North America : Market Leader in MRO Services

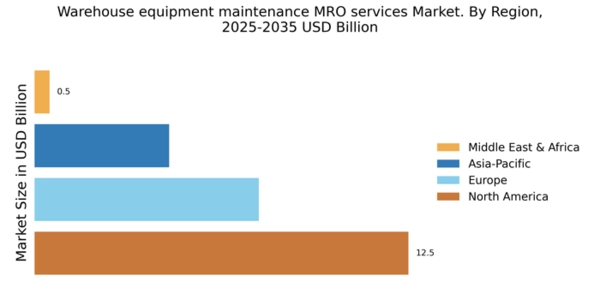

North America is poised to maintain its leadership in the Warehouse equipment maintenance MRO services market, holding a significant market share of 12.5 in 2024. The region's growth is driven by increasing automation in warehouses, stringent safety regulations, and a rising demand for efficient supply chain management. The adoption of advanced technologies, such as IoT and AI, further propels market expansion, ensuring compliance with regulatory standards and enhancing operational efficiency.

The competitive landscape in North America is robust, featuring key players like Honeywell, Rockwell Automation, and Emerson Electric. These companies leverage innovative solutions to meet the growing demand for maintenance services. The U.S. stands out as the leading country, supported by a strong industrial base and significant investments in warehouse infrastructure. The presence of established firms fosters a dynamic environment, driving continuous improvements in service delivery and customer satisfaction.

Europe : Emerging Market with Growth Potential

Europe's Warehouse equipment maintenance MRO services market is on an upward trajectory, with a market size of 7.5 in 2024. The region benefits from a strong regulatory framework promoting safety and efficiency in warehouse operations. Increasing investments in automation and digitalization are key growth drivers, alongside a growing emphasis on sustainability and energy efficiency. These factors are expected to enhance service demand, aligning with EU regulations aimed at improving operational standards across industries.

Leading countries in Europe include Germany, France, and the UK, where major players like Siemens and Schneider Electric are actively expanding their service offerings. The competitive landscape is characterized by a mix of established firms and emerging startups, fostering innovation and collaboration. The presence of key players ensures a diverse range of services, catering to the evolving needs of the market, thereby enhancing overall service quality and customer satisfaction.

Asia-Pacific : Rapidly Growing MRO Services Market

The Asia-Pacific region is experiencing rapid growth in the Warehouse equipment maintenance MRO services market, with a market size of 4.5 in 2024. This growth is fueled by increasing industrialization, urbanization, and a rising demand for efficient logistics solutions. Governments are implementing supportive policies to enhance infrastructure development, which is expected to further drive the demand for maintenance services in warehouses. The focus on improving supply chain efficiency is a key catalyst for market expansion in this region.

Countries like Japan, China, and Australia are leading the charge in this market, with significant investments in warehouse automation and maintenance technologies. Key players such as Mitsubishi Electric and Konecranes are actively involved in providing innovative solutions tailored to local market needs. The competitive landscape is evolving, with both The Warehouse equipment maintenance MRO services share, ensuring a dynamic environment for service delivery and innovation.

Middle East and Africa : Emerging Market with Untapped Potential

The Middle East and Africa region presents an emerging market for Warehouse equipment maintenance MRO services, with a market size of 0.5 in 2024. The growth in this region is primarily driven by increasing investments in infrastructure and logistics, alongside a growing emphasis on operational efficiency. Governments are recognizing the importance of modernizing warehouse facilities, which is expected to create new opportunities for maintenance services. The region's strategic location also enhances its appeal as a logistics hub, further driving demand for MRO services.

Leading countries in this region include South Africa and the UAE, where there is a growing presence of international players looking to capitalize on the market potential. The competitive landscape is characterized by a mix of local and global firms, fostering innovation and service diversification. As the market matures, the focus will shift towards enhancing service quality and meeting the evolving needs of customers, paving the way for sustainable growth in the MRO sector.