Walkie Talkie Size

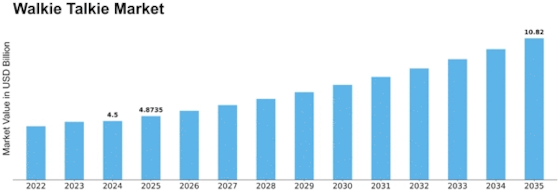

Walkie Talkie Market Growth Projections and Opportunities

The walkie-talkie market is influenced by several key factors that shape its growth and trajectory in today's communications landscape. One significant factor driving the market is the increasing demand for reliable and instant communication solutions across various industries and applications. Walkie-talkies offer a simple yet effective means of communication, allowing users to stay connected in environments where traditional cellular networks may be unreliable or unavailable. Industries such as construction, manufacturing, hospitality, security, and event management rely on walkie-talkies for real-time coordination, enhancing operational efficiency, and ensuring safety.

Moreover, the need for robust communication systems in emergency and disaster response scenarios fuels the demand for walkie-talkies. These devices play a critical role in enabling seamless communication among first responders, emergency personnel, and disaster relief teams during crises such as natural disasters, accidents, or public safety incidents. Walkie-talkies provide a reliable communication lifeline in situations where other forms of communication infrastructure may be compromised, making them indispensable tools for emergency preparedness and response efforts.

Furthermore, technological advancements and innovations in walkie-talkie design and functionality drive market growth. Manufacturers are continually improving walkie-talkie features such as range, battery life, durability, and audio quality to meet the evolving needs of users. Modern walkie-talkies may incorporate features like GPS tracking, Bluetooth connectivity, voice activation, and waterproofing, expanding their utility in diverse environments and applications. Additionally, the integration of digital technology into walkie-talkie systems enhances communication clarity, security, and interoperability, further driving market demand.

Additionally, the growing trend of outdoor recreational activities and adventure sports contributes to the expansion of the walkie-talkie market. Outdoor enthusiasts, hikers, campers, hunters, and boaters rely on walkie-talkies for communication during group outings or in remote areas where cellular coverage is limited. Walkie-talkies provide a convenient and cost-effective way for individuals to stay connected with friends and family members while enjoying outdoor adventures, enhancing safety and coordination during recreational pursuits.

Moreover, regulatory compliance and licensing requirements influence the walkie-talkie market dynamics. In many countries, walkie-talkie users are required to obtain licenses or permits to operate certain frequency bands to ensure efficient spectrum management and prevent interference with other communication systems. Compliance with regulatory standards and certification requirements is essential for walkie-talkie manufacturers and users to ensure legal operation and adherence to safety protocols. These regulations shape the design, distribution, and usage of walkie-talkie devices in different regions and industries, impacting market dynamics and competitiveness.

Furthermore, the increasing adoption of walkie-talkie solutions in emerging markets and developing countries drives market growth. As economies expand, infrastructure develops, and industrialization accelerates, there is a growing need for reliable communication tools to support business operations, public safety, and community services. Walkie-talkies offer cost-effective and scalable communication solutions that cater to the specific requirements and constraints of emerging markets, making them an attractive option for businesses, governments, and organizations seeking to improve connectivity and collaboration.

Additionally, the COVID-19 pandemic has highlighted the importance of walkie-talkies in maintaining communication and operational continuity in healthcare, public safety, and essential services. Healthcare professionals, emergency responders, and frontline workers rely on walkie-talkies for rapid communication and coordination in crisis situations, facilitating timely responses and resource allocation. The pandemic has underscored the resilience and versatility of walkie-talkies as essential tools for communication and collaboration in times of uncertainty and adversity.

Leave a Comment