Market Trends

Key Emerging Trends in the Wood Coatings Market

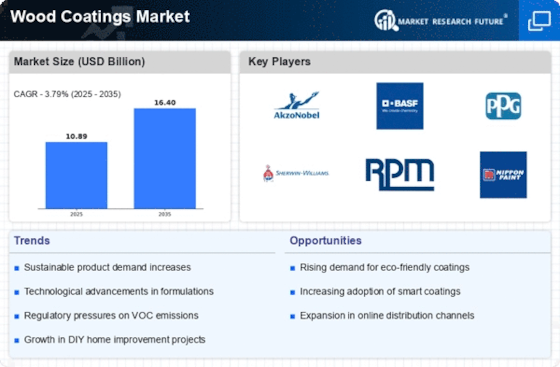

The market trends of wood coatings depict a dynamic landscape influenced by various factors shaping its growth trajectory. Wood coatings, applied to wood surfaces for protection, decoration, and enhancement of aesthetic appeal, find extensive applications in industries such as furniture, flooring, cabinets, doors, and decking. One significant trend driving the wood coatings market is the increasing demand for environmentally friendly and sustainable coatings solutions. With growing awareness of environmental issues and regulations concerning volatile organic compounds (VOCs) emissions, there is a rising preference for water-based and low-VOC wood coatings over solvent-based alternatives. Water-based coatings offer several benefits, including reduced environmental impact, lower odor, faster drying times, and ease of application, making them increasingly popular among consumers and manufacturers alike.

Moreover, the construction industry represents a major market for wood coatings, driven by the growing demand for wood-based building materials such as engineered wood products, laminates, and decorative panels. Wood coatings are essential for protecting exterior wood surfaces from exposure to harsh environmental conditions such as UV radiation, moisture, and temperature fluctuations. Additionally, the aesthetic appeal of wood coatings plays a crucial role in enhancing the appearance of interior wood surfaces such as floors, walls, ceilings, and trim, contributing to the overall ambiance and design of residential, commercial, and institutional spaces. Furthermore, the furniture industry relies heavily on wood coatings for finishing and protecting wooden furniture pieces, where the coatings' durability, scratch resistance, and color retention properties are essential for ensuring long-term performance and customer satisfaction.

Additionally, technological advancements and innovations are driving the growth of the wood coatings market. Manufacturers are investing in research and development activities to improve the performance characteristics of wood coatings and develop innovative formulations tailored to specific application requirements. This includes the development of UV-curable coatings, high-performance polyurethane coatings, and nanotechnology-based coatings with enhanced durability, weather resistance, and scratch resistance properties. Moreover, advancements in application technologies such as spray, brush, and roller coating systems enable the precise application of wood coatings, reducing material wastage, improving efficiency, and ensuring uniform coverage and finish quality.

Furthermore, the growing trend of DIY (do-it-yourself) projects and home renovations is contributing to the demand for wood coatings in the consumer market segment. With increasing disposable incomes and access to online resources and tutorials, homeowners are increasingly taking on home improvement projects and refinishing furniture and wood surfaces themselves. This trend has led to a surge in demand for consumer-friendly wood coatings that are easy to use, safe, and provide professional-quality results. Manufacturers are responding to this trend by introducing a wide range of DIY-friendly wood coatings in convenient packaging sizes, along with instructional materials and technical support, to cater to the needs of DIY enthusiasts and hobbyists.

However, the wood coatings market faces challenges such as raw material availability, pricing volatility, and competitive pressures. The prices of key raw materials used in wood coatings formulations, such as resins, pigments, and additives, are subject to fluctuations due to factors such as supply-demand dynamics, geopolitical tensions, and currency fluctuations. Moreover, the competitive landscape of the wood coatings market is characterized by the presence of numerous global and regional players vying for market share through product differentiation, branding, and distribution strategies. Additionally, regulatory requirements concerning product safety, labeling, and environmental compliance pose challenges for wood coatings manufacturers, necessitating investments in research, testing, and compliance activities.

Leave a Comment