MRAM Market Summary

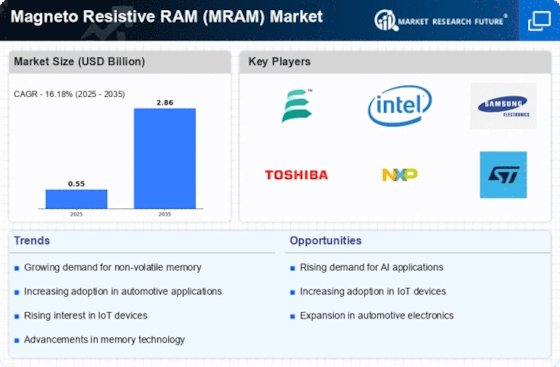

As per Market Research Future analysis, the Magneto Resistive RAM (MRAM Market) Market Size was estimated at 0.55 USD Billion in 2024. The MRAM industry is projected to grow from USD 0.639 Billion in 2025 to USD 2.863 Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 16.18% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Magneto Resistive RAM (MRAM Market) market is poised for substantial growth driven by technological advancements and increasing application demands.

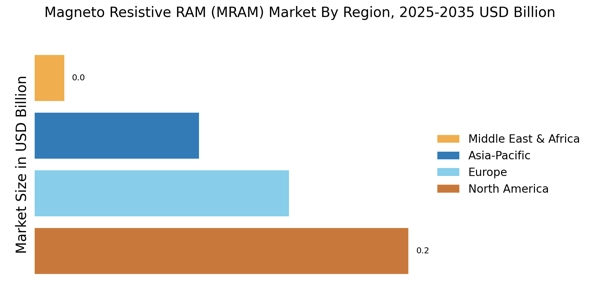

- The demand for high-performance memory solutions is escalating, particularly in North America, which remains the largest market for MRAM Market.

- Integration with the Internet of Things (IoT) is fostering innovative applications, especially in the rapidly growing Asia-Pacific region.

- Energy efficiency and sustainability are becoming focal points, influencing the design and production of MRAM Market technologies.

- The rising need for non-volatile memory solutions and advancements in MRAM Market technology are key drivers, particularly in the automotive sector.

Market Size & Forecast

| 2024 Market Size | 0.55 (USD Billion) |

| 2035 Market Size | 2.863 (USD Billion) |

| CAGR (2025 - 2035) | 16.18% |

Major Players

Everspin Technologies (US), Intel Corporation (US), Samsung Electronics (KR), Toshiba Corporation (JP), NXP Semiconductors (NL), STMicroelectronics (FR), Micron Technology (US), Western Digital Corporation (US), GlobalFoundries (US)