Veterinary Biomarkers Size

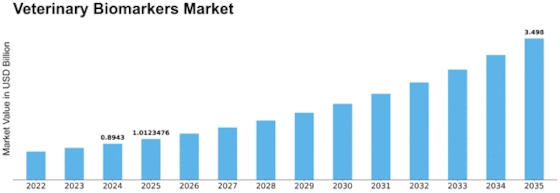

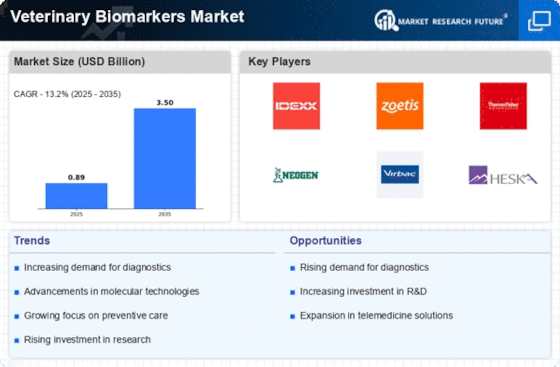

Veterinary Biomarkers Market Growth Projections and Opportunities

The Veterinary Biomarkers Market is shaped by diverse market factors that collectively influence its growth and trajectory. One of the key drivers is the increasing prevalence of diseases in animals, prompting a growing need for effective diagnostic tools. As awareness of animal health rises, veterinarians and pet owners alike seek advanced diagnostic solutions, fueling the demand for veterinary biomarkers. These biomarkers, which include various molecular, biochemical, and imaging markers, play a pivotal role in the early detection and monitoring of diseases in companion and livestock animals, contributing to the expansion of the market.

Research and development efforts contribute significantly to the evolution of the Veterinary Biomarkers Market. Continuous advancements in veterinary medicine and the exploration of new biomarkers enhance diagnostic capabilities. As scientists and researchers uncover novel biomarkers associated with various animal diseases, the market benefits from the development of more accurate and reliable diagnostic tests. The ongoing commitment to research drives innovation in the veterinary biomarkers landscape, addressing the diverse diagnostic needs of veterinarians and pet owners.

Government regulations and standards play a crucial role in shaping the Veterinary Biomarkers Market. Regulatory approvals are essential for the introduction of new biomarker-based diagnostic tests and treatments for animals. Compliance with regulatory requirements ensures the safety and efficacy of veterinary biomarkers, building trust among veterinarians and pet owners. Government policies related to animal health and welfare also influence the adoption of biomarker-based diagnostics in veterinary practices, impacting the overall market dynamics.

The role of veterinary infrastructure and access to diagnostic services is pivotal in the Veterinary Biomarkers Market. The availability of well-equipped veterinary laboratories and diagnostic facilities enhances the utilization of biomarker-based tests. Improved infrastructure supports timely and accurate diagnoses, influencing the adoption of veterinary biomarkers in different regions. Accessibility to advanced diagnostic services is a key factor in the market's growth, as it facilitates the integration of biomarker-based diagnostics into routine veterinary practice.

Market competition is a significant factor driving innovation in the Veterinary Biomarkers Market. The presence of various companies and research institutions fosters competition, leading to the development of diverse biomarker panels and diagnostic solutions. Market players strive to offer comprehensive and user-friendly biomarker-based tests, catering to the specific needs of veterinarians and addressing a wide range of animal health conditions. The competitive landscape encourages continuous improvement, benefiting both veterinary professionals and the animals under their care.

Public awareness and changing attitudes towards pet health contribute to the dynamics of the Veterinary Biomarkers Market. With an increasing focus on preventive veterinary care, pet owners are more inclined to invest in advanced diagnostic tests, including biomarker-based diagnostics, for their animal companions. Awareness campaigns and educational initiatives by veterinary professionals and industry stakeholders further drive the adoption of biomarker-based tests, emphasizing the importance of early disease detection and proactive animal healthcare.

Global economic conditions and spending patterns in the veterinary sector impact the Veterinary Biomarkers Market. Economic factors influence funding for research and development, market access, and affordability of biomarker-based diagnostic tests. As the demand for high-quality veterinary care rises, economic considerations play a role in shaping the market landscape, affecting the availability and adoption of biomarker-based diagnostics in different regions.

The ongoing COVID-19 pandemic has presented both challenges and opportunities for the Veterinary Biomarkers Market. While the pandemic has disrupted veterinary services and supply chains, it has also emphasized the significance of resilient and adaptable diagnostic solutions. The increased focus on zoonotic diseases and the importance of animal health in the context of public health may further drive investments in biomarker-based diagnostics for animals.

Leave a Comment