Increasing Urbanization

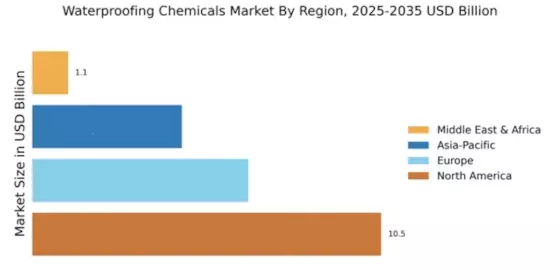

The rapid pace of urbanization globally drives the demand for the Global Waterproofing Chemicals Market Industry. As cities expand, the need for durable construction materials that can withstand environmental challenges becomes paramount. Urban areas are particularly susceptible to water damage, necessitating effective waterproofing solutions. For instance, the construction sector in emerging economies is projected to grow significantly, contributing to an estimated market value of 11.7 USD Billion in 2024. This trend indicates a growing awareness of the importance of waterproofing in urban infrastructure, which is likely to bolster the market further.

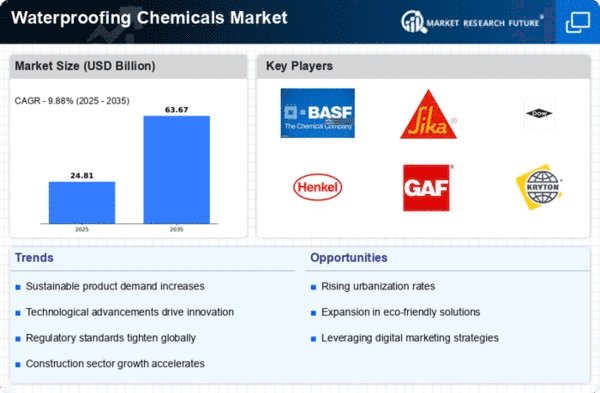

Market Growth Projections

The Global Waterproofing Chemicals Market Industry is poised for substantial growth, with projections indicating a compound annual growth rate (CAGR) of 5.15% from 2025 to 2035. This growth trajectory reflects the increasing demand for waterproofing solutions across various sectors, including construction, automotive, and consumer goods. As industries recognize the importance of protecting assets from water damage, investments in waterproofing technologies are likely to rise. This upward trend in market growth is indicative of a broader shift towards resilience and durability in product development, ensuring long-term viability in the market.

Rising Construction Activities

The resurgence of construction activities worldwide serves as a key driver for the Global Waterproofing Chemicals Market Industry. With increasing investments in residential, commercial, and industrial projects, the demand for waterproofing solutions is expected to rise. According to industry forecasts, the market is anticipated to reach 20.3 USD Billion by 2035, reflecting a robust growth trajectory. This surge is attributed to the need for sustainable building practices and the adoption of advanced waterproofing technologies, which enhance the longevity and performance of structures. Consequently, the construction boom is likely to propel the waterproofing chemicals market.

Regulatory Support and Standards

Government regulations and standards play a crucial role in shaping the Global Waterproofing Chemicals Market Industry. Many countries are implementing stringent building codes that mandate the use of effective waterproofing solutions to enhance structural integrity and safety. This regulatory framework encourages manufacturers to innovate and comply with safety standards, thereby fostering market growth. Additionally, government initiatives aimed at promoting sustainable construction practices further bolster the demand for waterproofing chemicals. As these regulations evolve, they are expected to create a favorable environment for market expansion.

Growing Awareness of Environmental Sustainability

There is a noticeable shift towards environmentally sustainable practices within the construction sector, which significantly impacts the Global Waterproofing Chemicals Market Industry. Stakeholders are increasingly prioritizing eco-friendly materials that minimize environmental impact. This trend is evident in the rising demand for water-based and bio-based waterproofing solutions. As regulations tighten globally regarding environmental standards, manufacturers are adapting their product lines to meet these requirements. This shift not only aligns with consumer preferences but also positions companies favorably in a competitive market, potentially enhancing their market share in the coming years.

Technological Advancements in Waterproofing Solutions

Innovations in waterproofing technologies are transforming the Global Waterproofing Chemicals Market Industry. The introduction of advanced materials and application techniques enhances the effectiveness and efficiency of waterproofing solutions. For example, the development of self-healing materials and nanotechnology-based coatings offers superior protection against water ingress. These advancements not only improve product performance but also reduce application time and costs. As the industry embraces these technologies, it is likely to attract new investments and expand its market reach, further driving growth in the sector.