Market Share

Waterproofing Chemicals Market Share Analysis

In the dynamic Waterproofing Chemicals market, players use market share positioning tactics to get a competitive edge and a large share. on order to differentiate their waterproofing chemicals, companies spend on research and development. This could include improving water resistance, durability, or other product-defining attributes. This distinction draws new customers and builds brand loyalty among existing customers who value these chemicals' revolutionary water damage protection.

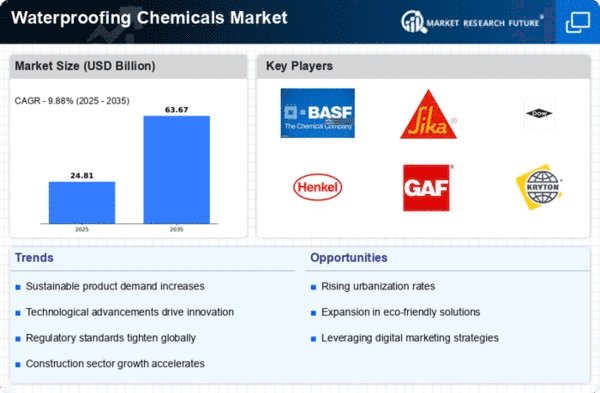

The growing and developing economies' biggest asset is infrastructure. Rapid urbanization drives Waterproofing Chemicals Market Trends. Different economies' commercial and governmental sectors are paying to get the right infrastructure. Power grids, roads, bridges, trains, water treatment facilities, airports, telecom, and more. Reliable, high-performance materials are needed. Demand for strong, resilient, lightweight, and adaptable waterproofing chemicals is rising.

Market share positioning depends on pricing strategies. Some companies pursue cost leadership to become the market's cheapest producer. They can acquire market share by targeting cost-conscious building and infrastructure projects with competitive pricing. Premium pricing tactics target a particular market that values specific waterproofing features or views higher prices as a sign of quality and durability. Companies who want to dominate the Waterproofing Chemicals market and satisfy building industry preferences must balance pricing and perceived value.

Distribution routes are key to market share. Waterproofing chemical companies establish effective distribution networks to assure timely and regular availability. Strategic product placement and agreements with major distributors, construction material suppliers, builders, and architects increase exposure and accessibility. Digital platforms and internet channels let companies reach more customers and ease construction project procurement.

Waterproofing Chemicals market share positioning requires brand building. Companies raise brand recognition, highlight unique formulations, and build trust with construction and infrastructure clients through targeted marketing and promotions. Companies can charge more and have a higher market share since construction professionals are more inclined to purchase waterproofing chemicals from a trusted brand for reliable and effective protection.

Waterproofing Chemicals market share positioning through strategic alliances and partnerships works. Company collaboration or strategic alliances might bring complementary resources, technologies, or markets. This synergy can boost market share and competitiveness. Collaborations, especially those with construction material manufacturers or building and infrastructure players, enable companies to introduce new and improved waterproofing chemical products, giving them a competitive edge in an industry that requires constant innovation.

Sustainability and environmental concerns are progressively influencing Waterproofing Chemicals market share. Companies are producing eco-friendly and sustainable formulas to suit the need for green building. This attracts environmentally conscious construction projects and corresponds with worldwide trends and legislation, improving market share.

Leave a Comment