Rising Demand for Consumer Electronics

The Wafer Manufacturing Equipment Market is significantly influenced by the rising demand for consumer electronics. With the proliferation of smartphones, tablets, and wearable devices, manufacturers are compelled to enhance their production capabilities. In 2025, the consumer electronics market is expected to surpass 1 trillion USD, creating a substantial need for efficient wafer manufacturing processes. This demand necessitates the adoption of advanced wafer manufacturing equipment to ensure high-quality production and meet consumer expectations. Consequently, the Wafer Manufacturing Equipment Market is poised for growth as manufacturers invest in state-of-the-art technologies to keep pace with consumer trends.

Growth of Electric Vehicles and Renewable Energy

The Wafer Manufacturing Equipment Market is also benefiting from the growth of electric vehicles (EVs) and renewable energy technologies. As the automotive sector shifts towards electrification, the demand for semiconductor components in EVs is escalating. In 2025, the semiconductor market for automotive applications is projected to reach around 50 billion USD, highlighting the increasing reliance on advanced wafer manufacturing equipment. Additionally, the expansion of solar energy technologies further drives the need for high-performance wafers. This trend suggests that the Wafer Manufacturing Equipment Market will continue to thrive as it adapts to the evolving energy landscape.

Increased Investment in Research and Development

Investment in research and development (R&D) within the Wafer Manufacturing Equipment Market is on the rise, as companies seek to innovate and improve their manufacturing processes. This trend is particularly evident in the semiconductor sector, where R&D expenditures are expected to reach 20 billion USD by 2025. Such investments are crucial for developing next-generation manufacturing technologies that enhance efficiency and reduce production costs. As companies strive to maintain a competitive edge, the focus on R&D will likely drive advancements in wafer manufacturing equipment, thereby propelling the industry forward.

Emerging Markets and Expanding Manufacturing Bases

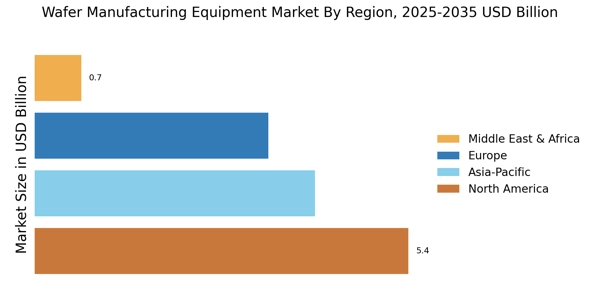

Emerging markets are playing a pivotal role in the Wafer Manufacturing Equipment Market, as countries invest in expanding their manufacturing bases. Regions such as Southeast Asia and Eastern Europe are witnessing a surge in semiconductor manufacturing activities, driven by favorable government policies and incentives. By 2025, the semiconductor manufacturing capacity in these regions is expected to grow significantly, creating new opportunities for wafer manufacturing equipment suppliers. This expansion indicates a shift in the global manufacturing landscape, suggesting that the Wafer Manufacturing Equipment Market will continue to evolve as it adapts to these emerging trends.

Technological Advancements in Semiconductor Manufacturing

The Wafer Manufacturing Equipment Market is experiencing a surge in technological advancements, particularly in semiconductor manufacturing processes. Innovations such as extreme ultraviolet lithography (EUV) and atomic layer deposition (ALD) are enhancing the precision and efficiency of wafer production. As semiconductor devices become increasingly complex, the demand for advanced manufacturing equipment rises. In 2025, the market for semiconductor manufacturing equipment is projected to reach approximately 100 billion USD, indicating a robust growth trajectory. This growth is driven by the need for smaller, faster, and more efficient electronic devices, which in turn propels the Wafer Manufacturing Equipment Market forward.