as additive manufacturing and precision casting, enable the creation of high-performance alloys that meet the stringent requirements of modern vehicles. These advancements not only improve the mechanical properties of alloys but also enhance their corrosion resistance and durability. As a result, automotive manufacturers are increasingly integrating these advanced alloys into their designs, which could lead to a market growth trajectory that sees the industry reach 236.4 USD Billion by 2035.

Market Segment Insights

Alloys for Automotive Type Insights

The Alloys for Automotive Market segmentation, based on type, includes Iron, Titanium, Steel, Copper, and Other. Titanium segment dominated the market, accounting for 46% of the market share (USD 46.4 billion) in 2022. The Others category, which includes aluminum alloy, is anticipated to grow significantly during the project timeframe due to its lightweight and durable properties.

Alloys for Automotive Application Insights

Based on Application, the Alloys for Automotive Market segmentation include Chassis, Powertrain, Interior, and Exterior. The powertrain category generated the highest market revenue of about 40% (USD 40.4 billion) in 2022. It is due to the requirement for lightweight components that will not hamper the strength and durability of components essential in automobiles and will boost the markets.

Alloys for Automotive Vehicle Insights

The Alloys for Automotive Market segmentation, based on vehicles, includes passenger and commercial vehicles. Passenger vehicle segment dominated the market, accounting for 55% of market revenue (USD 55.5 Billion) in 2022. The commercial vehicle category is expected to increase its market share during the projected timeframe.

Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review

Get more detailed insights about Alloys for Automotive Market Research Report – Global Forecast to 2032

Regional Insights

By region, the research provides market insights into North America, Europe, Asia-Pacific, and the Rest of the World. The North American Alloys for Automotive market is anticipated to grow significantly quickly during the projected timeframe due to increased demand for fuel-efficient and sustainable automobiles. In addition, the growing consumption of automobiles and the well-established automobile industry will boost market growth in the North American area.

Further, the major countries studied in the market report are the US, Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: Alloys for Automotive Market Share by Region 2022 (USD Billion)

Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review

Europe region’s Alloys for the Automotive market account for the second-largest market revenue due to the well-established hub for the luxury automobile market and spreading awareness among consumers regarding sustainable vehicles. Further, German Alloys for the Automotive market hold the highest market share, and UK Alloys for the Automotive market are expected to grow steadily in the European region.

The Asia-Pacific Alloys for Automotive Marketdominate the market due to rapid urbanization and subsequent increase in the manufacturing sector to produce automobiles that will boost the market growth. Moreover, China’s Alloys for the Automotive market dominate the market share, and Indian Alloys for the Automotive market are expected to grow rapidly during the projected timeframe in the Asia-Pacific region.

Key Players and Competitive Insights

Leading market players invested heavily in research and development (R&D) to increase their production capacity and develop innovative products, which will help the Alloys for the Automotive market expand and grow further. Market participants are also undertaking organic and inorganic approaches to expand and strengthen their global footprint, with important market developments including new product lines, contractual deals, raining funds and investments, mergers and acquisitions, capital expenditure, and strategic alliances with other organizations. The Alloys for the Automotive industry must offer cost-effective and innovative solutions to survive in a highly fragmented and competitive market.

Manufacturing locally to increase production capacity and minimize operational expenses is one of the key business strategies organizations use in the global Alloys for the Automotive industry to offer lucrative benefits to their clients and capture the untapped market share. The Alloys for the Automotive industry have offered significant advantages and technological advancements in the Automotive sector.

Major players in the Alloys for Automotive market, including ArcelorMittal SA (Luxembourg), Aditya Birla Group (India), Alcoa Inc. (U.S.), UACJ Corporation (Japan), ThyssenKrupp AG (Germany), Kobe Steel, Ltd. (Japan), Norsk Hydro ASA (Norway), AMG Advanced Metallurgical Group NV (Netherlands), and Constellium (Netherlands), and AGCO Corporation (U.S), are attempting to capture market share by investing in research and development (R&D) operations to offer innovative solutions.

Alcoa is one of the largest bauxite miners globally, with first-quartile costs and high-quality reserves. Charles Martin Hall founded the Pittsburgh-based business on July 9, 1886. It functions in the following areas: Aluminum, alumina, and bauxite. It is a leading manufacturer of fabricated aluminum, primary aluminum, and alumina as a whole because of its growing and active involvement in major industry sectors: innovation, mining, refining, purifying, manufacturing, and reusing.

In July 2022, Alcoa Corporation announced that out of its three operational smelting lines, one of its facilities, Warrick Operations plants in Indiana, will be shut down shortly due to operational difficulties.

Wheel Pros is a recognized aftermarket wheel developer, marketer, and supplier. The firm also distributes superior tires and components. Jody Groce, the Company's founder, established the business in 1995. Presently the Company sells confidential, established brands recognized throughout all key vehicle segments via a network of 30 nationwide and three foreign distribution centers. In November 2020, Wheel Pros announced in November 2020 that it had bought the assets of Performance Replicas, Inc., an established supplier of replica wheels. Performance Replicas is a renowned brand in the original equipment imitation wheel industry, having long-standing ties with well-known national and online merchants.

Key Companies in the Alloys for Automotive Market market include

Industry Developments

August 2022: Maxion wheels entered the steel and aluminum industry's drive to achieve carbon-free automobiles.

July 2022: Alcoa Corporation has announced out of its three operational smelting lines, one of its facilities, Warrick Operations plants in Indiana, is going to be shut down shortly due to operational difficulties.

November 2020: Wheel Pros announced in November 2020 that it had bought the assets of Performance Replicas, Inc., an established supplier of replica wheels. Performance Replicas is a renowned brand in the original equipment imitation wheel industry, having long-standing ties with well-known national and online merchants.

Future Outlook

Alloys for Automotive Market Future Outlook

The Global Alloys for Automotive Market is projected to grow at a 6.61% CAGR from 2025 to 2035, driven by advancements in lightweight materials, sustainability initiatives, and increasing electric vehicle production.

New opportunities lie in:

- Develop high-performance aluminum alloys for electric vehicle applications.

- Invest in recycling technologies to enhance sustainability of automotive alloys.

- Create innovative alloy compositions to improve fuel efficiency and reduce emissions.

By 2035, the market is expected to be robust, driven by innovation and sustainability in automotive alloys.

Market Segmentation

Alloys for Automotive Type Outlook

- Iron

- Titanium

- Steel

- Copper

- Other

Alloys for Automotive Regional Outlook

- US

- Canada

Alloys for Automotive Vehicles Outlook

- Passenger Vehicle

- Commercial Vehicles

Alloys for Automotive Application Outlook

- Chassis

- Powertrain

- Interior

- Exterior

Report Scope

| Attribute/Metric | Details |

| Market Size 2024 | USD 116.81 Billion |

| Market Size 2035 | 236.24 (Value (USD Billion)) |

| Compound Annual Growth Rate (CAGR) | 6.61% (2025 - 2035) |

| Base Year | 2024 |

| Market Forecast Period | 2025 - 2035 |

| Historical Data | 2018- 2022 |

| Market Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Type, Application, Vehicle, and Region |

| Geographies Covered | North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered | The US, Canada, German, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled | ArcelorMittal SA (Luxembourg), Aditya Birla Group (India), Alcoa Inc. (U.S.), UACJ Corporation (Japan), ThyssenKrupp AG (Germany), Kobe Steel, Ltd. (Japan), Norsk Hydro ASA (Norway), AMG Advanced Metallurgical Group NV (Netherlands), and Constellium (Netherlands), and AGCO Corporation (U.S) |

| Key Market Opportunities | Weight Reduction Pure Metals have the quality of being corrosion resistance |

| Key Market Dynamics | Energy-efficient Automobiles, Reduced weight, and outstanding performance |

| Market Size 2025 | 124.53 (Value (USD Billion)) |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

How much are the Alloys for the Automotive market?

The Alloys for Automotive Market size was valued at USD 108.56 Billion in 2023.

What is the growth rate of the Alloys for the Automotive market?

The global Alloys for the Automotive market is projected to grow and expand at a CAGR of 6.61% during the forecast period, 2024-2032.

Which region held the largest Alloys for the Automotive market share?

Asia-Pacific region holds the global Alloys for the Automotive market the largest share.

Who are the key players in the Alloys for the Automotive market?

The key players in the Alloys for the Automotive market are ArcelorMittal SA (Luxembourg), Aditya Birla Group (India), Alcoa Inc. (U.S.), UACJ Corporation (Japan), ThyssenKrupp AG (Germany), Kobe Steel, Ltd. (Japan), Norsk Hydro ASA (Norway), AMG Advanced Metallurgical Group NV (Netherlands), and Constellium (Netherlands), and AGCO Corporation (U.S).

Which type led the Alloys for the Automotive market?

The Titanium category dominated the market in 2022.

Which Application holds the largest market share in the Alloys for Automotive market?

Powertrain holds the largest share of the global market.

-

Table of Contents

-

REPORT PROLOGUE

-

INTRODUCTION

-

DEFINITION

-

Scope of the Study

-

RESEARCH OBJECTIVE

-

ASSUMPTIONS

-

LIMITATIONS

-

MARKET STRUCTURE

-

Market Segmentation

-

Research Methodology

-

RESEARCH PROCESS

-

PRIMARY RESEARCH

-

SECONDARY RESEARCH

-

MARKET SIZE ESTIMATION

-

FORECAST MODEL

-

MARKET DYNAMICS

-

DRIVERS & OPPURTUNITIES

-

CHALLENGES & RESTRAINTS

-

VALUE CHAIN ANALYSIS

-

PORTER’S FIVE FORCES ANALYSIS

-

ALLOYS FOR AUTOMOTIVE MARKET, BY TYPE

-

IRON

-

STEEL

-

COPPER

-

TITANIUM

-

OTHER

-

ALLOYS FOR AUTOMOTIVE MARKET, BY APPLICATION

-

CHASSIS

-

POWERTRAIN

-

INTERIOR

-

EXTERIOR

-

ALLOYS FOR AUTOMOTIVE MARKET, BY VEHICLES

-

PASSENGER VEHICLES

-

COMMERCIAL VEHICLES

-

ALLOYS FOR AUTOMOTIVE MARKET, BY REGION

-

NORTH AMERICA

-

U.S.

-

CANADA

-

MEXICO

-

EUROPE

-

U.K.

-

GERMANY

-

FRANCE

-

ITALY

-

REST OF EUROPE

-

ASIA–PACIFIC

-

CHINA

-

INDIA

-

JAPAN

-

REST OF ASIA

-

SOUTH AMERICA

-

BRAZIL

-

ARGENTINA

-

REST OF SOUTH AMERICA

-

MIDDLE EAST & AFRICA

-

SAUDI ARABIA

-

UAE

-

QATAR

-

SOUTH AFRICA

-

REST OF MIDDLE EAST & AFRICA

-

COMPANY LANDSCAPE

-

COMPETITIVE STRATEGY ANALYSIS

-

PARTNERSHIPS AND COLLABORATIONS

-

MERGERS & ACQUISITIONS

-

BUSINESS EXPANSION

-

LAUNCH/DEVELOPMENT

-

COMPANY PROFILE

-

ARCELORMITTAL SA (LUXEMBOURG)

-

COMPANY OVERVIEW

-

BUSINESS SEGMENT OVERVIEW

-

FINANCIAL UPDATES

-

KEY DEVELOPMENTS

-

ADITYA BIRLA GROUP (INDIA)

-

BUSINESS SEGMENT OVERVIEW

-

KEY DEVELOPMENTS

-

ALCOA INC. (U.S.)

-

UACJ CORPORATION (JAPAN)

-

THYSSENKRUPP AG (GERMANY)

-

BUSINESS SEGMENT OVERVIEW

-

KOBE STEEL, LTD. (JAPAN)

-

NORSK HYDRO ASA (NORWAY)

-

AMG ADVANCED METALLURGICAL GROUP NV (NETHERLANDS)

-

CONSTELLIUM (NETHERLANDS)

-

AGCO CORPORATION (U.S)

-

MRFR CONCLUSION

-

APPENDIX

-

List of Tables and Figures

- LIST OF TABLES

- TABLE 1 GLOBAL ALLOYS FOR AUTOMOTIVE MARKET SNAPSHOT

- TABLE 2 DRIVERS FOR THE MARKET

- TABLE 3 RESTRAINTS FOR THE MARKET

- TABLE 4 ALLOYS FOR AUTOMOTIVE MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 5 IRON: ALLOYS FOR AUTOMOTIVE MARKET, BY REGION, 2023-2032 (USD MILLION)

- TABLE 6 MAGNESIUM: ALLOYS FOR AUTOMOTIVE MARKET, BY REGION, 2023-2032 (USD MILLION)

- TABLE 7 STEEL: ALLOYS FOR AUTOMOTIVE MARKET, BY REGION, 2023-2032 (USD MILLION)

- TABLE 8 COPPER: ALLOYS FOR AUTOMOTIVE MARKET, BY REGION, 2023-2032 (USD MILLION)

- TABLE 9 ALUMINIUM: ALLOYS FOR AUTOMOTIVE MARKET, BY REGION, 2023-2032 (USD MILLION)

- TABLE 10 NICKEL: ALLOYS FOR AUTOMOTIVE MARKET, BY REGION, 2023-2032 (USD MILLION)

- TABLE 11 TITANIUM: ALLOYS FOR AUTOMOTIVE MARKET, BY REGION, 2023-2032 (USD MILLION)

- TABLE 12 ALLOYS FOR AUTOMOTIVE MARKET, BY APPLICATION, 2023-2032 (USD MILLION)

- TABLE 13 CHASSIS: ALLOYS FOR AUTOMOTIVE MARKET, BY REGION, 2023-2032 (USD MILLION)

- TABLE 14 POWERTRAIN: ALLOYS FOR AUTOMOTIVE MARKET, BY REGION, 2023-2032 (USD MILLION)

- TABLE 15 INTERIOR: ALLOYS FOR AUTOMOTIVE MARKET, BY REGION, 2023-2032 (USD MILLION)

- TABLE 16 EXTERIOR: ALLOYS FOR AUTOMOTIVE MARKET, BY REGION, 2023-2032 (USD MILLION)

- TABLE 17 ALLOYS FOR AUTOMOTIVE MARKET, BY VEHICLES, 2023-2032 (USD MILLION)

- TABLE 18 PASSENGER CARS: ALLOYS FOR AUTOMOTIVE MARKET, BY REGION, 2023-2032 (USD MILLION)

- TABLE 19 LIGHT COMMERCIAL VEHICLES: ALLOYS FOR AUTOMOTIVE MARKET, BY REGION, 2023-2032 (USD MILLION)

- TABLE 20 HEAVY TRUCKS: ALLOYS FOR AUTOMOTIVE MARKET, BY REGION, 2023-2032 (USD MILLION)

- TABLE 21 BUSES AND COACHES: ALLOYS FOR AUTOMOTIVE MARKET, BY REGION, 2023-2032 (USD MILLION)

- TABLE 22 ALLOYS FOR AUTOMOTIVE MARKET, BY REGION, 2023-2032 (USD MILLION)

- TABLE 23 NORTH AMERICA: ALLOYS FOR AUTOMOTIVE MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 24 U.S.: ALLOYS FOR AUTOMOTIVE MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 25 U.S.: ALLOYS FOR AUTOMOTIVE MARKET, BY APPLICATION, 2023-2032 (USD MILLION)

- TABLE 26 U.S.: ALLOYS FOR AUTOMOTIVE MARKET, BY VEHICLES, 2023-2032 (USD MILLION)

- TABLE 27 CANADA: ALLOYS FOR AUTOMOTIVE MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 28 CANADA: ALLOYS FOR AUTOMOTIVE MARKET, BY APPLICATION, 2023-2032 (USD MILLION) TABLE29 CANADA: ALLOYS FOR AUTOMOTIVE MARKET, BY VEHICLES, 2023-2032 (USD MILLION)

- TABLE 30 MEXICO: ALLOYS FOR AUTOMOTIVE MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 31 MEXICO: ALLOYS FOR AUTOMOTIVE MARKET, BY APPLICATION, 2023-2032 (USD MILLION)

- TABLE 32 MEXICO: ALLOYS FOR AUTOMOTIVE MARKET, BY VEHICLES, 2023-2032 (USD MILLION)

- TABLE 33 EUROPE: ALLOYS FOR AUTOMOTIVE MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 34 U.K.: ALLOYS FOR AUTOMOTIVE MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 35 U.K.: ALLOYS FOR AUTOMOTIVE MARKET, BY APPLICATION, 2023-2032 (USD MILLION)

- TABLE 36 U.K.: ALLOYS FOR AUTOMOTIVE MARKET, BY VEHICLES, 2023-2032 (USD MILLION)

- TABLE 37 GERMANY: ALLOYS FOR AUTOMOTIVE MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 38 GERMANY: ALLOYS FOR AUTOMOTIVE MARKET, BY APPLICATION, 2023-2032 (USD MILLION)

- TABLE 39 GERMANY: ALLOYS FOR AUTOMOTIVE MARKET, BY VEHICLES, 2023-2032 (USD MILLION)

- TABLE 40 FRANCE: ALLOYS FOR AUTOMOTIVE MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 41 FRANCE: ALLOYS FOR AUTOMOTIVE MARKET, BY APPLICATION, 2023-2032 (USD MILLION)

- TABLE 42 FRANCE: ALLOYS FOR AUTOMOTIVE MARKET, BY VEHICLES, 2023-2032 (USD MILLION)

- TABLE 43 ITALY: ALLOYS FOR AUTOMOTIVE MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 44 ITALY: ALLOYS FOR AUTOMOTIVE MARKET, BY APPLICATION, 2023-2032 (USD MILLION)

- TABLE 45 ITALY: ALLOYS FOR AUTOMOTIVE MARKET, BY VEHICLES, 2023-2032 (USD MILLION)

- TABLE 46 REST OF EUROPE: ALLOYS FOR AUTOMOTIVE MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 47 REST OF EUROPE: ALLOYS FOR AUTOMOTIVE MARKET, BY APPLICATION, 2023-2032 (USD MILLION)

- TABLE 48 REST OF EUROPE: ALLOYS FOR AUTOMOTIVE MARKET, BY VEHICLES, 2023-2032 (USD MILLION)

- TABLE 49 ASIA PACIFIC: ALLOYS FOR AUTOMOTIVE MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 50 CHINA: ALLOYS FOR AUTOMOTIVE MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 51 CHINA: ALLOYS FOR AUTOMOTIVE MARKET, BY APPLICATION, 2023-2032 (USD MILLION)

- TABLE 52 CHINA: ALLOYS FOR AUTOMOTIVE MARKET, BY VEHICLES, 2023-2032 (USD MILLION)

- TABLE 53 INDIA: ALLOYS FOR AUTOMOTIVE MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 54 INDIA: ALLOYS FOR AUTOMOTIVE MARKET, BY APPLICATION, 2023-2032 (USD MILLION)

- TABLE 55 INDIA: ALLOYS FOR AUTOMOTIVE MARKET, BY VEHICLES, 2023-2032 (USD MILLION)

- TABLE 56 JAPAN: ALLOYS FOR AUTOMOTIVE MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 57 JAPAN: ALLOYS FOR AUTOMOTIVE MARKET, BY APPLICATION, 2023-2032 (USD MILLION)

- TABLE 58 JAPAN: ALLOYS FOR AUTOMOTIVE MARKET, BY VEHICLES, 2023-2032 (USD MILLION)

- TABLE 59 REST OF APAC: ALLOYS FOR AUTOMOTIVE MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 60 REST OF APAC: ALLOYS FOR AUTOMOTIVE MARKET, BY APPLICATION, 2023-2032 (USD MILLION)

- TABLE 61 REST OF APAC: ALLOYS FOR AUTOMOTIVE MARKET, BY VEHICLES, 2023-2032 (USD MILLION)

- TABLE 62 SOUTH AMERICA: ALLOYS FOR AUTOMOTIVE MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 63 BRAZIL: ALLOYS FOR AUTOMOTIVE MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 64 BRAZIL: ALLOYS FOR AUTOMOTIVE MARKET, BY APPLICATION, 2023-2032 (USD MILLION)

- TABLE 65 BRAZIL: ALLOYS FOR AUTOMOTIVE MARKET, BY VEHICLES, 2023-2032 (USD MILLION)

- TABLE 66 ARGENTINA: ALLOYS FOR AUTOMOTIVE MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 67 ARGENTINA: ALLOYS FOR AUTOMOTIVE MARKET, BY APPLICATION, 2023-2032 (USD MILLION)

- TABLE 68 ARGENTINA: ALLOYS FOR AUTOMOTIVE MARKET, BY VEHICLES, 2023-2032 (USD MILLION)

- TABLE 69 REST OF SOUTH AMERICA: ALLOYS FOR AUTOMOTIVE MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 70 REST OF SOUTH AMERICA: ALLOYS FOR AUTOMOTIVE MARKET, BY APPLICATION, 2023-2032 (USD MILLION)

- TABLE 71 REST OF SOUTH AMERICA: ALLOYS FOR AUTOMOTIVE MARKET, BY VEHICLES, 2023-2032 (USD MILLION)

- TABLE 72 MIDDLE EAST & AFRICA: ALLOYS FOR AUTOMOTIVE MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- TABLE 73 SAUDI ARABIA: ALLOYS FOR AUTOMOTIVE MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 74 SAUDI ARABIA: ALLOYS FOR AUTOMOTIVE MARKET, BY APPLICATION, 2023-2032 (USD MILLION)

- TABLE 75 SAUDI ARABIA: ALLOYS FOR AUTOMOTIVE MARKET, BY VEHICLES, 2023-2032 (USD MILLION)

- TABLE 76 UAE: ALLOYS FOR AUTOMOTIVE MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 77 UAE: ALLOYS FOR AUTOMOTIVE MARKET, BY APPLICATION, 2023-2032 (USD MILLION)

- TABLE 78 UAE: ALLOYS FOR AUTOMOTIVE MARKET, BY VEHICLES, 2023-2032 (USD MILLION)

- TABLE 79 QATAR: ALLOYS FOR AUTOMOTIVE MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 80 QATAR: ALLOYS FOR AUTOMOTIVE MARKET, BY APPLICATION, 2023-2032 (USD MILLION)

- TABLE 81 QATAR: ALLOYS FOR AUTOMOTIVE MARKET, BY VEHICLES, 2023-2032 (USD MILLION)

- TABLE 82 SOUTH AFRICA: ALLOYS FOR AUTOMOTIVE MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 83 SOUTH AFRICA: ALLOYS FOR AUTOMOTIVE MARKET, BY APPLICATION, 2023-2032 (USD MILLION)

- TABLE 84 SOUTH AFRICA: ALLOYS FOR AUTOMOTIVE MARKET, BY VEHICLES, 2023-2032 (USD MILLION)

- TABLE 85 REST OF MIDDLE EAST & AFRICA: ALLOYS FOR AUTOMOTIVE MARKET, BY TYPE, 2023-2032 (USD MILLION)

- TABLE 86 REST OF MIDDLE EAST & AFRICA: ALLOYS FOR AUTOMOTIVE MARKET, BY APPLICATION, 2023-2032 (USD MILLION)

- TABLE 87 REST OF MIDDLE EAST & AFRICA: ALLOYS FOR AUTOMOTIVE MARKET, BY VEHICLES, 2023-2032 (USD MILLION) LIST OF FIGURES

- FIGURE 1 Research Methodology

- FIGURE 2 IMPACT ANALYSIS: DRIVERS AND RESTRAINTS

- FIGURE 3 ALLOYS FOR AUTOMOTIVE MARKET, BY TYPE, 2023-2032 (USD MILLION)

- FIGURE 4 ALLOYS FOR AUTOMOTIVE MARKET, BY APPLICATION, 2023-2032 (USD MILLION)

- FIGURE 5 ALLOYS FOR AUTOMOTIVE MARKET, BY VEHICLES, 2023-2032 (USD MILLION)

- FIGURE 6 ALLOYS FOR AUTOMOTIVE MARKET, BY REGION, 2023-2032 (USD MILLION)

- FIGURE 7 NORTH AMERICA: ALLOYS FOR AUTOMOTIVE MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- FIGURE 8 EUROPE: ALLOYS FOR AUTOMOTIVE MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- FIGURE 9 ASIA PACIFIC: ALLOYS FOR AUTOMOTIVE MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- FIGURE 10 SOUTH AMERICA: ALLOYS FOR AUTOMOTIVE MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

- FIGURE 11 MIDDLE EAST & AFRICA: ALLOYS FOR AUTOMOTIVE MARKET, BY COUNTRY, 2023-2032 (USD MILLION)

Alloys for Automotive Market Segmentation

Alloys for Automotive Type Outlook (USD Billion, 2018-2032)

- Iron

- Titanium

- Steel

- Copper

- Other

Alloys for Automotive Application Outlook (USD Billion, 2018-2032)

- Chassis

- Powertrain

- Interior

- Exterior

Alloys for Automotive Vehicles Outlook (USD Billion, 2018-2032)

- Passenger Vehicle

- Commercial Vehicles

Alloys for Automotive Regional Outlook (USD Billion, 2018-2032)

North America Outlook (USD Billion, 2018-2032)

- North America Alloys for Automotive by Type

- Iron

- Titanium

- Steel

- Copper

- Other

- North America Alloys for Automotive by Application

- Chassis

- Powertrain

- Interior

- Exterior

- North America Alloys for Automotive by Vehicles

- Passenger Vehicle

- Commercial Vehicles

US Outlook (USD Billion, 2018-2032)

- US Alloys for Automotive by Type

- Iron

- Titanium

- Steel

- Copper

- Other

- US Alloys for Automotive by Application

- Chassis

- Powertrain

- Interior

- Exterior

- US Alloys for Automotive by Vehicles

- Passenger Vehicle

- Commercial Vehicles

Canada Outlook (USD Billion, 2018-2032)

- Canada Alloys for Automotive by Type

- Iron

- Titanium

- Steel

- Copper

- Other

- Canada Alloys for Automotive by Application

- Chassis

- Powertrain

- Interior

- Exterior

- Canada Alloys for Automotive by Vehicles

- Passenger Vehicle

- Commercial Vehicles

- North America Alloys for Automotive by Type

Europe Outlook (USD Billion, 2018-2032)

- Europe Alloys for Automotive by Type

- Iron

- Titanium

- Steel

- Copper

- Other

- Europe Alloys for Automotive by Application

- Chassis

- Powertrain

- Interior

- Exterior

- Europe Alloys for Automotive by Vehicles

- Passenger Vehicle

- Commercial Vehicles

Germany Outlook (USD Billion, 2018-2032)

- Germany Alloys for Automotive by Type

- Iron

- Titanium

- Steel

- Copper

- Other

- Germany Alloys for Automotive by Application

- Chassis

- Powertrain

- Interior

- Exterior

- Germany Alloys for Automotive by Vehicles

- Passenger Vehicle

- Commercial Vehicles

France Outlook (USD Billion, 2018-2032)

- France Alloys for Automotive by Type

- Iron

- Titanium

- Steel

- Copper

- Other

- France Alloys for Automotive by Application

- Chassis

- Powertrain

- Interior

- Exterior

- France Alloys for Automotive by Vehicles

- Passenger Vehicle

- Commercial Vehicles

UK Outlook (USD Billion, 2018-2032)

- UK Alloys for Automotive by Type

- Iron

- Titanium

- Steel

- Copper

- Other

- UK Alloys for Automotive by Application

- Chassis

- Powertrain

- Interior

- Exterior

- UK Alloys for Automotive by Vehicles

- Passenger Vehicle

- Commercial Vehicles

Italy Outlook (USD Billion, 2018-2032)

- Italy Alloys for Automotive by Type

- Iron

- Titanium

- Steel

- Copper

- Other

- Italy Alloys for Automotive by Application

- Chassis

- Powertrain

- Interior

- Exterior

- Italy Alloys for Automotive by Vehicles

- Passenger Vehicle

- Commercial Vehicles

Spain Outlook (USD Billion, 2018-2032)

- Spain Alloys for Automotive by Type

- Iron

- Titanium

- Steel

- Copper

- Other

- Spain Alloys for Automotive by Application

- Chassis

- Powertrain

- Interior

- Exterior

- Spain Alloys for Automotive by Vehicles

- Passenger Vehicle

- Commercial Vehicles

Rest Of Europe Outlook (USD Billion, 2018-2032)

- Rest Of Europe Alloys for Automotive by Type

- Iron

- Titanium

- Steel

- Copper

- Other

- Rest Of Europe Alloys for Automotive by Application

- Chassis

- Powertrain

- Interior

- Exterior

- Rest of Europe Alloys for Automotive by Vehicles

- Passenger Vehicle

- Commercial Vehicles

- Europe Alloys for Automotive by Type

Asia-Pacific Outlook (USD Billion, 2018-2032)

- Asia-Pacific Alloys for Automotive by Type

- Iron

- Titanium

- Steel

- Copper

- Other

- Asia-Pacific Alloys for Automotive by Application

- Chassis

- Powertrain

- Interior

- Exterior

- Asia-Pacific Alloys for Automotive by Vehicles

- Passenger Vehicle

- Commercial Vehicles

China Outlook (USD Billion, 2018-2032)

- China Alloys for Automotive by Type

- Iron

- Titanium

- Steel

- Copper

- Other

- China Alloys for Automotive by Application

- Chassis

- Powertrain

- Interior

- Exterior

- China Alloys for Automotive by Vehicles

- Passenger Vehicle

- Commercial Vehicles

Japan Outlook (USD Billion, 2018-2032)

- Japan Alloys for Automotive by Type

- Iron

- Titanium

- Steel

- Copper

- Other

- Japan Alloys for Automotive by Application

- Chassis

- Powertrain

- Interior

- Exterior

- Japan Alloys for Automotive by Vehicles

- Passenger Vehicle

- Commercial Vehicles

India Outlook (USD Billion, 2018-2032)

- India Alloys for Automotive by Type

- Iron

- Titanium

- Steel

- Copper

- Other

- India Alloys for Automotive by Application

- Chassis

- Powertrain

- Interior

- Exterior

- India Alloys for Automotive by Vehicles

- Passenger Vehicle

- Commercial Vehicles

Australia Outlook (USD Billion, 2018-2032)

- Australia Alloys for Automotive by Type

- Iron

- Titanium

- Steel

- Copper

- Other

- Australia Alloys for Automotive by Application

- Chassis

- Powertrain

- Interior

- Exterior

- Australia Alloys for Automotive by Vehicles

- Passenger Vehicle

- Commercial Vehicles

Rest of Asia-Pacific Outlook (USD Billion, 2018-2032)

- Rest of Asia-Pacific Alloys for Automotive by Type

- Iron

- Titanium

- Steel

- Copper

- Other

- Rest of Asia-Pacific Alloys for Automotive by Application

- Chassis

- Powertrain

- Interior

- Exterior

- Rest of Asia-Pacific Alloys for Automotive by Vehicles

- Passenger Vehicle

- Commercial Vehicles

- Asia-Pacific Alloys for Automotive by Type

Rest of the World Outlook (USD Billion, 2018-2032)

- Rest of the World Alloys for Automotive by Type

- Iron

- Titanium

- Steel

- Copper

- Other

- Rest of the World Alloys for Automotive by Application

- Chassis

- Powertrain

- Interior

- Exterior

- Rest of the World Alloys for Automotive by Vehicles

- Passenger Vehicle

- Commercial Vehicles

Middle East Outlook (USD Billion, 2018-2032)

- Middle East Alloys for Automotive by Type

- Iron

- Titanium

- Steel

- Copper

- Other

- Middle East Alloys for Automotive by Application

- Chassis

- Powertrain

- Interior

- Exterior

- Middle East Alloys for Automotive by Vehicles

- Passenger Vehicle

- Commercial Vehicles

Africa Outlook (USD Billion, 2018-2032)

- Africa Alloys for Automotive by Type

- Iron

- Titanium

- Steel

- Copper

- Other

- Africa Alloys for Automotive by Application

- Chassis

- Powertrain

- Interior

- Exterior

- Africa Alloys for Automotive by Vehicles

- Passenger Vehicle

- Commercial Vehicles

Latin America Outlook (USD Billion, 2018-2032)

- Latin America Alloys for Automotive by Type

- Iron

- Titanium

- Steel

- Copper

- Other

- Latin America Alloys for Automotive by Application

- Chassis

- Powertrain

- Interior

- Exterior

- Latin America Alloys for Automotive by Vehicles

- Passenger Vehicle

- Commercial Vehicles

- Rest of the World Alloys for Automotive by Type

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment