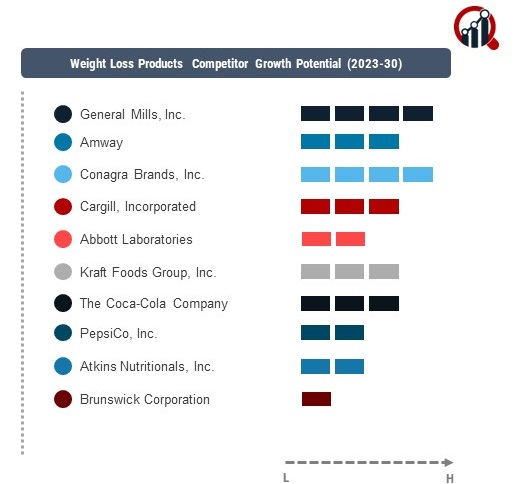

Top Industry Leaders in the Weight Loss Ingredients Market

Strategies Adopted by Weight Loss Products Key Players

The Weight Loss Products market is a dynamic segment within the broader health and wellness industry, shaped by factors such as increasing consumer awareness of health issues, rising obesity rates, and a growing emphasis on personal fitness. As of 2023, key players in this market employ various strategies to navigate these challenges, ensuring their relevance and market share in a competitive landscape.

Key Players:

General Mills Inc.

Amway

Conagra Brands Inc.

Cargill Incorporated

Abbott Laboratories

Kraft Foods Group Inc.

The Coca-Cola Company

PepsiCo Inc.

Atkins Nutritionals Inc.

Brunswick Corporation among others

Key players in the Weight Loss Products market deploy various strategies to remain competitive. Continuous innovation in product formulations, with a focus on incorporating natural ingredients, enhancing nutritional profiles, and addressing specific dietary preferences, is a central strategy. These companies invest in research and development to stay ahead of emerging trends in the weight loss and wellness space. Strategic marketing and partnerships with fitness influencers or health professionals contribute to building brand awareness and trust. Furthermore, engagement in e-commerce channels and digital marketing is a key strategy to reach a broader audience.

Market Share Analysis:

Market share analysis in the Weight Loss Products market is influenced by several factors, including brand reputation, product efficacy, pricing strategies, and distribution efficiency. Companies with strong brand equity and a history of producing effective weight loss products tend to secure a larger market share. Pricing strategies that balance affordability with the perceived value of weight loss offerings play a crucial role, given the competition with other wellness products and the varying budget constraints of consumers. Efficient distribution networks, covering both traditional retail channels and online platforms, are vital for maintaining a competitive edge in delivering weight loss products to consumers.

New and Emerging Companies:

While key players dominate the Weight Loss Products market, new and emerging companies are entering the sector, often focusing on niche markets or introducing innovative formulations. These entrants may emphasize unique weight loss methodologies, novel ingredients, or target specific demographic groups, contributing to the overall diversification and innovation in the Weight Loss Products market. Although their market share may be relatively modest compared to industry leaders, these companies play a role in driving trends and meeting the evolving demands of consumers seeking personalized and effective weight management solutions.

Industry Trends:

The Weight Loss Products market has witnessed noteworthy industry news and investment trends in 2023. Key players are investing in technology adoption, incorporating features such as personalized nutrition apps, wearables, and smart devices to enhance the overall weight loss experience for consumers. Collaborations with health and fitness professionals for creating customized weight loss programs and leveraging data analytics to understand consumer behavior contribute to the development of more targeted and effective products. Additionally, investments in sustainable and eco-friendly packaging solutions reflect the industry's response to growing consumer concerns about environmental impact.

Competitive Scenario:

The overall competitive scenario in the Weight Loss Products market is marked by intense rivalry among key players striving to capture a larger share of the growing market. The industry's competitiveness is evident in the emphasis on innovation, consumer engagement, and strategic collaborations to address evolving health and wellness trends. The global reach of these companies enables them to adapt to regional variations in dietary habits, capitalize on emerging markets, and navigate complex regulatory landscapes, contributing to the overall dynamism of the industry.

Recent Development in 2023:

Quorn's Meatless Chik'n Nuggets and Beyond Meat's Fe burger are two examples of vegan and vegetarian weight reduction products that provide reduced calorie and cholesterol-free alternatives for managing weight.

Protein-rich snacks and gut-friendly probiotics are two examples of ingredients that have been integrated with additional health benefits and have gained popularity in products like Perfect Bar's Protein Brownie and RXBAR's High-Protein Chocolate Bar.