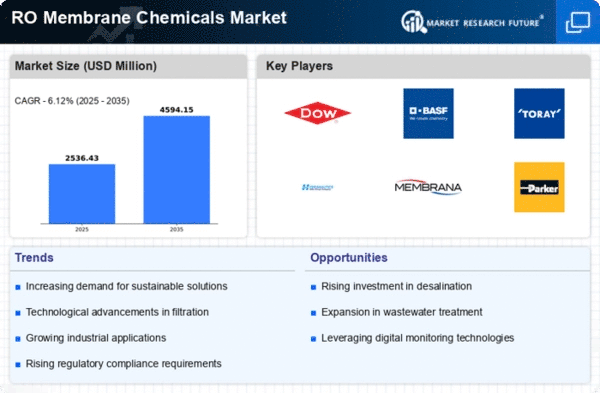

Market Growth Projections

The Global RO Membrane Chemicals Market Industry is poised for substantial growth, with projections indicating an increase from 2.39 USD Billion in 2024 to 4.59 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate (CAGR) of 6.12% from 2025 to 2035. The driving forces behind this expansion include rising demand for water purification, technological advancements, and regulatory support for water quality standards. As industries and municipalities prioritize clean water access and sustainability, the market is likely to witness robust developments in the coming years.

Rising Industrial Applications

The Global RO Membrane Chemicals Market Industry is significantly influenced by the growing applications of reverse osmosis technology across various industrial sectors. Industries such as food and beverage, pharmaceuticals, and electronics are increasingly relying on RO systems for water purification and process optimization. This trend is driven by the need for high-purity water and the reduction of contaminants in production processes. As industries continue to expand and evolve, the demand for effective membrane chemicals is likely to increase, contributing to the market's projected growth to 4.59 USD Billion by 2035.

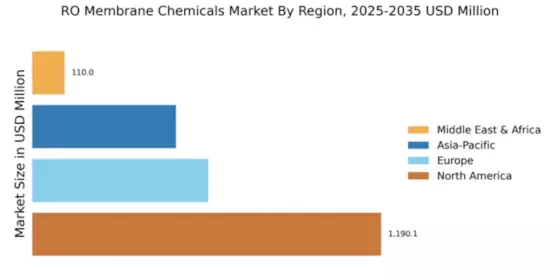

Increasing Demand for Water Purification

The Global RO Membrane Chemicals Market Industry experiences a notable surge in demand due to the increasing necessity for water purification solutions. As urbanization accelerates and industrial activities expand, the need for clean water becomes paramount. In 2024, the market is projected to reach 2.39 USD Billion, driven by the rising awareness of water quality and safety. This trend is particularly evident in developing regions where access to potable water remains a challenge. The adoption of reverse osmosis technology in municipal water treatment facilities further propels the market, indicating a robust growth trajectory in the coming years.

Regulatory Support for Water Quality Standards

The Global RO Membrane Chemicals Market Industry benefits from stringent regulatory frameworks aimed at ensuring water quality and safety. Governments worldwide are implementing regulations that mandate the treatment of wastewater and the use of advanced filtration technologies. This regulatory support fosters an environment conducive to the adoption of reverse osmosis systems across various sectors, including municipal, industrial, and agricultural. As compliance with these regulations becomes increasingly critical, the demand for RO membrane chemicals is expected to rise, further solidifying the market's growth potential in the coming years.

Technological Advancements in Membrane Technology

Technological innovations play a pivotal role in shaping the Global RO Membrane Chemicals Market Industry. The development of advanced membrane materials, such as thin-film composites, enhances the efficiency and longevity of reverse osmosis systems. These advancements not only improve water recovery rates but also reduce energy consumption, making the technology more sustainable. As a result, industries are increasingly adopting these innovations, contributing to market growth. The anticipated CAGR of 6.12% from 2025 to 2035 reflects the industry's commitment to integrating cutting-edge technologies that optimize performance and reduce operational costs.

Environmental Concerns and Sustainability Initiatives

The Global RO Membrane Chemicals Market Industry is increasingly shaped by heightened environmental awareness and sustainability initiatives. As concerns regarding water scarcity and pollution grow, industries are compelled to adopt more sustainable practices, including the use of reverse osmosis technology. This shift not only addresses environmental challenges but also aligns with corporate social responsibility goals. The emphasis on sustainable water management solutions is expected to drive the demand for RO membrane chemicals, as businesses seek to minimize their ecological footprint while ensuring compliance with environmental regulations.