Rising Obesity Rates

The increasing prevalence of obesity in the US has become a critical driver for the weight loss-supplements market. According to the Centers for Disease Control and Prevention (CDC), approximately 42.4% of adults in the US were classified as obese in 2017-2018. This alarming statistic suggests a growing demand for effective weight management solutions, including supplements. As more individuals seek to combat obesity-related health issues, the weight loss-supplements market will likely experience significant growth. The urgency to address weight-related health concerns, such as diabetes and cardiovascular diseases, further propels consumers towards weight loss supplements, indicating a robust market potential. The focus on health and wellness continues to shape consumer behavior, leading to increased investments in this sector.

Increased Health Awareness

The growing awareness of health and wellness among the US population is significantly influencing the weight loss-supplements market. As individuals become more conscious of their dietary choices and lifestyle habits, there is a heightened interest in products that support weight management. Surveys indicate that nearly 60% of adults in the US actively seek out dietary supplements to aid in weight loss efforts. This trend is further fueled by the proliferation of health information through digital platforms, which empowers consumers to make informed decisions. Consequently, the weight loss-supplements market is experiencing a surge in demand, as consumers prioritize their health and seek effective solutions to achieve their weight loss goals.

Evolving Consumer Preferences

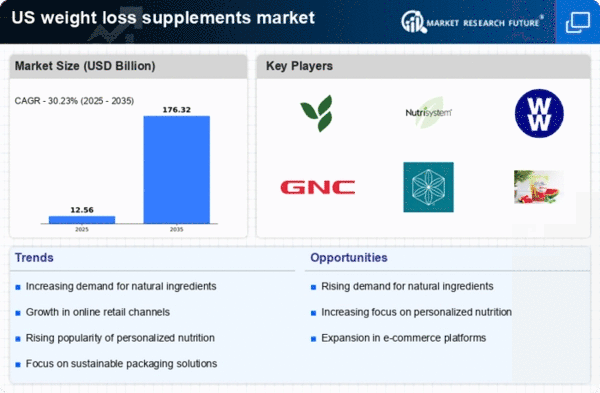

Consumer preferences in the weight loss-supplements market are shifting towards products that align with health-conscious lifestyles. A notable trend is the demand for clean-label products, which are perceived as healthier and more transparent. According to Market Research Future, around 70% of consumers in the US express a preference for supplements with natural ingredients and minimal processing. This shift indicates a growing skepticism towards artificial additives and a desire for products that promote overall well-being. As consumers become more informed about nutrition and health, the weight loss-supplements market is adapting to meet these evolving preferences. Companies are increasingly reformulating their products to cater to this demand, which may enhance their market competitiveness and appeal to a broader audience.

Regulatory Support and Guidelines

Regulatory frameworks in the US are evolving to support the weight loss-supplements market, providing a structured environment for product development and consumer safety. The Food and Drug Administration (FDA) has established guidelines that ensure the safety and efficacy of dietary supplements, which can enhance consumer trust. This regulatory support is crucial, as it encourages innovation and investment in the weight loss-supplements market. Companies that adhere to these regulations are likely to gain a competitive edge, as consumers increasingly favor products that are backed by scientific research and regulatory approval. The emphasis on safety and quality assurance may lead to a more robust market, fostering growth and consumer confidence.

Technological Advancements in Product Development

Technological innovations are playing a pivotal role in shaping the weight loss-supplements market. Advances in research and development have led to the formulation of more effective and targeted supplements. For instance, the use of biotechnology and nutrigenomics allows for the creation of personalized supplements tailored to individual metabolic profiles. This trend is gaining traction, as consumers are increasingly seeking products that cater to their unique health needs. The weight loss-supplements market is likely to benefit from these advancements, as they enhance product efficacy and consumer satisfaction. Furthermore, the integration of technology in manufacturing processes may lead to cost reductions, enabling companies to offer competitive pricing while maintaining quality.