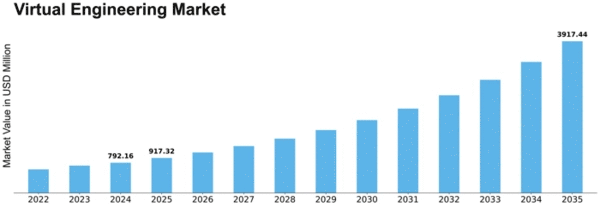

Virtual Engineering Size

Virtual Engineering Market Growth Projections and Opportunities

The Virtual Engineering market is dynamically influenced by a myriad of factors that collectively shape its landscape and drive its growth. One of the primary market factors is the rapid advancement in technology. As cutting-edge technologies like augmented reality (AR), virtual reality (VR), and artificial intelligence (AI) continue to evolve, they empower virtual engineering solutions with enhanced capabilities. This technological progress not only improves the efficiency of virtual engineering processes but also opens up new possibilities for innovation and problem-solving.

One of the other major market factors that directly influence the virtual engineering climate is globalization. The need to outsource engineering and construction products has also grown dramatically, especially when the businesses expand their product endeavor across borders. Virtual engineering makes remote teams’ collaboration costs-effective and timely since all of them get connected whereas relying on virtual engineering assures the productivity by making communication and interaction smooth throughout, irrespective of their location. This trend is especially applicable in fields including automotive, aerospace, and manufacturing industry where the distributed system is widely used to develop products.

The industry is impacted by cost consideration too, the latter of which also significantly influences virtual economy. The regular product development colour wheel may be a resourceful and time-consuming process. What is more, virtual engineering solutions offer a less expensive variant for the design and test phases as it automates production of prototypes that significantly decrease with their creation costs. Businesses are looking for opportunities to keep quality levels high but gain efficiencies and save money, thus costing issues make virtual engineering an attractive option.

The market of virtual engineering is also being affected by the growing attention to manners aimed at sustainability. Companies are subjected to increasing pressures in the reduction of environmental footprints and the technology plays a very important role in this. Virtual engineering facilitates simulations and analyses dedicated to optimizing energy consumption, material use, as well as the lifecycle of the products which brings sustainability in terms of things or processes produced. Along with the increasing significance and popularity of environmental issues, the mainstreaming solutions that involve virtual engineering into sustainable practice are considered an important driver, which leads to its implementation.

Another of the leading factors that influences the dynamics of virtual engineering market is compliance with regulations. Certain industrial sectors, including health care, aerospace and automotive have to satisfy stringent legislations as it can be dangerous without them. Virtual engineering tools offer a testing and validating environment that helps companies comply with the regulations under which all aspects of their production are tested for compliance purposes. The simulations and analysis of different scenarios ensure that the products which are manufacturing, tested and marketed meet industry standards, consequently minimizing losses because of regulatory drawbacks. Market competition is intensifying across various sectors, prompting companies to seek ways to differentiate themselves. Virtual engineering offers a competitive advantage by accelerating time-to-market, improving product quality, and fostering innovation. Businesses that integrate virtual engineering into their development processes can gain a strategic edge in delivering products that meet or exceed customer expectations. As the competitive landscape continues to evolve, the adoption of virtual engineering becomes a strategic imperative for companies aiming to stay ahead in their respective industries.

Leave a Comment