North America : Market Leader in Water Treatment

North America leads the Water Treatment Equipment and Services Market, holding a significant share of 12.0 in 2024. The region's growth is driven by stringent environmental regulations, increasing water scarcity, and a rising demand for advanced treatment technologies. Government initiatives aimed at improving water quality and sustainability further catalyze market expansion. The focus on infrastructure upgrades and smart water management systems is also pivotal in shaping demand trends.

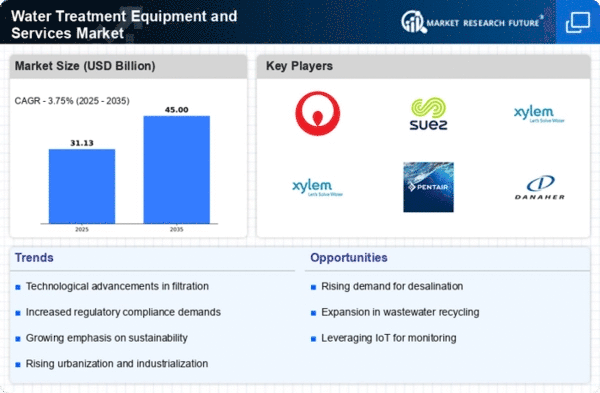

The competitive landscape in North America is robust, featuring key players such as Veolia, SUEZ, and Xylem. The U.S. stands out as the largest market, driven by substantial investments in water infrastructure and technology. Companies are increasingly adopting innovative solutions to enhance efficiency and reduce operational costs. The presence of major firms like Evoqua and Pentair underscores the region's commitment to advancing water treatment technologies, ensuring a dynamic market environment.

Europe : Innovative Water Solutions Hub

Europe's Water Treatment Equipment and Services Market is valued at 9.0, reflecting a strong commitment to sustainability and innovation. The region is propelled by stringent EU regulations aimed at improving water quality and reducing pollution. Increasing public awareness regarding water conservation and the adoption of green technologies are key demand drivers. The European market is also witnessing a shift towards decentralized water treatment solutions, enhancing efficiency and sustainability.

Leading countries such as Germany, France, and the UK dominate the market, with a competitive landscape featuring major players like Veolia and SUEZ. The presence of advanced research institutions fosters innovation, enabling the development of cutting-edge technologies. The European market is characterized by collaborations between public and private sectors, ensuring a comprehensive approach to water management. "The European Union aims to ensure that all citizens have access to clean and safe drinking water," European Commission report, 2023.

Asia-Pacific : Emerging Market with High Potential

The Asia-Pacific region, with a market size of 7.5, is rapidly emerging as a key player in the Water Treatment Equipment and Services Market. The growth is driven by urbanization, industrialization, and increasing water pollution levels. Governments are implementing stringent regulations to address water quality issues, which is boosting demand for advanced treatment solutions. The rising population and economic development further contribute to the growing need for efficient water management systems.

Countries like China, India, and Japan are at the forefront of this market, with significant investments in water infrastructure. The competitive landscape includes major players such as Kurita Water Industries and Xylem, who are focusing on innovative technologies to meet the rising demand. The region's market is characterized by a mix of local and international companies, enhancing competition and driving technological advancements. The focus on sustainable practices is also gaining traction, aligning with global environmental goals.

Middle East and Africa : Resource-Rich Yet Challenged Region

The Middle East and Africa region, with a market size of 1.5, faces significant challenges related to water scarcity and quality. The demand for Water Treatment Equipment and Services is driven by the need for sustainable solutions to address these pressing issues. Governments are increasingly investing in desalination and wastewater treatment technologies to ensure water availability. Regulatory frameworks are evolving to support innovative water management practices, enhancing market growth prospects.

Leading countries such as the UAE and South Africa are making strides in water treatment initiatives, with a focus on adopting advanced technologies. The competitive landscape features both local and international players, fostering innovation and collaboration. Companies are exploring partnerships to enhance service delivery and expand their market reach. The region's unique challenges present opportunities for growth, particularly in the development of cost-effective and efficient water treatment solutions.