Research Methodology on Waterproof Security Cameras Market

Introduction

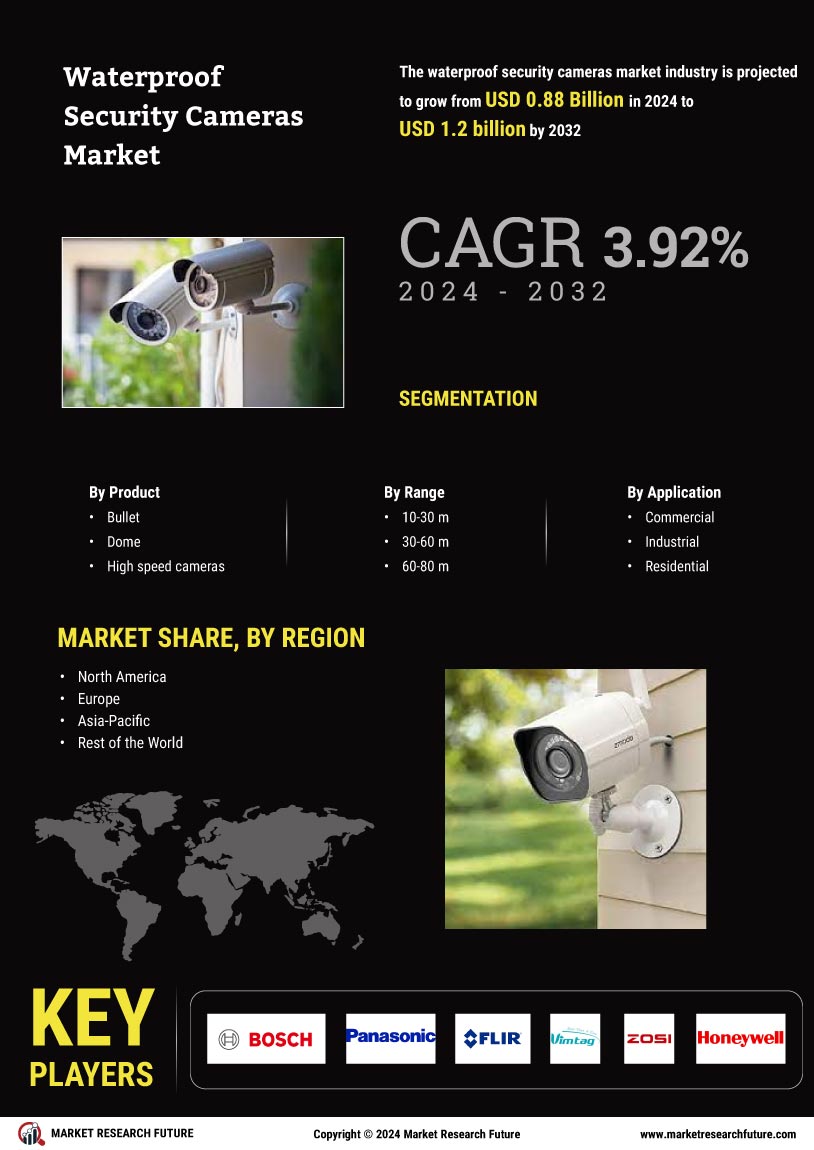

Current security cameras provide an effective and visible form of surveillance in buildings, streets and other public places and are often used to deter crime and operations of malicious activities and capture real-time activities. However, these surveillance cameras are prone to damage due to weather elements.

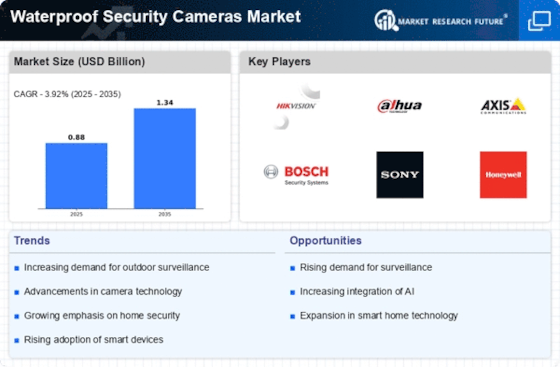

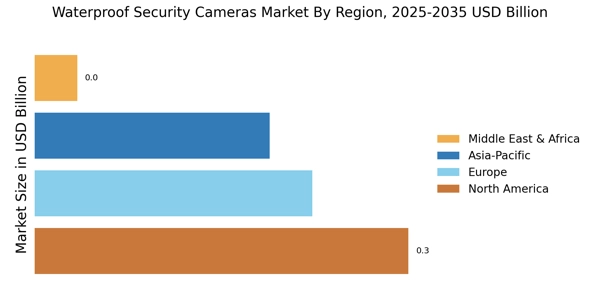

Waterproof security cameras, on the other hand, provide both security and monitoring in outdoor and indoor spaces and are specifically designed to withstand extreme environmental conditions. Today, waterproof security cameras are often used in managing public areas and private premises due to their improved capabilities. This has caused the market for waterproof security cameras to grow significantly over the past few years and the trend is expected to continue from 2023 to 2030.

Research Aim

This research aims to provide an in-depth analysis of the market for waterproof security cameras and identify the key factors driving its market growth. The research will also focus on the challenges and opportunities which are being faced by the market players to gain a comprehensive understanding of the market dynamics. This in-depth understanding will be used to form strategies and make appropriate decisions to successfully capitalize on the growth opportunities of the market.

Research Methodology

The research methodology applied in this research report consists of a combination of primary, secondary and expert interviews. These different sources of data will be used to arrive at an accurate market evaluation and analysis.

Primary Sources:

Primary sources of data are mainly used to obtain direct and first-hand information relevant to the topic under study. These sources include surveys and interviews conducted with market executives, industry experts, opinion leaders and other stakeholders who have first-hand experience and knowledge of the subject under study.

Secondary Sources:

Secondary sources of data refer to sources which are used to obtain past data and related information regarding the topic under study. Secondary sources of data for this research will include data from publications such as market reports, industry reports and journals, news websites, annual reports, case studies, white papers, etc.

Expert Interviews:

To obtain insights from the market players, interviews with industry professionals and experts will be conducted. These professionals and experts are selected based upon their experience in the field and their insights are used to understand the market dynamics and create strategies for market expansion.

Data Analysis:

Data analysis refers to the process of organizing, transforming and evaluating the data obtained from various sources to turn it into a meaningful piece of information. For this research, data analysis will be used to analyze the market trends, key market drivers and restraints, competitive landscape, and other market-related information.

Research Framework:

The research framework forms the basis of the research methodology employed in this research. This framework specifies the research process and the different activities that are to be completed at each step. It also helps in mapping out the different objectives of the research and the methods to be used to achieve these objectives.

Research Objectives

- To provide an in-depth analysis of the waterproof security cameras market

- To identify the key drivers and restraints affecting the market

- To analyze the competitive landscape and identify the leading market players

- To provide an overview of the market segmentation

- To provide insights into the future growth opportunities of the market

Conclusion

This research report aims to provide an in-depth understanding of the market for waterproof security cameras. The research methodology employed in this report consists of primary, secondary and expert interviews to arrive at an accurate market evaluation and analysis. The research has also focused on the challenges and opportunities which are being faced by the market players and identified the key factors driving the market growth.

The insights obtained from the research are expected to help the market players to gain a comprehensive understanding of the markets and create strategies to successfully capitalize on the growth opportunities of the market.