Alcoholic Beverages Market Trends

Alcoholic Beverages Market Research Report By Product Type (Beer, Wine, Spirits, Cider, Ready-to-Drink), By Distribution Channel (Supermarkets, Convenience Stores, Online Retail, Liquor Stores), By Alcoholic Strength (Low Alcohol, Medium Alcohol, High Alcohol), By Consumer Demographics (Millennials, Generation X, Baby Boomers, Gen Z) and By Regional (North America, Europe, South America, Asia P...

Market Summary

As per Market Research Future Analysis, the Global Alcoholic Beverages Market was valued at 2319.87 USD Billion in 2024 and is projected to grow to 3002.33 USD Billion by 2035, reflecting a CAGR of 2.37% from 2025 to 2035. The market is driven by rising consumption among young adults, the expansion of e-commerce, and a shift towards health-conscious alternatives. Key players are adapting to these trends by innovating product offerings and enhancing distribution strategies.

Key Market Trends & Highlights

Key trends shaping the Alcoholic Beverages Market include:

- Rising consumption among young adults (18-34 years) has increased by 17% globally over the past five years.

- E-commerce sales of alcoholic beverages surged by 25% during the COVID-19 pandemic.

- The market for low-alcohol and non-alcoholic beverages is growing at approximately 10% annually.

- Beer remains the dominant segment, valued at 800.0 USD Billion in 2024, expected to reach 3002.33 USD Billion by 2035.

Market Size & Forecast

| 2024 Market Size | USD 2319.87 Billion |

| 2035 Market Size | USD 3002.33 Billion |

| CAGR (2025-2035) | 2.37% |

| Largest Regional Market Share in 2024 | Europe. |

Major Players

Anheuser-Busch InBev, E. and J. Gallo Winery, Molson Coors Beverage Company, SABMiller, Pernod Ricard, Carlsberg Group, Asahi Group Holdings, Campari Group, Davide Campari-Milano, Brown-Forman, Diageo, Constellation Brands, Heineken, Treasury Wine Estates.

Market Trends

There are a number of major trends in the Alcoholic Beverages Market that are affecting its growth. One big trend is that artisan and high-end alcoholic drinks are becoming more and more popular. People are drawn to unusual tastes and artisanal manufacturing processes, which is why there are more small-scale brewers and distilleries. People want realness and quality, which is what is driving this change. This gives companies a chance to stand out in a congested market. Also, customers' focus on health is affecting the products that are available.

People are looking for ways to balance their lives and drinking habits. Thus, there is a rising demand for low-alcohol or alcohol-free options.

This development pushes businesses to produce new drinks that meet this shifting need from customers. The notion of sustainability is also becoming more popular in the worldwide market. People are becoming more conscious of environmental concerns and choose businesses that concentrate on eco-friendly sourcing and packaging. This has led producers to look into eco-friendly materials and methods, which gives market participants a chance to improve their brand image and attract customers who care about the environment. The market is also going through a big technical change as e-commerce and direct-to-consumer sales channels become more popular.

People are increasingly likely to buy alcohol online, which means that businesses need to produce new ways to sell themselves and have a strong online presence. The Alcoholic Beverages Market is changing quickly because of new technologies, changing consumer behaviours, and new ways of living. Companies that keep an eye on these changes and pay attention to what customers want will find a lot of chances to expand in this ever-changing industry.

The Global Alcoholic Beverages Market appears to be experiencing a notable shift towards premiumization, as consumers increasingly seek higher-quality products that offer unique flavors and experiences.

U.S. Department of Agriculture

Alcoholic Beverages Market Market Drivers

Rising Consumer Demand

The Global Alcoholic Beverages Market Industry experiences a notable increase in consumer demand, driven by changing lifestyles and preferences. As of 2024, the market is valued at approximately 1710.3 USD Billion, reflecting a growing inclination towards premium and craft alcoholic beverages. This trend is particularly evident among millennials and Gen Z consumers, who seek unique flavors and experiences. The rise of social media platforms further amplifies this demand, as consumers share their experiences and recommendations. Consequently, brands are adapting their offerings to cater to these evolving preferences, indicating a dynamic shift in the market landscape.

Market Growth Projections

The Global Alcoholic Beverages Market Industry is poised for substantial growth, with projections indicating a market value of 2200 USD Billion by 2035. This growth trajectory is supported by a compound annual growth rate (CAGR) of 2.32% from 2025 to 2035. Various factors contribute to this optimistic outlook, including rising disposable incomes, evolving consumer preferences, and the expansion of distribution channels. As the market continues to evolve, stakeholders are likely to adapt their strategies to capitalize on emerging trends and consumer demands, ensuring sustained growth in this dynamic industry.

Expansion of E-commerce Channels

The Global Alcoholic Beverages Market Industry is witnessing a significant transformation with the expansion of e-commerce channels. Online sales of alcoholic beverages have surged, providing consumers with convenient access to a wide range of products. This trend is particularly pronounced in urban areas, where busy lifestyles limit traditional shopping methods. E-commerce platforms enable consumers to explore diverse brands and products, often at competitive prices. As a result, the market is projected to grow, with estimates suggesting a value of 2200 USD Billion by 2035. This shift towards online purchasing is likely to reshape distribution strategies within the industry.

Innovations in Product Development

The Global Alcoholic Beverages Market Industry is characterized by continuous innovations in product development. Companies are investing in research and development to create unique flavors, packaging, and experiences that resonate with consumers. This includes the introduction of flavored spirits, ready-to-drink cocktails, and sustainable packaging solutions. Such innovations not only attract new consumers but also encourage brand loyalty among existing customers. As the market evolves, these developments are likely to play a crucial role in maintaining competitiveness and driving growth. The emphasis on innovation aligns with the projected market value of 2200 USD Billion by 2035.

Cultural Influences and Globalization

The Global Alcoholic Beverages Market Industry is significantly influenced by cultural factors and globalization. As cultures intermingle, there is an increased appreciation for diverse alcoholic beverages from various regions. This cultural exchange fosters a demand for international brands and products, allowing consumers to explore flavors from around the world. Additionally, global travel and tourism contribute to this trend, as travelers seek to experience local beverages. This cultural integration not only enhances consumer knowledge but also drives market growth, as brands leverage these influences to expand their offerings and reach new audiences.

Health Consciousness and Low-Alcohol Options

The Global Alcoholic Beverages Market Industry is adapting to a growing trend of health consciousness among consumers. As individuals become more aware of their health and wellness, there is an increasing demand for low-alcohol and non-alcoholic alternatives. This shift is reflected in the introduction of innovative products that cater to health-oriented consumers, such as low-calorie beers and alcohol-free spirits. Brands are responding by diversifying their portfolios to include these options, which not only appeal to health-conscious individuals but also attract a broader audience. This trend may contribute to sustained growth in the market, particularly as the CAGR is projected at 2.32% for 2025-2035.

Market Segment Insights

Alcoholic Beverages Market Product Type Insights

The Alcoholic Beverages Market showcases a diverse segmentation under the Product Type category, reflecting varied consumer preferences and trends across the globe. In 2024, the market is valued at 1710.3 USD Billion, with Beer, Wine, Spirits, Cider, and Ready-to-Drink all contributing to this impressive figure. Beer holds a significant share, valued at 600.5 USD Billion, and is anticipated to reach 780.0 USD Billion by 2035.

Its popularity can be attributed to the craft beer movement and a growing interest in unique flavors and brewing techniques, coupled with the increasing consumption of beer during social gatherings.Wine, as another crucial segment, is projected to grow from 240.3 USD Billion in 2024 to 310.0 USD Billion in 2035, driven by rising disposable incomes and the expansion of wine tourism, which enhances consumer experience with wine selections.

Spirits, which embody a classic allure and often serve as the base for cocktails, are expected to grow from 500.0 USD Billion in 2024 to 620.0 USD Billion by 2035, showing an ever-increasing interest in premium products and artisanal distilleries providing unique offerings.

The Cider segment, while smaller at a valuation of 120.0 USD Billion in 2024, is estimated to increase to 150.0 USD Billion by 2035, capturing the attention of those seeking gluten-free alternatives and appealing flavors, indicating a distinct shift in consumer dietary preferences.Lastly, the Ready-to-Drink category, valued at 249.5 USD Billion in 2024, is expected to rise to 340.0 USD Billion, capitalizing on the trend of convenience in beverage consumption among younger demographics and busy lifestyles. This product type supports a wide array of flavors and combinations, positioning itself as a flexible choice for consumers.

The various segments within the Alcoholic Beverages Market portray distinct characteristics and growth dynamics, significantly influencing the market's overall trajectory and expansion through evolving trends driven by consumer tastes and preferences, thereby shaping the market’s structure and developments from 2024 to 2035.

Alcoholic Beverages Market Distribution Channel Insights

The Distribution Channel segment of the Alcoholic Beverages Market plays a crucial role in driving market accessibility and consumer purchasing habits. The overall market is expected to be valued at 1710.3 USD Billion in 2024, reflecting significant growth in various channels. Among different distribution channels, supermarkets and convenience stores continue to dominate due to their widespread presence and convenience, targeting both bulk buyers and casual consumers effectively.

The rise of online retail has transformed the landscape, offering consumers the flexibility to purchase alcoholic beverages from home, thus catering to changing shopping preferences.Liquor stores remain a significant channel, providing specialized products and expertise. As e-commerce continues to expand, it presents new opportunities for market entrants and established brands to enhance their reach. Additionally, trends such as premiumization and the demand for craft beverages are reshaping sales dynamics across all channels, influencing inventory and merchandising strategies. Understanding the Alcoholic Beverages Market segmentation is vital for stakeholders aiming to navigate this evolving industry landscape successfully.

Alcoholic Beverages Market Alcoholic Strength Insights

The Alcoholic Beverages Market has shown a remarkable growth trajectory, with an expected valuation of 1710.3 USD Billion in 2024, projecting an increase to 2200.0 USD Billion by 2035. The Alcoholic Strength segment is a crucial aspect of this market, categorized into Low Alcohol, Medium Alcohol, and High Alcohol. Each of these categories plays a significant role in shaping consumer preferences and trends in the industry. Low Alcohol beverages, with their rising popularity driven by health-conscious consumers, reflect a substantial market share.Medium Alcohol drinks cater to a broad demographic by offering both flavor and moderate potency, attracting a diverse audience.

High Alcohol products typically dominate in premium segments, appealing to consumers seeking richer and more robust experiences. The trends towards craft and artisanal products particularly enhance the visibility of high alcohol beverages. As craft breweries and distilleries rise, the market growth is facilitated by evolving consumer tastes and lifestyle changes. The Alcoholic Beverages Market revenue continues to benefit from these dynamic segments, responding to consumer demand while also facing challenges such as regulatory compliance and health awareness.As these segments evolve, they represent both challenges and opportunities within the ever-expanding Alcoholic Beverages Market.

Alcoholic Beverages Market Consumer Demographics Insights

The Alcoholic Beverages Market has shown varied preferences among different Consumer Demographics, shaping its overall growth and segmentation. By 2024, the market is expected to reach a valuation of 1710.3 USD Billion, reflecting the dynamic trends influenced by various age groups. Millennials have emerged as significant consumers, often favoring craft beers and innovative cocktails, thereby driving market trends towards more diverse offerings. Generation X, on the other hand, values quality and brand heritage, contributing to stable revenue streams for premium products.Baby Boomers maintain a strong inclination towards traditional drinks, presenting both challenges and opportunities for tailored marketing.

Meanwhile, Gen Z is increasingly influencing the market with their preference for low-alcohol, healthier options, showcasing a shift towards wellness-oriented beverages. This generational diversity within the Alcoholic Beverages Market emphasizes the necessity for adaptive strategies that cater to distinct consumer preferences, ultimately shaping the trajectory of market growth. With each demographic playing a vital role in the Alcoholic Beverages Market data, understanding these segments is essential for leveraging growth opportunities and addressing the evolving demands of consumers.

Get more detailed insights about Alcoholic Beverages Market Research Report - Forecast to 2035

Regional Insights

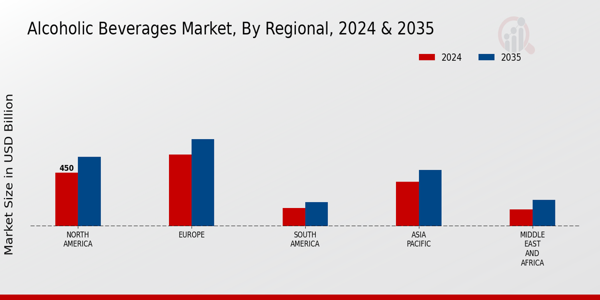

The Alcoholic Beverages Market is gaining a robust presence across various regions, with a valuation of 1710.3 USD Billion in 2024 and a projected growth trajectory to 2200.0 USD Billion by 2035. North America emerges as a significant player, holding a market value of 450.0 USD Billion in 2024, attributed to a strong cultural affinity for alcoholic beverages and evolving consumer preferences.

Europe leads the market with a substantial valuation of 600.0 USD Billion in 2024, showcasing a diverse range of alcoholic products and a long-standing tradition in wine and spirits consumption.Asia Pacific, valued at 370.3 USD Billion in 2024, is witnessing an increasing demand driven by a young population and changing lifestyle trends, highlighting its importance as an emerging market. South America, while valued at 150.0 USD Billion in 2024, plays a vital role due to its rich culture of drink production, particularly in rum and wine.

The Middle East and Africa, with a market value of 140.0 USD Billion in 2024, face unique challenges due to regulatory constraints but show potential for growth as consumer attitudes evolve. Each region contributes uniquely to the overall dynamics of the Alcoholic Beverages Market revenue, indicating varying preferences, regulations, and cultural influences that drive market growth across the globe.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Key Players and Competitive Insights

The Alcoholic Beverages Market is a diverse and dynamic industry characterized by constant innovation, changing consumer preferences, and varying regulations across regions. A multitude of segments, including beer, wine, and spirits, compete for market share while catering to an increasingly health-conscious consumer base that demands premium, organic, and lower-alcohol options. The landscape is shaped by established players and new entrants, each vying for a foothold in this lucrative market. With globalization, brands now have the potential to expand beyond their traditional borders, leading to intense competition as well as collaboration through mergers and acquisitions.

The competitive insights in this sector reveal not only the financial performance indicators but also brand loyalty, distribution channels, and marketing strategies employed by these companies to maintain and grow their market presence.Pernod Ricard stands as a formidable player in the Alcoholic Beverages Market, known for its extensive portfolio that includes a range of high-quality spirits and wines. With a strong presence in various markets around the globe, Pernod Ricard benefits from its strategic brand acquisitions and the establishment of local partnerships that enhance its distribution effectiveness.

Their strength lies in their ability to leverage the brands under their umbrella, optimizing their marketing strategies to appeal to diverse consumer demographics. The company's commitment to sustainability and innovation further solidifies its position, allowing it to adapt to emerging trends and consumer preferences rapidly. This flexibility and well-rounded approach have been pivotal in maintaining a competitive edge in a saturated market.Constellation Brands represents another key player within the Alcoholic Beverages Market, especially recognized for its dominance in the beer segment.

The company has successfully carved out a niche for itself with a focus on high-quality brands that resonate across global markets. Constellation Brands has made significant investments in key products and services, including the expansion of its craft beer offerings and a diverse wine portfolio. Their notable strength lies in their robust supply chain and distribution networks that facilitate global reach and penetration into key markets. Additionally, the company's mergers and acquisitions have enabled it to diversify its product offerings while capitalizing on growing consumer trends.

Constellation Brands’ commitment to the quality and innovation of its beverages positions it favorably within the competitive landscape, further enhancing its market presence on a global scale.

Key Companies in the Alcoholic Beverages Market market include

Industry Developments

Recent developments in the Alcoholic Beverages Market reveal significant activity among major players. In October 2023, Pernod Ricard announced the acquisition of the majority stake in the French wine company, Chteau de Sancerre, aiming to enhance its premium wine portfolio. Additionally, in September 2023, Constellation Brands revealed plans to invest heavily in sustainable practices across its beer and wine operations to meet growing consumer demands for environmentally responsible products.

Carlsberg Group has launched several innovative zero-alcohol beverages, meeting the rising trend of health-conscious consumers. In the past couple of years, Diageo has been focusing on digital marketing strategies to engage millennial customers effectively. Similarly, in August 2023, Heineken initiated a collaborative partnership with Vintage Wine Estates to expand its presence in the US market.

The market has shown robust growth, driven by increasing consumer interest in premium alcoholic beverages, with industry valuations experiencing a surge, particularly in the wine and spirits segments. The competitive landscape is characterized by mergers and acquisitions, sustainability initiatives, and innovation in product offerings, indicating a dynamic and evolving market geared towards capturing emerging consumer trends.

Future Outlook

Alcoholic Beverages Market Future Outlook

The Global Alcoholic Beverages Market is projected to grow at a 2.37% CAGR from 2025 to 2035, driven by premiumization, health-conscious trends, and innovative product offerings.

New opportunities lie in:

- Develop low-alcohol and alcohol-free beverage lines to cater to health-conscious consumers.

- Leverage e-commerce platforms for direct-to-consumer sales, enhancing market reach.

- Invest in sustainable packaging solutions to attract environmentally aware customers.

By 2035, the market is expected to demonstrate robust growth, reflecting evolving consumer preferences and innovative strategies.

Market Segmentation

Alcoholic Beverages Market Regional Outlook

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

Alcoholic Beverages Market Product Type Outlook

- Supermarkets

- Convenience Stores

- Online Retail

- Liquor Stores

Alcoholic Beverages Market Alcoholic Strength Outlook

- Millennials

- Generation X

- Baby Boomers

- Gen Z

Alcoholic Beverages Market Distribution Channel Outlook

- Low Alcohol

- Medium Alcohol

- High Alcohol

Alcoholic Beverages Market Consumer Demographics Outlook

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

Report Scope

|

Report Attribute/Metric |

Details |

|

Market Size 2024 |

1710.3(USD Billion) |

|

Market Size 2035 |

3002.33 (USD Billion) |

|

Compound Annual Growth Rate (CAGR) |

2.37% (2025 - 2035) |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

|

Base Year |

2024 |

|

Market Forecast Period |

2025 - 2035 |

|

Historical Data |

2019 - 2024 |

|

Market Forecast Units |

USD Billion |

|

Key Companies Profiled |

Pernod Ricard, Constellation Brands, Carlsberg Group, Molson Coors Beverage Company, Campari Group, Treasury Wine Estates, Diageo, AnheuserBusch InBev, Heineken, AB InBev, Vintage Wine Estates, BrownForman, Asahi Group Holdings, Sapporo Holdings |

|

Segments Covered |

Product Type, Distribution Channel, Alcoholic Strength, Consumer Demographics, Regional |

|

Key Market Opportunities |

Craft cocktails trend, Health-conscious beverages demand, E-commerce growth in sales, Premium spirits expansion, Sustainable packaging innovations |

|

Key Market Dynamics |

Rising disposable income, Changing consumer preferences, Growing craft beverage trend, Increasing health consciousness, Expansion of online retailing |

|

Countries Covered |

North America, Europe, APAC, South America, MEA |

| Market Size 2025 | 2374.90 (USD Billion) |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

What will be the total market value of the Alcoholic Beverages Market in 2035?

The Alcoholic Beverages Market is expected to be valued at 2200.0 USD Billion in 2035.

What is the expected CAGR for the Alcoholic Beverages Market from 2025 to 2035?

The expected CAGR for the Alcoholic Beverages Market from 2025 to 2035 is 2.31%.

Which region is projected to have the largest market share in the Alcoholic Beverages Market by 2035?

By 2035, Europe is projected to have the largest market share, valued at 730.0 USD Billion.

What will be the market size of the Beer segment in 2035?

The Beer segment of the Alcoholic Beverages Market is expected to reach 780.0 USD Billion by 2035.

Who are the major players in the Alcoholic Beverages Market?

Key players in the market include Pernod Ricard, Constellation Brands, and Anheuser-Busch InBev.

What is the estimated market value for Spirits in 2024?

The Spirits segment is estimated to have a market value of 500.0 USD Billion in 2024.

How much is the Asia Pacific region projected to contribute to the market by 2035?

The Asia Pacific region is projected to contribute 470.0 USD Billion to the Alcoholic Beverages Market by 2035.

What is the expected market value for the Ready-to-Drink segment in 2035?

The Ready-to-Drink segment is expected to have a market value of 340.0 USD Billion in 2035.

What challenges might the Alcoholic Beverages Market face in the coming years?

The market may face challenges due to changing consumer preferences and increasing health consciousness.

What will be the estimated market size for Wine in 2035?

The Wine segment is estimated to reach 310.0 USD Billion in market size by 2035.

-

Table of Contents

-

Executive Summary

- Market Overview

- Key Findings

- Market Segmentation

- Competitive Landscape

- Challenges and Opportunities

- Future Outlook

-

Market Introduction

- Definition

-

Scope of the Study

- Research Objective

- Assumption

- Limitations

-

Research Methodology

- Overview

- Data Mining

- Secondary Research

-

Primary Research

- Primary Interviews and Information Gathering Process

- Breakdown of Primary Respondents

- Forecasting Model

-

Market Size Estimation

- Bottom-up Approach

- Top-Down Approach

- Data Triangulation

- Validation

-

MARKET DYNAMICS

- Overview

- Drivers

- Restraints

- Opportunities

-

MARKET FACTOR ANALYSIS

- Value chain Analysis

-

Porter's Five Forces Analysis

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of New Entrants

- Threat of Substitutes

- Intensity of Rivalry

-

COVID-19 Impact Analysis

- Market Impact Analysis

- Regional Impact

- Opportunity and Threat Analysis

-

ALCOHOLIC BEVERAGES MARKET, BY PRODUCT TYPE (USD BILLION)

- Beer

- Wine

- Spirits

- Cider

- Ready-to-Drink

-

ALCOHOLIC BEVERAGES MARKET, BY DISTRIBUTION CHANNEL (USD BILLION)

- Supermarkets

- Convenience Stores

- Online Retail

- Liquor Stores

-

ALCOHOLIC BEVERAGES MARKET, BY ALCOHOLIC STRENGTH (USD BILLION)

- Low Alcohol

- Medium Alcohol

- High Alcohol

-

ALCOHOLIC BEVERAGES MARKET, BY CONSUMER DEMOGRAPHICS (USD BILLION)

- Millennials

- Generation X

- Baby Boomers

- Gen Z

-

ALCOHOLIC BEVERAGES MARKET, BY REGIONAL (USD BILLION)

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Russia

- Italy

- Spain

- Rest of Europe

-

APAC

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Indonesia

- Rest of APAC

-

South America

- Brazil

- Mexico

- Argentina

- Rest of South America

-

MEA

- GCC Countries

- South Africa

- Rest of MEA

-

North America

-

Competitive Landscape

- Overview

- Competitive Analysis

- Market share Analysis

- Major Growth Strategy in the Alcoholic Beverages Market

- Competitive Benchmarking

- Leading Players in Terms of Number of Developments in the Alcoholic Beverages Market

-

Key developments and growth strategies

- New Product Launch/Service Deployment

- Merger & Acquisitions

- Joint Ventures

-

Major Players Financial Matrix

- Sales and Operating Income

- Major Players R&D Expenditure. 2023

-

COMPANY PROFILES

-

Pernod Ricard

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Constellation Brands

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Carlsberg Group

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Molson Coors Beverage Company

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Campari Group

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Treasury Wine Estates

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Diageo

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

AnheuserBusch InBev

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Heineken

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

AB InBev

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Vintage Wine Estates

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

BrownForman

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Asahi Group Holdings

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Sapporo Holdings

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Pernod Ricard

-

APPENDIX

- References

- Related Reports

-

List of Tables and Figures

- LIST OF TABLES

- TABLE 1. LIST OF ASSUMPTIONS

- TABLE 2. NORTH AMERICA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 3. NORTH AMERICA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 4. NORTH AMERICA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY ALCOHOLIC STRENGTH, 2019-2035 (USD BILLIONS)

- TABLE 5. NORTH AMERICA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY CONSUMER DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

- TABLE 6. NORTH AMERICA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 7. US ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 8. US ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 9. US ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY ALCOHOLIC STRENGTH, 2019-2035 (USD BILLIONS)

- TABLE 10. US ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY CONSUMER DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

- TABLE 11. US ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 12. CANADA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 13. CANADA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 14. CANADA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY ALCOHOLIC STRENGTH, 2019-2035 (USD BILLIONS)

- TABLE 15. CANADA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY CONSUMER DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

- TABLE 16. CANADA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 17. EUROPE ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 18. EUROPE ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 19. EUROPE ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY ALCOHOLIC STRENGTH, 2019-2035 (USD BILLIONS)

- TABLE 20. EUROPE ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY CONSUMER DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

- TABLE 21. EUROPE ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 22. GERMANY ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 23. GERMANY ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 24. GERMANY ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY ALCOHOLIC STRENGTH, 2019-2035 (USD BILLIONS)

- TABLE 25. GERMANY ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY CONSUMER DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

- TABLE 26. GERMANY ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 27. UK ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 28. UK ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 29. UK ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY ALCOHOLIC STRENGTH, 2019-2035 (USD BILLIONS)

- TABLE 30. UK ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY CONSUMER DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

- TABLE 31. UK ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 32. FRANCE ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 33. FRANCE ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 34. FRANCE ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY ALCOHOLIC STRENGTH, 2019-2035 (USD BILLIONS)

- TABLE 35. FRANCE ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY CONSUMER DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

- TABLE 36. FRANCE ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 37. RUSSIA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 38. RUSSIA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 39. RUSSIA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY ALCOHOLIC STRENGTH, 2019-2035 (USD BILLIONS)

- TABLE 40. RUSSIA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY CONSUMER DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

- TABLE 41. RUSSIA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 42. ITALY ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 43. ITALY ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 44. ITALY ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY ALCOHOLIC STRENGTH, 2019-2035 (USD BILLIONS)

- TABLE 45. ITALY ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY CONSUMER DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

- TABLE 46. ITALY ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 47. SPAIN ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 48. SPAIN ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 49. SPAIN ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY ALCOHOLIC STRENGTH, 2019-2035 (USD BILLIONS)

- TABLE 50. SPAIN ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY CONSUMER DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

- TABLE 51. SPAIN ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 52. REST OF EUROPE ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 53. REST OF EUROPE ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 54. REST OF EUROPE ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY ALCOHOLIC STRENGTH, 2019-2035 (USD BILLIONS)

- TABLE 55. REST OF EUROPE ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY CONSUMER DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

- TABLE 56. REST OF EUROPE ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 57. APAC ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 58. APAC ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 59. APAC ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY ALCOHOLIC STRENGTH, 2019-2035 (USD BILLIONS)

- TABLE 60. APAC ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY CONSUMER DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

- TABLE 61. APAC ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 62. CHINA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 63. CHINA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 64. CHINA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY ALCOHOLIC STRENGTH, 2019-2035 (USD BILLIONS)

- TABLE 65. CHINA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY CONSUMER DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

- TABLE 66. CHINA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 67. INDIA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 68. INDIA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 69. INDIA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY ALCOHOLIC STRENGTH, 2019-2035 (USD BILLIONS)

- TABLE 70. INDIA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY CONSUMER DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

- TABLE 71. INDIA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 72. JAPAN ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 73. JAPAN ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 74. JAPAN ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY ALCOHOLIC STRENGTH, 2019-2035 (USD BILLIONS)

- TABLE 75. JAPAN ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY CONSUMER DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

- TABLE 76. JAPAN ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 77. SOUTH KOREA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 78. SOUTH KOREA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 79. SOUTH KOREA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY ALCOHOLIC STRENGTH, 2019-2035 (USD BILLIONS)

- TABLE 80. SOUTH KOREA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY CONSUMER DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

- TABLE 81. SOUTH KOREA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 82. MALAYSIA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 83. MALAYSIA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 84. MALAYSIA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY ALCOHOLIC STRENGTH, 2019-2035 (USD BILLIONS)

- TABLE 85. MALAYSIA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY CONSUMER DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

- TABLE 86. MALAYSIA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 87. THAILAND ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 88. THAILAND ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 89. THAILAND ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY ALCOHOLIC STRENGTH, 2019-2035 (USD BILLIONS)

- TABLE 90. THAILAND ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY CONSUMER DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

- TABLE 91. THAILAND ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 92. INDONESIA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 93. INDONESIA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 94. INDONESIA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY ALCOHOLIC STRENGTH, 2019-2035 (USD BILLIONS)

- TABLE 95. INDONESIA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY CONSUMER DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

- TABLE 96. INDONESIA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 97. REST OF APAC ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 98. REST OF APAC ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 99. REST OF APAC ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY ALCOHOLIC STRENGTH, 2019-2035 (USD BILLIONS)

- TABLE 100. REST OF APAC ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY CONSUMER DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

- TABLE 101. REST OF APAC ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 102. SOUTH AMERICA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 103. SOUTH AMERICA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 104. SOUTH AMERICA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY ALCOHOLIC STRENGTH, 2019-2035 (USD BILLIONS)

- TABLE 105. SOUTH AMERICA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY CONSUMER DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

- TABLE 106. SOUTH AMERICA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 107. BRAZIL ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 108. BRAZIL ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 109. BRAZIL ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY ALCOHOLIC STRENGTH, 2019-2035 (USD BILLIONS)

- TABLE 110. BRAZIL ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY CONSUMER DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

- TABLE 111. BRAZIL ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 112. MEXICO ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 113. MEXICO ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 114. MEXICO ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY ALCOHOLIC STRENGTH, 2019-2035 (USD BILLIONS)

- TABLE 115. MEXICO ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY CONSUMER DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

- TABLE 116. MEXICO ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 117. ARGENTINA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 118. ARGENTINA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 119. ARGENTINA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY ALCOHOLIC STRENGTH, 2019-2035 (USD BILLIONS)

- TABLE 120. ARGENTINA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY CONSUMER DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

- TABLE 121. ARGENTINA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 122. REST OF SOUTH AMERICA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 123. REST OF SOUTH AMERICA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 124. REST OF SOUTH AMERICA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY ALCOHOLIC STRENGTH, 2019-2035 (USD BILLIONS)

- TABLE 125. REST OF SOUTH AMERICA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY CONSUMER DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

- TABLE 126. REST OF SOUTH AMERICA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 127. MEA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 128. MEA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 129. MEA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY ALCOHOLIC STRENGTH, 2019-2035 (USD BILLIONS)

- TABLE 130. MEA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY CONSUMER DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

- TABLE 131. MEA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 132. GCC COUNTRIES ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 133. GCC COUNTRIES ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 134. GCC COUNTRIES ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY ALCOHOLIC STRENGTH, 2019-2035 (USD BILLIONS)

- TABLE 135. GCC COUNTRIES ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY CONSUMER DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

- TABLE 136. GCC COUNTRIES ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 137. SOUTH AFRICA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 138. SOUTH AFRICA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 139. SOUTH AFRICA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY ALCOHOLIC STRENGTH, 2019-2035 (USD BILLIONS)

- TABLE 140. SOUTH AFRICA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY CONSUMER DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

- TABLE 141. SOUTH AFRICA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 142. REST OF MEA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD BILLIONS)

- TABLE 143. REST OF MEA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 144. REST OF MEA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY ALCOHOLIC STRENGTH, 2019-2035 (USD BILLIONS)

- TABLE 145. REST OF MEA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY CONSUMER DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

- TABLE 146. REST OF MEA ALCOHOLIC BEVERAGES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 147. PRODUCT LAUNCH/PRODUCT DEVELOPMENT/APPROVAL

- TABLE 148. ACQUISITION/PARTNERSHIP LIST OF FIGURES

- FIGURE 1. MARKET SYNOPSIS

- FIGURE 2. NORTH AMERICA ALCOHOLIC BEVERAGES MARKET ANALYSIS

- FIGURE 3. US ALCOHOLIC BEVERAGES MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 4. US ALCOHOLIC BEVERAGES MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 5. US ALCOHOLIC BEVERAGES MARKET ANALYSIS BY ALCOHOLIC STRENGTH

- FIGURE 6. US ALCOHOLIC BEVERAGES MARKET ANALYSIS BY CONSUMER DEMOGRAPHICS

- FIGURE 7. US ALCOHOLIC BEVERAGES MARKET ANALYSIS BY REGIONAL

- FIGURE 8. CANADA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 9. CANADA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 10. CANADA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY ALCOHOLIC STRENGTH

- FIGURE 11. CANADA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY CONSUMER DEMOGRAPHICS

- FIGURE 12. CANADA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY REGIONAL

- FIGURE 13. EUROPE ALCOHOLIC BEVERAGES MARKET ANALYSIS

- FIGURE 14. GERMANY ALCOHOLIC BEVERAGES MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 15. GERMANY ALCOHOLIC BEVERAGES MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 16. GERMANY ALCOHOLIC BEVERAGES MARKET ANALYSIS BY ALCOHOLIC STRENGTH

- FIGURE 17. GERMANY ALCOHOLIC BEVERAGES MARKET ANALYSIS BY CONSUMER DEMOGRAPHICS

- FIGURE 18. GERMANY ALCOHOLIC BEVERAGES MARKET ANALYSIS BY REGIONAL

- FIGURE 19. UK ALCOHOLIC BEVERAGES MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 20. UK ALCOHOLIC BEVERAGES MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 21. UK ALCOHOLIC BEVERAGES MARKET ANALYSIS BY ALCOHOLIC STRENGTH

- FIGURE 22. UK ALCOHOLIC BEVERAGES MARKET ANALYSIS BY CONSUMER DEMOGRAPHICS

- FIGURE 23. UK ALCOHOLIC BEVERAGES MARKET ANALYSIS BY REGIONAL

- FIGURE 24. FRANCE ALCOHOLIC BEVERAGES MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 25. FRANCE ALCOHOLIC BEVERAGES MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 26. FRANCE ALCOHOLIC BEVERAGES MARKET ANALYSIS BY ALCOHOLIC STRENGTH

- FIGURE 27. FRANCE ALCOHOLIC BEVERAGES MARKET ANALYSIS BY CONSUMER DEMOGRAPHICS

- FIGURE 28. FRANCE ALCOHOLIC BEVERAGES MARKET ANALYSIS BY REGIONAL

- FIGURE 29. RUSSIA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 30. RUSSIA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 31. RUSSIA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY ALCOHOLIC STRENGTH

- FIGURE 32. RUSSIA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY CONSUMER DEMOGRAPHICS

- FIGURE 33. RUSSIA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY REGIONAL

- FIGURE 34. ITALY ALCOHOLIC BEVERAGES MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 35. ITALY ALCOHOLIC BEVERAGES MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 36. ITALY ALCOHOLIC BEVERAGES MARKET ANALYSIS BY ALCOHOLIC STRENGTH

- FIGURE 37. ITALY ALCOHOLIC BEVERAGES MARKET ANALYSIS BY CONSUMER DEMOGRAPHICS

- FIGURE 38. ITALY ALCOHOLIC BEVERAGES MARKET ANALYSIS BY REGIONAL

- FIGURE 39. SPAIN ALCOHOLIC BEVERAGES MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 40. SPAIN ALCOHOLIC BEVERAGES MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 41. SPAIN ALCOHOLIC BEVERAGES MARKET ANALYSIS BY ALCOHOLIC STRENGTH

- FIGURE 42. SPAIN ALCOHOLIC BEVERAGES MARKET ANALYSIS BY CONSUMER DEMOGRAPHICS

- FIGURE 43. SPAIN ALCOHOLIC BEVERAGES MARKET ANALYSIS BY REGIONAL

- FIGURE 44. REST OF EUROPE ALCOHOLIC BEVERAGES MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 45. REST OF EUROPE ALCOHOLIC BEVERAGES MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 46. REST OF EUROPE ALCOHOLIC BEVERAGES MARKET ANALYSIS BY ALCOHOLIC STRENGTH

- FIGURE 47. REST OF EUROPE ALCOHOLIC BEVERAGES MARKET ANALYSIS BY CONSUMER DEMOGRAPHICS

- FIGURE 48. REST OF EUROPE ALCOHOLIC BEVERAGES MARKET ANALYSIS BY REGIONAL

- FIGURE 49. APAC ALCOHOLIC BEVERAGES MARKET ANALYSIS

- FIGURE 50. CHINA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 51. CHINA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 52. CHINA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY ALCOHOLIC STRENGTH

- FIGURE 53. CHINA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY CONSUMER DEMOGRAPHICS

- FIGURE 54. CHINA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY REGIONAL

- FIGURE 55. INDIA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 56. INDIA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 57. INDIA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY ALCOHOLIC STRENGTH

- FIGURE 58. INDIA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY CONSUMER DEMOGRAPHICS

- FIGURE 59. INDIA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY REGIONAL

- FIGURE 60. JAPAN ALCOHOLIC BEVERAGES MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 61. JAPAN ALCOHOLIC BEVERAGES MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 62. JAPAN ALCOHOLIC BEVERAGES MARKET ANALYSIS BY ALCOHOLIC STRENGTH

- FIGURE 63. JAPAN ALCOHOLIC BEVERAGES MARKET ANALYSIS BY CONSUMER DEMOGRAPHICS

- FIGURE 64. JAPAN ALCOHOLIC BEVERAGES MARKET ANALYSIS BY REGIONAL

- FIGURE 65. SOUTH KOREA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 66. SOUTH KOREA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 67. SOUTH KOREA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY ALCOHOLIC STRENGTH

- FIGURE 68. SOUTH KOREA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY CONSUMER DEMOGRAPHICS

- FIGURE 69. SOUTH KOREA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY REGIONAL

- FIGURE 70. MALAYSIA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 71. MALAYSIA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 72. MALAYSIA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY ALCOHOLIC STRENGTH

- FIGURE 73. MALAYSIA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY CONSUMER DEMOGRAPHICS

- FIGURE 74. MALAYSIA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY REGIONAL

- FIGURE 75. THAILAND ALCOHOLIC BEVERAGES MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 76. THAILAND ALCOHOLIC BEVERAGES MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 77. THAILAND ALCOHOLIC BEVERAGES MARKET ANALYSIS BY ALCOHOLIC STRENGTH

- FIGURE 78. THAILAND ALCOHOLIC BEVERAGES MARKET ANALYSIS BY CONSUMER DEMOGRAPHICS

- FIGURE 79. THAILAND ALCOHOLIC BEVERAGES MARKET ANALYSIS BY REGIONAL

- FIGURE 80. INDONESIA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 81. INDONESIA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 82. INDONESIA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY ALCOHOLIC STRENGTH

- FIGURE 83. INDONESIA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY CONSUMER DEMOGRAPHICS

- FIGURE 84. INDONESIA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY REGIONAL

- FIGURE 85. REST OF APAC ALCOHOLIC BEVERAGES MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 86. REST OF APAC ALCOHOLIC BEVERAGES MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 87. REST OF APAC ALCOHOLIC BEVERAGES MARKET ANALYSIS BY ALCOHOLIC STRENGTH

- FIGURE 88. REST OF APAC ALCOHOLIC BEVERAGES MARKET ANALYSIS BY CONSUMER DEMOGRAPHICS

- FIGURE 89. REST OF APAC ALCOHOLIC BEVERAGES MARKET ANALYSIS BY REGIONAL

- FIGURE 90. SOUTH AMERICA ALCOHOLIC BEVERAGES MARKET ANALYSIS

- FIGURE 91. BRAZIL ALCOHOLIC BEVERAGES MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 92. BRAZIL ALCOHOLIC BEVERAGES MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 93. BRAZIL ALCOHOLIC BEVERAGES MARKET ANALYSIS BY ALCOHOLIC STRENGTH

- FIGURE 94. BRAZIL ALCOHOLIC BEVERAGES MARKET ANALYSIS BY CONSUMER DEMOGRAPHICS

- FIGURE 95. BRAZIL ALCOHOLIC BEVERAGES MARKET ANALYSIS BY REGIONAL

- FIGURE 96. MEXICO ALCOHOLIC BEVERAGES MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 97. MEXICO ALCOHOLIC BEVERAGES MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 98. MEXICO ALCOHOLIC BEVERAGES MARKET ANALYSIS BY ALCOHOLIC STRENGTH

- FIGURE 99. MEXICO ALCOHOLIC BEVERAGES MARKET ANALYSIS BY CONSUMER DEMOGRAPHICS

- FIGURE 100. MEXICO ALCOHOLIC BEVERAGES MARKET ANALYSIS BY REGIONAL

- FIGURE 101. ARGENTINA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 102. ARGENTINA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 103. ARGENTINA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY ALCOHOLIC STRENGTH

- FIGURE 104. ARGENTINA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY CONSUMER DEMOGRAPHICS

- FIGURE 105. ARGENTINA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY REGIONAL

- FIGURE 106. REST OF SOUTH AMERICA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 107. REST OF SOUTH AMERICA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 108. REST OF SOUTH AMERICA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY ALCOHOLIC STRENGTH

- FIGURE 109. REST OF SOUTH AMERICA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY CONSUMER DEMOGRAPHICS

- FIGURE 110. REST OF SOUTH AMERICA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY REGIONAL

- FIGURE 111. MEA ALCOHOLIC BEVERAGES MARKET ANALYSIS

- FIGURE 112. GCC COUNTRIES ALCOHOLIC BEVERAGES MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 113. GCC COUNTRIES ALCOHOLIC BEVERAGES MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 114. GCC COUNTRIES ALCOHOLIC BEVERAGES MARKET ANALYSIS BY ALCOHOLIC STRENGTH

- FIGURE 115. GCC COUNTRIES ALCOHOLIC BEVERAGES MARKET ANALYSIS BY CONSUMER DEMOGRAPHICS

- FIGURE 116. GCC COUNTRIES ALCOHOLIC BEVERAGES MARKET ANALYSIS BY REGIONAL

- FIGURE 117. SOUTH AFRICA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 118. SOUTH AFRICA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 119. SOUTH AFRICA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY ALCOHOLIC STRENGTH

- FIGURE 120. SOUTH AFRICA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY CONSUMER DEMOGRAPHICS

- FIGURE 121. SOUTH AFRICA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY REGIONAL

- FIGURE 122. REST OF MEA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 123. REST OF MEA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 124. REST OF MEA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY ALCOHOLIC STRENGTH

- FIGURE 125. REST OF MEA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY CONSUMER DEMOGRAPHICS

- FIGURE 126. REST OF MEA ALCOHOLIC BEVERAGES MARKET ANALYSIS BY REGIONAL

- FIGURE 127. KEY BUYING CRITERIA OF ALCOHOLIC BEVERAGES MARKET

- FIGURE 128. RESEARCH PROCESS OF MRFR

- FIGURE 129. DRO ANALYSIS OF ALCOHOLIC BEVERAGES MARKET

- FIGURE 130. DRIVERS IMPACT ANALYSIS: ALCOHOLIC BEVERAGES MARKET

- FIGURE 131. RESTRAINTS IMPACT ANALYSIS: ALCOHOLIC BEVERAGES MARKET

- FIGURE 132. SUPPLY / VALUE CHAIN: ALCOHOLIC BEVERAGES MARKET

- FIGURE 133. ALCOHOLIC BEVERAGES MARKET, BY PRODUCT TYPE, 2025 (% SHARE)

- FIGURE 134. ALCOHOLIC BEVERAGES MARKET, BY PRODUCT TYPE, 2019 TO 2035 (USD Billions)

- FIGURE 135. ALCOHOLIC BEVERAGES MARKET, BY DISTRIBUTION CHANNEL, 2025 (% SHARE)

- FIGURE 136. ALCOHOLIC BEVERAGES MARKET, BY DISTRIBUTION CHANNEL, 2019 TO 2035 (USD Billions)

- FIGURE 137. ALCOHOLIC BEVERAGES MARKET, BY ALCOHOLIC STRENGTH, 2025 (% SHARE)

- FIGURE 138. ALCOHOLIC BEVERAGES MARKET, BY ALCOHOLIC STRENGTH, 2019 TO 2035 (USD Billions)

- FIGURE 139. ALCOHOLIC BEVERAGES MARKET, BY CONSUMER DEMOGRAPHICS, 2025 (% SHARE)

- FIGURE 140. ALCOHOLIC BEVERAGES MARKET, BY CONSUMER DEMOGRAPHICS, 2019 TO 2035 (USD Billions)

- FIGURE 141. ALCOHOLIC BEVERAGES MARKET, BY REGIONAL, 2025 (% SHARE)

- FIGURE 142. ALCOHOLIC BEVERAGES MARKET, BY REGIONAL, 2019 TO 2035 (USD Billions)

- FIGURE 143. BENCHMARKING OF MAJOR COMPETITORS

Alcoholic Beverages Market Segmentation

- Alcoholic Beverages Market By Product Type (USD Billion, 2019-2035)

- Beer

- Wine

- Spirits

- Cider

- Ready-to-Drink

- Alcoholic Beverages Market By Distribution Channel (USD Billion, 2019-2035)

- Supermarkets

- Convenience Stores

- Online Retail

- Liquor Stores

- Alcoholic Beverages Market By Alcoholic Strength (USD Billion, 2019-2035)

- Low Alcohol

- Medium Alcohol

- High Alcohol

- Alcoholic Beverages Market By Consumer Demographics (USD Billion, 2019-2035)

- Millennials

- Generation X

- Baby Boomers

- Gen Z

- Alcoholic Beverages Market By Regional (USD Billion, 2019-2035)

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

Alcoholic Beverages Market Regional Outlook (USD Billion, 2019-2035)

- North America Outlook (USD Billion, 2019-2035)

- North America Alcoholic Beverages Market by Product Type

- Beer

- Wine

- Spirits

- Cider

- Ready-to-Drink

- North America Alcoholic Beverages Market by Distribution Channel Type

- Supermarkets

- Convenience Stores

- Online Retail

- Liquor Stores

- North America Alcoholic Beverages Market by Alcoholic Strength Type

- Low Alcohol

- Medium Alcohol

- High Alcohol

- North America Alcoholic Beverages Market by Consumer Demographics Type

- Millennials

- Generation X

- Baby Boomers

- Gen Z

- North America Alcoholic Beverages Market by Regional Type

- US

- Canada

- US Outlook (USD Billion, 2019-2035)

- US Alcoholic Beverages Market by Product Type

- Beer

- Wine

- Spirits

- Cider

- Ready-to-Drink

- US Alcoholic Beverages Market by Distribution Channel Type

- Supermarkets

- Convenience Stores

- Online Retail

- Liquor Stores

- US Alcoholic Beverages Market by Alcoholic Strength Type

- Low Alcohol

- Medium Alcohol

- High Alcohol

- US Alcoholic Beverages Market by Consumer Demographics Type

- Millennials

- Generation X

- Baby Boomers

- Gen Z

- CANADA Outlook (USD Billion, 2019-2035)

- CANADA Alcoholic Beverages Market by Product Type

- Beer

- Wine

- Spirits

- Cider

- Ready-to-Drink

- CANADA Alcoholic Beverages Market by Distribution Channel Type

- Supermarkets

- Convenience Stores

- Online Retail

- Liquor Stores

- CANADA Alcoholic Beverages Market by Alcoholic Strength Type

- Low Alcohol

- Medium Alcohol

- High Alcohol

- CANADA Alcoholic Beverages Market by Consumer Demographics Type

- Millennials

- Generation X

- Baby Boomers

- Gen Z

- Europe Outlook (USD Billion, 2019-2035)

- Europe Alcoholic Beverages Market by Product Type

- Beer

- Wine

- Spirits

- Cider

- Ready-to-Drink

- Europe Alcoholic Beverages Market by Distribution Channel Type

- Supermarkets

- Convenience Stores

- Online Retail

- Liquor Stores

- Europe Alcoholic Beverages Market by Alcoholic Strength Type

- Low Alcohol

- Medium Alcohol

- High Alcohol

- Europe Alcoholic Beverages Market by Consumer Demographics Type

- Millennials

- Generation X

- Baby Boomers

- Gen Z

- Europe Alcoholic Beverages Market by Regional Type

- Germany

- UK

- France

- Russia

- Italy

- Spain

- Rest of Europe

- GERMANY Outlook (USD Billion, 2019-2035)

- GERMANY Alcoholic Beverages Market by Product Type

- Beer

- Wine

- Spirits

- Cider

- Ready-to-Drink

- GERMANY Alcoholic Beverages Market by Distribution Channel Type

- Supermarkets

- Convenience Stores

- Online Retail

- Liquor Stores

- GERMANY Alcoholic Beverages Market by Alcoholic Strength Type

- Low Alcohol

- Medium Alcohol

- High Alcohol

- GERMANY Alcoholic Beverages Market by Consumer Demographics Type

- Millennials

- Generation X

- Baby Boomers

- Gen Z

- UK Outlook (USD Billion, 2019-2035)

- UK Alcoholic Beverages Market by Product Type

- Beer

- Wine

- Spirits

- Cider

- Ready-to-Drink

- UK Alcoholic Beverages Market by Distribution Channel Type

- Supermarkets

- Convenience Stores

- Online Retail

- Liquor Stores

- UK Alcoholic Beverages Market by Alcoholic Strength Type

- Low Alcohol

- Medium Alcohol

- High Alcohol

- UK Alcoholic Beverages Market by Consumer Demographics Type

- Millennials

- Generation X

- Baby Boomers

- Gen Z

- FRANCE Outlook (USD Billion, 2019-2035)

- FRANCE Alcoholic Beverages Market by Product Type

- Beer

- Wine

- Spirits

- Cider

- Ready-to-Drink

- FRANCE Alcoholic Beverages Market by Distribution Channel Type

- Supermarkets

- Convenience Stores

- Online Retail

- Liquor Stores

- FRANCE Alcoholic Beverages Market by Alcoholic Strength Type

- Low Alcohol

- Medium Alcohol

- High Alcohol

- FRANCE Alcoholic Beverages Market by Consumer Demographics Type

- Millennials

- Generation X

- Baby Boomers

- Gen Z

- RUSSIA Outlook (USD Billion, 2019-2035)

- RUSSIA Alcoholic Beverages Market by Product Type

- Beer

- Wine

- Spirits

- Cider

- Ready-to-Drink

- RUSSIA Alcoholic Beverages Market by Distribution Channel Type

- Supermarkets

- Convenience Stores

- Online Retail

- Liquor Stores

- RUSSIA Alcoholic Beverages Market by Alcoholic Strength Type

- Low Alcohol

- Medium Alcohol

- High Alcohol

- RUSSIA Alcoholic Beverages Market by Consumer Demographics Type

- Millennials

- Generation X

- Baby Boomers

- Gen Z

- ITALY Outlook (USD Billion, 2019-2035)

- ITALY Alcoholic Beverages Market by Product Type

- Beer

- Wine

- Spirits

- Cider

- Ready-to-Drink

- ITALY Alcoholic Beverages Market by Distribution Channel Type

- Supermarkets

- Convenience Stores

- Online Retail

- Liquor Stores

- ITALY Alcoholic Beverages Market by Alcoholic Strength Type

- Low Alcohol

- Medium Alcohol

- High Alcohol

- ITALY Alcoholic Beverages Market by Consumer Demographics Type

- Millennials

- Generation X

- Baby Boomers

- Gen Z

- SPAIN Outlook (USD Billion, 2019-2035)

- SPAIN Alcoholic Beverages Market by Product Type

- Beer

- Wine

- Spirits

- Cider

- Ready-to-Drink

- SPAIN Alcoholic Beverages Market by Distribution Channel Type

- Supermarkets

- Convenience Stores

- Online Retail

- Liquor Stores

- SPAIN Alcoholic Beverages Market by Alcoholic Strength Type

- Low Alcohol

- Medium Alcohol

- High Alcohol

- SPAIN Alcoholic Beverages Market by Consumer Demographics Type

- Millennials

- Generation X

- Baby Boomers

- Gen Z

- REST OF EUROPE Outlook (USD Billion, 2019-2035)

- REST OF EUROPE Alcoholic Beverages Market by Product Type

- Beer

- Wine

- Spirits

- Cider

- Ready-to-Drink

- REST OF EUROPE Alcoholic Beverages Market by Distribution Channel Type

- Supermarkets

- Convenience Stores

- Online Retail

- Liquor Stores

- REST OF EUROPE Alcoholic Beverages Market by Alcoholic Strength Type

- Low Alcohol

- Medium Alcohol

- High Alcohol

- REST OF EUROPE Alcoholic Beverages Market by Consumer Demographics Type

- Millennials

- Generation X

- Baby Boomers

- Gen Z

- APAC Outlook (USD Billion, 2019-2035)

- APAC Alcoholic Beverages Market by Product Type

- Beer

- Wine

- Spirits

- Cider

- Ready-to-Drink

- APAC Alcoholic Beverages Market by Distribution Channel Type

- Supermarkets

- Convenience Stores

- Online Retail

- Liquor Stores

- APAC Alcoholic Beverages Market by Alcoholic Strength Type

- Low Alcohol

- Medium Alcohol

- High Alcohol

- APAC Alcoholic Beverages Market by Consumer Demographics Type

- Millennials

- Generation X

- Baby Boomers

- Gen Z

- APAC Alcoholic Beverages Market by Regional Type

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Indonesia

- Rest of APAC

- CHINA Outlook (USD Billion, 2019-2035)

- CHINA Alcoholic Beverages Market by Product Type

- Beer

- Wine

- Spirits

- Cider

- Ready-to-Drink

- CHINA Alcoholic Beverages Market by Distribution Channel Type

- Supermarkets

- Convenience Stores

- Online Retail

- Liquor Stores

- CHINA Alcoholic Beverages Market by Alcoholic Strength Type

- Low Alcohol

- Medium Alcohol

- High Alcohol

- CHINA Alcoholic Beverages Market by Consumer Demographics Type

- Millennials

- Generation X

- Baby Boomers

- Gen Z

- INDIA Outlook (USD Billion, 2019-2035)

- INDIA Alcoholic Beverages Market by Product Type

- Beer

- Wine

- Spirits

- Cider

- Ready-to-Drink

- INDIA Alcoholic Beverages Market by Distribution Channel Type

- Supermarkets

- Convenience Stores

- Online Retail

- Liquor Stores

- INDIA Alcoholic Beverages Market by Alcoholic Strength Type

- Low Alcohol

- Medium Alcohol

- High Alcohol

- INDIA Alcoholic Beverages Market by Consumer Demographics Type

- Millennials

- Generation X

- Baby Boomers

- Gen Z

- JAPAN Outlook (USD Billion, 2019-2035)

- JAPAN Alcoholic Beverages Market by Product Type

- Beer

- Wine

- Spirits

- Cider

- Ready-to-Drink

- JAPAN Alcoholic Beverages Market by Distribution Channel Type

- Supermarkets

- Convenience Stores

- Online Retail

- Liquor Stores

- JAPAN Alcoholic Beverages Market by Alcoholic Strength Type

- Low Alcohol

- Medium Alcohol

- High Alcohol

- JAPAN Alcoholic Beverages Market by Consumer Demographics Type

- Millennials

- Generation X

- Baby Boomers

- Gen Z

- SOUTH KOREA Outlook (USD Billion, 2019-2035)

- SOUTH KOREA Alcoholic Beverages Market by Product Type

- Beer

- Wine

- Spirits

- Cider

- Ready-to-Drink

- SOUTH KOREA Alcoholic Beverages Market by Distribution Channel Type

- Supermarkets

- Convenience Stores

- Online Retail

- Liquor Stores

- SOUTH KOREA Alcoholic Beverages Market by Alcoholic Strength Type

- Low Alcohol

- Medium Alcohol

- High Alcohol

- SOUTH KOREA Alcoholic Beverages Market by Consumer Demographics Type

- Millennials

- Generation X

- Baby Boomers

- Gen Z

- MALAYSIA Outlook (USD Billion, 2019-2035)

- MALAYSIA Alcoholic Beverages Market by Product Type

- Beer

- Wine

- Spirits

- Cider

- Ready-to-Drink

- MALAYSIA Alcoholic Beverages Market by Distribution Channel Type

- Supermarkets

- Convenience Stores

- Online Retail

- Liquor Stores

- MALAYSIA Alcoholic Beverages Market by Alcoholic Strength Type

- Low Alcohol

- Medium Alcohol

- High Alcohol

- MALAYSIA Alcoholic Beverages Market by Consumer Demographics Type

- Millennials

- Generation X

- Baby Boomers

- Gen Z

- THAILAND Outlook (USD Billion, 2019-2035)

- THAILAND Alcoholic Beverages Market by Product Type

- Beer

- Wine

- Spirits

- Cider

- Ready-to-Drink

- THAILAND Alcoholic Beverages Market by Distribution Channel Type

- Supermarkets

- Convenience Stores

- Online Retail

- Liquor Stores

- THAILAND Alcoholic Beverages Market by Alcoholic Strength Type

- Low Alcohol

- Medium Alcohol

- High Alcohol

- THAILAND Alcoholic Beverages Market by Consumer Demographics Type

- Millennials

- Generation X

- Baby Boomers

- Gen Z

- INDONESIA Outlook (USD Billion, 2019-2035)

- INDONESIA Alcoholic Beverages Market by Product Type

- Beer

- Wine

- Spirits

- Cider

- Ready-to-Drink

- INDONESIA Alcoholic Beverages Market by Distribution Channel Type

- Supermarkets

- Convenience Stores

- Online Retail

- Liquor Stores

- INDONESIA Alcoholic Beverages Market by Alcoholic Strength Type

- Low Alcohol

- Medium Alcohol

- High Alcohol

- INDONESIA Alcoholic Beverages Market by Consumer Demographics Type

- Millennials

- Generation X

- Baby Boomers

- Gen Z

- REST OF APAC Outlook (USD Billion, 2019-2035)

- REST OF APAC Alcoholic Beverages Market by Product Type

- Beer

- Wine

- Spirits

- Cider

- Ready-to-Drink

- REST OF APAC Alcoholic Beverages Market by Distribution Channel Type

- Supermarkets

- Convenience Stores

- Online Retail

- Liquor Stores

- REST OF APAC Alcoholic Beverages Market by Alcoholic Strength Type

- Low Alcohol

- Medium Alcohol

- High Alcohol

- REST OF APAC Alcoholic Beverages Market by Consumer Demographics Type

- Millennials

- Generation X

- Baby Boomers

- Gen Z

- South America Outlook (USD Billion, 2019-2035)

- South America Alcoholic Beverages Market by Product Type

- Beer

- Wine

- Spirits

- Cider

- Ready-to-Drink

- South America Alcoholic Beverages Market by Distribution Channel Type

- Supermarkets

- Convenience Stores

- Online Retail

- Liquor Stores

- South America Alcoholic Beverages Market by Alcoholic Strength Type

- Low Alcohol

- Medium Alcohol

- High Alcohol

- South America Alcoholic Beverages Market by Consumer Demographics Type

- Millennials

- Generation X

- Baby Boomers

- Gen Z

- South America Alcoholic Beverages Market by Regional Type

- Brazil

- Mexico

- Argentina

- Rest of South America

- BRAZIL Outlook (USD Billion, 2019-2035)

- BRAZIL Alcoholic Beverages Market by Product Type

- Beer

- Wine

- Spirits

- Cider

- Ready-to-Drink

- BRAZIL Alcoholic Beverages Market by Distribution Channel Type

- Supermarkets

- Convenience Stores

- Online Retail

- Liquor Stores

- BRAZIL Alcoholic Beverages Market by Alcoholic Strength Type

- Low Alcohol

- Medium Alcohol

- High Alcohol

- BRAZIL Alcoholic Beverages Market by Consumer Demographics Type

- Millennials

- Generation X

- Baby Boomers

- Gen Z

- MEXICO Outlook (USD Billion, 2019-2035)

- MEXICO Alcoholic Beverages Market by Product Type

- Beer

- Wine

- Spirits

- Cider

- Ready-to-Drink

- MEXICO Alcoholic Beverages Market by Distribution Channel Type

- Supermarkets

- Convenience Stores

- Online Retail

- Liquor Stores

- MEXICO Alcoholic Beverages Market by Alcoholic Strength Type

- Low Alcohol

- Medium Alcohol

- High Alcohol

- MEXICO Alcoholic Beverages Market by Consumer Demographics Type

- Millennials

- Generation X

- Baby Boomers

- Gen Z

- ARGENTINA Outlook (USD Billion, 2019-2035)

- ARGENTINA Alcoholic Beverages Market by Product Type

- Beer

- Wine

- Spirits

- Cider

- Ready-to-Drink

- ARGENTINA Alcoholic Beverages Market by Distribution Channel Type

- Supermarkets

- Convenience Stores

- Online Retail

- Liquor Stores

- ARGENTINA Alcoholic Beverages Market by Alcoholic Strength Type

- Low Alcohol

- Medium Alcohol

- High Alcohol

- ARGENTINA Alcoholic Beverages Market by Consumer Demographics Type

- Millennials

- Generation X

- Baby Boomers

- Gen Z

- REST OF SOUTH AMERICA Outlook (USD Billion, 2019-2035)

- REST OF SOUTH AMERICA Alcoholic Beverages Market by Product Type

- Beer

- Wine

- Spirits

- Cider

- Ready-to-Drink

- REST OF SOUTH AMERICA Alcoholic Beverages Market by Distribution Channel Type

- Supermarkets

- Convenience Stores

- Online Retail

- Liquor Stores

- REST OF SOUTH AMERICA Alcoholic Beverages Market by Alcoholic Strength Type

- Low Alcohol

- Medium Alcohol

- High Alcohol

- REST OF SOUTH AMERICA Alcoholic Beverages Market by Consumer Demographics Type

- Millennials

- Generation X

- Baby Boomers

- Gen Z

- MEA Outlook (USD Billion, 2019-2035)

- MEA Alcoholic Beverages Market by Product Type

- Beer

- Wine

- Spirits

- Cider

- Ready-to-Drink

- MEA Alcoholic Beverages Market by Distribution Channel Type

- Supermarkets

- Convenience Stores

- Online Retail

- Liquor Stores

- MEA Alcoholic Beverages Market by Alcoholic Strength Type

- Low Alcohol

- Medium Alcohol

- High Alcohol

- MEA Alcoholic Beverages Market by Consumer Demographics Type

- Millennials

- Generation X

- Baby Boomers

- Gen Z

- MEA Alcoholic Beverages Market by Regional Type

- GCC Countries

- South Africa

- Rest of MEA

- GCC COUNTRIES Outlook (USD Billion, 2019-2035)

- GCC COUNTRIES Alcoholic Beverages Market by Product Type

- Beer

- Wine