Aging Population

The demographic shift towards an older population in the US is likely to have a profound impact on the vitamins market. As the baby boomer generation ages, there is an increasing need for dietary supplements that support health and vitality in later years. Older adults often require specific vitamins to address age-related health concerns, such as bone density and cognitive function. Market Research Future suggests that the segment of the vitamins market catering to seniors is expected to grow significantly, potentially reaching $20 billion by 2025. This demographic trend indicates a sustained demand for products tailored to the nutritional needs of older consumers, thereby driving innovation and expansion within the vitamins market.

Influence of Social Media

The role of social media in shaping consumer behavior cannot be underestimated, particularly in the context of the vitamins market. Platforms such as Instagram and TikTok have become influential in promoting health trends and products, leading to increased visibility for various vitamin brands. Influencers and health advocates often share personal testimonials and recommendations, which can significantly sway consumer purchasing decisions. This trend has resulted in a notable uptick in online sales of vitamins, with e-commerce channels experiencing growth rates of over 30% in recent years. The ability of social media to create communities around health and wellness further enhances consumer engagement, thereby propelling the vitamins market forward.

Expansion of Retail Channels

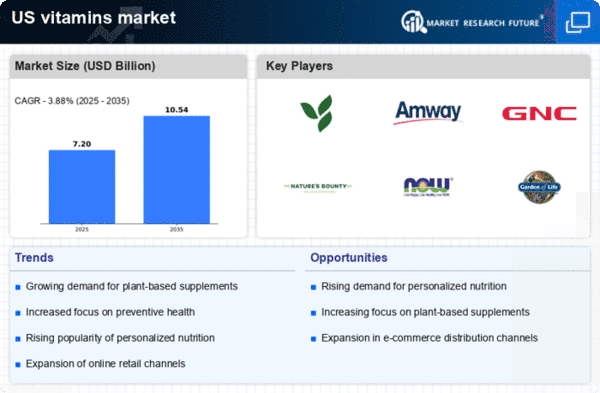

The diversification of retail channels is a notable driver of the vitamins market. Traditional brick-and-mortar stores are increasingly complemented by online platforms, health food stores, and specialty shops, providing consumers with a wider array of purchasing options. This expansion is particularly relevant in the context of the growing e-commerce sector, which has seen a surge in vitamin sales. Data suggests that online sales of vitamins could account for nearly 40% of total sales by 2026. The convenience of online shopping, coupled with the ability to access a broader selection of products, is likely to enhance consumer purchasing behavior, thereby contributing to the overall growth of the vitamins market.

Growing Health Consciousness

The increasing awareness of health and wellness among consumers appears to be a primary driver of the vitamins market. As individuals become more informed about the benefits of vitamins and supplements, they are more likely to incorporate these products into their daily routines. This trend is reflected in the market data, which indicates that the vitamins market in the US is projected to reach approximately $50 billion by 2026. The shift towards preventive healthcare, where consumers prioritize maintaining health over treating illness, further fuels this growth. Additionally, the rise in lifestyle-related health issues, such as obesity and diabetes, has led to a greater emphasis on nutritional supplementation, thereby enhancing the demand for various vitamin products.

Rising Interest in Preventive Healthcare

The growing focus on preventive healthcare is reshaping the landscape of the vitamins market. Consumers are increasingly seeking ways to enhance their overall well-being and prevent health issues before they arise. This proactive approach to health is driving demand for vitamins that support immune function, energy levels, and overall vitality. Market data indicates that the preventive healthcare segment is expected to account for a substantial portion of the vitamins market, with projections suggesting a growth rate of around 8% annually. As healthcare costs continue to rise, individuals are likely to invest more in preventive measures, including dietary supplements, thereby reinforcing the market's expansion.