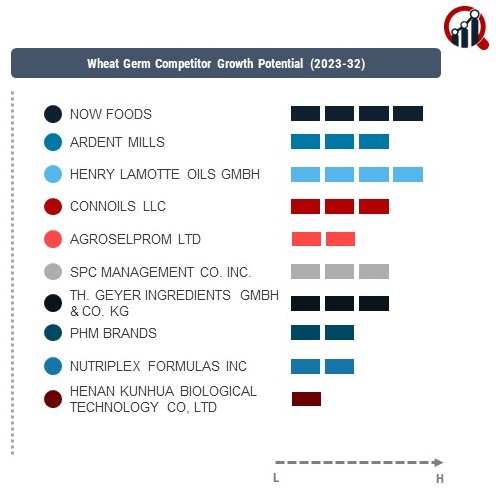

Top Industry Leaders in the Wheat Germ Market

Strategies Adopted by Wheat Germ Key Players

The wheat germ market, integral to the health food sector, is marked by a competitive landscape shaped by numerous players, each leveraging unique strategies to consolidate their market presence. This analysis aims to dissect this landscape, examining key players, their strategies, factors influencing market share, emerging companies, recent industry developments, investment trends, and the overall competitive scenario, with a focus on recent developments in 2023.

List of Key Players

- NOW Foods

- ARDENT MILLS

- Henry Lamotte Oils GmbH

- Agroselprom Ltd

- SPC Management Co. Inc.

- Geyer Ingredients GmbH & Co. KG

- PHM Brands

- NutriPlex Formulas Inc.

- ConnOils LLC

- Henan Kunhua Biological Technology Co. Ltd.

The strategies adopted by these key players are multifaceted, focusing on innovation, market expansion, and strategic partnerships. For example, General Mills employs a strategy of product diversification and leveraging its brand to promote wheat germ as a nutritious food ingredient. Expansion into new geographic markets, partnering with food manufacturers for product development, and marketing initiatives that highlight the health benefits of wheat germ are common strategies employed by these companies.

Factors for Market Share Analysis

Market share in the wheat germ sector is influenced by several factors including product quality, pricing strategies, brand reputation, distribution effectiveness, and alignment with consumer health trends. Companies that excel in managing these aspects tend to dominate the market.

New and Emerging Companies

The wheat germ market is also witnessing the entry of new and emerging companies. These entrants often focus on niche segments, such as organic or non-GMO wheat germ, catering to a growing base of health-conscious consumers. These new companies are introducing innovative products and challenging established players.

Industry News and Current Company Updates

Recent industry news has centered around the health benefits associated with wheat germ, including its nutrient density and potential health benefits. Companies are leveraging these attributes in marketing and product development strategies. Additionally, there's a trend of incorporating wheat germ into a broader range of food products, such as bakery items and health bars, increasing its market application.

Investment Trends

Investment in the wheat germ market is characterized by funding directed towards product innovation, health research, and improving supply chain capabilities. Investors are particularly interested in companies innovating in product formulation and expanding wheat germ applications in the food and beverage industry.

Overall Competitive Scenario

The wheat germ market is characterized by robust competition, with both established players and new entrants vying for market share. The market is somewhat fragmented, with large multinational corporations coexisting with smaller, niche players. Competition is based on a combination of price, product quality, brand loyalty, and alignment with evolving consumer health trends.

Recent Developments

The year 2023 brought several key developments in the wheat germ market. Notably, there was a surge in demand for organic and non-GMO wheat germ products, responding to increasing consumer demand for natural and organic foods. In response, companies either introduced new organic product lines or acquired smaller organic brands to broaden their offerings.

Advancements in processing technologies were also significant in 2023. Enhanced methods for stabilizing wheat germ have led to longer shelf lives and better nutrient preservation, broadening its use in the food industry.

Strategic collaborations and partnerships have become more prominent, with wheat germ producers and food manufacturers working together to develop new products. This collaboration is driven by the rising consumer interest in healthier eating options.

Geographically, companies in the wheat germ market have been exploring emerging markets in Asia and South America, driven by a growing middle-class interest in health foods. This expansion is supported by establishing new distribution channels and forming local partnerships.

Regulatory changes have also impacted the market. Updates to food labeling regulations in several regions now require greater transparency around the sourcing and processing of ingredients like wheat germ. Companies are adapting to these changes by enhancing supply chain transparency and ensuring compliance with new regulations.