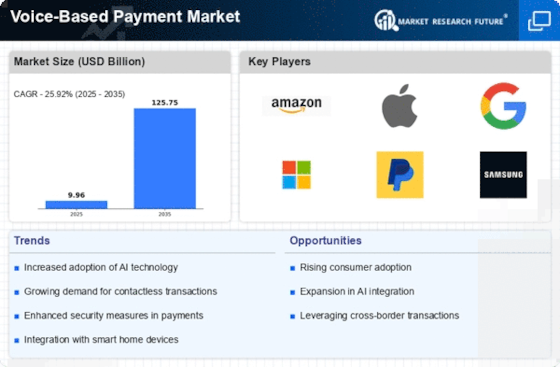

Growing E-commerce Sector

The rapid expansion of the e-commerce sector is significantly influencing the Voice-Based Payment Market. With online shopping becoming a staple for consumers, the demand for efficient and user-friendly payment methods is on the rise. Recent reports suggest that e-commerce sales have reached unprecedented levels, with projections indicating continued growth in the coming years. Voice-based payments offer a convenient alternative to traditional payment methods, allowing users to complete transactions hands-free. This trend is particularly appealing to younger demographics who prioritize speed and convenience in their shopping experiences. As e-commerce continues to thrive, the Voice-Based Payment Market is likely to benefit from increased adoption, as businesses seek to enhance their payment offerings to meet consumer expectations.

Rise of Contactless Payments

The rise of contactless payment methods is a significant driver for the Voice-Based Payment Market. As consumers increasingly prefer touchless transactions, voice-activated payments are emerging as a viable alternative. Recent data indicates that contactless payment transactions have surged, with a notable increase in adoption across various sectors. This shift is driven by the desire for convenience and speed, as consumers seek to minimize physical contact during transactions. Voice-based payments align perfectly with this trend, offering a hands-free solution that enhances the overall shopping experience. As retailers and service providers integrate voice payment options into their systems, the Voice-Based Payment Market is expected to witness substantial growth. The synergy between contactless payments and voice technology may redefine consumer behavior in the payment landscape.

Focus on Security and Privacy

Security and privacy concerns are paramount in the Voice-Based Payment Market. As voice transactions become more prevalent, consumers are increasingly aware of the potential risks associated with voice data. Recent surveys indicate that over 70% of users express concerns about the security of their voice-activated payments. In response, companies are investing heavily in advanced encryption and authentication technologies to safeguard user data. This focus on security not only addresses consumer apprehensions but also fosters trust in voice payment systems. As the industry evolves, it is expected that enhanced security measures will become a standard feature, further driving the adoption of voice-based payment solutions. The commitment to protecting user privacy may ultimately shape the future landscape of the Voice-Based Payment Market.

Integration with Smart Devices

The proliferation of smart devices is a key driver for the Voice-Based Payment Market. As more households adopt smart speakers, wearables, and IoT devices, the demand for voice-activated payment solutions is likely to increase. Recent statistics indicate that the number of smart speakers in use has surpassed 200 million, creating a vast ecosystem for voice-based transactions. This integration allows consumers to make payments effortlessly, enhancing convenience and user experience. Furthermore, as manufacturers continue to embed voice payment capabilities into their devices, the Voice-Based Payment Market is poised for substantial growth. The seamless interaction between devices and payment systems may redefine how consumers engage with their finances, making voice payments a preferred method for many.

Technological Advancements in AI

The Voice-Based Payment Market is experiencing a surge in technological advancements, particularly in artificial intelligence. AI-driven voice recognition systems are becoming increasingly sophisticated, enabling more accurate and efficient transactions. According to recent data, the accuracy of voice recognition technology has improved significantly, with error rates dropping below 5%. This enhancement not only boosts user confidence but also encourages wider adoption among consumers and businesses alike. As AI continues to evolve, it is likely that the Voice-Based Payment Market will see further innovations, such as personalized voice assistants that can handle complex transactions seamlessly. This trend suggests a promising future for voice-based payment solutions, as they become more integrated into everyday financial activities.