Public Awareness and Engagement

Public awareness regarding environmental issues is increasingly impacting the Waste Management Carbon Credit Market. As communities become more informed about the implications of waste management on climate change, there is a growing demand for sustainable practices. Educational campaigns and community engagement initiatives are fostering a culture of recycling and waste reduction. In 2025, surveys indicate that approximately 70% of consumers are willing to support businesses that actively participate in carbon credit programs. This heightened awareness is likely to drive participation in the Waste Management Carbon Credit Market, as consumers advocate for responsible waste management practices and seek to reduce their carbon footprints.

International Climate Agreements

International climate agreements are exerting a profound influence on the Waste Management Carbon Credit Market. Commitments made by countries to reduce greenhouse gas emissions are leading to the establishment of carbon credit trading systems. These agreements often include provisions for waste management practices that contribute to emission reductions. In 2025, it is projected that countries adhering to international climate accords will collectively generate over 300 million carbon credits from waste management initiatives. This trend not only enhances the credibility of the Waste Management Carbon Credit Market but also encourages cross-border collaboration in waste management solutions, fostering a more integrated approach to tackling climate change.

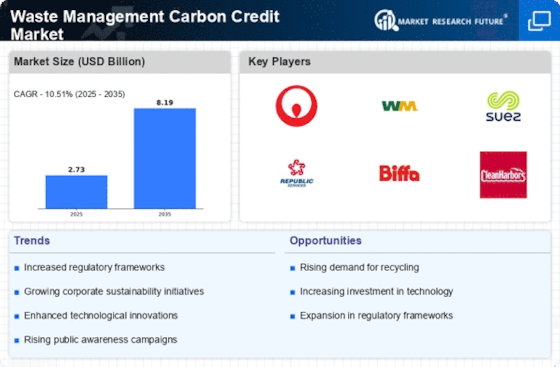

Regulatory Framework Enhancements

The Waste Management Carbon Credit Market is experiencing a notable shift due to enhanced regulatory frameworks. Governments are increasingly implementing stringent waste management policies aimed at reducing greenhouse gas emissions. For instance, regulations mandating waste diversion from landfills are becoming commonplace, thereby creating a robust demand for carbon credits. In 2025, it is estimated that compliance markets could generate over 200 million carbon credits, reflecting a significant increase in market activity. This regulatory push not only incentivizes waste management companies to adopt sustainable practices but also encourages investment in innovative waste processing technologies. As a result, the Waste Management Carbon Credit Market is likely to see accelerated growth driven by these regulatory enhancements.

Corporate Sustainability Initiatives

The increasing emphasis on corporate sustainability is significantly influencing the Waste Management Carbon Credit Market. Companies are now prioritizing environmental responsibility, often setting ambitious targets for carbon neutrality. This trend is evident as many corporations are investing in waste management solutions that align with their sustainability goals. In 2025, it is anticipated that over 60% of Fortune 500 companies will actively participate in carbon credit markets, thereby driving demand for credits generated from waste management practices. This corporate shift not only enhances the credibility of the Waste Management Carbon Credit Market but also encourages innovation and investment in sustainable waste management solutions.

Technological Advancements in Waste Processing

Technological innovations are playing a pivotal role in shaping the Waste Management Carbon Credit Market. Advanced waste processing technologies, such as anaerobic digestion and gasification, are becoming more prevalent, enabling the conversion of waste into energy while simultaneously reducing emissions. In 2025, the market for waste-to-energy technologies is projected to reach approximately 50 billion USD, indicating a growing recognition of their potential. These technologies not only enhance the efficiency of waste management operations but also generate carbon credits that can be traded in the market. Consequently, the Waste Management Carbon Credit Market is likely to benefit from the integration of these cutting-edge technologies, fostering a more sustainable approach to waste management.