Increasing Energy Demand

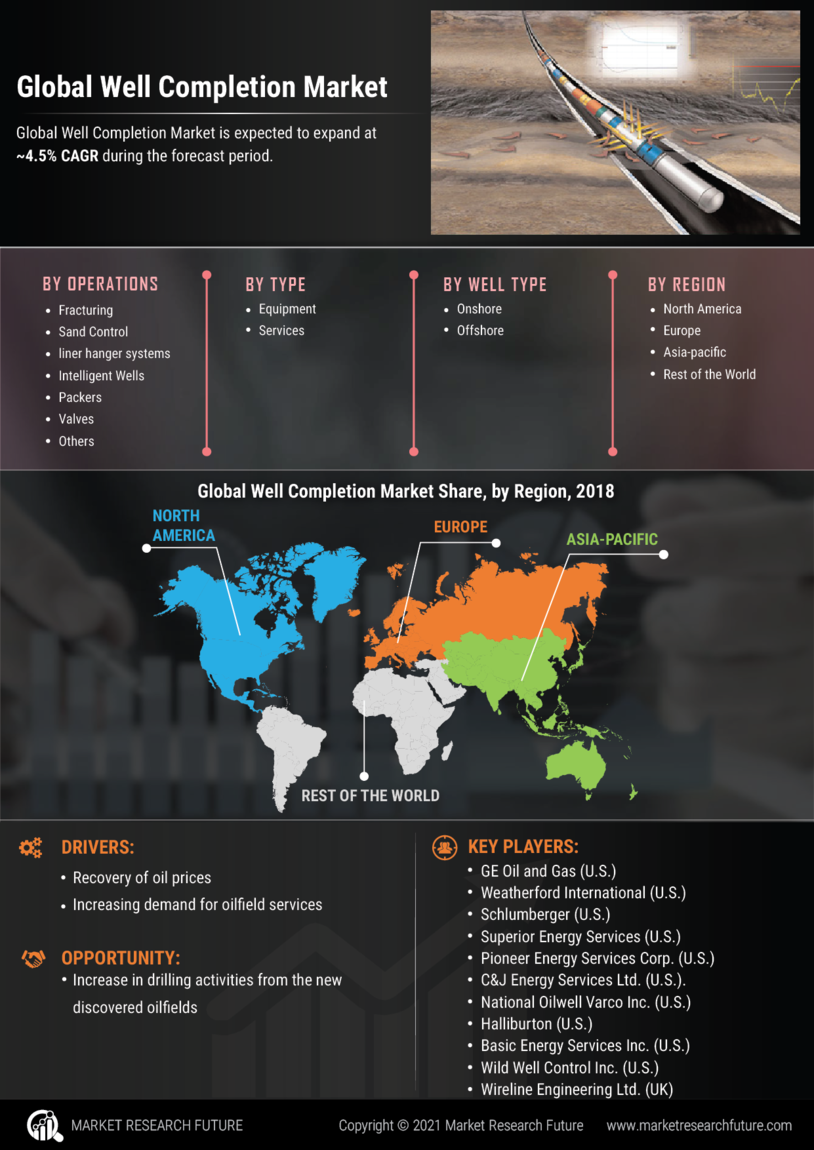

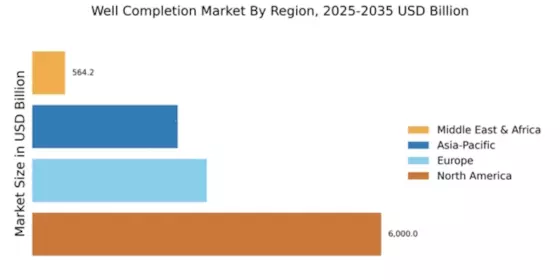

The Global Well Completion Industry is experiencing a surge in demand driven by the increasing global energy requirements. As economies expand, the need for oil and gas escalates, prompting investments in well completion technologies. In 2024, the market is valued at 40.5 USD Billion, reflecting the industry's response to heightened energy consumption. Countries are focusing on enhancing their energy security, which necessitates efficient well completion processes. This trend is expected to continue, with projections indicating a market growth to 53.8 USD Billion by 2035, suggesting a robust compound annual growth rate of 2.61% from 2025 to 2035.

Technological Advancements

Technological innovations play a pivotal role in shaping the Global Well Completion Industry. Enhanced drilling techniques, such as hydraulic fracturing and horizontal drilling, have revolutionized the efficiency of well completions. These advancements not only reduce operational costs but also improve recovery rates of hydrocarbons. The integration of automation and data analytics further optimizes completion strategies, allowing for real-time decision-making. As companies strive to maximize output while minimizing environmental impact, the adoption of these technologies is likely to accelerate. This trend indicates a significant shift towards more sustainable practices within the industry.

Investment in Unconventional Resources

The exploration and production of unconventional resources, such as shale gas and tight oil, are driving the Global Well Completion Industry. These resources require specialized completion techniques to unlock their potential, leading to increased investments in advanced technologies. As countries seek to diversify their energy portfolios, the demand for well completion services tailored to unconventional resources is likely to rise. This trend is particularly evident in regions with abundant unconventional reserves, where companies are actively pursuing innovative completion strategies to enhance recovery rates and optimize production efficiency.

Market Volatility and Economic Factors

The Global Well Completion Industry is subject to fluctuations driven by economic factors and market volatility. Changes in oil prices significantly impact exploration and production budgets, influencing investment in well completion activities. Economic downturns may lead to reduced spending on new projects, while periods of high prices can stimulate growth and innovation. Companies must navigate these challenges by adopting flexible strategies that allow for rapid adjustments to market conditions. This dynamic environment necessitates a keen understanding of economic indicators and their implications for well completion investments.

Regulatory Frameworks and Environmental Concerns

The Global Well Completion Industry is increasingly influenced by stringent regulatory frameworks aimed at minimizing environmental impacts. Governments worldwide are implementing policies that mandate safer and more environmentally friendly completion practices. This regulatory landscape encourages companies to invest in innovative technologies that comply with environmental standards. As a result, firms are focusing on sustainable well completion methods that reduce emissions and water usage. The growing emphasis on environmental stewardship not only aligns with public expectations but also enhances the industry's reputation, potentially leading to increased investment and market growth.