Rising Obesity Rates

The weight loss-ingredients market is significantly influenced by the rising obesity rates in the United States. According to the Centers for Disease Control and Prevention (CDC), the prevalence of obesity among adults was approximately 42.4% in 2017-2018, a figure that has likely increased in subsequent years. This alarming trend has prompted consumers to seek effective weight management solutions, thereby boosting demand for weight loss ingredients. The market is responding with a variety of products, including meal replacements, fat burners, and appetite suppressants, all designed to cater to the needs of those looking to lose weight. As the obesity epidemic continues, the weight loss-ingredients market is expected to expand, with innovative formulations and targeted marketing strategies aimed at this growing demographic.

Influence of Social Media

The weight loss-ingredients market is increasingly shaped by the influence of social media platforms. With the rise of fitness influencers and health advocates, consumers are exposed to a plethora of weight loss products and ingredients through social media channels. This trend has led to a significant increase in consumer engagement and interest in weight loss solutions. Market data suggests that social media advertising for weight loss products has grown by over 50% in the past year, indicating a shift in marketing strategies within the weight loss-ingredients market. As consumers turn to social media for guidance and inspiration, brands are leveraging these platforms to promote their products, creating a dynamic environment that fosters competition and innovation.

Increasing Health Consciousness

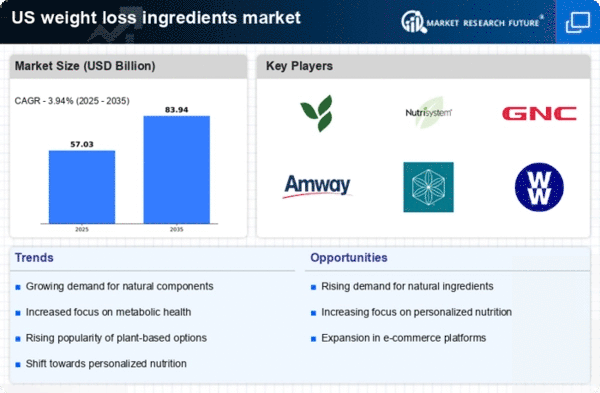

The weight loss-ingredients market is experiencing a notable surge due to the increasing health consciousness among consumers. As individuals become more aware of the health implications of obesity and related diseases, there is a growing demand for effective weight loss solutions. This trend is reflected in the market data, which indicates that the weight loss-ingredients market is projected to reach approximately $30 billion by 2026. Consumers are actively seeking products that contain natural and scientifically-backed ingredients, which has led to a rise in the popularity of supplements and functional foods. This heightened awareness is driving innovation in the weight loss-ingredients market, as companies strive to meet the evolving preferences of health-focused consumers.

Growing Demand for Personalized Nutrition

The weight loss-ingredients market is witnessing a growing demand for personalized nutrition solutions. As consumers increasingly seek tailored approaches to weight management, companies are responding by developing products that cater to individual dietary needs and preferences. This trend is supported by advancements in technology, such as DNA testing and mobile health applications, which allow for more customized dietary recommendations. The market for personalized nutrition is projected to grow significantly, with estimates suggesting it could reach $11 billion by 2027. This shift towards personalization is reshaping the weight loss-ingredients market, as brands strive to offer unique formulations that align with the specific goals and lifestyles of consumers.

Regulatory Developments and Safety Concerns

The weight loss-ingredients market is also impacted by regulatory developments and safety concerns surrounding dietary supplements. As consumers become more discerning about the products they consume, there is an increasing demand for transparency and safety in weight loss ingredients. Regulatory bodies, such as the Food and Drug Administration (FDA), are enhancing their scrutiny of weight loss products, which has led to a more cautious approach among manufacturers. This environment encourages companies to invest in research and development to ensure compliance with safety standards. As a result, the weight loss-ingredients market is evolving, with a focus on high-quality, safe, and effective products that meet regulatory requirements and consumer expectations.