Increased Adoption of Hybrid Events

The emergence of hybrid events is reshaping the landscape of the Virtual Event Software Market. Hybrid events, which combine in-person and virtual elements, are gaining traction as organizations seek to cater to diverse audience preferences. This trend is supported by data indicating that nearly 70% of event planners are now incorporating hybrid formats into their strategies. The flexibility offered by hybrid events allows for greater participation, enabling organizations to engage both local and remote attendees effectively. Consequently, the demand for versatile virtual event software that can seamlessly integrate both formats is on the rise, as businesses strive to create inclusive experiences that resonate with a wider audience.

Shift Towards Sustainable Practices

The shift towards sustainable practices is becoming a significant driver in the Virtual Event Software Market. As environmental concerns gain prominence, organizations are increasingly prioritizing eco-friendly solutions in their event planning. Virtual events inherently reduce carbon footprints by eliminating the need for travel and physical venues. This sustainability aspect resonates with consumers and stakeholders alike, prompting businesses to adopt virtual platforms as part of their corporate social responsibility initiatives. Data indicates that 60% of companies are now considering sustainability as a key factor in their event strategies. Consequently, the demand for virtual event software that emphasizes sustainability is likely to grow, as organizations seek to align their practices with the values of their audiences.

Growing Demand for Remote Engagement

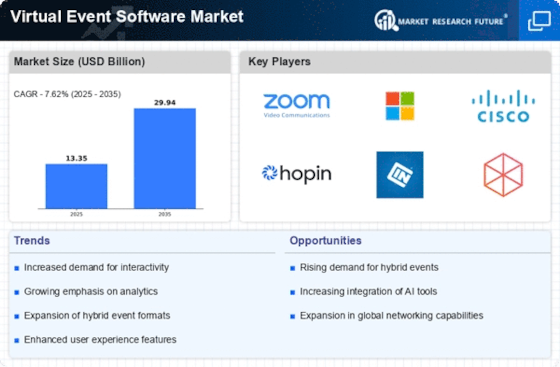

The Virtual Event Software Market is experiencing a notable surge in demand for remote engagement solutions. As organizations increasingly recognize the value of reaching wider audiences without geographical constraints, the need for effective virtual platforms has intensified. Recent data indicates that the market is projected to grow at a compound annual growth rate (CAGR) of approximately 23% over the next five years. This growth is driven by the necessity for businesses to maintain connections with clients and stakeholders in a cost-effective manner. Furthermore, the rise in remote work culture has led to a greater reliance on virtual events, thereby solidifying the importance of robust software solutions that facilitate seamless interaction and engagement.

Cost Efficiency and Resource Optimization

Cost efficiency remains a pivotal driver within the Virtual Event Software Market. Organizations are increasingly seeking ways to optimize their resources while maximizing outreach. Virtual events typically incur lower costs compared to traditional in-person gatherings, as expenses related to travel, venue rental, and catering are significantly reduced. This financial advantage is particularly appealing to small and medium-sized enterprises, which may have limited budgets for marketing and outreach. Data suggests that companies utilizing virtual event platforms can save up to 50% on event-related costs. As a result, the demand for virtual event software continues to rise, as businesses aim to leverage these cost-effective solutions to enhance their marketing strategies and reach broader audiences.

Technological Advancements in Event Platforms

Technological advancements play a crucial role in driving the Virtual Event Software Market forward. Innovations such as artificial intelligence, augmented reality, and interactive features are enhancing the overall user experience. These technologies enable event organizers to create immersive environments that foster engagement and interaction among participants. For instance, AI-driven analytics tools provide valuable insights into attendee behavior, allowing for more tailored experiences. The integration of such advanced technologies is expected to propel market growth, with estimates suggesting that the adoption of AI in event management could increase efficiency by up to 30%. As a result, organizations are increasingly investing in sophisticated virtual event platforms to stay competitive in a rapidly evolving market.