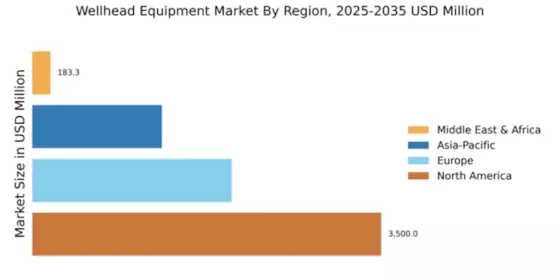

North America : Market Leader in Wellhead Equipment

North America continues to lead the Wellhead Equipment Market, holding a significant share of 3500.0. The region's growth is driven by increasing oil and gas exploration activities, technological advancements, and supportive regulatory frameworks. The demand for efficient and reliable wellhead systems is on the rise, fueled by the need for enhanced production capabilities and safety standards. Regulatory catalysts, including environmental policies, are also shaping market dynamics, encouraging innovation and investment in sustainable technologies. The competitive landscape in North America is robust, featuring key players such as Schlumberger, Halliburton, and Baker Hughes. These companies are leveraging advanced technologies and strategic partnerships to enhance their market presence. The U.S. remains the leading country, with significant contributions from Canada and Mexico. The focus on unconventional resources and offshore drilling is further propelling market growth, making North America a pivotal region in the global wellhead equipment landscape.

Europe : Emerging Market with Growth Potential

Europe's Wellhead Equipment Market is poised for growth, with a market size of 2000.0. The region is witnessing increased investments in oil and gas infrastructure, driven by the need for energy security and sustainability. Regulatory frameworks, such as the European Green Deal, are encouraging the adoption of advanced technologies and environmentally friendly practices. The demand for wellhead equipment is expected to rise as countries transition to cleaner energy sources while maintaining oil and gas production capabilities. Leading countries in this region include Norway, the UK, and Germany, which are home to several key players like Aker Solutions and TechnipFMC. The competitive landscape is characterized by innovation and collaboration among industry stakeholders. As Europe aims to balance energy needs with environmental goals, the wellhead equipment market is set to benefit from ongoing technological advancements and regulatory support. "The European Union aims to reduce greenhouse gas emissions by at least 55% by 2030," European Commission.

Asia-Pacific : Rapidly Growing Market Dynamics

The Asia-Pacific Wellhead Equipment Market is experiencing rapid growth, with a market size of 1300.0. This surge is driven by increasing energy demands, particularly in countries like China and India, where industrialization and urbanization are accelerating. The region is also witnessing significant investments in oil and gas exploration, supported by favorable government policies and initiatives aimed at enhancing energy security. The demand for advanced wellhead systems is expected to rise as operators seek to improve efficiency and reduce operational costs. Key players in the Asia-Pacific market include major companies such as Weatherford International and National Oilwell Varco. The competitive landscape is evolving, with local players emerging alongside established global firms. Countries like Australia and Indonesia are also contributing to market growth, driven by their rich natural resources and expanding energy sectors. As the region continues to develop, the wellhead equipment market is likely to see increased competition and innovation, positioning it as a vital player in the global landscape.

Middle East and Africa : Resource-Rich Frontier for Growth

The Middle East and Africa Wellhead Equipment Market, valued at 183.35, presents significant growth potential driven by the region's abundant oil and gas reserves. The demand for wellhead equipment is increasing as countries focus on maximizing production efficiency and enhancing safety measures. Regulatory frameworks are evolving to support sustainable practices, which is expected to further stimulate market growth. The region's strategic importance in global energy supply chains also contributes to its attractiveness for investment in wellhead technologies. Leading countries in this region include Saudi Arabia, the UAE, and South Africa, where major players like Cameron International and Oceaneering International are actively involved. The competitive landscape is characterized by a mix of local and international companies, all vying for market share in a resource-rich environment. As the region continues to develop its oil and gas infrastructure, the wellhead equipment market is set to expand, driven by both domestic and foreign investments.