Rising Energy Costs

The increasing costs of traditional energy sources are driving interest in the Small Wind Power Market. As fossil fuel prices fluctuate, consumers are seeking alternative energy solutions that provide long-term savings. Small wind power offers a viable option, allowing individuals and businesses to generate their own electricity and reduce reliance on grid power. This trend is particularly pronounced in regions with high energy costs, where small wind systems can provide substantial savings over time. The potential for cost savings is likely to encourage more investments in small wind technology, further enhancing market growth.

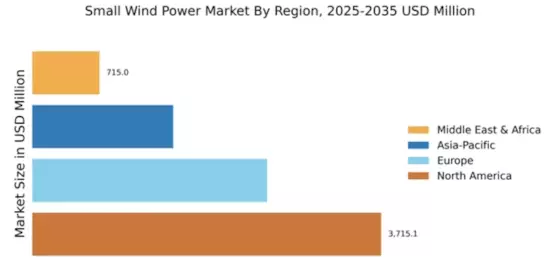

Market Growth Projections

The Small Wind Power Market is projected to experience robust growth in the coming years. With a compound annual growth rate (CAGR) of 14.33% anticipated from 2025 to 2035, the market is expected to expand significantly. This growth is driven by various factors, including technological advancements, government support, and rising energy costs. As the market evolves, it is likely to attract new players and investments, further enhancing its potential. The projected increase in market value to 32.4 USD Billion by 2035 underscores the growing importance of small wind power in the global energy landscape.

Technological Advancements

Technological innovations are propelling the Small Wind Power Market forward. Enhanced turbine designs, improved materials, and advanced control systems are making small wind turbines more efficient and cost-effective. For instance, the development of vertical-axis wind turbines has expanded the applicability of small wind systems in urban settings. These advancements not only increase energy output but also reduce maintenance costs, making small wind power more appealing to consumers. As technology continues to evolve, it is expected that the market will see a significant increase in installations, further driving growth in the sector.

Government Incentives and Policies

Government incentives and supportive policies play a crucial role in the expansion of the Small Wind Power Market. Many countries are implementing feed-in tariffs, tax credits, and grants to encourage the adoption of small wind systems. For example, in several regions, local governments are offering financial assistance for the installation of small wind turbines, which lowers the barrier to entry for consumers. These initiatives not only stimulate market growth but also align with broader energy transition goals. As policies become more favorable, the market is projected to grow significantly, with estimates suggesting a market value of 32.4 USD Billion by 2035.

Growing Demand for Renewable Energy

The Small Wind Power Market is experiencing a surge in demand for renewable energy sources. As nations strive to meet their climate goals, small wind power presents an attractive solution for decentralized energy generation. In 2024, the market is valued at 7.43 USD Billion, reflecting a growing recognition of the need for sustainable energy alternatives. This trend is particularly evident in rural and off-grid areas, where small wind turbines can provide reliable electricity. The increasing adoption of small wind systems is likely to contribute to a more resilient energy infrastructure, aligning with global efforts to reduce carbon emissions.

Environmental Awareness and Sustainability

Growing environmental awareness is significantly influencing the Small Wind Power Industry. As public concern regarding climate change and environmental degradation rises, there is a shift towards sustainable energy practices. Small wind power is viewed as a clean energy source that can help mitigate the impacts of climate change. This awareness is prompting both consumers and businesses to consider renewable energy options, including small wind systems. The increasing emphasis on sustainability is likely to drive demand for small wind power, contributing to a more sustainable energy landscape.