Top Industry Leaders in the Vitamins Market

The Vitamins market, an essential segment within the global healthcare and wellness industry, is characterized by a competitive landscape shaped by factors such as increased consumer awareness of health, preventive healthcare trends, and the demand for high-quality, science-backed vitamin supplements. As of 2023, key players strategically position themselves in this competitive environment, implementing various strategies to maintain or enhance their market share.

Strategies Adopted:

Key players in the Vitamins market deploy a range of strategies to remain competitive. Continuous innovation in vitamin formulations, adherence to evolving health and nutritional trends, and compliance with regulatory standards are central strategies. Companies invest in research and development to create vitamin supplements that address specific health concerns, such as immune support, bone health, and overall well-being. Strategic partnerships with healthcare professionals, nutritionists, and fitness influencers contribute to expanding the market reach and product visibility of vitamin supplements. Marketing efforts often focus on brand trust, emphasizing the safety, efficacy, and bioavailability of their vitamin offerings.

Market Share Analysis:

Market share analysis in the Vitamins market is influenced by several factors, including brand reputation, product quality, pricing strategies, and distribution efficiency. Companies with strong brand equity and a reputation for producing high-quality and science-backed vitamin supplements tend to secure a larger market share. Pricing strategies that balance affordability with the perceived value of vitamin products play a crucial role, given the competition with other health and wellness supplements and the varying cost sensitivities of consumers. Effective distribution networks, covering both traditional retail channels and e-commerce platforms, are vital for maintaining a competitive edge.

New and Emerging Companies:

While key players dominate the Vitamins market, new and emerging companies are entering the sector, often focusing on specific vitamin categories or introducing innovative formulations. These entrants may emphasize unique extraction methods, bioavailability enhancement, or target niche markets with specialized vitamin blends, contributing to the overall diversification and innovation in the Vitamins market. Although their market share may be relatively modest compared to industry leaders, these companies play a role in driving trends and meeting the evolving demands of consumers seeking personalized and scientifically advanced vitamin solutions.

Industry Trends:

The Vitamins market has witnessed noteworthy industry news and investment trends in 2023. Key players are investing in sustainability initiatives, responding to the growing consumer awareness of environmental impact and responsible sourcing. Collaborations with sustainable agriculture projects, efforts to reduce carbon footprints, and initiatives to ensure traceability contribute to maintaining a consistent and responsibly sourced supply of raw materials for vitamin production. Additionally, investments in technology adoption, such as advanced production methods and digital traceability, aim to enhance production efficiency and maintain the quality and purity of vitamin supplements.

Competitive Scenario:

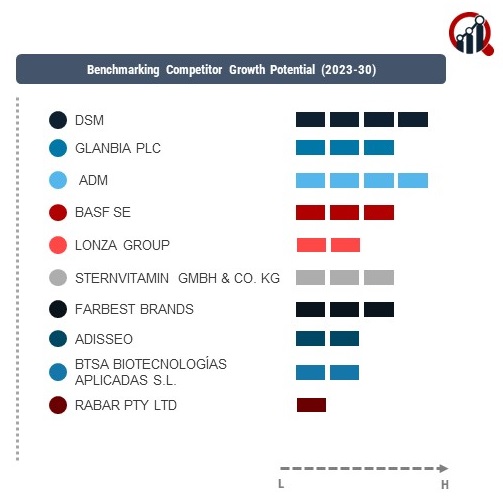

The overall competitive scenario in the Vitamins market is marked by intense rivalry among key players striving to capture a larger share of the growing market. The industry's competitiveness is evident in the emphasis on innovation, sustainability, and strategic collaborations to address evolving consumer preferences and regulatory requirements. The global reach of these companies enables them to adapt to regional dietary habits, capitalize on emerging markets, and navigate complex regulatory landscapes, contributing to the overall dynamism of the industry.

Key Players:

Cargill Incorporated (U.S.)

Archer Daniels Midland Company (U.S.)

Ingredion Incorporated (U.S.)

Tate & Lyle PLC (U.K.)

Agrana Beteiligungs-AG (Austria)

Grain Processing Corporation (U.S.)

Roquette Frères (France)

Recent Development in 2023:

Glanbia Nutritionals: Introduced botanical-infused supplements and energy candies to address particular needs such as brain function and mood support.