Rising Demand for Bottled Wine

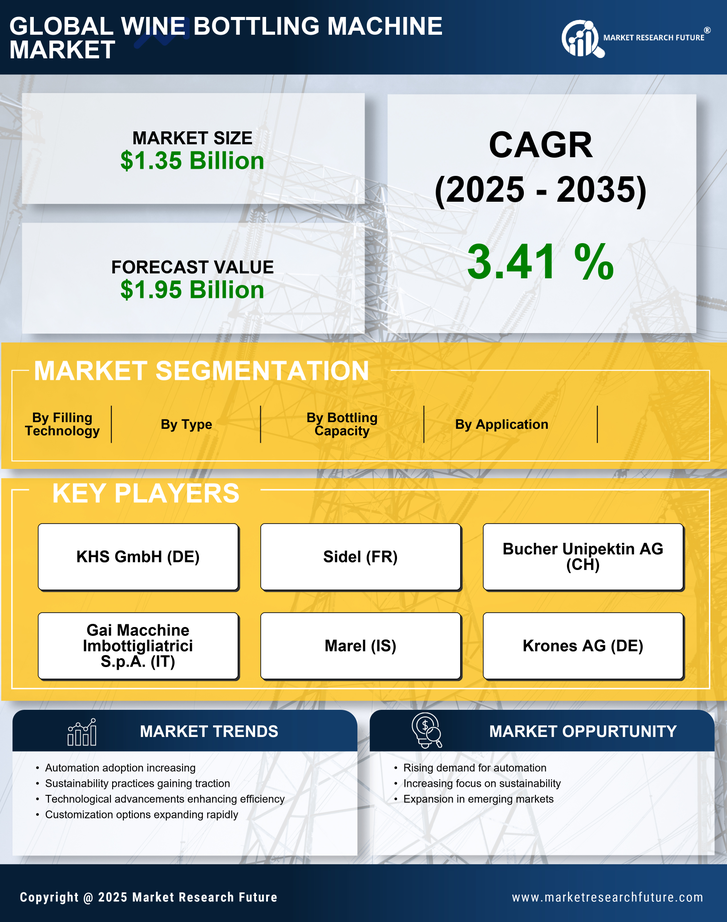

The Wine Bottling Machine Market is experiencing a notable surge in demand for bottled wine, driven by changing consumer preferences. As wine consumption continues to rise, particularly among millennials and younger demographics, the need for efficient bottling solutions becomes paramount. In 2025, the wine market is projected to reach a valuation of approximately 400 billion USD, indicating a robust growth trajectory. This increasing demand necessitates advanced bottling technologies that can enhance production efficiency and maintain product quality. Consequently, manufacturers are investing in innovative bottling machines that cater to the evolving needs of wineries, thereby propelling the Wine Bottling Machine Market forward.

Focus on Quality and Consistency

Quality assurance remains a critical factor in the Wine Bottling Machine Market, as consumers increasingly seek premium products. Wineries are prioritizing consistency in flavor and packaging, which necessitates the use of advanced bottling technologies. The integration of automated systems and precision filling machines ensures that each bottle meets stringent quality standards. This focus on quality is reflected in the market, where the demand for high-end bottling solutions is on the rise. As wineries strive to enhance their brand reputation, the investment in sophisticated bottling machinery becomes essential, thereby driving growth in the Wine Bottling Machine Market.

Expansion of Wine Production Facilities

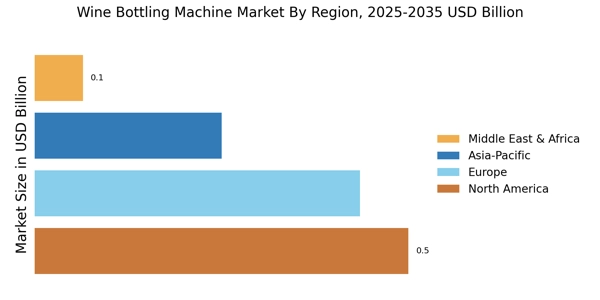

The expansion of wine production facilities is a pivotal driver in the Wine Bottling Machine Market. As new wineries emerge and existing ones expand their operations, the demand for efficient bottling solutions escalates. This trend is particularly evident in regions known for wine production, where investment in modern bottling equipment is essential to meet growing consumer demand. In 2025, it is projected that the number of wineries will increase by approximately 15%, further fueling the need for advanced bottling technologies. Consequently, manufacturers of wine bottling machines are poised to benefit from this expansion, driving growth within the Wine Bottling Machine Market.

Sustainability and Eco-Friendly Practices

Sustainability initiatives are gaining traction within the Wine Bottling Machine Market, as consumers become more environmentally conscious. Wineries are increasingly adopting eco-friendly practices, including the use of recyclable materials and energy-efficient bottling processes. This shift is not only beneficial for the environment but also aligns with consumer expectations for sustainable products. In 2025, it is estimated that the market for sustainable packaging solutions in the wine industry will exceed 10 billion USD. As a result, manufacturers of bottling machines are innovating to provide solutions that support these sustainability goals, thus contributing to the growth of the Wine Bottling Machine Market.

Technological Advancements in Bottling Equipment

The Wine Bottling Machine Market is witnessing rapid technological advancements that enhance production capabilities. Innovations such as smart bottling systems, IoT integration, and automated quality control are transforming traditional bottling processes. These technologies not only improve efficiency but also reduce operational costs for wineries. In 2025, the adoption of smart bottling solutions is expected to increase by over 25%, reflecting a significant shift towards automation in the industry. As wineries seek to optimize their operations and respond to market demands, the integration of advanced bottling technologies becomes a key driver in the Wine Bottling Machine Market.