Rising Adoption in Commercial Spaces

The Video Intercom Devices and Equipment Market is experiencing a notable rise in adoption within commercial spaces. Businesses are increasingly recognizing the value of video intercom systems for enhancing communication and security. These devices facilitate efficient visitor management and improve overall operational efficiency. According to recent market analysis, the commercial segment is expected to account for over 40% of the total market share by 2025. This growth is driven by the need for secure access control in offices, retail environments, and public buildings. Furthermore, the integration of video intercom systems with existing security infrastructure is becoming a common practice, allowing businesses to streamline their security protocols. This trend indicates a shift towards more comprehensive security solutions that encompass both communication and surveillance.

Growing Emphasis on Security Solutions

In the current landscape, the Video Intercom Devices and Equipment Market is witnessing a heightened emphasis on security solutions. With increasing concerns about safety and crime rates, consumers are prioritizing security features in their purchasing decisions. Video intercom systems provide a reliable means of monitoring entry points, allowing users to visually identify visitors before granting access. The market data suggests that approximately 60% of consumers consider security features as a primary factor when selecting intercom systems. This trend is particularly pronounced in urban areas, where the demand for enhanced security measures is more acute. As a result, manufacturers are focusing on developing advanced security functionalities, such as remote monitoring and integration with alarm systems, to meet consumer expectations.

Expansion of Multi-Tenant Housing Solutions

The Video Intercom Devices and Equipment Market is experiencing an expansion in solutions tailored for multi-tenant housing. As urbanization continues to rise, the need for efficient communication and security systems in apartment complexes and condominiums is becoming increasingly apparent. Video intercom systems provide a practical solution for managing access in multi-tenant environments, allowing residents to communicate with visitors and control entry points. Recent statistics suggest that the multi-tenant housing segment is projected to grow by over 15% annually through 2025. This growth is attributed to the increasing number of residential developments and the demand for enhanced security features in shared living spaces. Consequently, manufacturers are focusing on developing scalable intercom solutions that cater to the unique needs of multi-tenant properties.

Increased Demand for Remote Access Features

The Video Intercom Devices and Equipment Market is witnessing an increased demand for remote access features. As consumers seek greater convenience and control, the ability to monitor and manage intercom systems remotely has become a key selling point. This trend is particularly relevant in the context of smart home technology, where users desire seamless integration with their existing devices. Market data indicates that nearly 50% of consumers are willing to pay a premium for intercom systems that offer remote access capabilities. This demand is driving manufacturers to innovate and develop user-friendly mobile applications that allow for real-time monitoring and communication. The emphasis on remote access features is likely to shape the future of the market, as consumers continue to prioritize convenience and connectivity.

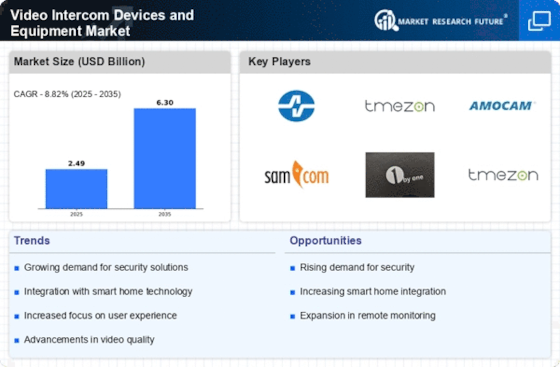

Technological Advancements in Communication

The Video Intercom Devices and Equipment Market is experiencing a surge in technological advancements that enhance communication capabilities. Innovations such as high-definition video, two-way audio, and mobile app integration are becoming standard features. These advancements not only improve user experience but also increase the appeal of video intercom systems for residential and commercial applications. As of 2025, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 10%, driven by the demand for seamless communication solutions. The integration of artificial intelligence and machine learning into these devices further enhances their functionality, allowing for features such as facial recognition and automated alerts. This trend indicates a shift towards more sophisticated intercom systems that cater to the evolving needs of consumers.