Expansion of Smart Cities

The development of smart cities is a crucial factor influencing the Wireless Infrastructure Market. As urban areas evolve into smart cities, the integration of advanced technologies such as IoT, AI, and big data analytics becomes essential. This transformation requires a robust wireless infrastructure to support various applications, including smart transportation, energy management, and public safety. Reports indicate that investments in smart city projects are expected to exceed 2 trillion dollars by 2025, highlighting the substantial opportunities for wireless infrastructure providers. The Wireless Infrastructure Market stands to benefit immensely as municipalities prioritize the establishment of reliable and efficient communication networks.

Emergence of Advanced Technologies

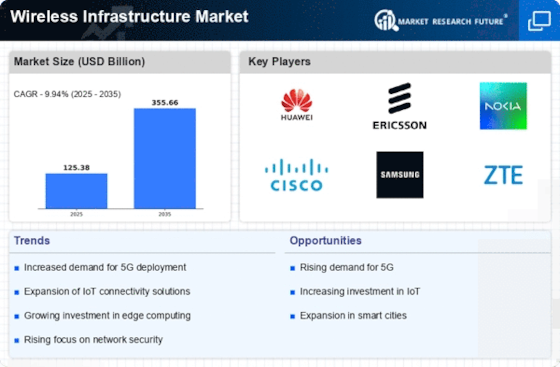

The emergence of advanced technologies such as 5G, edge computing, and artificial intelligence is reshaping the Wireless Infrastructure Market. These technologies promise to enhance network performance, reduce latency, and enable new applications that require high-speed connectivity. For instance, 5G technology is expected to support up to 1 million devices per square kilometer, significantly increasing network capacity. As industries adopt these technologies, the demand for upgraded wireless infrastructure will likely escalate. This shift presents a substantial opportunity for infrastructure providers to innovate and expand their offerings, thereby driving growth within the Wireless Infrastructure Market.

Regulatory Initiatives and Funding

Regulatory initiatives and funding programs play a pivotal role in shaping the Wireless Infrastructure Market. Governments worldwide are increasingly recognizing the importance of robust wireless infrastructure for economic growth and social development. Initiatives aimed at expanding broadband access, particularly in underserved areas, are gaining momentum. For example, funding programs are being established to support the deployment of wireless networks in rural regions. This regulatory support not only encourages investment in infrastructure but also fosters competition among service providers. As a result, the Wireless Infrastructure Market is poised for growth as stakeholders respond to these favorable regulatory environments.

Increased Mobile Device Penetration

The proliferation of mobile devices is a significant driver of the Wireless Infrastructure Market. With billions of smartphones, tablets, and wearables in use, the demand for reliable wireless connectivity continues to rise. Data suggests that mobile device penetration is projected to reach over 80% of the global population by 2025. This trend necessitates the expansion of wireless networks to accommodate the growing number of connected devices. As a result, telecommunications companies are likely to invest heavily in enhancing their infrastructure capabilities, thereby propelling the Wireless Infrastructure Market forward. The need for improved coverage and capacity is becoming increasingly critical.

Rising Demand for High-Speed Connectivity

The increasing demand for high-speed connectivity is a primary driver of the Wireless Infrastructure Market. As consumers and businesses alike seek faster internet speeds, the need for robust wireless infrastructure becomes paramount. According to recent data, the number of broadband subscriptions has surged, with a notable increase in mobile data traffic projected to reach 77 exabytes per month by 2025. This surge necessitates the expansion and enhancement of wireless networks, compelling service providers to invest in advanced infrastructure solutions. Consequently, the Wireless Infrastructure Market is likely to experience significant growth as companies strive to meet the escalating demand for seamless connectivity.