North America : Market Leader in Analytics

North America continues to lead the Workforce Analytics and Forecasting Services Market, holding a significant market share of 6.75B in 2025. The region's growth is driven by increasing demand for data-driven decision-making, regulatory support for workforce optimization, and advancements in AI technologies. Companies are increasingly adopting analytics solutions to enhance productivity and employee engagement, making it a hotbed for innovation in workforce management.

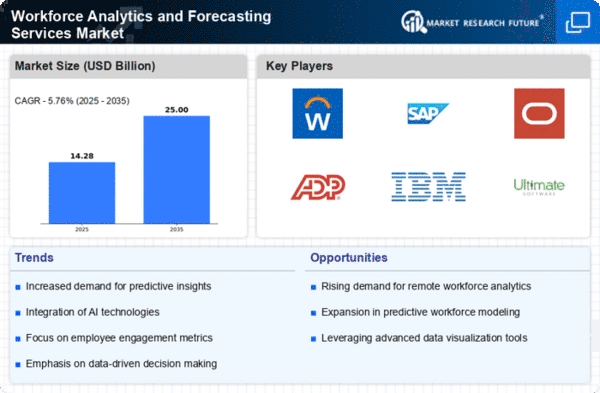

The competitive landscape is robust, with key players like Workday, Oracle, and IBM dominating the market. The U.S. is the primary contributor, supported by a strong technology infrastructure and a skilled workforce. Canadian firms like Ceridian and Visier are also making strides, contributing to the region's overall growth. The focus on compliance and data security further propels the demand for sophisticated analytics solutions, ensuring North America's position as a market leader.

Europe : Emerging Analytics Hub

Europe is witnessing a burgeoning Workforce Analytics and Forecasting Services Market, valued at 3.9B in 2025. The region's growth is fueled by increasing regulatory requirements for workforce transparency and efficiency, alongside a rising emphasis on employee well-being. Countries like Germany and the UK are at the forefront, leveraging analytics to enhance operational efficiency and comply with stringent labor laws, thus driving market demand.

The competitive landscape features major players such as SAP and Oracle, who are investing heavily in localized solutions to meet diverse regulatory needs. The presence of innovative startups is also notable, contributing to a dynamic market environment. As organizations increasingly recognize the value of data-driven insights, Europe is set to become a key player in the global workforce analytics landscape.

Asia-Pacific : Rapidly Growing Market

The Asia-Pacific region is emerging as a significant player in the Workforce Analytics and Forecasting Services Market, projected to reach 2.7B by 2025. The growth is driven by rapid digital transformation, increasing investments in technology, and a growing awareness of the benefits of workforce analytics. Countries like China and India are leading this trend, as organizations seek to optimize their workforce and improve productivity through data-driven insights.

The competitive landscape is evolving, with both The Workforce Analytics and Forecasting Services share. Companies like SAP and Oracle are expanding their presence, while regional firms are also gaining traction. The focus on enhancing employee experience and operational efficiency is pushing organizations to adopt advanced analytics solutions, making the Asia-Pacific market a focal point for future growth.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa region is in the nascent stages of developing its Workforce Analytics and Forecasting Services Market, currently valued at 0.15B in 2025. The growth potential is significant, driven by increasing investments in technology and a growing recognition of the importance of data analytics in workforce management. Countries like South Africa and the UAE are beginning to adopt analytics solutions to enhance operational efficiency and workforce planning.

The competitive landscape is still developing, with a mix of local and international players entering the market. As organizations in this region increasingly prioritize data-driven decision-making, the demand for workforce analytics is expected to rise. Government initiatives aimed at improving workforce productivity further support this emerging market, positioning it for future growth.