Security Cameras Market Summary

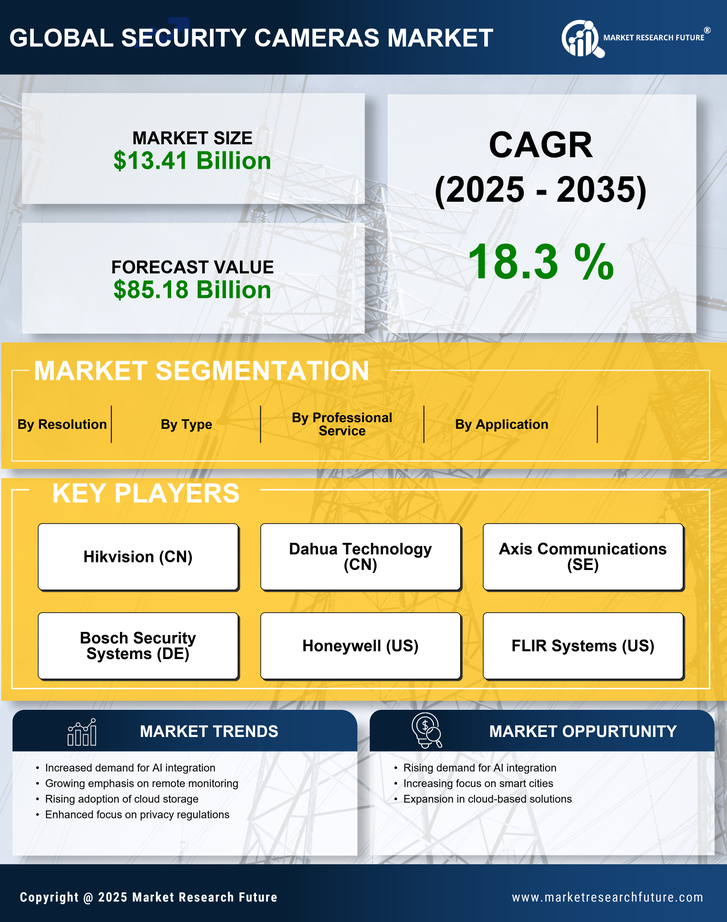

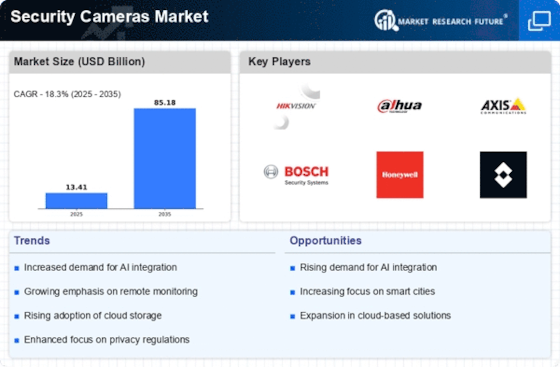

As per Market Research Future analysis, the Security Cameras Market was estimated at 13.41 USD Billion in 2024. The Security Cameras industry is projected to grow from 15.86 USD Billion in 2025 to 85.18 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 18.3% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Security Cameras Market is experiencing robust growth driven by technological advancements and increasing security concerns.

- The integration of Artificial Intelligence is enhancing the functionality and efficiency of security cameras.

- Cloud-based solutions are gaining traction, providing users with flexible and scalable monitoring options.

- Privacy and data security concerns are prompting manufacturers to develop more secure camera systems.

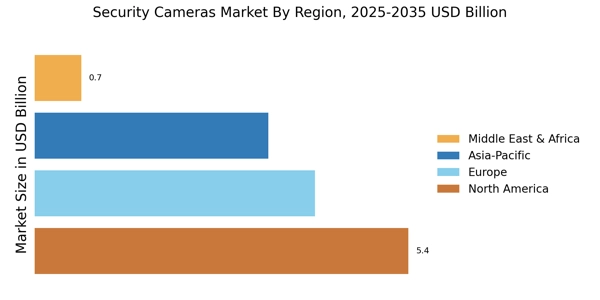

- Increasing crime rates and government initiatives are driving demand for security solutions, particularly in the North American market, while the Asia-Pacific region sees rapid growth in outdoor cameras.

Market Size & Forecast

| 2024 Market Size | 13.41 (USD Billion) |

| 2035 Market Size | 85.18 (USD Billion) |

| CAGR (2025 - 2035) | 18.3% |

Major Players

Hikvision (CN), Dahua Technology (CN), Axis Communications (SE), Bosch Security Systems (DE), Honeywell (US), FLIR Systems (US), Samsung Techwin (KR), Sony (JP), Panasonic (JP)