Research Methodology on Web Performance Market

INTRODUCTION

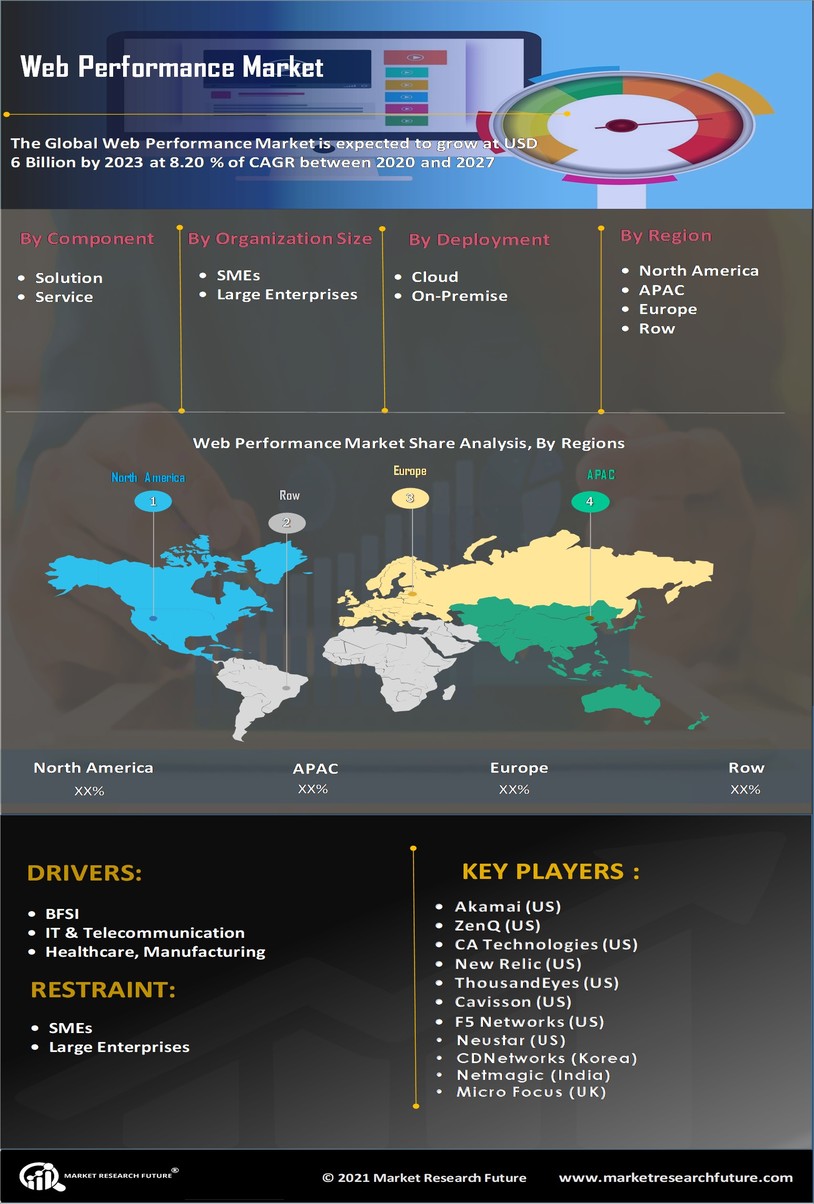

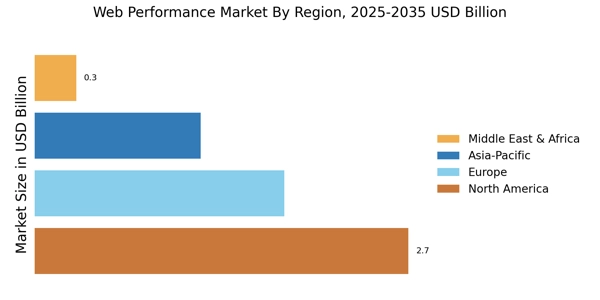

The research report titled "Global Web Performance Market" examines how the market for web performance is changing, what the potential opportunities are, and how this change is impacting the industry and the economy of the world. The report provides detailed information on the current market trends, forecasts, and projections of the upcoming trends, along with an in-depth analysis of the current professional and financial developments in the web performance market. The report covers the current estimates of the global web performance market and discusses the future prospects. The focus of this report is on the market size, key drivers and trends, as well as opportunities, and challenges faced by the industry from 2023 to 2030.

RESEARCH METHODOLOGY

BIS's research methodology includes an in-depth review of the existing market drivers and trends that affect the industry. Our research methodology is based on an empirical approach which is formulated through the use of secondary and primary data sources. Secondary data sources include published literature, case studies, public and private databases as well as online portals. Primary data sources include interviews, industry surveys, and field visits.

In order to gain an in-depth understanding of the dynamics driving the market, we have made use of a top-down and bottom-up approach. This involved the analysis of macro-economic indicators such as GDP growth rate, GDP per capita and inflation rates, the analysis of the industry structure and different segments, market size, and competitive landscape and the analysis of market trends.

The analysis and estimation of the market size were done using a combination of top-down, bottom-up and demand-side approaches. A top-down approach is adopted to estimate the overall market size based on current market trends and the market share held by leading players in the industry. The bottom-up approach was adopted to estimate the market size of different segments and sub-segments in the industry.

The qualitative and quantitative data obtained from the secondary research is validated by conducting primary interviews with industry experts. The interviews were conducted with key personnel executives, technical directors, industry associations, associations and end-users. These interviews helped to provide a thorough understanding of the industry, its dynamics and expected trends. The information obtained was used to fine-tune the research model.

Sampling and data collection included a mix of primary and secondary research sources. To obtain an understanding of the market dynamics and to estimate the overall market size, MRFR conducted surveys and interviews with stakeholders such as end-users, vendors and distributors in the web performance industry. The interviews were conducted with key personnel- directors, decision-makers, retail segment executives, distributors and end-users. Primary data was collected through online surveys and telephonic interviews.

The analysis of the data obtained through primary research is used to further corroborate the findings from the secondary research. This helped in the refining of the research model and the estimation of the market size.

Secondary data sources include existing published and unpublished literature such as company annual reports, company reports, market research reports, financial literature, statistical databases, government reports and websites. In addition, the data was also collected from public and private databases as well as online portals.

Data validation was done to ensure the accuracy of the data and the reliability of the results. The results were checked, cross-checked and verified with the help of triangulation methodologies which included the use of primary and secondary methods of data collection.

Finally, the analysis of all the data collected was synthesized and evaluated for a comprehensive understanding of the industry and to obtain accurate market estimates.

CONCLUSION

The research methodology ensures accurate market estimates and insights by leveraging a mix of primary and secondary research sources, data analysis and validation techniques. This research methodology provides a comprehensive understanding of the web performance industry, its growth prospects, key drivers and trends and emerging opportunities.

It helps industry players and stakeholders make informed decisions that add value to their businesses. The comprehensive research methodology employed provides key insights about the web performance market that helps guide their strategy and decision-making in the years to come.