Advancements in Technology

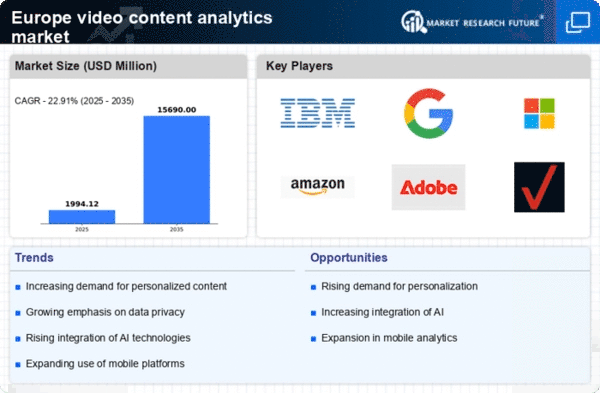

Technological advancements play a crucial role in shaping the video content-analytics market in Europe. Innovations in cloud computing, artificial intelligence, and machine learning have enabled more sophisticated analytics capabilities. These technologies facilitate the processing of large volumes of video data, allowing for real-time insights and improved decision-making. For instance, the integration of AI algorithms can enhance content recommendations and viewer targeting, thereby increasing engagement rates. As organizations adopt these advanced technologies, the demand for video content-analytics solutions is likely to rise. The market is projected to grow at a CAGR of approximately 15% over the next five years, driven by the need for more efficient and effective analytics tools that can keep pace with the evolving digital landscape.

Growing Demand for Video Content

The increasing consumption of video content across various platforms is a primary driver for the video content-analytics market in Europe. As consumers gravitate towards video for entertainment, education, and information, businesses are compelled to analyze viewer engagement and preferences. Reports indicate that video content consumption in Europe has surged by over 70% in recent years. This trend necessitates advanced analytics tools to derive insights from vast amounts of video data. Consequently, companies are investing in video content-analytics solutions to enhance their content strategies, optimize viewer experiences, and ultimately drive revenue growth. The video content-analytics market in Europe is expected to witness substantial growth as organizations seek to leverage data-driven insights to stay competitive in a rapidly evolving digital landscape.

Increased Focus on Marketing ROI

In the competitive landscape of Europe, businesses are increasingly focused on measuring the return on investment (ROI) of their marketing efforts, particularly in video advertising. The video content-analytics market is responding to this demand by providing tools that enable companies to track viewer engagement, conversion rates, and overall campaign effectiveness. By analyzing video performance metrics, organizations can make informed decisions about their marketing strategies and allocate resources more efficiently. This focus on ROI is expected to drive the adoption of video content-analytics solutions, as companies seek to maximize their marketing budgets and improve their overall performance. As a result, the video content-analytics market in Europe is likely to experience robust growth as businesses prioritize data-driven marketing approaches.

Regulatory Compliance and Data Security

The video content-analytics market in Europe is significantly influenced by the need for regulatory compliance and data security. With stringent regulations such as the General Data Protection Regulation (GDPR) in place, organizations must ensure that their analytics practices adhere to legal standards. This has led to an increased demand for video content-analytics solutions that prioritize data privacy and security. Companies are seeking tools that not only provide insights but also ensure compliance with regulations to avoid potential fines and reputational damage. As businesses navigate the complexities of data protection laws, the video content-analytics market is likely to expand, driven by the need for secure and compliant analytics solutions that can support their operations.

Rising Popularity of Streaming Services

The proliferation of streaming services in Europe has created a fertile ground for the video content-analytics market. As platforms like Netflix, Amazon Prime, and local streaming services gain traction, the demand for analytics tools to understand viewer behavior and preferences intensifies. Streaming services require in-depth analysis to optimize content offerings, enhance user experiences, and retain subscribers. The video content-analytics market is poised to benefit from this trend, as service providers seek to leverage data insights to inform content creation and marketing strategies. With the streaming industry projected to grow by over 20% annually, the demand for effective video content-analytics solutions is expected to rise, positioning the market for significant expansion in the coming years.