Prototyping

Tooling

Production Parts

Custom Components

Plastic

Metal

Ceramics

Composites

Fused Deposition Modeling

Selective Laser Sintering

Stereolithography

Digital Light Processing

Passenger Vehicles

Commercial Vehicles

Motorcycles

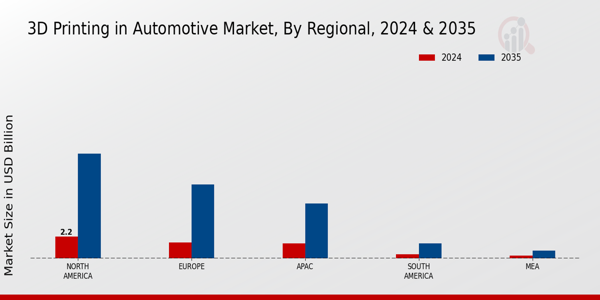

North America

Europe

South America

Asia Pacific

Middle East and Africa

North America Outlook (USD Billion, 2019-2035)

North America 3D Printing in Automotive Market by Application Type

Prototyping

Tooling

Production Parts

Custom Components

North America 3D Printing in Automotive Market by Material Type

Plastic

Metal

Ceramics

Composites

North America 3D Printing in Automotive Market by Technology Type

Fused Deposition Modeling

Selective Laser Sintering

Stereolithography

Digital Light Processing

North America 3D Printing in Automotive Market by End Use Type

Passenger Vehicles

Commercial Vehicles

Motorcycles

North America 3D Printing in Automotive Market by Regional Type

US

Canada

US Outlook (USD Billion, 2019-2035)

US 3D Printing in Automotive Market by Application Type

Prototyping

Tooling

Production Parts

Custom Components

US 3D Printing in Automotive Market by Material Type

Plastic

Metal

Ceramics

Composites

US 3D Printing in Automotive Market by Technology Type

Fused Deposition Modeling

Selective Laser Sintering

Stereolithography

Digital Light Processing

US 3D Printing in Automotive Market by End Use Type

Passenger Vehicles

Commercial Vehicles

Motorcycles

CANADA Outlook (USD Billion, 2019-2035)

CANADA 3D Printing in Automotive Market by Application Type

Prototyping

Tooling

Production Parts

Custom Components

CANADA 3D Printing in Automotive Market by Material Type

Plastic

Metal

Ceramics

Composites

CANADA 3D Printing in Automotive Market by Technology Type

Fused Deposition Modeling

Selective Laser Sintering

Stereolithography

Digital Light Processing

CANADA 3D Printing in Automotive Market by End Use Type

Passenger Vehicles

Commercial Vehicles

Motorcycles

Europe Outlook (USD Billion, 2019-2035)

Europe 3D Printing in Automotive Market by Application Type

Prototyping

Tooling

Production Parts

Custom Components

Europe 3D Printing in Automotive Market by Material Type

Plastic

Metal

Ceramics

Composites

Europe 3D Printing in Automotive Market by Technology Type

Fused Deposition Modeling

Selective Laser Sintering

Stereolithography

Digital Light Processing

Europe 3D Printing in Automotive Market by End Use Type

Passenger Vehicles

Commercial Vehicles

Motorcycles

Europe 3D Printing in Automotive Market by Regional Type

Germany

UK

France

Russia

Italy

Spain

Rest of Europe

GERMANY Outlook (USD Billion, 2019-2035)

GERMANY 3D Printing in Automotive Market by Application Type

Prototyping

Tooling

Production Parts

Custom Components

GERMANY 3D Printing in Automotive Market by Material Type

Plastic

Metal

Ceramics

Composites

GERMANY 3D Printing in Automotive Market by Technology Type

Fused Deposition Modeling

Selective Laser Sintering

Stereolithography

Digital Light Processing

GERMANY 3D Printing in Automotive Market by End Use Type

Passenger Vehicles

Commercial Vehicles

Motorcycles

UK Outlook (USD Billion, 2019-2035)

UK 3D Printing in Automotive Market by Application Type

Prototyping

Tooling

Production Parts

Custom Components

UK 3D Printing in Automotive Market by Material Type

Plastic

Metal

Ceramics

Composites

UK 3D Printing in Automotive Market by Technology Type

Fused Deposition Modeling

Selective Laser Sintering

Stereolithography

Digital Light Processing

UK 3D Printing in Automotive Market by End Use Type

Passenger Vehicles

Commercial Vehicles

Motorcycles

FRANCE Outlook (USD Billion, 2019-2035)

FRANCE 3D Printing in Automotive Market by Application Type

Prototyping

Tooling

Production Parts

Custom Components

FRANCE 3D Printing in Automotive Market by Material Type

Plastic

Metal

Ceramics

Composites

FRANCE 3D Printing in Automotive Market by Technology Type

Fused Deposition Modeling

Selective Laser Sintering

Stereolithography

Digital Light Processing

FRANCE 3D Printing in Automotive Market by End Use Type

Passenger Vehicles

Commercial Vehicles

Motorcycles

RUSSIA Outlook (USD Billion, 2019-2035)

RUSSIA 3D Printing in Automotive Market by Application Type

Prototyping

Tooling

Production Parts

Custom Components

RUSSIA 3D Printing in Automotive Market by Material Type

Plastic

Metal

Ceramics

Composites

RUSSIA 3D Printing in Automotive Market by Technology Type

Fused Deposition Modeling

Selective Laser Sintering

Stereolithography

Digital Light Processing

RUSSIA 3D Printing in Automotive Market by End Use Type

Passenger Vehicles

Commercial Vehicles

Motorcycles

ITALY Outlook (USD Billion, 2019-2035)

ITALY 3D Printing in Automotive Market by Application Type

Prototyping

Tooling

Production Parts

Custom Components

ITALY 3D Printing in Automotive Market by Material Type

Plastic

Metal

Ceramics

Composites

ITALY 3D Printing in Automotive Market by Technology Type

Fused Deposition Modeling

Selective Laser Sintering

Stereolithography

Digital Light Processing

ITALY 3D Printing in Automotive Market by End Use Type

Passenger Vehicles

Commercial Vehicles

Motorcycles

SPAIN Outlook (USD Billion, 2019-2035)

SPAIN 3D Printing in Automotive Market by Application Type

Prototyping

Tooling

Production Parts

Custom Components

SPAIN 3D Printing in Automotive Market by Material Type

Plastic

Metal

Ceramics

Composites

SPAIN 3D Printing in Automotive Market by Technology Type

Fused Deposition Modeling

Selective Laser Sintering

Stereolithography

Digital Light Processing

SPAIN 3D Printing in Automotive Market by End Use Type

Passenger Vehicles

Commercial Vehicles

Motorcycles

REST OF EUROPE Outlook (USD Billion, 2019-2035)

REST OF EUROPE 3D Printing in Automotive Market by Application Type

Prototyping

Tooling

Production Parts

Custom Components

REST OF EUROPE 3D Printing in Automotive Market by Material Type

Plastic

Metal

Ceramics

Composites

REST OF EUROPE 3D Printing in Automotive Market by Technology Type

Fused Deposition Modeling

Selective Laser Sintering

Stereolithography

Digital Light Processing

REST OF EUROPE 3D Printing in Automotive Market by End Use Type

Passenger Vehicles

Commercial Vehicles

Motorcycles

APAC Outlook (USD Billion, 2019-2035)

APAC 3D Printing in Automotive Market by Application Type

Prototyping

Tooling

Production Parts

Custom Components

APAC 3D Printing in Automotive Market by Material Type

Plastic

Metal

Ceramics

Composites

APAC 3D Printing in Automotive Market by Technology Type

Fused Deposition Modeling

Selective Laser Sintering

Stereolithography

Digital Light Processing

APAC 3D Printing in Automotive Market by End Use Type

Passenger Vehicles

Commercial Vehicles

Motorcycles

APAC 3D Printing in Automotive Market by Regional Type

China

India

Japan

South Korea

Malaysia

Thailand

Indonesia

Rest of APAC

CHINA Outlook (USD Billion, 2019-2035)

CHINA 3D Printing in Automotive Market by Application Type

Prototyping

Tooling

Production Parts

Custom Components

CHINA 3D Printing in Automotive Market by Material Type

Plastic

Metal

Ceramics

Composites

CHINA 3D Printing in Automotive Market by Technology Type

Fused Deposition Modeling

Selective Laser Sintering

Stereolithography

Digital Light Processing

CHINA 3D Printing in Automotive Market by End Use Type

Passenger Vehicles

Commercial Vehicles

Motorcycles

INDIA Outlook (USD Billion, 2019-2035)

INDIA 3D Printing in Automotive Market by Application Type

Prototyping

Tooling

Production Parts

Custom Components

INDIA 3D Printing in Automotive Market by Material Type

Plastic

Metal

Ceramics

Composites

INDIA 3D Printing in Automotive Market by Technology Type

Fused Deposition Modeling

Selective Laser Sintering

Stereolithography

Digital Light Processing

INDIA 3D Printing in Automotive Market by End Use Type

Passenger Vehicles

Commercial Vehicles

Motorcycles

JAPAN Outlook (USD Billion, 2019-2035)

JAPAN 3D Printing in Automotive Market by Application Type

Prototyping

Tooling

Production Parts

Custom Components

JAPAN 3D Printing in Automotive Market by Material Type

Plastic

Metal

Ceramics

Composites

JAPAN 3D Printing in Automotive Market by Technology Type

Fused Deposition Modeling

Selective Laser Sintering

Stereolithography

Digital Light Processing

JAPAN 3D Printing in Automotive Market by End Use Type

Passenger Vehicles

Commercial Vehicles

Motorcycles

SOUTH KOREA Outlook (USD Billion, 2019-2035)

SOUTH KOREA 3D Printing in Automotive Market by Application Type

Prototyping

Tooling

Production Parts

Custom Components

SOUTH KOREA 3D Printing in Automotive Market by Material Type

Plastic

Metal

Ceramics

Composites

SOUTH KOREA 3D Printing in Automotive Market by Technology Type

Fused Deposition Modeling

Selective Laser Sintering

Stereolithography

Digital Light Processing

SOUTH KOREA 3D Printing in Automotive Market by End Use Type

Passenger Vehicles

Commercial Vehicles

Motorcycles

MALAYSIA Outlook (USD Billion, 2019-2035)

MALAYSIA 3D Printing in Automotive Market by Application Type

Prototyping

Tooling

Production Parts

Custom Components

MALAYSIA 3D Printing in Automotive Market by Material Type

Plastic

Metal

Ceramics

Composites

MALAYSIA 3D Printing in Automotive Market by Technology Type

Fused Deposition Modeling

Selective Laser Sintering

Stereolithography

Digital Light Processing

MALAYSIA 3D Printing in Automotive Market by End Use Type

Passenger Vehicles

Commercial Vehicles

Motorcycles

THAILAND Outlook (USD Billion, 2019-2035)

THAILAND 3D Printing in Automotive Market by Application Type

Prototyping

Tooling

Production Parts

Custom Components

THAILAND 3D Printing in Automotive Market by Material Type

Plastic

Metal

Ceramics

Composites

THAILAND 3D Printing in Automotive Market by Technology Type

Fused Deposition Modeling

Selective Laser Sintering

Stereolithography

Digital Light Processing

THAILAND 3D Printing in Automotive Market by End Use Type

Passenger Vehicles

Commercial Vehicles

Motorcycles

INDONESIA Outlook (USD Billion, 2019-2035)

INDONESIA 3D Printing in Automotive Market by Application Type

Prototyping

Tooling

Production Parts

Custom Components

INDONESIA 3D Printing in Automotive Market by Material Type

Plastic

Metal

Ceramics

Composites

INDONESIA 3D Printing in Automotive Market by Technology Type

Fused Deposition Modeling

Selective Laser Sintering

Stereolithography

Digital Light Processing

INDONESIA 3D Printing in Automotive Market by End Use Type

Passenger Vehicles

Commercial Vehicles

Motorcycles

REST OF APAC Outlook (USD Billion, 2019-2035)

REST OF APAC 3D Printing in Automotive Market by Application Type

Prototyping

Tooling

Production Parts

Custom Components

REST OF APAC 3D Printing in Automotive Market by Material Type

Plastic

Metal

Ceramics

Composites

REST OF APAC 3D Printing in Automotive Market by Technology Type

Fused Deposition Modeling

Selective Laser Sintering

Stereolithography

Digital Light Processing

REST OF APAC 3D Printing in Automotive Market by End Use Type

Passenger Vehicles

Commercial Vehicles

Motorcycles

South America Outlook (USD Billion, 2019-2035)

South America 3D Printing in Automotive Market by Application Type

Prototyping

Tooling

Production Parts

Custom Components

South America 3D Printing in Automotive Market by Material Type

Plastic

Metal

Ceramics

Composites

South America 3D Printing in Automotive Market by Technology Type

Fused Deposition Modeling

Selective Laser Sintering

Stereolithography

Digital Light Processing

South America 3D Printing in Automotive Market by End Use Type

Passenger Vehicles

Commercial Vehicles

Motorcycles

South America 3D Printing in Automotive Market by Regional Type

Brazil

Mexico

Argentina

Rest of South America

BRAZIL Outlook (USD Billion, 2019-2035)

BRAZIL 3D Printing in Automotive Market by Application Type

Prototyping

Tooling

Production Parts

Custom Components

BRAZIL 3D Printing in Automotive Market by Material Type

Plastic

Metal

Ceramics

Composites

BRAZIL 3D Printing in Automotive Market by Technology Type

Fused Deposition Modeling

Selective Laser Sintering

Stereolithography

Digital Light Processing

BRAZIL 3D Printing in Automotive Market by End Use Type

Passenger Vehicles

Commercial Vehicles

Motorcycles

MEXICO Outlook (USD Billion, 2019-2035)

MEXICO 3D Printing in Automotive Market by Application Type

Prototyping

Tooling

Production Parts

Custom Components

MEXICO 3D Printing in Automotive Market by Material Type

Plastic

Metal

Ceramics

Composites

MEXICO 3D Printing in Automotive Market by Technology Type

Fused Deposition Modeling

Selective Laser Sintering

Stereolithography

Digital Light Processing

MEXICO 3D Printing in Automotive Market by End Use Type

Passenger Vehicles

Commercial Vehicles

Motorcycles

ARGENTINA Outlook (USD Billion, 2019-2035)

ARGENTINA 3D Printing in Automotive Market by Application Type

Prototyping

Tooling

Production Parts

Custom Components

ARGENTINA 3D Printing in Automotive Market by Material Type

Plastic

Metal

Ceramics

Composites

ARGENTINA 3D Printing in Automotive Market by Technology Type

Fused Deposition Modeling

Selective Laser Sintering

Stereolithography

Digital Light Processing

ARGENTINA 3D Printing in Automotive Market by End Use Type

Passenger Vehicles

Commercial Vehicles

Motorcycles

REST OF SOUTH AMERICA Outlook (USD Billion, 2019-2035)

REST OF SOUTH AMERICA 3D Printing in Automotive Market by Application Type

Prototyping

Tooling

Production Parts

Custom Components

REST OF SOUTH AMERICA 3D Printing in Automotive Market by Material Type

Plastic

Metal

Ceramics

Composites

REST OF SOUTH AMERICA 3D Printing in Automotive Market by Technology Type

Fused Deposition Modeling

Selective Laser Sintering

Stereolithography

Digital Light Processing

REST OF SOUTH AMERICA 3D Printing in Automotive Market by End Use Type

Passenger Vehicles

Commercial Vehicles

Motorcycles

MEA Outlook (USD Billion, 2019-2035)

MEA 3D Printing in Automotive Market by Application Type

Prototyping

Tooling

Production Parts

Custom Components

MEA 3D Printing in Automotive Market by Material Type

Plastic

Metal

Ceramics

Composites

MEA 3D Printing in Automotive Market by Technology Type

Fused Deposition Modeling

Selective Laser Sintering

Stereolithography

Digital Light Processing

MEA 3D Printing in Automotive Market by End Use Type

Passenger Vehicles

Commercial Vehicles

Motorcycles

MEA 3D Printing in Automotive Market by Regional Type

GCC Countries

South Africa

Rest of MEA

GCC COUNTRIES Outlook (USD Billion, 2019-2035)

GCC COUNTRIES 3D Printing in Automotive Market by Application Type

Prototyping

Tooling

Production Parts

Custom Components

GCC COUNTRIES 3D Printing in Automotive Market by Material Type

Plastic

Metal

Ceramics

Composites

GCC COUNTRIES 3D Printing in Automotive Market by Technology Type

Fused Deposition Modeling

Selective Laser Sintering

Stereolithography

Digital Light Processing

GCC COUNTRIES 3D Printing in Automotive Market by End Use Type

Passenger Vehicles

Commercial Vehicles

Motorcycles

SOUTH AFRICA Outlook (USD Billion, 2019-2035)

SOUTH AFRICA 3D Printing in Automotive Market by Application Type

Prototyping

Tooling

Production Parts

Custom Components

SOUTH AFRICA 3D Printing in Automotive Market by Material Type

Plastic

Metal

Ceramics

Composites

SOUTH AFRICA 3D Printing in Automotive Market by Technology Type

Fused Deposition Modeling

Selective Laser Sintering

Stereolithography

Digital Light Processing

SOUTH AFRICA 3D Printing in Automotive Market by End Use Type

Passenger Vehicles

Commercial Vehicles

Motorcycles

REST OF MEA Outlook (USD Billion, 2019-2035)

REST OF MEA 3D Printing in Automotive Market by Application Type

Prototyping

Tooling

Production Parts

Custom Components

REST OF MEA 3D Printing in Automotive Market by Material Type

Plastic

Metal

Ceramics

Composites

REST OF MEA 3D Printing in Automotive Market by Technology Type

Fused Deposition Modeling

Selective Laser Sintering

Stereolithography

Digital Light Processing

REST OF MEA 3D Printing in Automotive Market by End Use Type

Passenger Vehicles

Commercial Vehicles

Motorcycles

Leave a Comment