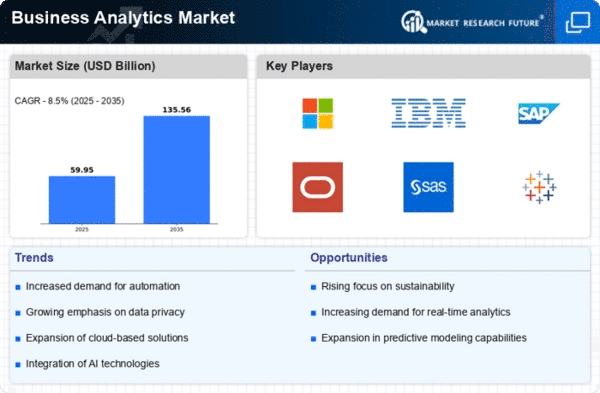

Market Growth Projections

The Global Business Analytics Market Industry is poised for substantial growth in the coming years. Projections indicate that the market will reach 35.8 USD Billion in 2024 and is expected to expand to 135.5 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate of 12.85% from 2025 to 2035. The increasing reliance on data analytics across various industries, coupled with technological advancements, suggests a robust future for the market. As organizations continue to prioritize data-driven strategies, the Global Business Analytics Market is likely to evolve, presenting new opportunities and challenges for stakeholders.

Regulatory Compliance and Risk Management

Regulatory compliance and risk management are becoming pivotal drivers in the Global Business Analytics Market Industry. As businesses face increasing scrutiny from regulatory bodies, the need for robust analytics solutions to ensure compliance with various regulations is paramount. Analytics tools help organizations monitor and analyze data to identify potential risks and ensure adherence to legal standards. This necessity is particularly pronounced in sectors such as finance and healthcare, where compliance failures can lead to severe penalties. Consequently, the demand for analytics solutions that facilitate risk assessment and compliance monitoring is expected to grow, further propelling market expansion.

Increasing Adoption of Cloud-Based Solutions

The shift towards cloud-based solutions significantly influences the Global Business Analytics Market Industry. Organizations are increasingly migrating their analytics operations to the cloud, attracted by the scalability, flexibility, and cost-effectiveness that cloud platforms offer. This transition allows businesses to access advanced analytics tools without the need for substantial upfront investments in infrastructure. As a result, the market is expected to witness a compound annual growth rate of 12.85% from 2025 to 2035. The ability to analyze data in real-time and collaborate across geographies enhances decision-making processes, further driving the adoption of cloud-based analytics solutions.

Rising Demand for Data-Driven Decision Making

The Global Business Analytics Market Industry experiences a surge in demand for data-driven decision making as organizations recognize the value of leveraging data insights. In 2024, the market is projected to reach 35.8 USD Billion, driven by the need for improved operational efficiency and competitive advantage. Companies across various sectors, including finance and healthcare, are increasingly adopting analytics tools to enhance their strategic planning. This trend indicates a broader shift towards data-centric cultures, where decisions are informed by empirical evidence rather than intuition. As organizations continue to invest in analytics capabilities, the market is expected to expand significantly.

Technological Advancements in Analytics Tools

Technological advancements play a crucial role in propelling the Global Business Analytics Market Industry forward. Innovations in artificial intelligence, machine learning, and cloud computing are transforming how businesses analyze data. These technologies enable organizations to process vast amounts of information quickly and derive actionable insights. For instance, AI-driven analytics platforms can identify patterns and trends that human analysts might overlook. As these tools become more sophisticated and accessible, businesses are likely to invest more heavily in analytics solutions, contributing to the projected growth of the market, which is anticipated to reach 135.5 USD Billion by 2035.

Growing Importance of Customer Experience Management

The emphasis on customer experience management is reshaping the Global Business Analytics Market Industry. Organizations are increasingly utilizing analytics to understand customer behavior, preferences, and feedback. By leveraging data insights, businesses can tailor their offerings and improve customer satisfaction, leading to increased loyalty and retention. This trend is particularly evident in retail and e-commerce sectors, where companies analyze purchasing patterns to optimize marketing strategies. As customer-centric approaches gain traction, the demand for analytics solutions that provide actionable insights into customer interactions is likely to rise, contributing to the overall growth of the market.