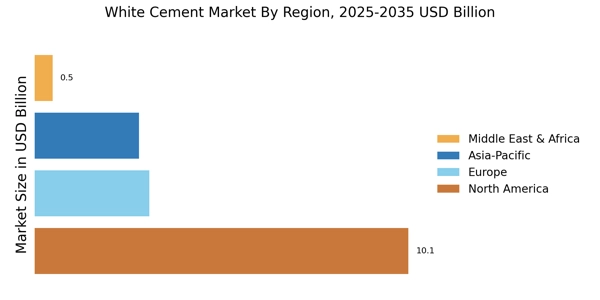

North America : Sustainable Growth Focus

The North American white cement market is driven by increasing construction activities and a growing emphasis on sustainable building materials. The United States white cement market holds the largest market share at approximately 65%, followed by Canada at around 25%. Regulatory initiatives promoting eco-friendly construction practices are further catalyzing demand. The region's focus on energy-efficient buildings and infrastructure development is expected to sustain growth in the coming years. The Mexico white cement market is emerging with new opportunities for the sector.

Leading the market are key players like LafargeHolcim and CEMEX, which dominate with innovative products and sustainable practices. The competitive landscape is characterized by a mix of established companies and emerging players, all vying for market share. The presence of stringent regulations regarding emissions and sustainability is pushing companies to innovate, ensuring that they meet both consumer demand and regulatory requirements.

Europe : Innovation and Sustainability

The Europe white cement market is witnessing a significant rise in the white cement market, driven by increasing urbanization and a shift towards sustainable construction practices. Germany and France are the largest markets, holding approximately 30% and 20% market shares, respectively. Regulatory frameworks emphasizing low-carbon construction are acting as catalysts for growth. The European Union's Green Deal is expected to further enhance the demand for eco-friendly building materials, including white cement.

Countries like Germany, France, and the UK are leading the charge, with major players such as HeidelbergCement and Saint-Gobain at the forefront. The competitive landscape is robust, with companies investing heavily in R&D to develop innovative products that meet stringent environmental standards. The presence of a well-established supply chain and distribution network further supports market growth, ensuring that demand is met efficiently.

Asia-Pacific : Emerging Market Dynamics

The Asia-Pacific region is experiencing rapid growth in the white cement market, fueled by urbanization and infrastructure development. China and India white cement market are the largest markets, accounting for approximately 40% and 25% of the market share, respectively. Government initiatives aimed at enhancing infrastructure and housing are significant growth drivers. The region's increasing focus on sustainable construction practices is also contributing to the rising demand for white cement, as it aligns with global environmental goals.

China's construction boom, coupled with India's growing urban population, presents substantial opportunities for key players like UltraTech Cement and Taiheiyo Cement Corporation. The growth of the white cement market in India is marked by both local and international companies striving to capture market share. The presence of a diverse range of products and innovations in manufacturing processes is enhancing the region's market dynamics, ensuring a competitive edge in the global arena.

Middle East and Africa : Resource-Rich Opportunities

The Middle East and Africa region is witnessing a burgeoning white cement market, driven by rapid urbanization and significant investments in infrastructure. The UAE and South Africa white cement market are the largest markets, holding approximately 35% and 20% market shares, respectively. Government initiatives aimed at enhancing construction capabilities and promoting sustainable practices are key growth drivers. The region's strategic location and resource availability further bolster its market potential.

UAE and Saudi Arabia white cement market are leading the charge, with major players such as Sika AG and Cementos Argos actively participating in the market. The competitive landscape is characterized by a mix of local and international firms, all vying for a share of the growing demand. The presence of robust construction projects and a focus on high-quality materials are shaping the market dynamics, ensuring sustained growth in the coming years.