Miniaturization Trends in Electronics

The trend towards miniaturization in electronics is significantly influencing the Waveguide Components and Assemblies Market. As devices become smaller and more compact, the demand for miniaturized waveguide components that maintain performance integrity is increasing. This trend is particularly evident in consumer electronics, where space constraints necessitate innovative design solutions. Manufacturers are focusing on developing smaller, lighter waveguide assemblies that do not compromise on efficiency or signal quality. The market for miniaturized waveguide components is projected to expand, driven by the growing consumer electronics sector, which is expected to reach a valuation of over 300 billion dollars by 2026.

Increasing Demand in Telecommunications

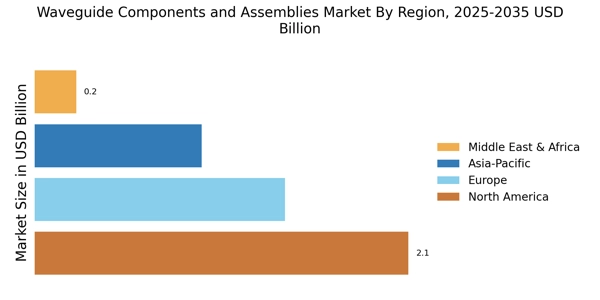

The Waveguide Components and Assemblies Market is witnessing a notable increase in demand from the telecommunications sector. The proliferation of 5G networks necessitates the deployment of advanced waveguide systems to support higher data rates and improved connectivity. As telecommunications companies invest heavily in infrastructure upgrades, the need for reliable and efficient waveguide components becomes paramount. Reports indicate that the telecommunications segment accounts for nearly 40% of the total market share, underscoring its significance. This trend is expected to continue as the global demand for high-speed internet and mobile connectivity escalates, further propelling the growth of the waveguide components market.

Growing Focus on Research and Development

The Waveguide Components and Assemblies Market is witnessing a growing focus on research and development (R&D) initiatives. Companies are increasingly investing in R&D to innovate and enhance their product offerings, aiming to meet the evolving needs of various industries. This emphasis on R&D is crucial for developing next-generation waveguide technologies that can support higher frequencies and improved performance metrics. As organizations strive to maintain competitive advantages, the market is expected to see a rise in collaborations between academic institutions and industry players. Such partnerships are likely to foster innovation and accelerate the introduction of advanced waveguide components into the market.

Emerging Applications in Aerospace and Defense

The Waveguide Components and Assemblies Market is also benefiting from emerging applications in the aerospace and defense sectors. The increasing need for advanced communication systems, radar technologies, and electronic warfare capabilities is driving demand for high-performance waveguide components. These applications require components that can withstand extreme conditions while delivering reliable performance. The aerospace and defense segment is anticipated to contribute significantly to market growth, with investments in military modernization and satellite communications expected to reach unprecedented levels. This sector's unique requirements for durability and efficiency are likely to propel the development of specialized waveguide assemblies.

Technological Advancements in Waveguide Components

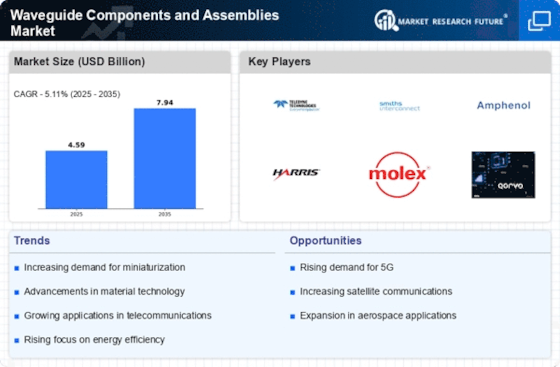

The Waveguide Components and Assemblies Market is experiencing a surge in technological advancements, which are pivotal in enhancing performance and efficiency. Innovations in materials, such as low-loss dielectrics and advanced metals, are being integrated into waveguide designs. These advancements facilitate higher frequency operations and improved signal integrity, which are crucial for applications in telecommunications and radar systems. Furthermore, the introduction of computer-aided design (CAD) tools has streamlined the development process, allowing for more complex geometries and optimized performance. As a result, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 6% over the next five years, driven by these technological enhancements.